Is The Fed "Seriously Considering" Negative Interest Rates?

The Fed may "seriously consider" negative rates after moving rates back to zero, reintroducing forward guidance and making "stronger pleas" to Congress for fiscal policy action as there are complications for money markets, according to BofAML strategist Mark Cabana.

This would not be a total surprise as Mises Institute's Joseph Salerno warns recent Fed commentary suggests they want to test-drive negative interest rates...

In 2016, the Fed's annual stress test on banks will include a scenario in which the interest rate on the three-month U.S. Treasury bill becomes negative in the second quarter of 2016 and then declines to -0.5%, remaining at that level until the first quarter of 2019. According to the Fed, "The severely adverse scenario is characterized by a severe global recession, accompanied by a period of heightened corporate financial stress and negative yields for short-term U.S. Treasury securities." In other words, including this scenario in its stress test is not supposed to signal that the Fed is contemplating adopting a deliberate policy of negative interest rates. It is simply testing the resilience of big banks in the face of a severe recession that precipitates a "flight to safety" which spontaneously drives rates on short-term Treasury securities into negative territory. Or so they would have us believe.

Recent remarks by those associated with the Fed, however, seem to suggest otherwise. For example, former Fed official Roberto Perli, now a partner at Cornerstone Macro LLC, commented "It doesn’t signal anything" about future monetary policy, but then added, it is "another sign that the Fed would not be entirely adverse" to reducing its target rate below zero if economic conditions should warrant. In mid-January, New York Fed President William Dudley denied that policy makers were "thinking at all seriously of moving to negative interest rates." However, he conceded, "I suppose if the economy were to unexpectedly weaken dramatically, and we decided that we needed to use a full array of monetary policy tools to provide stimulus, it’s something that we would contemplate as a potential action." Most tellingly, just this past Monday, Fed Vice Chairman Stanley Fischer gave a talk to the Council on Foreign Relations in New York in which he approvingly discussed negative interest rates in some detail. Because a speech by a Fed Vice Chairman sometimes turns out to be a bellwether of a radical shift in monetary policy--recall Bernanke's infamous speech on deflation and unconventional monetary policy in November 2002--Fischer's remarks are worth quoting:

[W]e believed that we could not get interest rates to go below zero. Well, it turns out that . . . four European and one Asian country have now done that. And how can you do that when currency has a zero rate of return? You can do it because it turns out that holding currency is not so easy. If you’re going to keep your billion dollars in currency, you’re going to have to find a place to store it, you’re going to have to insure it, and you’re going to have to have it guarded. And by the time that’s done . . . zero is no longer the lower bound. All those costs are the lower bound, and those costs seem to be significantly below zero in the sense that we have a Denmark and one other country having a negative 75 basis point interest rate, which worked. . . . So that idea is there. And that’s what they’re pursuing. And, you know, everybody is looking at . . . how that works. . . . [W]e have actual experience of countries that have used negative interest rates. . . . Countries that have used it continue to use it. They haven’t given it up. . . . So it’s working more than I can say that I expected in 2012. . . .

And, lest we forget, Fed Chairman Yellen went on record as conditionally favoring negative interest rates as President of the Federal Reserve Bank of San Francisco in 2010:

If it were positive to take interest rates into negative territory I would be voting for that.

Of course, as we noted previously, NIRP in America is becoming more inevitable...

When stripping away all the philosophy, the pompous rhetoric, and the jawboning, all central banks do, or are supposed to do, is to influence capital allocations and spending behavior by adjusting the liquidity preference of the population by adjusting interest rates and thus the demand for money.

To be sure, over the past 7 years central banks around the globe have gone absolutely overboard when it comes to their primary directive and have engaged every possible legal (and in the case of Europe, illegal) policy at their disposal to force consumers away from a "saving" mindset, and into purchasing risk(free) assets or otherwise burning through savings in hopes of stimulating inflation.

Today's action by the Bank of Japan, which is meant to force banks, and consumers, to spend their cash which will now carry a penalty of -0.1% if "inert" was proof of just that.

Ironically, and perversely from a classical economic standpoint, as we showed before in the case of Europe's NIRP bastions, Denmark, Sweden, and Switzerland, the more negative rates are, the higher the amount of household savings!

This is what Bank of America said back in October: "Yet, household savings rates have also risen. For Switzerland and Sweden this appears to have happened at the tail end of 2013 (before the oil price decline). As the BIS have highlighted, ultra-low rates may perversely be driving a greater propensity for consumers to save as retirement income becomes more uncertain."

Bingo: that is precisely the fatal flaw in all central planning models, one which not a single tenured economist appears capable of grasping yet which even a child could easily understand.

This is how Bank of America politely concluded that NIRP is a failure:

For now, negative rates as a policy tool remain a “work in progress”, judging by the current inflation levels across Europe. But the rise in household savings rates amid so much central bank support is paradoxical to us, and mimics what we highlighted in the credit market earlier this year. Companies in Europe are deleveraging, not releveraging, and are buying back bonds not stock.

One can now add Japan to the equation.

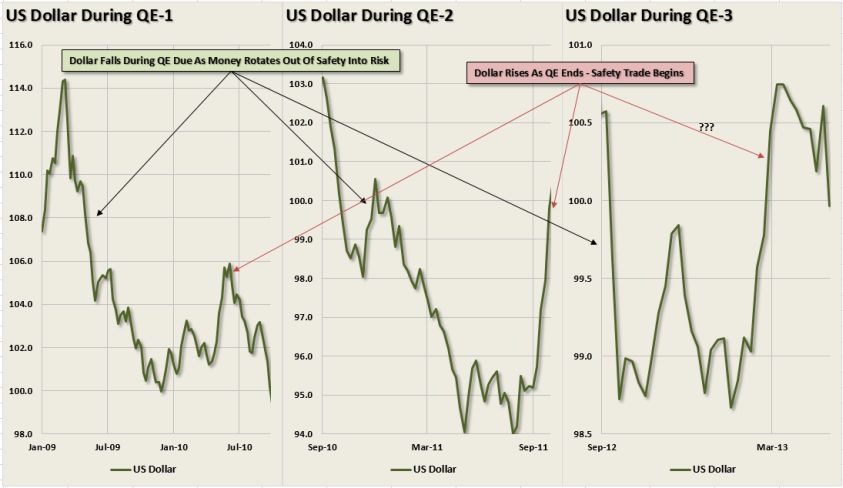

And soon the US, because as the chart below shows, the Fed has likewise dramatically failed in shifting the liquidity preference of US investors. First, here is what Bank of America finds when looking at recent fund flows:

4 straight weeks of robust inflows to govt/tsy bond funds; 19 straight weeks of muni bond inflows; since 2H’15, cash has been the most popular asset class by far ($208bn inflows – Chart 1) vs a lackluster $7bn inflows for equities & $46bn outflows from fixed income (dogged by redemptions from credit)

And here is the one chart which in our opinion virtually assures that the Fed will follow in the footsteps of Sweden, Denmark, Europe, Switzerland and now Japan.

Since the middle of 2015, US investors have bought a big fat net zero of either bonds or equities (in fact, they have been net sellers of risk) and have parked all incremental cash in money-market funds instead, precisely the inert non-investment that is almost as hated by central banks as gold.

To Yellen, this behavior will have to stop, and she will make sure it does sooner rather than later. Just ask Kocherlakota.

Will this crush money markets as we know them, and unleash even more volatility and havoc around the world?

Absolutely. But at this point, when evey other central bank has lost credibility, to paraphrase Hillary Clinton loosely, "what difference will it make" if the Fed joins the party on the central bank Titanic?

So now you're contradicting yourself.

So now you're contradicting yourself.