A Different Big Picture

First unread post • 20 posts

• Page 1 of 1

A Different Big Picture

A long piece but offers a very different potential view of the future. Lots of meat on this bone to chew on. Some aspects seem plausible IMHO.

Reuters - The 40 percent plunge in oil prices since July, when Brent crude peaked at $115 a barrel, is almost certainly good news for the world economy; but it is surely a crippling blow for oil producers. Oil prices below $70 certainly spell trouble for U.S. and Canadian shale and tar-sand producers and also for oil-exporting countries such as Venezuela, Nigeria, Mexico and Russia that depend on inflated oil revenues to finance government spending or pay foreign debts. On the other hand, the implications of lower oil prices for the biggest U.S. and European oil companies are more ambiguous and could even be positive.

In fact, the shareholders of oil majors such as Exxon, Chevron, Shell, BP and Total could be among the biggest beneficiaries of the price slump, if it forces their corporate managements to abandon some of the bad habits they acquired in the 40-year oil boom when OPEC first established itself as an effective cartel in January, 1974. If this period of cartelized monopoly pricing is now ending, as Saudi Arabia has strongly hinted in the past few weeks, then it is time to re-focus on some basic principles of resource economics that Big Oil managements have ignored for decades, to their shareholders’ enormous cost.

The most important of these principles is “diminishing returns”: The more oil that corporate geologists discover, the lower the returns their shareholders can hope to achieve, because new reserves will almost invariably be more expensive to develop than the ones discovered earlier that were, almost by definition, more accessible. This inherent flaw in the oil companies’ business model was disguised for the past 40 years by the fact that oil prices rose even faster than the costs of exploration and production. But this is where a second economic principle now starts to bite.

Unless a market is totally dominated by monopoly power, prices will be set by the most efficient supplier’s marginal costs of production – in layman’s terms, by the cost of producing an extra barrel from oil reserves that have already been discovered and developed. In a fully competitive market, the enormous sums of money invested in exploring for new oil fields could not be recovered until all lower-cost reserves ran dry and there would be no point in exploring for anywhere outside the Middle Eastern and central Asian oilfields where the oil is easiest to pump.

That is, of course, an over-simplification. In the real world of geopolitical conflicts and transport and infrastructure bottlenecks, consumers want energy security and will pay premium prices for supplies from their own oil-fields or from those that belong to trusted allies. Nevertheless, the broad principle applies: The vast sums spent on exploring and developing new reserves with production costs much higher than in Middle East oilfields will never be recovered if the oil market becomes even vaguely competitive.

Considering that Western companies spend about $450 billion annually on exploration and development according to the Ernst & Young oil reserves study, this could be one of the worst capital misallocations in history. The fact is that Western producers can never match the costs of oil pumped by Saudi Aramco, or even Rosneft or other state-owned companies with exclusive access to the world’s most accessible reserves. While Exxon or BP must spend billions drilling through Arctic ice-caps or exploring 5 miles under the Gulf of Mexico, the Saudis can pump oil from their deserts with machines not much more expensive than old-fashioned “nodding donkeys.”

In a competitive market the rational strategy for Western oil companies would be stop all exploration, while continuing to provide technology, geology and other profitable oilfield services to the nationalized owners of readily-accessible reserves. The vast amounts of cash generated by selling oil from existing low-cost reserves already developed could then be distributed to shareholders until these low-cost oilfields ran dry. This strategy of self-liquidation could be described euphemistically as “running the business for cash” in the same way as tobacco companies or closed insurance funds.

There are two reasons why this hasn’t happened thus far. Firstly, OPEC has sheltered Western oil companies from diminishing returns and marginal-cost pricing by keeping prices artificially high through output restraint and limited expansion of cheap Middle Eastern oilfields (strictures reinforced by wars and sanctions in Iraq and Iran). Secondly, oil company managements have believed with quasi-religious fervor in perpetually rising oil demand. Therefore finding new reserves seemed more important than maximizing cash distributions to shareholders.

The second assumption could soon be overturned, as suggested by rumors of a takeover bid for BP. If private equity investors could raise the $160 billion needed to buy BP, they could liquidate for cash a company whose proven reserves of 10.05 billion barrels would be worth $350 billion even after another 50 percent price decline.

But what of the first condition? The Saudis would surely want to stabilize prices at some point by limiting production, but the target prices may now be considerably lower than previously assumed. The Saudis seem to have realized that by ceding market share to other producers they risk allowing much of their oil to become a worthless “stranded asset” that can never be sold or burnt. With the global atmosphere approaching its carbon limits and technological progress gradually reducing the price of non-fossil fuels, the Bank of England warned this week that some of the world’s oil reserves could become “stranded assets,” with no market value despite the huge sums sunk into the ground by oil companies, their shareholders and banks.

The Saudis are well aware of this risk. Back in the 1970s, Sheikh Zaki Yamani, the wily Saudi oil minister used to warn his compatriots not to rely forever on selling oil: “The stone age didn’t end because the cave-men ran out of stones.” Maybe the end of the “oil age” is now approaching, and the Saudis have understood this better than Western oil-men.

Reuters - The 40 percent plunge in oil prices since July, when Brent crude peaked at $115 a barrel, is almost certainly good news for the world economy; but it is surely a crippling blow for oil producers. Oil prices below $70 certainly spell trouble for U.S. and Canadian shale and tar-sand producers and also for oil-exporting countries such as Venezuela, Nigeria, Mexico and Russia that depend on inflated oil revenues to finance government spending or pay foreign debts. On the other hand, the implications of lower oil prices for the biggest U.S. and European oil companies are more ambiguous and could even be positive.

In fact, the shareholders of oil majors such as Exxon, Chevron, Shell, BP and Total could be among the biggest beneficiaries of the price slump, if it forces their corporate managements to abandon some of the bad habits they acquired in the 40-year oil boom when OPEC first established itself as an effective cartel in January, 1974. If this period of cartelized monopoly pricing is now ending, as Saudi Arabia has strongly hinted in the past few weeks, then it is time to re-focus on some basic principles of resource economics that Big Oil managements have ignored for decades, to their shareholders’ enormous cost.

The most important of these principles is “diminishing returns”: The more oil that corporate geologists discover, the lower the returns their shareholders can hope to achieve, because new reserves will almost invariably be more expensive to develop than the ones discovered earlier that were, almost by definition, more accessible. This inherent flaw in the oil companies’ business model was disguised for the past 40 years by the fact that oil prices rose even faster than the costs of exploration and production. But this is where a second economic principle now starts to bite.

Unless a market is totally dominated by monopoly power, prices will be set by the most efficient supplier’s marginal costs of production – in layman’s terms, by the cost of producing an extra barrel from oil reserves that have already been discovered and developed. In a fully competitive market, the enormous sums of money invested in exploring for new oil fields could not be recovered until all lower-cost reserves ran dry and there would be no point in exploring for anywhere outside the Middle Eastern and central Asian oilfields where the oil is easiest to pump.

That is, of course, an over-simplification. In the real world of geopolitical conflicts and transport and infrastructure bottlenecks, consumers want energy security and will pay premium prices for supplies from their own oil-fields or from those that belong to trusted allies. Nevertheless, the broad principle applies: The vast sums spent on exploring and developing new reserves with production costs much higher than in Middle East oilfields will never be recovered if the oil market becomes even vaguely competitive.

Considering that Western companies spend about $450 billion annually on exploration and development according to the Ernst & Young oil reserves study, this could be one of the worst capital misallocations in history. The fact is that Western producers can never match the costs of oil pumped by Saudi Aramco, or even Rosneft or other state-owned companies with exclusive access to the world’s most accessible reserves. While Exxon or BP must spend billions drilling through Arctic ice-caps or exploring 5 miles under the Gulf of Mexico, the Saudis can pump oil from their deserts with machines not much more expensive than old-fashioned “nodding donkeys.”

In a competitive market the rational strategy for Western oil companies would be stop all exploration, while continuing to provide technology, geology and other profitable oilfield services to the nationalized owners of readily-accessible reserves. The vast amounts of cash generated by selling oil from existing low-cost reserves already developed could then be distributed to shareholders until these low-cost oilfields ran dry. This strategy of self-liquidation could be described euphemistically as “running the business for cash” in the same way as tobacco companies or closed insurance funds.

There are two reasons why this hasn’t happened thus far. Firstly, OPEC has sheltered Western oil companies from diminishing returns and marginal-cost pricing by keeping prices artificially high through output restraint and limited expansion of cheap Middle Eastern oilfields (strictures reinforced by wars and sanctions in Iraq and Iran). Secondly, oil company managements have believed with quasi-religious fervor in perpetually rising oil demand. Therefore finding new reserves seemed more important than maximizing cash distributions to shareholders.

The second assumption could soon be overturned, as suggested by rumors of a takeover bid for BP. If private equity investors could raise the $160 billion needed to buy BP, they could liquidate for cash a company whose proven reserves of 10.05 billion barrels would be worth $350 billion even after another 50 percent price decline.

But what of the first condition? The Saudis would surely want to stabilize prices at some point by limiting production, but the target prices may now be considerably lower than previously assumed. The Saudis seem to have realized that by ceding market share to other producers they risk allowing much of their oil to become a worthless “stranded asset” that can never be sold or burnt. With the global atmosphere approaching its carbon limits and technological progress gradually reducing the price of non-fossil fuels, the Bank of England warned this week that some of the world’s oil reserves could become “stranded assets,” with no market value despite the huge sums sunk into the ground by oil companies, their shareholders and banks.

The Saudis are well aware of this risk. Back in the 1970s, Sheikh Zaki Yamani, the wily Saudi oil minister used to warn his compatriots not to rely forever on selling oil: “The stone age didn’t end because the cave-men ran out of stones.” Maybe the end of the “oil age” is now approaching, and the Saudis have understood this better than Western oil-men.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: A Different Big Picture

With the global atmosphere approaching its carbon limits....

????

The atmosphere doesn't have a "carbon limit." There is no natural geophysical limit to the amount of carbon in the atmosphere (the atmosphere of Venus is 96% CO2).

Also, there currently is no political or treaty obligation for any country on earth to limit their carbon emissions to the atmosphere.

some of the world’s oil reserves could become “stranded assets,” with no market value despite the huge sums sunk into the ground by oil companies, their shareholders and banks.

That is theoretically possible, but it seems unlikely. Its probably more likely that oil will become increasingly valuable when this period of oil glut ends and we eventually reach peak oil (whenever that finally happens).

????

The atmosphere doesn't have a "carbon limit." There is no natural geophysical limit to the amount of carbon in the atmosphere (the atmosphere of Venus is 96% CO2).

Also, there currently is no political or treaty obligation for any country on earth to limit their carbon emissions to the atmosphere.

some of the world’s oil reserves could become “stranded assets,” with no market value despite the huge sums sunk into the ground by oil companies, their shareholders and banks.

That is theoretically possible, but it seems unlikely. Its probably more likely that oil will become increasingly valuable when this period of oil glut ends and we eventually reach peak oil (whenever that finally happens).

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: A Different Big Picture

Another problem is the possibility that the global economy can only withstand higher prices to a certain extent, after which it starts to weaken.

-

ralfy - Light Sweet Crude

- Posts: 5600

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: A Different Big Picture

That is assuming those old fields will not peak and decline.ROCKMAN wrote:Unless a market is totally dominated by monopoly power, prices will be set by the most efficient supplier’s marginal costs of production – in layman’s terms, by the cost of producing an extra barrel from oil reserves that have already been discovered and developed. In a fully competitive market, the enormous sums of money invested in exploring for new oil fields could not be recovered until all lower-cost reserves ran dry and there would be no point in exploring for anywhere outside the Middle Eastern and central Asian oilfields where the oil is easiest to pump.

Aren't they heavily invested in EOR ?Saudis can pump oil from their deserts with machines not much more expensive than old-fashioned “nodding donkeys.”

Facebook knows you're a dog.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: A Different Big Picture

IMO, this fits with Steven Kopits' supply-constrained evaluation from earlier this year: https://www.youtube.com/watch?v=dLCsMRr7hAg , especially in regard to the major non-NOCs. Russia and KSA can afford to play the longer game.

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: A Different Big Picture

Having not had the time to keep up with movement triggers lately, my intuition tells me it's likely we are in for a repeat of the pattern of 2007/9 with a new spike & eventually resettling above the sticking point around $100. I always wait until last minute to put my price predictions in. I won the game twice, on the basis of lowest price being just over break even for the frackers & high being what the market could bear psychologically. I lost on the same basis the last couple of years, then changed strategy towards new normal stability. If I had stuck to the earlier formula I would have won again this year. Next year, I am thinking radical instability, a peak/ crash scenario & new normal significantly above the $100 mark. If the majors can use this to put the heebeegeebees on the frackers, mess with their financial systems enough, they will kill it pretty dead for considerable time. To get fracking going again after a big boom & bust will take sustained high prices. I think those calling this the beginning of a sustained price lull are totally deluded.

- SeaGypsy

- Master Prognosticator

- Posts: 9284

- Joined: Wed 04 Feb 2009, 04:00:00

Re: A Different Big Picture

.

a pretty good overview , , I loose it toward the end talking of Gulf fields being “stranded asset”

, producing 10% less for longer at a price 40% higher would strike me as a reasonable business model

What is the big deal with market share if one can sell all its production ,it improve as the others sellers deplete

a pretty good overview , , I loose it toward the end talking of Gulf fields being “stranded asset”

, producing 10% less for longer at a price 40% higher would strike me as a reasonable business model

What is the big deal with market share if one can sell all its production ,it improve as the others sellers deplete

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: A Different Big Picture

Isnt the stranded asset a reference to a fear that potential carbon reduction legislation/targets or increased renewables removing the demand for their product before they can make a profit from selling it.

It will be interesting to see how long they keep the lower prices for.

I imagine the key goal is to hurt Russia and their ability to support their allies in the middle east.

As well as knock out a few of the high price dependant competitors.(mainly shale).

When the price does bounce back, as you expect it will, it should create a fair shock wave through an already weak economy, after raising false expectations.

If the shale players get massively burnt in the process, it could mean the short term boost in supply, shale has provided, may not be so quick to fill the gap,causing even more economic pain.

It will be interesting to see how long they keep the lower prices for.

I imagine the key goal is to hurt Russia and their ability to support their allies in the middle east.

As well as knock out a few of the high price dependant competitors.(mainly shale).

When the price does bounce back, as you expect it will, it should create a fair shock wave through an already weak economy, after raising false expectations.

If the shale players get massively burnt in the process, it could mean the short term boost in supply, shale has provided, may not be so quick to fill the gap,causing even more economic pain.

Ready to turn Zombies into WWOOFers

-

Shaved Monkey - Intermediate Crude

- Posts: 2486

- Joined: Wed 30 Mar 2011, 01:43:28

Re: A Different Big Picture

The idea oil is becoming a stranded asset due to AGW legislation is fanciful. Oil is still king & will remain so for a long time yet.

- SeaGypsy

- Master Prognosticator

- Posts: 9284

- Joined: Wed 04 Feb 2009, 04:00:00

Re: A Different Big Picture

Keith/Sparky - Some interesting thoughts presented in the piece and some that went right past me too. LOL. That's the main reason I didn't try to edit it down. I figured I would let the group separate the wheat from the chaff. But regardless of some of the parts as a whole it's one on the more comprehensive efforts I've seen of late.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: A Different Big Picture

SeaGypsy wrote:The idea oil is becoming a stranded asset due to AGW legislation is fanciful. Oil is still king & will remain so for a long time yet.

I agree no hope,it will be only lack of profit that stops it being pumped.

Ready to turn Zombies into WWOOFers

-

Shaved Monkey - Intermediate Crude

- Posts: 2486

- Joined: Wed 30 Mar 2011, 01:43:28

Re: A Different Big Picture

The Economist

Will falling oil prices curb America’s shale boom?

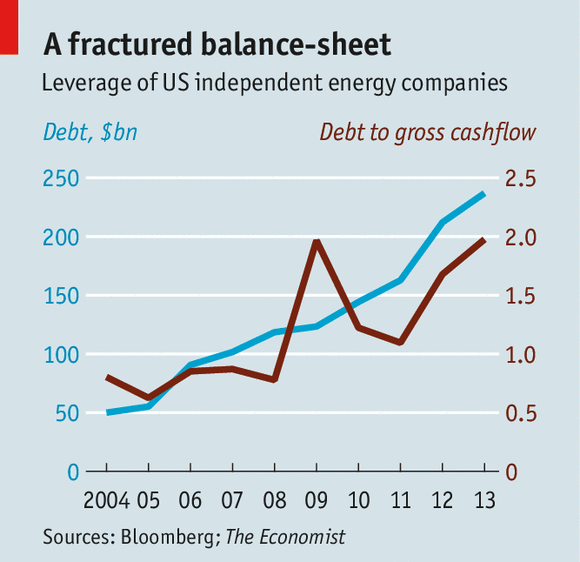

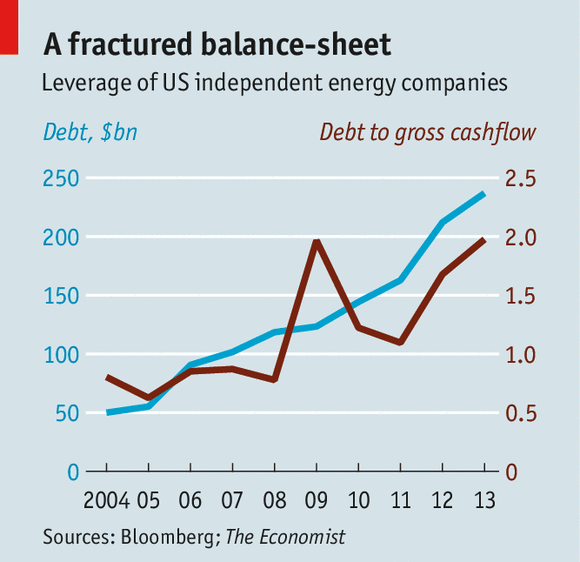

Saudi may not feel it needs to take the pain of a cut, the short life cycles of shale mean the market will force them to take the pain and Saudi can maintain market share and reap the gain in a couple of years from now. The debt levels in many aggressive drillers is a big eye opener.

Some people could be headed to the bath and those cash rich operators may be able to gobble up some debt imploding competitors in the coming years.

Will falling oil prices curb America’s shale boom?

This time some of the pain will be taken by the big integrated energy firms, such as Exxon Mobil and Shell. After a decade of throwing shareholders’ cash at prospects in the Arctic and deep tropical waters to little effect, they began cutting budgets in 2013. Long-term projects equivalent to about 3% of global output have been deferred or cancelled, says Oswald Clint of Sanford C. Bernstein, a research firm. Most “majors” assume an oil price of $80 when making plans, so deeper cuts are likely.

But much of the burden of adjustment will fall on America’s shale industry. It has been a big swing factor in supply, with output rising from 0.5% of the global total in 2008 to 3.7% today. That has required hefty spending: shale accounted for at least 20% of global investment in oil production last year. Saudi Arabia, the leading member of OPEC, has made clear it will tolerate lower prices in order to do to shale firms’ finances what fracking does to rocks.

Saudi likely simply does not see a need to cut production itself as over the next two years either price goes up or others will exit the market. Especially long term projects by the IOCs would take supply off the market for years to come.Harold Hamm (whose fortune has dropped by $11 billion since July), has said he can cope as long as the oil price is above $50. Stephen Chazen, who runs Occidental Petroleum, has said the industry is “not healthy” below $70. The uncertainty reflects the diversity of activity. Wells produce different mixes of oil and gas (which sells for less). Transport costs vary: it is cheap to pipe oil from the Eagle Ford play, in Texas, but expensive to shift it by train out of the Bakken formation, in North Dakota. Firms use different engineering techniques to pare costs.

Two generalisations can still be made. First, in the very near term, the industry’s economics are good at almost any price. Wells that are producing oil or gas are extraordinarily profitable, because most of the costs are sunk. Taking a sample of eight big independent firms, average operating costs in 2013 were $10-20 per barrel of oil (or equivalent unit of gas) produced—so no shale firm will curtail current production. But the output of shale wells declines rapidly, by 60-70% in their first year, so within a couple of years this oil will stop flowing.

Second, it is far less clear if, at $70 a barrel, the industry can profitably invest in new wells to maintain or boost production. Wood Mackenzie, a research consultancy, estimates that the “break-even price” of American projects is clustered around $65-70, suggesting many are vulnerable (these calculations exclude some sunk costs, such as building roads). If the oil price stays at $70, it estimates investment will be cut by 20% and production growth for America could slow to 10% a year. At $60, investment could drop by as much as half and production growth grind to a halt.

Saudi may not feel it needs to take the pain of a cut, the short life cycles of shale mean the market will force them to take the pain and Saudi can maintain market share and reap the gain in a couple of years from now. The debt levels in many aggressive drillers is a big eye opener.

Some people could be headed to the bath and those cash rich operators may be able to gobble up some debt imploding competitors in the coming years.

-

dorlomin - Light Sweet Crude

- Posts: 5193

- Joined: Sun 05 Aug 2007, 03:00:00

Re: A Different Big Picture

I always appreciate Rockman's comments. And as always followed by the debates people with no training, expertise or experience. But this is to be expected. Years ago, I was listening to a man ramble on about what jet planes would/wouldn't do. After a bit a fellow listener came over and asked "don't you have experience flying those planes?" "Yep" I said "thousands of hours but experience rarely wins over opinion in discussions like this".

- eugene

- Peat

- Posts: 76

- Joined: Sat 23 Aug 2014, 10:08:45

Re: A Different Big Picture

pstarr - Thanks but sometimes I am full of sh*t. Often on purpose to provoke discussions and on rare occasions I am actually full of sh*t. LOL.

And not that I'm necessarily disagreeing with you about Big Oil profits per se. But my personal experience over the last 40 years: some of the best ROR I've generated were during down periods in the oil patch. I'll state the obvious: a company's profitability isn't based upon the price of oil/NG. It's determined by what they sell it for less what they spent developing it. The best NG drilling program I ever generated sold production for $0.90 to $1.25/mcf. The 3 best wells in a new shallow field I drilled costs a total of $0.12/mcf to get the production out of the ground. Those wells cost about $50k each. Today the same well would cost over $400k. But in 1986 when the oil patch was busted flat on its back the service companies had little choice but to almost give their work away for free.

And yes: I've already started putting the screws to service companies who are involved heavily in the Eager Ford Shale play. As always: it ain't personal...just business. LOL.

And not that I'm necessarily disagreeing with you about Big Oil profits per se. But my personal experience over the last 40 years: some of the best ROR I've generated were during down periods in the oil patch. I'll state the obvious: a company's profitability isn't based upon the price of oil/NG. It's determined by what they sell it for less what they spent developing it. The best NG drilling program I ever generated sold production for $0.90 to $1.25/mcf. The 3 best wells in a new shallow field I drilled costs a total of $0.12/mcf to get the production out of the ground. Those wells cost about $50k each. Today the same well would cost over $400k. But in 1986 when the oil patch was busted flat on its back the service companies had little choice but to almost give their work away for free.

And yes: I've already started putting the screws to service companies who are involved heavily in the Eager Ford Shale play. As always: it ain't personal...just business. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: A Different Big Picture

There are two reasons why this hasn’t happened thus far. Firstly, OPEC has sheltered Western oil companies from diminishing returns and marginal-cost pricing by keeping prices artificially high through output restraint and limited expansion of cheap Middle Eastern oilfields (strictures reinforced by wars and sanctions in Iraq and Iran).

I think I might want to start some discussion also. The quote is from the article (not from, I think, Rockman). This is so "in your face peak oil crowd". Isn't this supposed to be physically impossible. Isn't all the "cheap oi"l gone. I as a not oil man have no opinion, but isn't somebody gonna get all indignant.

-

kuidaskassikaeb - Coal

- Posts: 438

- Joined: Fri 13 Apr 2007, 03:00:00

- Location: western new york

Re: A Different Big Picture

kuidaskassikaeb wrote:There are two reasons why this hasn’t happened thus far. Firstly, OPEC has sheltered Western oil companies from diminishing returns and marginal-cost pricing by keeping prices artificially high through output restraint and limited expansion of cheap Middle Eastern oilfields (strictures reinforced by wars and sanctions in Iraq and Iran).

I think I might want to start some discussion also. The quote is from the article (not from, I think, Rockman). This is so "in your face peak oil crowd". Isn't this supposed to be physically impossible. Isn't all the "cheap oi"l gone. I as a not oil man have no opinion, but isn't somebody gonna get all indignant.

The writer seems to think it possible to pump dry the low cost oil first and then move up the marginal cost curve later:

According to PO it doesn't work that way. The old fields are expected to go into gradual decline (somewhat abated by expensive EOR) at their halfway point and lost production will have to be replaced by new high marginal cost sources.Unless a market is totally dominated by monopoly power, prices will be set by the most efficient supplier’s marginal costs of production – in layman’s terms, by the cost of producing an extra barrel from oil reserves that have already been discovered and developed. In a fully competitive market, the enormous sums of money invested in exploring for new oil fields could not be recovered until all lower-cost reserves ran dry and there would be no point in exploring for anywhere outside the Middle Eastern and central Asian oilfields where the oil is easiest to pump.

Facebook knows you're a dog.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: A Different Big Picture

k - Unfortunate what I think you're describing is part of the bad legacy of so many in the PO crowd being focused on dates and production rates. It's why I started pushing the POD concept long ago. Yes: production rates in the US have risen and oil prices are crashing to current levels because of PO. More specifically because of the Peak Oil Dynamic. I would hope by now it would become apparent to many (hopefully most here) that such metrics don't exist in a vacuum: PO dates, production surges, expensive drilling programs, military adventures, economic growth/stagnation, employment levels, shale high decline rates, Democrat/Republican controlled Congress, oil exports, huge oil company debt levels, Canadian pipelines, LNG terminals, etc. They are all interconnected pieces of the POD. Some of the connections are strong and obvious...and some not so obvious. And others are weak but collectively have their influence.

Long ago I expressed my opinion that the surge in US oil production was one of the strongest evidences of the coming PO crisis. And now I would add the current slide in oil prices as more evidence since I view it as resulting more from the impact high oil prices having finally caught up with the global economy reducing its ability to afford energy. As the point I made in another post: what was a big factor leading to the price surge that justified companies chasing shale production as it never has before? Oil prices less than $17/bbl in 1998. What??? The same oil prices that let the world increase consumption from 65 million bbls/day to over 90 million bbls/day. Which led to recent high oil prices which the world apparently can no longer afford and thus leading to lower prices.

Time will tell if the lower oil price will allow the world to continue consuming 90+ million bbls/day. If not and consumption decreases producers, especially in the ME, will still need to max their cash flow. Which could mean even lower oil prices to stimulate increased consumption. Less than $20/bbl? Who knows. But the POD existed in 1998 just as it exists today. Just as it did in 1980 when the inflation adjusted price of oil shot past $100/bbl. Just as it did in the mid 80’s when that same price pushed down towards $10/bbl.

The old joke was that only taxes and herpes lasted forever. We might want to add the POD to that short list. LOL.

Long ago I expressed my opinion that the surge in US oil production was one of the strongest evidences of the coming PO crisis. And now I would add the current slide in oil prices as more evidence since I view it as resulting more from the impact high oil prices having finally caught up with the global economy reducing its ability to afford energy. As the point I made in another post: what was a big factor leading to the price surge that justified companies chasing shale production as it never has before? Oil prices less than $17/bbl in 1998. What??? The same oil prices that let the world increase consumption from 65 million bbls/day to over 90 million bbls/day. Which led to recent high oil prices which the world apparently can no longer afford and thus leading to lower prices.

Time will tell if the lower oil price will allow the world to continue consuming 90+ million bbls/day. If not and consumption decreases producers, especially in the ME, will still need to max their cash flow. Which could mean even lower oil prices to stimulate increased consumption. Less than $20/bbl? Who knows. But the POD existed in 1998 just as it exists today. Just as it did in 1980 when the inflation adjusted price of oil shot past $100/bbl. Just as it did in the mid 80’s when that same price pushed down towards $10/bbl.

The old joke was that only taxes and herpes lasted forever. We might want to add the POD to that short list. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

20 posts

• Page 1 of 1

Who is online

Users browsing this forum: No registered users and 243 guests