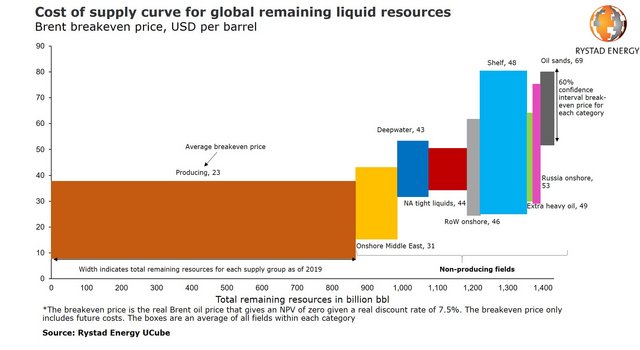

Pops wrote:AdamB wrote:Scarcity at A PRICE YOU PREFER might be an issue, but not outright scarcity.

Cold comfort. Price and availability are two sides of the same coin, at $1,000 bbl there is an eternity of oil.

Yes, when the masses really can't use it without, say, sacrificing food, housing, medicine, clothing, etc, then oil IS scarce, re any practical definition we've been using the past 50 years, at least in the US.

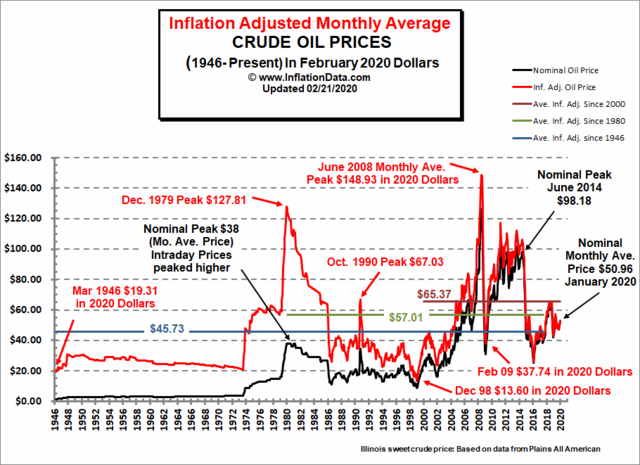

However, there is a lot of middle ground there. By DESIGN, Western Europe has had taxes pushing gasoline towards the general area of $10 a gallon in most countries for quite a few years, to incent people to drive less, drive smaller cars, use more public transit, etc. And it has done so to a significant degree, at least compared to the US.

I would argue that, for example, $5 gasoline in the US (due to a fuel tax or a crude oil tax) would induce LOTS of whining and LOTS of politics, but would NOT induce the mass starvation, end of times, implosion of the economy, etc. that the usual fast crash doomer suspects have claimed it would for decades on this site. Especially if we moved to that gradually -- say at 25 cents a year, for example.

Even $10 gasoline (and diesel) could be dealt with, given time to plan for it. Plus, by the time we got there at 25 cents a year, BEV's and PHEV's and possibly FCEV's would likely dominate, so few would have to buy much gasoline.

But of course, at least in the US, MOST of getting to that middle ground and restraining consumption just to SOME meaningful degree is all about POLITICS. To the extent that we don't even have enough gasoline taxes to come CLOSE to proper care of our road and bridge infrastructure in the US, for example.

Some moderation is surely called for. But do ANY major US politicians have the GUTS to actually openly call for that, even if they might not get re-elected?

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.