Bankruptcy filings are flying in the American oil patch.

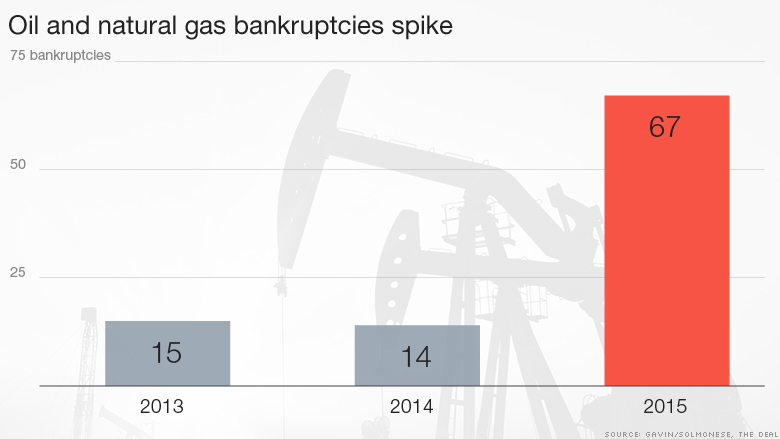

At least 67 U.S. oil and natural gas companies filed for bankruptcy in 2015, according to consulting firm Gavin/Solmonese.

That represents a 379% spike from the previous year when oil prices were substantially higher.

With oil prices crashing further in recent weeks, five more energy gas producers succumbed to bankruptcy in the first five weeks of this year, according to Houston law firm Haynes and Boone.

"It looks pretty bad. We fully anticipate it's only going to get worse," said Buddy Clark, a partner at Haynes and Boone and 33-year veteran in the energy finance space.

This bleak outlook highlights one of the flip sides to cheap energy prices.

Sure, it's great for drivers filling their tanks with cheap gas. But it's also fueling the demise of dozens of drilling and servicing companies -- and killing thousands of jobs in the process.

Even Chesapeake Energy (CHK), one of the better known winners from the shale boom, was forced to deny bankruptcy rumors earlier this week as its stock tanked.

Oil companies are drowning -- in tons of debt

The dramatic increase in bankruptcy filings corresponds with the plunge in oil prices from over $100 a barrel in mid-2014 to below $27 today. It also reflects the drop in natural gas prices, which are near 14-year lows.

When oil prices were comfortably in the $90-$100 range and the shale oil boom took off, companies took on tons of debt to fund expensive drilling. But the ensuing surge in U.S. oil production created an epic supply glut that caused crude to crash.

Revenues have dropped, choking off cash flows and making it challenging for companies to pay off all that debt. Companies have responded by cutting jobs and slashing spending. But some of the more leveraged ones have been forced to resort to bankruptcy.

Energy bankruptcies can be very messy

For instance, last March Fort Worth-based Quicksilver Resources collapsed under the weight of more than $2 billion in debt taken on to finance its drilling in the Barnett Shale in Texas.

Quicksilver's assets were put up for sale.

However, in a sign of how messy these restructurings can be, it took 10 months for Quicksilver's oil and natural gas acreage to be auctioned off. Quicksilver's assets fetched just $245 million, or one-fifth of the company's estimate of its assets at the time of the filing.

Clark said bankruptcies and auctions get slowed by complex capital structures that pit investors with competing interests against one another.

"To get all those constituencies aligned is like herding cats -- cats who don't like each other," he said.

Get ready for many more bankruptcies

Besides Quicksilver, a number of other oil and natural gas companies with at least $1 billion in debt have filed for bankruptcy, including Sabine Oil & Gas, Milagro Oil & Gas, Samson Resources and Swift Energy.

Just in the past week, at least three smaller oil and natural gas companies filed for bankruptcy in Texas and Oklahoma, according to Haynes and Boone.

It's very likely a lot more energy companies will succumb to the commodities crash, especially oil services firms. These companies have less bargaining power with banks because they don't actually own the oil in the ground, they just help extract it.

Clark said he knows of at least another half-dozen bankruptcy filings being prepared for the next few weeks alone -- including some larger and publicly-traded oil and natural gas companies.

"We saw the low hanging fruit already happen. Now the ones that were able to survive this long are going to start teetering," said Ted Gavin, founding partner of Gavin/Solmonese, which did the bankruptcy analysis from data compiled by The Deal.

Even the oil drillers that survive face an uncertain future.

"The companies that are just making it today may not have the cash to invest in their future. That's a recipe for disaster three or four years from now," said Gavin.

http://money.cnn.com/2016/02/11/investi ... -stack-dom