MonteQuest wrote:Tanada wrote:But look on the bright side, because there are so many idea arrows in the quiver we have so far delayed world terminal decline for 6-9 years depending on where you place conventional peak. BAU has managed to stumble along years past where I thought it would end.

Demand destruction has played a large role in that delay. If growth had continued, the US would be consuming 23 mbpd instead of just under 19 mbpd. With Europe's depression, their demand is down as well. Without this, even with shale oil, demand would be outstripping supply.

The economics is where this all lies. Can we keep the price of oil high enough to make arrows?

Its not just the price of oil, it is the willingness of the fiat bankers to invest the money needed, at least in the USA and EU. WTI was under $69.00 overnight and not much higher as I type this right now. In the USA that is destroying the value of oil companies left and right, stock prices are in freefall. In Russia where the government is a major player the oil companies will survive the storm because the government knows they are vital to the future of Russia. In the USA the government has the international philosophy that if the oil companies here fail them too bad so sad for them. Globalization is killing the domestic oil industry right now, today. The national oil companies will come out of this peachy keen in places like KSA and Oman. For Mexico it is anybody's guess, the infrastructure to weather low prices does not exist because the profits were all spent on other programs outside the oil industry.

How long will it take for the already contracted wells in Fracking locations in the USA to be drilled and completed? How many of them will be cancelled at $69.00/bbl? I suspect the first answer is, those places where work is already under weigh will be finished to recoup as much capital as possible. The second answer is a LOT to preserve whatever capital remains unspent.

If the USA government had an ounce of sense, something lacking in all politicians, they would be buying a million bbl/d of oil and putting it in the Strategic Reserve. That would immediately balance the oil production and consumption rates and restore prices to a level where Fracking would continue to receive financing from investment banks. President Obama ended the royalty payment in kind system that was slowly filling the reserves years ago, but all the capacity built for that oil we never took in still exists. Buying 300,000,000 bbl at a rate of 1,000,000 per day would take most of a year to fill existing capacity.

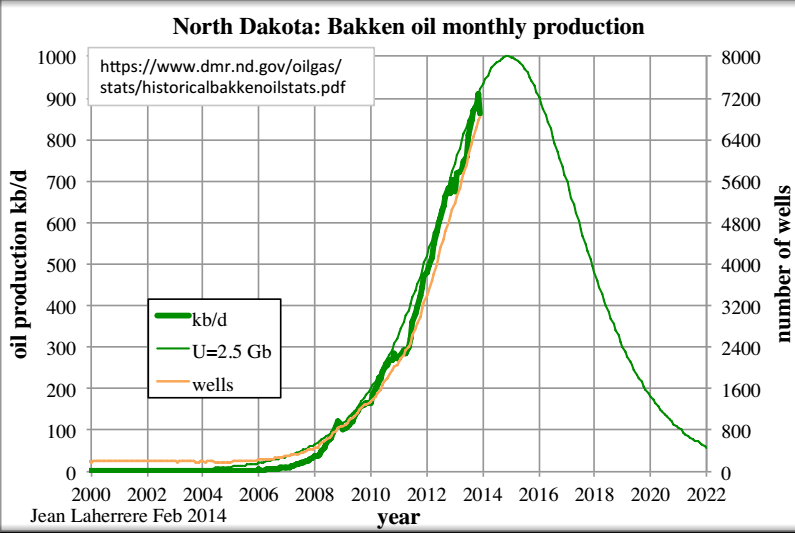

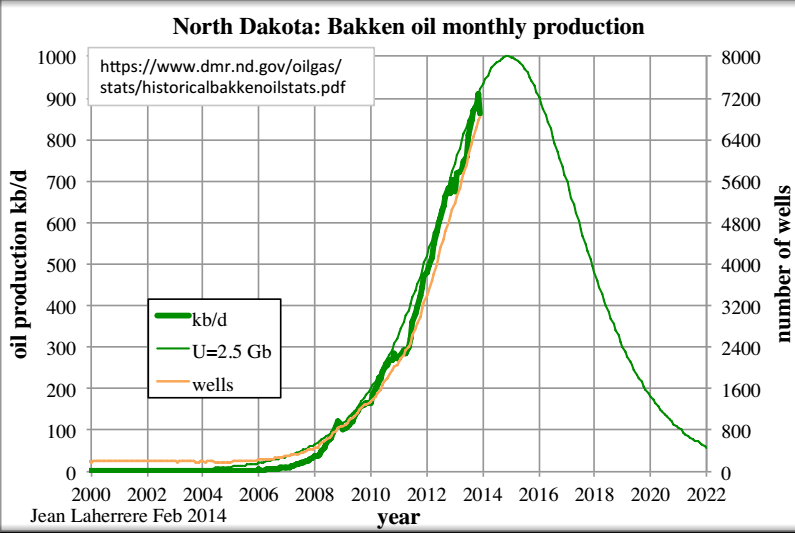

All of the above is kind of off the main tack of this thread however, every arrow does have its own price point. Right now I think we are below the price point for many but not all of the Fracking projects that have been planned. At the current price consumption is likely to rise which will take out some of the 'glut', and a slow down in the Fracking red queen race will also cut USA production. LaHere predicted Bakken would peak out in the middle of 2015,

I am predicting he was eight months too optimistic and Bakken peaked in November or December 2014 because at these prices drilling is going to collapse. The oil that is still there could still be drilled, especially in the sweet spots that have been identified, but between the massive depletion rate and the slow down in drilling rate the peak is here now.

Of course I am just some person on the internet who knows enough to sound like I might know what I am talking about too the uninformed, but I am making the best guess I know how to make.