Has the danger of Peak Oil passed?

Re: Has the danger of Peak Oil passed?

I think that we will be able to date peak oil in the rearview mirror. In maybe a couple of years we'll start to see it. then we'll see that we never came up to that amount of oil we produced in 2015, or whenever the peak was. Everything's clear in hindsight.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Has the danger of Peak Oil passed?

Revi - So true. Which emphasizes the point I keep boring some folks with: the date of global PO actually has little relevance in our daily lives.

LONG LIVE THE POD!!!

As if we have a f*cking choice. LOL

LONG LIVE THE POD!!!

As if we have a f*cking choice. LOL

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

pstarr wrote:Regardless I asked about the the missing $1 trillion dollars. In your opinion, did it have

a) nothing,

b) little,

c) or a trifle to do with our Great Recession?

b) Maybe 25% or less. Note the oil speculation going on at the time. There was maybe a $20-30 premium tacked on due to speculation.

Of course, when you evoke the recession, you never even mention real-estate. Only peak-oil. It's that sin of omission I can't let pass without calling you on it. It's BS.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Has the danger of Peak Oil passed?

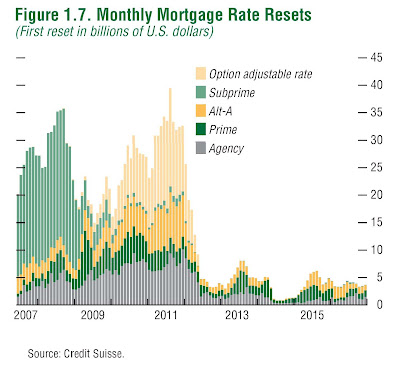

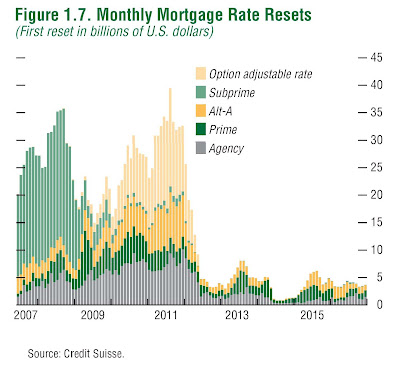

This is the only chart anyone needs to see to blame real-estate for the credit-crisis. I've used it many times and each time PStarr scoffs at it because he's mentally incapable of adding 2+2 on this simple logic. Clear peaker blinders.

The big spike up in people's monthly mortgage payments far outweighed the increased cost of commuting from the exurbs at $3.xx vs. $2.00 gas.

The big spike up in people's monthly mortgage payments far outweighed the increased cost of commuting from the exurbs at $3.xx vs. $2.00 gas.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Has the danger of Peak Oil passed?

pstarr wrote: Current reserves from old fields are mostly unknowable as the old fields were mapped before modern 4-D seismic.

Current reserves are not required to be calculated using any seismic. And decades of performance, all the way back into the the old "unknowable" days, are great sources of information from which to do current reserves, with nary a seismic plot in sight.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

Revi wrote:I think that we will be able to date peak oil in the rearview mirror. In maybe a couple of years we'll start to see it. then we'll see that we never came up to that amount of oil we produced in 2015, or whenever the peak was. Everything's clear in hindsight.

That idea certainly worked for awhile in the US. But the real problem is, how many decades must we wait to figure out if it was the real deal? Using the US as an example, we have to wait more than 4 decades to make sure it doesn't happen all over again. So now we have to worry about the sine curve example of oil production coming back to haunt our grandchildren. Cycle 2, halfway through at this point. In 2050, maybe it'll be the oil shales doing the peak of cycle 3?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

PStarr's argument seems to revolve around the simple truth that oil is underground and we can't see it therefore we don't know how much is left. And since we can't, it's up to our individual biases to predict how much. Doomers = less. Cornies = more. That's really not a scientific argument. It's arguing for superstition or a crap-shoot.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Has the danger of Peak Oil passed?

pstarr wrote:How can current reserves from an old field be determined (modern reserves measure are a function both of production history and field geology).

a) the original production data is not accurate before SEC filings and,

b) the original field dimension were not mapped.

So You are wrong. And you need to drop the snarky images. They waste bandwidth and are visually actually an ad hom. Flagged?

I stand by my original statement. The SEC requirements on reserve reporting date back to 1933.

First page, halfway down.

https://www.sec.gov/rules/final/2008/33-8995.pdf

3D seismic was a 60's event, you figure between 1933 and sometime after the 60's when 4D got invented no one was filing any reserve reports? 1/3 of the way down the page.

http://www.offshore-technology.com/feat ... d-4436910/

But even though you obviously aren't familiar with how reserves are done, I would like to ask Rockman if 4D seismic is how his billionaire oil boss estimates the future value of his fields or assets. How about it Rockman, does your rich boss call in Schlumberger every so often so he can reassess the value of his producing properties, it being apparently the way it can be done?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

ennui2 wrote:PStarr's argument seems to revolve around the simple truth that oil is underground and we can't see it therefore we don't know how much is left. And since we can't, it's up to our individual biases to predict how much. Doomers = less. Cornies = more. That's really not a scientific argument. It's arguing for superstition or a crap-shoot.

Well, he needs to get out and talk to the scientists who do all sorts of things like that, and without even using seismic! Hubbert's direct scientific descendants no less.

Been at it since Hubbert was still alive and working for them, based on the chronology of their work.

http://energy.usgs.gov/OilGas/Assessmen ... zP97fkrIdU

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

Most recent reserves where not a result of hot new technology applied, but only to economical recovery linked to high prices which permitted to apply these expensive technologies. And everybody believed these prices would stay because of the lack of major new discoveries. The reserves grew because of the prices, and are decreasing for the same reason.

Unfortunately, high prices had an effect on consumption, and an unexpected effect on production (shale oil, but also other developments). The turnaround in prices reverse this situation. But it doesn't change the fact that we have no more huge discoveries of cheap oil.

Unfortunately, high prices had an effect on consumption, and an unexpected effect on production (shale oil, but also other developments). The turnaround in prices reverse this situation. But it doesn't change the fact that we have no more huge discoveries of cheap oil.

-

tita - Coal

- Posts: 418

- Joined: Fri 10 Jun 2005, 03:00:00

Re: Has the danger of Peak Oil passed?

Guys, guys, guys. If you don't want to believe me that's OK. But for more than 40 years one of my primary duties has been estimating reserves IN DEVELOPED AND PRODUCING FIELDS. Seismic data is too coarse a tool to help. First, since it has been drilled up, there's a lot of very detailed geologic data from the well logs which is infinitely more accurate then seismic. But even with all that subsurface data many assumptions have to be made to predict future recovery. But that's true only before production begins. Once a field has been producing for a significant time the validity or inaccuracy of those assumptions typically become rather obvious. Several years ago I saw a well with an expected life of 5+ years deplete in 31 days. We still don’t know why even after drilling a number of offset wells. Note: there are exploration geologists that discover fields, development geologists that drill them up and also production geologists that study them after they’ve been drilled up. For at least 2 decades the Rockman's duties have been that of a production geologist: I study fields that have a significant production history. And I do this looking for new opportunities.

Which is what led Rockman to drilling hz wells in a 66 year old conventional oil reservoir. Before those wells were drilled the entire field was doing 12 bopd from 6 wells. Yes: about 2 bopd per well and a sh*t load of water. The first hz well was drilled in the middle of 4 “depleted” producers and flowed 400 bopd. I can’t give details as to why this worked because I would have to kill everyone here. LOL. And the Rockman wasn’t the first to recognize all the stranded oil in this field as well as others in the trend. But he was the first one to figure out how to produce that oil profitably: numerous other efforts failed economically. And one more trade secret I can’t share. And yes: my little company (that very few in the Texas oil patch even know exists) was the first one to drill a commercial successful hz well in the Gulf Coast in a conventional sandstone reservoir.

FYI: there no seismic data that would have even hinted at the possibly redevelopment of this reservoir. Again I can’t begin to off all the tech training to folks here to allow them to grasp even the simplest fundamentals: it has taken me 4 decades to get to where I am now and I’m still learning. So believe or don’t believe and continue arguing amongst yourselves. This is all I have to say on the matter.

Which is what led Rockman to drilling hz wells in a 66 year old conventional oil reservoir. Before those wells were drilled the entire field was doing 12 bopd from 6 wells. Yes: about 2 bopd per well and a sh*t load of water. The first hz well was drilled in the middle of 4 “depleted” producers and flowed 400 bopd. I can’t give details as to why this worked because I would have to kill everyone here. LOL. And the Rockman wasn’t the first to recognize all the stranded oil in this field as well as others in the trend. But he was the first one to figure out how to produce that oil profitably: numerous other efforts failed economically. And one more trade secret I can’t share. And yes: my little company (that very few in the Texas oil patch even know exists) was the first one to drill a commercial successful hz well in the Gulf Coast in a conventional sandstone reservoir.

FYI: there no seismic data that would have even hinted at the possibly redevelopment of this reservoir. Again I can’t begin to off all the tech training to folks here to allow them to grasp even the simplest fundamentals: it has taken me 4 decades to get to where I am now and I’m still learning. So believe or don’t believe and continue arguing amongst yourselves. This is all I have to say on the matter.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

All three reserve measures (volumetric, materials balance, and production decline curve) of legacy fields require some combination of current/past production and OOP. There is no way to determine the size of a legacy reservoir if that historical perspective is missing. This is why Saudi Arabia has been able to maintain reserve in Ghawar at exactly 250 BBO for 35 years. And that is meaningless.

actually in terms of volumetric assessments you do not need past production history, simply wireline logs, seismic and someone knowledgable about depositional models. This sort of assessment is not the most accurate but is done all the time when you are looking to acquire fields where either the production history is sketchy (eg: old fields in places like Egypt and Algeria) or the production books were obviously "cooked" to reflect something that wasn't really happening (eg: Russia, Mexico). The idea is if you know the shape of the field and where the current gas/water or oil/gas or oil/water interface is and a little bit about fluid properties and pressure conditions in the reservoir it is easy to come up with a good estimate. As you produce the field those reserves are continually re-evaluated. Note that reserve auditors will use everything at their disposal to come up with a reasonable estimate. If you have a field that is producing under natural gas depletion drive and there is a good history of production volumes and static pressures a material balance calculation is ideal. However if the operator was lax in getting reliable static pressures then a material balance calculation is more difficult to rely on and if there is any amount of water drive support a material balance calculation is invalid (you need to see pressure drops which will not happen with a strong water drive). I served the role of internal reserve auditor for awhile and to my mind prior to subjecting your fields to external audit you would look at every possible bit of evidence pointing you to a reserve estimate. If the various methods agree that's great but the fact they might not is also important as to what number you land on in the end. Like most things in life it isn't simple, certainly not a paint by numbers activity.

With regards to the shale reservoirs reserve auditors now accept type curve matching and are especially keen to do that in basins where there is a huge history of type curves (eg: Marcellus or perhaps Bakken). Even though there is wide variability in well behavior there is a range and it is relatively easy to assign the P90, P50 and P10 envelopes in the various well production curves. Hence if someone drills a horizontal well in a well known basin and was able to measure a valid IP (initial production rate) the reserve auditor can assign P1, P2 and P3 reserves based on the decline curve analysis. Each subsequent year those numbers would have to be adjusted of course.

As to Saudi Arabia it has always been difficult to find the 2P reserve number, the 3P reserve number and OOIP. Back in 2006 there was a thread I started called something like Saudi Arabia looking at the numbers which was a place I tried to discuss the data that was actually available from various sources. The issue here is the "official" reserve number might not change appreciably year on year if Aramco is continually elevating 3P to 2P or 2P to 1P status. It is clear that would have happened from 2008 through 2011 as they completed the various mega-projects. The lack of transparency (and I'm not sure why they would be transparent) is a problem. But I find it interesting that although there have been scads of expats working for Aramco over the years (and I know a bakers dozen of them) there has never been a "tell all" account of reserve reporting malfeasance.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Has the danger of Peak Oil passed?

ROCKMAN wrote:Guys, guys, guys. If you don't want to believe me that's OK. But for more than 40 years one of my primary duties has been estimating reserves IN DEVELOPED AND PRODUCING FIELDS. Seismic data is too coarse a tool to help.

WHAT!!!! BJ, I gotta say, we have just been informed in quite the authoritarian way that without 4D seismic you can't know ANYTHING!!! It is...IMPOSSIBLE!!!

Of what use is multiple decades of industry experience against such authoritarian claims!!

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

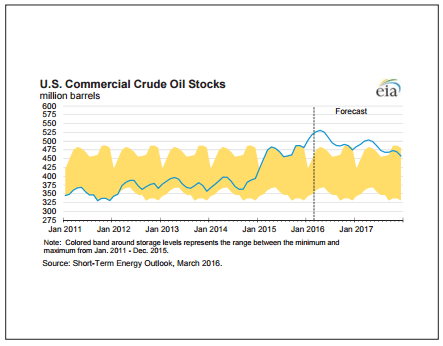

tita wrote: But it doesn't change the fact that we have no more huge discoveries of cheap oil.

Define cheap. I consider anything less than the maximum nominal in price in 2008 to be "cheap", if only because it can't be "expensive" when compared to that time period. The even better news is that at even 30% less than that price, the US was able to turn on cheaper resources, and reset the world order in terms of oil production. Rockman and his friends did a bang up job on that one as any trip to the local gasoline store will attest. Did it so well, it might continue for at least a year or two, and those boys right now are IDLING around...just waiting for consumers to start soaking up all the new supply they brought online, and keep filling up inventory with.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

Adam - For years I would run into many companies that wouldn't even review a prospect if there wasn't 3d seismic. Of course 3d seismic was a huge advance. It provided a much better success rate. Unfortunately one of the reason for that better success was that 3d seis probably killed more prospects then it got drilled. OTOH there have been many viable prospects that couldn't be killed or improved by 3d. My hz redevelopment of a conventional oil field for example. 3D wouldn't not have killed it or made it an easier sell. I sold it on the basis of a very unique and relatively unknown reservoir production dynamic. If you showed what I was able to do the majority of Houston reservoir engineers would call you a liar. Really. LOL. That's how very unique the reservoir dynamics have played out. I tried selling the idea for 10 years with no buyers. The I found my owner who has made non-oil patch $BILLIONS by thinking out side the box.

That and $90/bbl got my wells drilled. LOL.

That and $90/bbl got my wells drilled. LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

"Evidence suggests $60 is untenable."

And the corollary can be made that less than $60 is untenable for Shale and Tar production and deliverance to market.

And the corollary can be made that less than $60 is untenable for Shale and Tar production and deliverance to market.

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Who is online

Users browsing this forum: No registered users and 258 guests