One way to fight global warming is to shut out the polluters. This battle will be fought to the bitter end when the fossil-fuel industry will lose. But in the meantime, there is battle being fought right now across USA.

The Attack On Renewable Energy Standards In NumbersAt least twenty-two of the 29 state renewables standards have been attacked by legislators or regulators in the last year or are now under attack.

Known as a Renewable Portfolio Standard (RPS) or a Renewable Energy Standard (RES), these mandates require utilities to obtain a portion of their power from renewable sources by a certain date. Research shows they add less than 5 percent, on average, to the cost of electricity bills and are an effective driver of renewables growth.

Some of the attacks are part of a push led by the American Legislative Exchange Council (ALEC) and aligned advocacy groups funded by fossil and nuclear interests. Most lack significant force. “But if they slow things,” Environment America Energy Program Director Rob Sargent noted, “they’re having an impact.”

The most serious fights

1. Landmark struggles between advocates for traditional generation and renewables in Kansas narrowly went to renewables in the most recent session. Bills that would have weakened the 20 percent by 2020 standard either by extending it to 2024 or revising it to 15 percent by 2018 were held up in committee. Both sides remain committed to their respective positions.

2. A North Carolina Assembly bill would essentially freeze the existing 12.5 percent standard at the present 3 percent except for existing contracts. Local advocates say the attack has moved moderate Republicans away.

3. In Vermont, anti-wind activists’ proposal would require large energy projects to comply to Act 250, the state’s land-use law and allow a minority to force costly delays on developers and slow the growth driven by Vermont’s popular 20 percent by 2017 standard.

4. Pennsylvania’s 18 percent by 2021 standard is under serious attack by an all-Republican legislature and Republican governor. One bill would allow natural gas to count toward the mandate, another would allow solid waste incineration to replace wind and solar, and a third would eliminate the tracking of new generation, allowing burned renewables to displace wind and solar.

5.The 15 percent by 2021 standard in Missouri was, as a ballot measure, approved by 66 percent of the state’s electorate. A new bill allowing hydroelectric to displace wind and solar, which appears on its way to approval, would reverse the voters’ will and stall out wind and solar growth.

6.In Ohio, a bill would review the 25 percent by 2025 standard and the state’s efficiency standard and another would repeal the standard, despite a recent poll showing almost 80 percent of Ohio voters support the mandate.

7.Two major utilities have long lobbied in Connecticut to count HydroQuebec power toward the state’s 20 percent by 2020 standard. This year’s version would ostensibly expand the standard to 25 percent by 2025. But its provisions for hydro would end up allowing less wind and solar in 2025 than the current standard mandates for 2020. Supporters are rushing the measure to a vote and some legislators are beginning to wonder what the hurry is.

cleantechnicaResidential Solar Power Heads Toward Grid ParityPhotovoltaics are still, on average, a pricey, subsidy-dependent source of electricity. However, rooftop panels are beginning to beat the grid in a number of jurisdictions with high retail power rates—and their ranks are projected to swell over this decade. A growing number of economists say that rapidly shrinking costs have turned distributed solar generation into a disruptive technology that’s set for runaway growth. In fact, they say, it could ultimately upend the power distribution market.

“We’re completely unprepared for the opportunity that’s going to present itself,” says John Farrell, an economist and senior researcher at the Institute for Local Self-Reliance, a Minneapolis-based economic think tank.

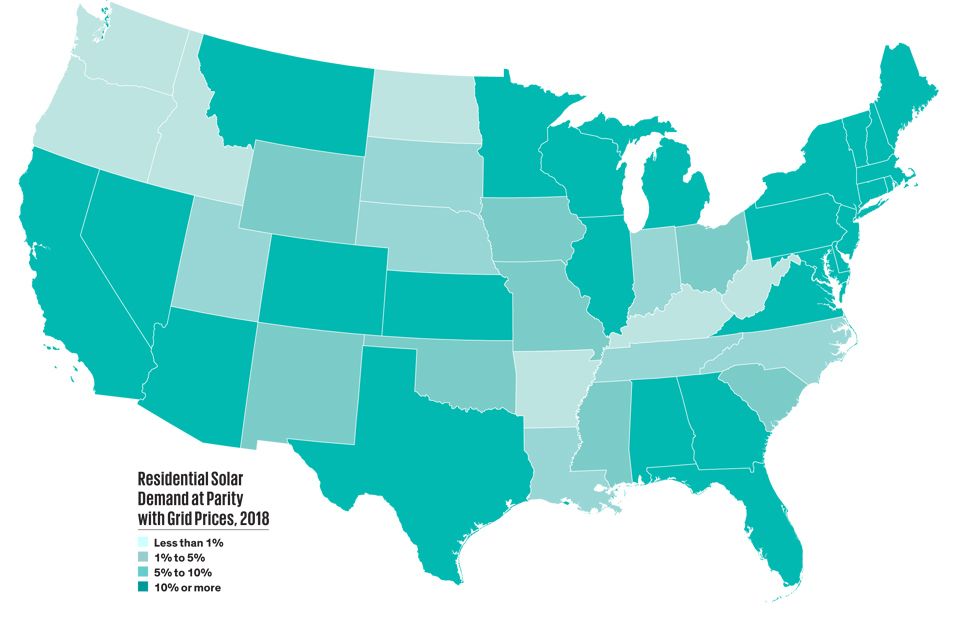

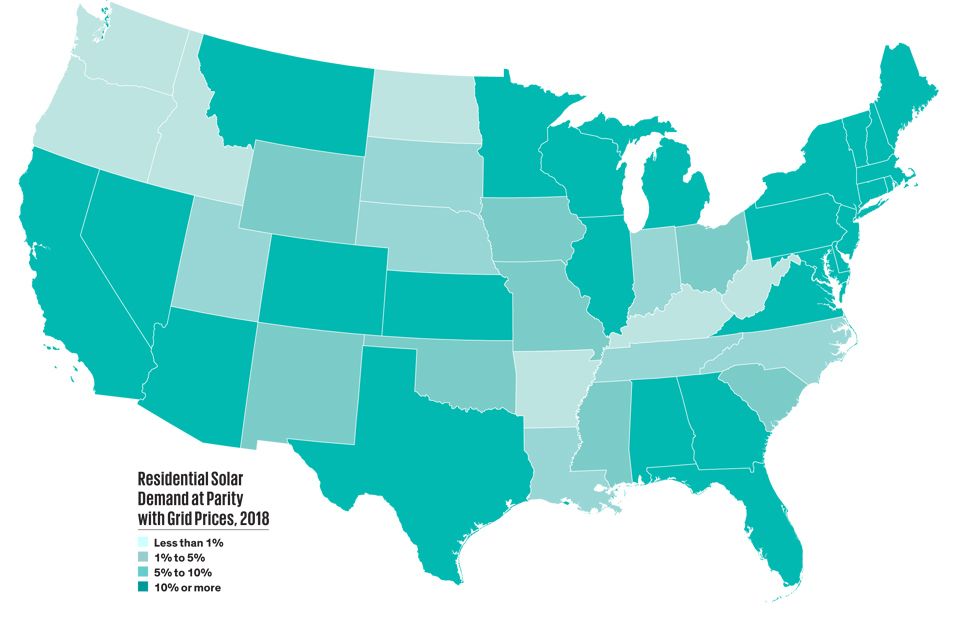

Farrell got beyond the less-inspiring U.S. national average price of rooftop solar on homes and businesses by examining how it stacks up in each of 3100 electric utility rate zones across the country. He projected the per-kilowatt costs of generation from PV systems through 2022 by estimating the cost of installing and maintaining them over their 25-year lifetime and calculating the number of kilowatt-hours they are likely to generate under each zone’s prevailing sunlight. Dividing cost by generation gave him what economists call the levelized cost of solar energy, which he compared to the local utility’s retail power rates.

The results, presented since January as an online map, suggest that rooftop PV already delivers power more cheaply than the U.S. grid for more than 10 percent of residential demand in five states—California, Connecticut, Hawaii, New Hampshire, and New Jersey. By 2022, home panels are predicted to be the economic winner for at least 10 percent of residential demand in 49 states; the grid holds its edge only in the state of Washington, thanks to notoriously gray skies and cheap local hydropower. PV installed by businesses, meanwhile, will be competitive with at least 10 percent of total U.S. commercial power consumption in 2022.

The most controversial element in the new economic forecasts for solar is what drives its spread across Farrell’s map as the years pass: the assumption that PV costs will continue to fall. Critics of solar energy attribute its plummeting prices to massive overproduction in China and to subsidy trimming in Europe. According to this argument, prices will rise as more producers go bankrupt (as Solyndra did famously in 2011 and others have since) and supply shrinks.

Stefan Reichelstein, faculty research director at Stanford’s Steyer-Taylor Center for Energy Policy and Finance, however, says the evidence indicates otherwise. His study, in Energy Policy, evaluated the impact of the unusually large price drops in recent years—40 percent in 2011 alone. Replacing PV’s recent dips with an extension of its historic price curve, which has been remarkably smooth for three decades, only increases the levelized cost of today’s systems by 12 to 15 percent. This suggests that the real drivers of PV’s price decline are technology and industrial efficiency, and there is no reason to believe they will hit a wall.

ieee

Human history becomes more and more a race between education and catastrophe. H. G. Wells.

Fatih Birol's motto: leave oil before it leaves us.