6th Natural Resources Day on Thursday, September 14, 2023.

https://www.youtube.com/watch?v=RIcM8ZQ8J2I

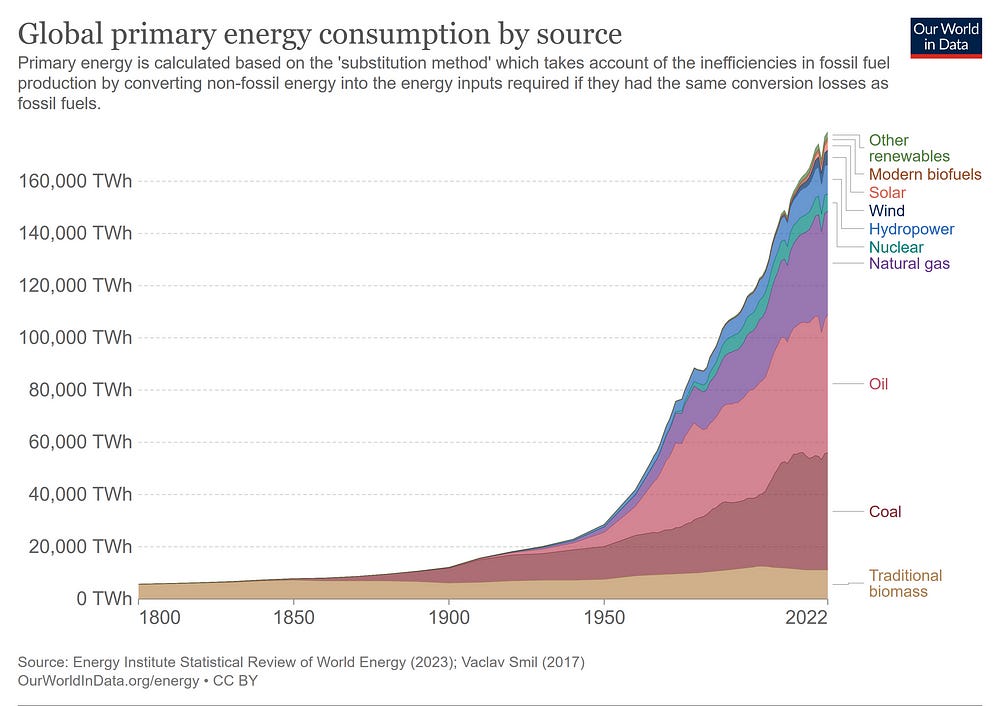

Mentions depletion:

you know a a cookie factory as long as you maintain the machines can

produce cookies forever but the copper mine or an oil field cannot

produce forever after a number of years depending on how big the thing

is it's empty that's it there's some more now every year some fields

become extinct and that depends a lot on how fast that happened how

many you get in a particular year depends on how much you reinvest

because you can always get a little bit more oil spending more money

out of the out of the place until it's really truly empty and that's

called depletion and now depletion it depends on the year as you see

in this curves on the right but it averages about five percent so that

means that every year you lose five percent of production capacity

which means that every year you have to increase I mean you need new

production of five percent to stay even not to produce more blah blah

blah just to stay even now five percent would be five million more or

less that would make you the fourth largest producer in the world and

we need one every year a new one every year every single year the

moment you stop investing well nothing happens but you start losing

that and eventually it catches up with you and this is what is

happening right now

Sorry the text is all run together. I scraped the transcript which does not have punctuation and sentence breaks.

I doubt this will reach you since you are drowning in sour grapes, however I never said that. Neither did I say the government or university studies are free of bias. That is a ridiculous notion that I would never say. Nonetheless, getting your facts from tabloids and fossil fuel funded lobby groups is even worse. They have lower professional standards, are even more biased, and have incentive to peddle propaganda & sensationalist click bait crap.

I doubt this will reach you since you are drowning in sour grapes, however I never said that. Neither did I say the government or university studies are free of bias. That is a ridiculous notion that I would never say. Nonetheless, getting your facts from tabloids and fossil fuel funded lobby groups is even worse. They have lower professional standards, are even more biased, and have incentive to peddle propaganda & sensationalist click bait crap.