1. Oil and the Global Economy

Despite the volatility engendered by the Islamic State’s move against Kurdistan and the US’s reentry into active participation in Iraq’s civil war, oil prices were little changed for the week with New York futures closing at $97.65 a barrel and London at $105.02. For now the markets seem to believe that US airpower will keep the IS out of Kurdistan’s and Iraq’s southern oilfields so that oil production will remain stable or even grow. Likewise, the markets seem to believe that current oil and gas sales are exempt from any sanctions resulting from whatever Moscow does in response to Ukraine’s successes against the separatists. The markets continue to move in response to normal supply and demand developments with a wary eye to the risks that may stem from the political chaos.

The global supply and demand picture is mixed with OPEC reporting that production in July was at the highest level in five months; however much of this was due to a jump in Libyan production which is a murky story at best. Chinese imports were up by 2 percent from June to July, but still 9 percent lower than last July. Last week’s US stocks report provided little guidance to the markets as changes were in line with recent trends and seasonal expectations.

US natural gas prices continued to climb slowly last week as forecasters are back to talking about warmer weather for the rest of August. Prices are up at 10 cents per million BTU’s in the last ten days, closing Friday at $3.97.

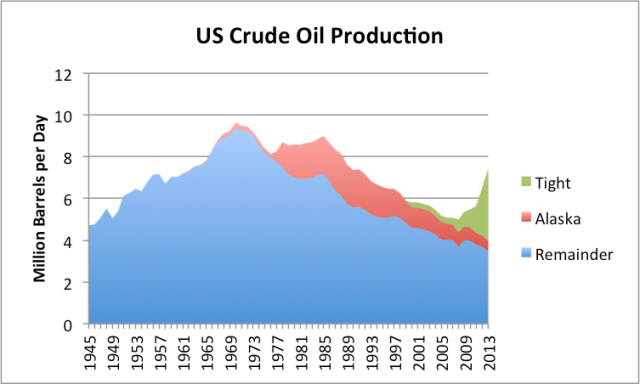

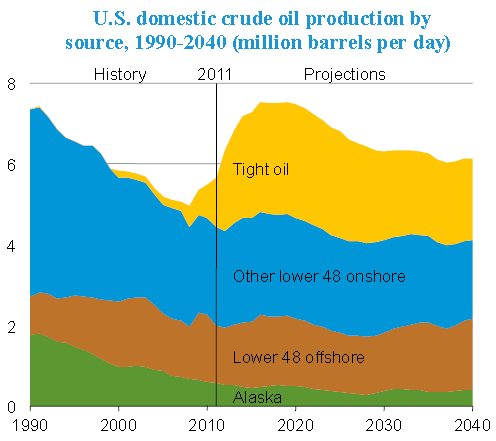

Perhaps the key question for the future of world oil supplies and prices is just how long before US shale oil production peaks and starts what will likely be a rapid decline. As the financial press and even government agencies have to been loath to address this issue except in optimistic terms, outside analysts using different techniques have been providing estimates as to how long what is termed the “shale oil bubble” will last. The most pessimistic of these estimates have been running around 2016-2017 giving the shale or light tight oil industry another two or three years to grow. The government has production growing for most of this decade but then declining only gradually

resilience