pstarr wrote: …. SA oil production.

The numbers on KSA oil production are pretty clear---they produced more oil in 2015 then in 2005.

Too bad you can't understand what the numbers mean.

Cheers!

pstarr wrote: …. SA oil production.

pstarr wrote:No Adam, SA is very very pertinent to the peak-oil dilemma, much more so than IEA's cooked books and failed predictions.

pstarr wrote:SA was the swing producer among the entire OPEC cartel, the one country with excess wealth and a reserve cushion that granted it power to stabilize prices and production when other member were hard pressed for income and needed to produce full out. That it can no longer do so in the face of $30 oil is further proof that Saudi Arabia is pumping full out.

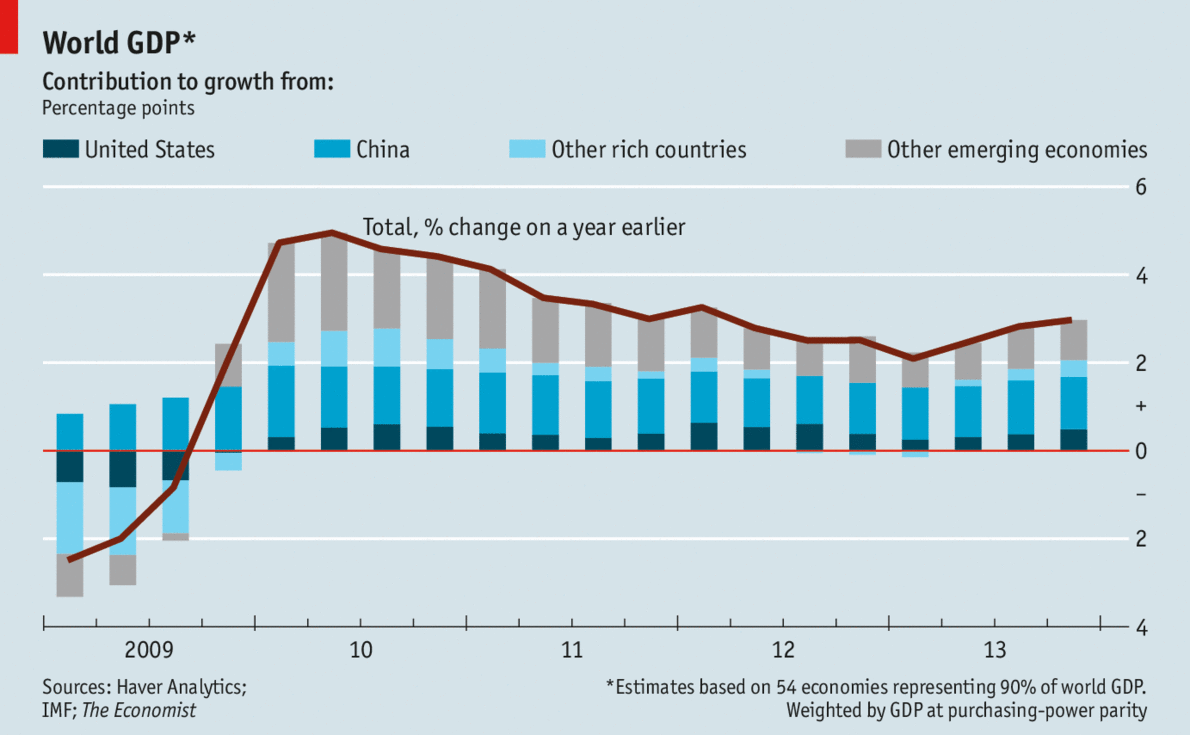

pstarr wrote: We need to wrap our heads around this dismal truth. Every major oil producer is pumping full out. Yet oil prices have tanked. Is that a glut? Or is that demand destruction. I'll leave it up to you to mull over. But I will be back to this debate.

pstarr wrote:I don't see how a book cover refutes OPEC's death? Nor your lie regarding SA oil production.

ennui2 wrote:So you think the last remaining vestige of Pravda (the USSR propaganda outlet) carries more weight than Reuters?

That's cherry-picking for you.

pstarr wrote:Listen Adam, I got carried away with my claim that SA total production peaked. It has not.

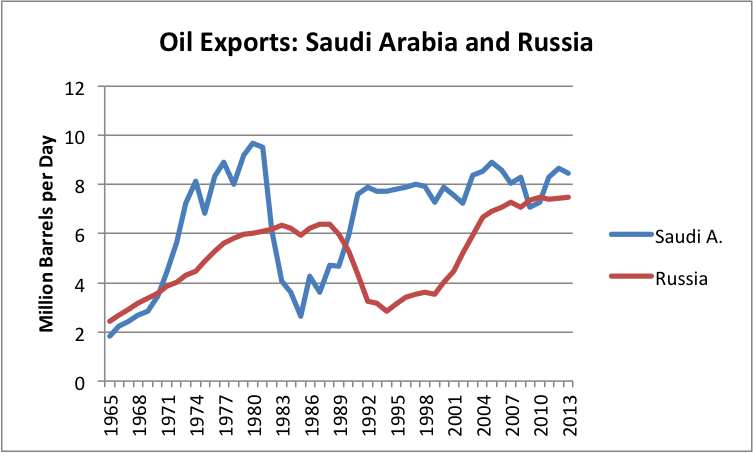

pstarr wrote: But rather it's exports peaked, for most of a decade in the face of relentless high oil prices above $100 dollars/barrel.

pstarr wrote:How would one expect the country to constrain its income at $30 (by reducing exports) when it was unable to do so at $100 dollars? That makes no sense.

pstarr wrote:The Export Land Model simply states that oil exporting nations, enriched by sales, will consume more of their production at the expense of exports. This simple fact explains the current world Depression.

Shaved Monkey wrote:ennui2 wrote:So you think the last remaining vestige of Pravda (the USSR propaganda outlet) carries more weight than Reuters?

That's cherry-picking for you.

They both have their barrows to push neither is more legitimate than the other.

pstarr wrote:This is not an oil glut, rather it is an economic slowdown. Too much oil and money have essentially disappeared forever down the bore hole on energy-intensive oil production. I would be surprised if oil rebounds much higher than $40 for any appreciable length of time. That is still not enough to produce what is left in the ground. Much of that oil will remain in the ground forever.

Ever-increasing amounts of money continue to be lost daily to the general economy as oil companies are forced to buy back and squander their own oil on expensive energy-intensive operations like tight-shale, tar sands, and deep offshore GOM. Little gets multiplied in the general economy. This is the economic consequence of falling net-energy.

Money is also lost to the general economy when oil is purchased overseas; some $600 billion/year essentially disappeared when we were forced to purchase oil on the open international market at $100 barrel.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

pstarr wrote:Tanada, if demand is so great why has the price of oil collapsed to $35? Shouldn't it be back to $100? Or $147? Is this a glut or demand destruction?

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

pstarr wrote:Tanada, if demand is so great why has the price of oil collapsed to $35? Shouldn't it be back to $100? Or $147? Is this a glut or demand destruction?

pstarr wrote:AdamB wrote:ELM was wrong . . . Saudi exports peaked back in the late 1970's

How do you reconcile your two contrary statements. You agree that SA exports peaked in the 1970's . . . yet you consider ELM wrong. That makes no sense?

pstarr wrote:The Export Land Model simply states that oil exporting nations, enriched by sales, will consume more of their production at the expense of exports.

pstarr wrote: This simple fact explains the current world Depression. We saw it in the US with the devistating stagflation in the 1970's, several years after its 1972 peak.

pstarr wrote:This is not an oil glut, rather it is an economic slowdown.

pstarr wrote: Too much oil and money have essentially disappeared forever down the bore hole on energy-intensive oil production. I would be surprised if oil rebounds much higher than $40 for any appreciable length of time. That is still not enough to produce what is left in the ground. Much of that oil will remain in the ground forever.

pstarr wrote:Ever-increasing amounts of money continue to be lost daily to the general economy as oil companies are forced to buy back and squander their own oil on expensive energy-intensive operations like tight-shale, tar sands, and deep offshore GOM. Little gets multiplied in the general economy. This is the economic consequence of falling net-energy.

pstarr wrote:Money is also lost to the general economy when oil is purchased overseas; some $600 billion/year essentially disappeared when we were forced to purchase oil on the open international market at $100 barrel.

AdamB wrote:And my efficiency is doing the same things I did yesterday, except with less energy.

And presto! increased discretionary. Woo Hoo! And you think this is BAD? It isn't.

Users browsing this forum: No registered users and 21 guests