>I knew meemoe_uk the tool was going to throw out the inflation argument......... lsolI knew vision_master the tool was going to throw the US PPP to examplify oil prices.

The US and its PPP is not representative of the world economy. It is a special case, where its industry ( which 40 years ago was world #1 ) has been stripped out and sent abroad. Now there are broken communities all over the US.

How come you didn't throw out a developing nations PPP 40 year chart hmm?

How come you didn't show world PPP ?

2ndly, you just made a complete tool of yourself infront of anyone who can understand a graph. On this forum that's me, oilfinder and rockdoc and a couple of others maybe. No one else will have clue what I'm going to say.

2 fails.

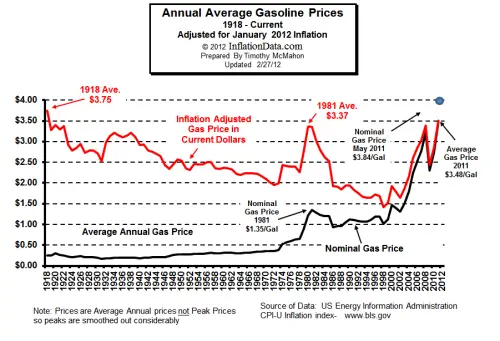

- a) its not a oil price graph. You have to combine oil cost with PPP. But you haven't.

- b) its a growth graph, therefore _IF_ we're taking straight PPP to represent the cost of oil, then its not saying US PPP & oil availability is now worse than in 1970s, its saying its 2855 + 3888 - 324 = $6419 better than the 1970s.

You understand? I'd be surprised.

All in all, its exactly what I'd expect from a PO_is_now type. You just gotta block out or burn the past.

. In the 70s oil crisis, people couldn't buy gasoline, not because the price was too high, but because there was no gasoline at the pump. A consumer had to barter and haggle with those that had it.

How can the most fanatical delusional peeker possibly think we've got it worse now then back in the 70s oil crisis? They can't. So they just have to erase the past. In doomer land the 70s didn't exist. Its no accident that vm and chums ignored that part of my post that described the 1970s.