Declining Production in Alaska

Re: Declining Production in Alaska

Rail? Possibly. If you come across another article mentioning rail oil shipments from the N. slope, please post it.

I don't know the economics of rail vs. ship vs. pipeline improvements (heaters), but I suspect the oil companies are weighing their options in order to still move oil from the N. slope when the TAPS may no longer be the primary method of shipment. Depends on the Alaskan and national politics too, i.e., the ANWR may finally be opened to production or more state tax incentives for the oil companies. ???

I don't know the economics of rail vs. ship vs. pipeline improvements (heaters), but I suspect the oil companies are weighing their options in order to still move oil from the N. slope when the TAPS may no longer be the primary method of shipment. Depends on the Alaskan and national politics too, i.e., the ANWR may finally be opened to production or more state tax incentives for the oil companies. ???

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: Declining Production in Alaska

PO - Found it. I was half ass correct. Ship Canadian oil sands production via rail to TAPS and maintain/increase throughput to Valdez. In effect letting declining N. Slope production piggyback on the oil sands production thus allowing a MOL beyond what the Slope could provide. I knew rail was part of the story...just couldn't remember what part. As an aside there's been increasing chatter about moving oil sands production to the Pacific via various rail systems given the battle over pipelines. It appears the rail industry is working out the economics such that tank cars are proving to be a viable approach even when pipelining is available. Besides a much quicker timeline than a pipeline many understand the relatively short lives of some of these oil plays. A big pipeline can take 5 - 8 years to just recover the initial investment. And when the oil plays out there's no alternative use. OTOH new rails can haul more than oil and tank cars can be easily moved to other markets as focus shifts.

Maybe Mr. Buffet is more smart than lucky. LOL.

http://www.alaskajournal.com/Alaska-Jou ... -pipeline/

Maybe Mr. Buffet is more smart than lucky. LOL.

http://www.alaskajournal.com/Alaska-Jou ... -pipeline/

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Declining Production in Alaska

Thanks for the updates peakoiler. Looks like the minimum next year might be <350 kb/d. Regarding addressing TAPS itself: Alyeska studies how to operate TAPS at low flow - Alaska Journal of Commerce - September Issue 5 2013 - Anchorage, AK

Alan Drake seemed pretty confident new rail lines along the TAPS route could take the place of the line itself if it went below MOL. Didn't know about these plans to ship bitumen north, that's nuts. Are they really stonewalling that much about the line to Kitimat? Schlepping crude all the way to the Yukon, jeez. Delta AK is SE of Fairbanks, about 40% of the way to the border, and the site of PS9. The logistics in getting tar sands crude that far, you really wonder if it could ever be economical.

Editorial: Alberta oil will reach the coast, like it or not

Alyeska spokesman Michelle Egan said the pipeline company is pursuing two paths to deal with lower flow: one being to add more heat to the pipeline in winter, in addition to heat now being added, and the second is to test whether removing water from the crude will allow TAPS to operate at colder temperatures and lower flow rates.

Alan Drake seemed pretty confident new rail lines along the TAPS route could take the place of the line itself if it went below MOL. Didn't know about these plans to ship bitumen north, that's nuts. Are they really stonewalling that much about the line to Kitimat? Schlepping crude all the way to the Yukon, jeez. Delta AK is SE of Fairbanks, about 40% of the way to the border, and the site of PS9. The logistics in getting tar sands crude that far, you really wonder if it could ever be economical.

Editorial: Alberta oil will reach the coast, like it or not

But, with public opinion against new pipeline capacity, oil companies increasingly are relying on railways to get their product to market.

For example, CN anticipates shipping 110,000 barrels of oil per day in 2013. Next year that will grow to 250,000 barrels, and 300,000 barrels by 2015 — which would represent 10 per cent of Canada’s oil market.

So it’s little surprise, given opposition to the Northern Gateway pipeline proposal, that Nexen has been talking to CN about moving oil through B.C. to Prince Rupert.

To do so, the company would need no regulatory permit, as the rails already are in place. The only impediment to having railcars carry oil to Kitimat or Prince Rupert for export would be a need for regulatory approval for construction of any tanker port.

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: Declining Production in Alaska

Dude – “Are they really stonewalling that much about the line to Kitimat?”. Not my area but I’m starting to get the sense that rail shipping is shifting from a “we ain’t got no choice” option to a “this makes more economic sense” option. Not that the operational costs of moving a bbl by rail is cheaper but the time factor combined that rail expansion (cars and lines) having multipurpose potential could be of increasing importance. A company can haul several thousand tank cars across the continent in a few weeks as markets change over time…can’t do that with a buried pipeline. I’m wondering how many pipeline projects are being re-evaluated where a rail option is currently being implemented. You lay a pipeline you expect to have something of a monopoly but if there’s a parallel rain system in place the tariffs might become too competitive.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Declining Production in Alaska

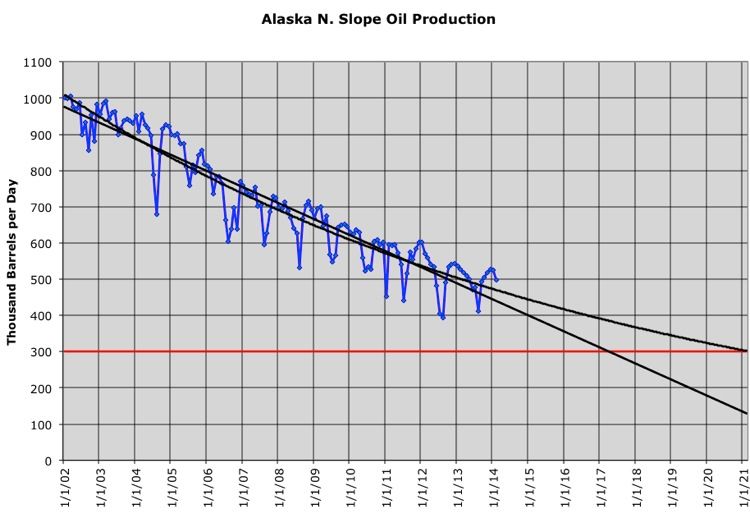

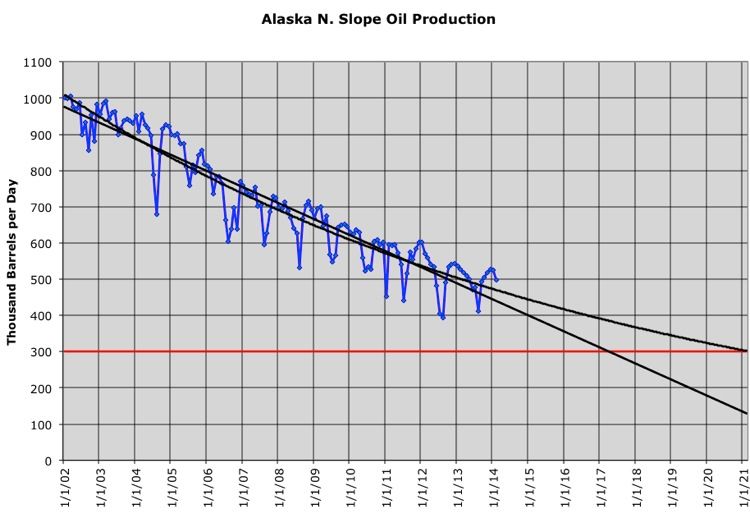

Alaska N. Slope production was down to 411 kbpd in August. I'll post an updated graph next month after the September data are reported.

There must have been some (or more) pigs going through the pipeline in August. I wonder how much ice they scraped out...? Or are they installing more heaters?

At any rate, it looks like in one or two more years, the red line will be reached. We'll learn then if oil can still be piped below 300 kbpd.

There must have been some (or more) pigs going through the pipeline in August. I wonder how much ice they scraped out...? Or are they installing more heaters?

At any rate, it looks like in one or two more years, the red line will be reached. We'll learn then if oil can still be piped below 300 kbpd.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: Declining Production in Alaska

Alyeska Pipeline company just signed a five-year-long contract with the ASRC to continue operations and do maintainance and other work on the Pipeline.

That doesn't sound like they expect to shut down the Pipeline any time soon.

Alyeska Pipeline: contracting for five more years

That doesn't sound like they expect to shut down the Pipeline any time soon.

Alyeska Pipeline: contracting for five more years

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Declining Production in Alaska

P - Maybe...maybe not. Actually a pipeline takes as much or more maintenance when it stops flowing. Sometimes deterioration can be worse with a line shut in. So even if they planned to shut the line in soon they would still be signing longer term maintenance contracts. If they have serious hopes on new production in the area they might maintain a non-flowing pipeline for many years waiting for the new grease to develop.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Declining Production in Alaska

ROCKMAN wrote:P - Maybe...maybe not. Actually a pipeline takes as much or more maintenance when it stops flowing. Sometimes deterioration can be worse with a line shut in. So even if they planned to shut the line in soon they would still be signing longer term maintenance contracts. If they have serious hopes on new production in the area they might maintain a non-flowing pipeline for many years waiting for the new grease to develop.

How hard is it to turn the pipeline on and off? I just have this idea bumping around in my head that they could keep it at minimum flow for 12 hours and store oil in tanks at the North Slope end, then increase the throughput for 12 hours to empty the tanks each day. When the oil field output falls below minimum flow rate could they just not pump for an hour to build up enough to run the next 23 hours at minimum flow? If that was possible then they could switch off for say 15 minutes every hour so that for the other 45 minutes the flow was at minimum even if they only had enough oil for 18 hours of daily minimum?

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17056

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Declining Production in Alaska

Not an expert on the line but I think one problem is sustaining enough flow rate to keep the line from freezing. In that sense it's not so much a flow rate issue but a thermal issue. I think they may have plans to add heaters and extra pumps. Otherwise as long as the line is full of oil they can pump 100 bopd into the north wend they'll get 100 bopd out of the south end. I think there was also talk of adding water to the oil and separating it at the end but there's still that freeze problem.

More from Wiki: The minimum flow through the pipeline is not as clearly defined as its maximum. Operating at lower flows will extend the life of the pipeline as well as increasing profit for its owners. The 2012 flow of 600,000 bbd is significantly less than what the pipeline was designed for. Low flow rates require that the oil move slower through the line, meaning that its temperature drops more than in high-flow situations. A freeze in the line would block a pig in the line, which would force a shutdown and repairs. A 2011 engineering report by Alyeska stated that, to avoid freezing, heaters would need to be installed at several pump stations. This report noted that these improvements could bring flow as low as 350,000 bbd, but it did not attempt to determine the absolute minimum. Other studies have suggested that the minimum is 70,000 100,000 bbd with the current pipeline. Alyeska could also replace the 48" pipeline from Prudhoe Bay to Fairbanks with a 20" pipeline and use rail the rest of the way, which would allow as little as 45,000 bbd.

More from Wiki: The minimum flow through the pipeline is not as clearly defined as its maximum. Operating at lower flows will extend the life of the pipeline as well as increasing profit for its owners. The 2012 flow of 600,000 bbd is significantly less than what the pipeline was designed for. Low flow rates require that the oil move slower through the line, meaning that its temperature drops more than in high-flow situations. A freeze in the line would block a pig in the line, which would force a shutdown and repairs. A 2011 engineering report by Alyeska stated that, to avoid freezing, heaters would need to be installed at several pump stations. This report noted that these improvements could bring flow as low as 350,000 bbd, but it did not attempt to determine the absolute minimum. Other studies have suggested that the minimum is 70,000 100,000 bbd with the current pipeline. Alyeska could also replace the 48" pipeline from Prudhoe Bay to Fairbanks with a 20" pipeline and use rail the rest of the way, which would allow as little as 45,000 bbd.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Declining Production in Alaska

ROCKMAN wrote:. Alyeska could also replace the 48" pipeline from Prudhoe Bay to Fairbanks with a 20" pipeline and use rail the rest of the way, which would allow as little as 45,000 bbd.

Sleeving it would't hurt either, but would require an acceptance that it will never again be needed at its higher flowrate.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: Declining Production in Alaska

EIA's September data shows N. Slope production bumped up to 493 kbpd from 411 kbpd in August:

Perhaps some summer maintenance on the TAPS was completed.

Next graph update in a couple of months.

Perhaps some summer maintenance on the TAPS was completed.

Next graph update in a couple of months.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: Declining Production in Alaska

Stumbled across an article about Alaska tight oil while looking at links about Ohio's Utica Shale.

Sounds to me like they are hoping to restore the North Slope to large scale production like it was at its peak.

Margaret Kriz Hobson, E&E reporter wrote:EnergyWire: Thursday, September 26, 2013

ANCHORAGE, Alaska -- Late this month, with the first snow of winter dusting the tops of the Chugach Mountains, Ed Duncan was holding his cards close to his chest when talking about Great Bear Petroleum LLC's winter plans for expanded shale oil development in northern Alaska.

Last winter, Great Bear drilled two exploration wells on its leases along the Dalton Highway, which links the state's lucrative northern oil fields to an export terminal in Valdez.

Exploration wells on the slope are generally drilled in the winter months to avoid damaging the local tundra. Great Bear had hoped to begin horizontal drilling and fracking at the two sites, but the company's rig contract expired in December before the tests could proceed (EnergyWire, April 3).

According to state officials, Duncan's 2012 drilling operation hit a small but promising pool of conventional oil.

Beyond that, however, Duncan, who serves as president and CEO of the privately owned company, won't say whether Great Bear encountered commercially viable resources.

He notes that the company has spent $40 million on 3-D seismic testing in the last three years and expects to spend an equal amount for future exploration.

"It passes the simple logic test that we're not going to make that kind of capital commitment if we're not encouraged by what we are doing," he told reporters at last week's Alaska Oil and Gas Congress.

State officials are counting on Great Bear to launch unconventional shale development in Alaska. They're hoping that if Duncan succeeds, other companies will buy up state land leases and shale development will spread throughout the North Slope and into other parts of Alaska.

"All it takes is one company," said Department of Natural Resources Commissioner Dan Sullivan. "If they did hit it and start making money, then in a place as big as Alaska -- it could have the potential to really take off."

Two other companies have purchased leases near Great Bear's operations. In November, Alaska will hold a lease sale for an additional 14 million acres of state lands on the North Slope, the slope foothills and the Beaufort Sea.

But at this point, Great Bear remains the only company that is actively working to commercialize Alaska's shale oil reserves.

Bakken of Alaska?

Great Bear's operations have been the subject of close scrutiny since 2010, when Duncan scooped up leases on 500,000 acres of northern Alaska state land in a region that international energy giants had long ago dismissed.

Following that lease sale, Duncan boasted that he expects his North Slope plays to yield bountiful untapped resources as vast as the unconventional oil plays at Texas' Eagle Ford and North Dakota's Bakken shale fields.

In testimony before the state Legislature in 2011, he predicted that his leases could produce 200,000 barrels of crude per day by 2020.

Great Bear's leases contain three layers of rich source rock that geologists say generated Alaska's lucrative Prudhoe Bay and Kuparuk oil fields.

According to a 2012 U.S. Geological Survey report, the North Slope shale formations could contain an additional 2 billion barrels of technically recoverable oil and 80 trillion cubic feet of natural gas. That geology stretches from the Chukchi Sea in the west to the Arctic National Wildlife Refuge in the east.

Duncan, a petroleum geologist and oil industry veteran, explained that the layers of rock underlying his leases hold intriguing potential.

"There's an intermingling of conventional and unconventional plays," he said. "The conventional plays have been proven on the North Slope. The plays are still speculative until we actually see barrels flowing out and being sold."

He expects to produce oil and natural gas liquids that could easily be added to the Trans-Alaska Pipeline, which runs close to his leases.

But Duncan expressed frustration that the dry natural gas Great Bear finds can't be shipped to market.

"As a small company with a very large position in northern Alaska and actively exploring, we have every reason to believe that our resource base might be a significant blend of oil and natural gas liquids and gas itself," he said.

"But today gas in north Alaska is stranded," because a pipeline hasn't been built from the North Slope gas fields to Alaska's population centers. "It's time to get off the dime on this," he added.

Big plans over red wine

This fall, after years of bold projections, Duncan is maintaining a lower profile when discussing his expectation for the coming drilling season.

Last year the company drilled on leases close to the Dalton Highway to provide easy access for equipment and personnel. This year "we have six currently permitted locations along the highway. It's conceivable that we'll drill one of those next."

"But we have a very big position," he added. "So we need to move off of the highway, most likely to the west."

Great Bear has not yet contracted for drill rigs for that operation, however, a significant issue in Alaska, where rigs are usually in high demand during the winter drilling season.

Nonetheless, Duncan said Great Bear's shale development operation is on target to meet its original timetable for moving forward.

"Our hope would be that you would see a sanction of full-field development in the next year or so," he said. Full oil field development could mean as many as 200 wells per year, he added.

At that point, Great Bear will face the task of obtaining environmental permits, building roads and drill pads, and setting up a commercial drilling operation.

For the time being, Duncan won't "speculate on what our forward strategy is" for the Great Bear shale project.

"We have established a very dominant position in the fairways, and we're very, very happy about that," he said. "What we do, how we manage that, is between [him and his wife] and a few other people. And a glass of red wine."

Sounds to me like they are hoping to restore the North Slope to large scale production like it was at its peak.

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4701

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: Declining Production in Alaska

Subjectivist,

Ha! Thanks for this. I'd been wondering how Great Bear was doing. They've been kind of quiet, or I've just not paid attention to the proper sources.

Ha! Thanks for this. I'd been wondering how Great Bear was doing. They've been kind of quiet, or I've just not paid attention to the proper sources.

- Synapsid

- Tar Sands

- Posts: 780

- Joined: Tue 06 Aug 2013, 21:21:50

Re: Declining Production in Alaska

Here's the latest graph using EIA data through Nov. 2013:

I'll be interested to see what the winter/spring data will look like.

I'll be interested to see what the winter/spring data will look like.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: Declining Production in Alaska

This is my 3000th post! Wow! Do I get a promotion? lol

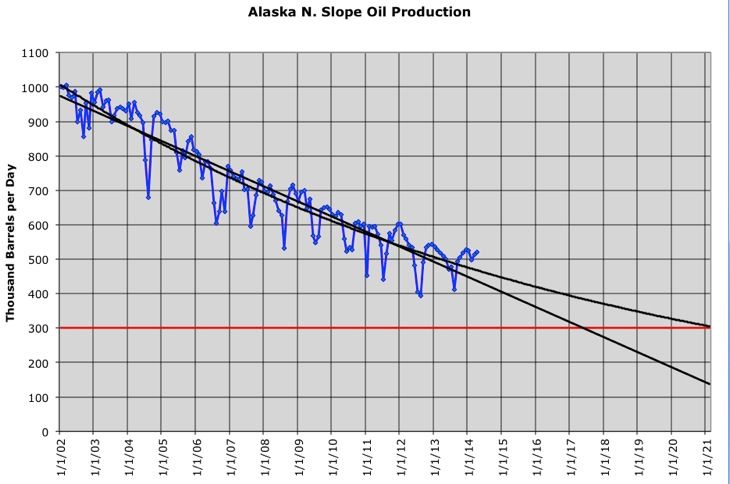

Meanwhile, the EIA has reported the oil production data for the N. Slope through February, 2014 and I updated the chart:

And over the next 6 months we probably will see the usual annual decline as maintenance is performed on the TAPS.

Anybody care to guess what this year's minimum will be?

Meanwhile, the EIA has reported the oil production data for the N. Slope through February, 2014 and I updated the chart:

And over the next 6 months we probably will see the usual annual decline as maintenance is performed on the TAPS.

Anybody care to guess what this year's minimum will be?

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: Declining Production in Alaska

I'll start it at 375PeakOiler wrote:Anybody care to guess what this year's minimum will be?

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Declining Production in Alaska

I'll guess 425 tbpd.

Meanwhile, BP is busy cleaning up an oil spill on the North slope:

Reuters Article on BP Oil Spill

Meanwhile, BP is busy cleaning up an oil spill on the North slope:

Reuters Article on BP Oil Spill

(Reuters) - Work crews for BP Plc were clearing contaminated snow on Thursday on Alaska's North Slope after a Prudhoe Bay well line ruptured, spraying a 34-acre area with crude oil and natural gas.

Just how much liquid escaped from the line remains under investigation by BP and Alaska's Department of Environmental Conservation.

It remains unclear whether the leak, detected earlier this week, is connected to a decline in North Slope oil production. BP did not return emails seeking comment.

Since the spill occurred, daily North Slope production has dropped about 10,000 barrels per day, from 533,000 to 521,000, according to state tracking data.

As of Saturday, however, two days before an inspector discovered the problem, production was at 551,000, according to Alaska's Department of Revenue.

The production figures include five major fields, the largest of which is Prudhoe Bay.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: Declining Production in Alaska

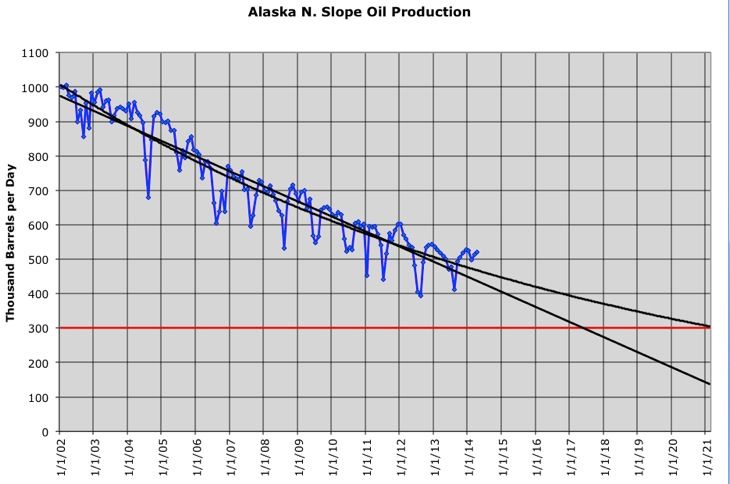

Here's the latest chart using data through April, 2014:

Surprisingly, production went up a little more in March and April, but according to a recent po.com news report, http://peakoil.com/production/tech-talk-here-we-go-again-again

it may have already dropped back down to 501 kbpd in June:

The EIA has about a three month time lag in reporting the production data, so we'll have to wait until October for the EIA June data.

Meanwhile, I came across this article:

http://www.alyeska-pipe.com/TAPS/PipelineOperations/LowFlowOperations

ANWR perhaps?

So the energy needed to remove the water from the crude before it goes through the TAPS is less than the energy needed to heat the oil more along the TAPS. That does make sense since it would probably also mean less pigs and other maintenance which would include more labor costs. Either way, the EROEI is getting lower for that oil.

Surprisingly, production went up a little more in March and April, but according to a recent po.com news report, http://peakoil.com/production/tech-talk-here-we-go-again-again

it may have already dropped back down to 501 kbpd in June:

We are just about at the point where the Alaskan Pipeline will tip over into feeding less than half-a-million barrels a day down from the North Slope. (It sent 501 kbd down the pipe in June with a 98.6% reliability factor).

The EIA has about a three month time lag in reporting the production data, so we'll have to wait until October for the EIA June data.

Meanwhile, I came across this article:

http://www.alyeska-pipe.com/TAPS/PipelineOperations/LowFlowOperations

A continuum of challenges

The trans-Alaska pipeline transformed Alaska’s economy and strengthened the nation’s energy infrastructure. The pipeline today transports some eight percent of the nation’s domestic crude production and remains the backbone of Alaska’s economy, delivering about 90 percent of unrestricted general fund revenue.

More than 2 million barrels a day (BPD) once surged through the Trans Alaska Pipeline Systems (TAPS). Since peak flow in the late 1980s, TAPS throughput has dropped. Today it is declining more than 5 percent per year. Less oil means slower-moving oil. Slower oil means colder oil. And the slower and colder the oil, the more complicated the challenges for Alyeska Pipeline Service Company, the pipeline’s operator.

The best long-term solution is more oil. In the meantime, daily throughput is already lower than it was at pipeline startup in 1977.

ANWR perhaps?

Less throughput = more challenges

Less oil → slower flow → crude spends more time in pipe, and less turbulence

Slower flow/less turbulence → more wax may accumulate in the pipe, requiring more frequent ‘pig’ cleaning

More time in pipe → Crude loses heat → higher risk of ice problems, more wax forms

TAPS is currently moving an average of 548,000 BPD (2012 daily average)

Challenges are immediate

No hard and fast thresholds; a continuum of challenges requires corresponding actions to address them

Ultimately may need shift to intermittent flow

Longer term: cold dry flow

As throughput further declines, continuing to add ever more heat would create new problems. At some point – teams are researching this now – it appears the most effective approach will be to operate the line in a “cold-dry flow” state.

With cold-dry flow, most of the water is removed from the crude before it enters the pipeline and the system runs much cooler. Since the purpose of heat is mainly to prevent ice formation, eliminating most of the water eliminates the need for elaborate heating systems.

Once the cold dry flow system has been validated through field and laboratory testing, a transition phase will shift the system from heat-dependent operations to cold-dry flow.

Work is in progress to determine how best to manage wax accumulation.

So the energy needed to remove the water from the crude before it goes through the TAPS is less than the energy needed to heat the oil more along the TAPS. That does make sense since it would probably also mean less pigs and other maintenance which would include more labor costs. Either way, the EROEI is getting lower for that oil.

There’s a strange irony related to this subject [oil and gas extraction] that the better you do the job at exploiting this oil and gas, the sooner it is gone.

--Colin Campbell

--Colin Campbell

-

PeakOiler - Intermediate Crude

- Posts: 3664

- Joined: Thu 18 Nov 2004, 04:00:00

- Location: Central Texas

Re: Declining Production in Alaska

Looking for more news on TAPS we find that a literally more mundane issue might play havoc with the line - and with NS operations in general: Sliding mass threatens pipeline, Dalton Highway - Fairbanks Daily News-Miner: Local News

Interesting margin of error there regarding when they gave the thing a name. $68 million to move the highway, that'll happen without question, but what about TAPS? And they've only recently began to study these things in the first place!

Check out the links in the comments - you can really see the slide coming down the mountains, especially on LIDAR. TAPS runs just west of the Dalton highway according to the story, although on the Google Street View you don't really get a clear view of it; but there are various access roads leading over to it. Actually I don't see how moving the highway would buy them much of any time here - to permanently get out the slide's way they'd have to reroute to the other side of the river west of the highway/TAPS, which I'm guessing is the Middle Fork of the Koyukuk. But is there room there in the first place?

At this point it’s difficult to predict the exact amount of time it will take for the debris lobe to hit the highway, but estimates range from as far out as 10 years to as soon as three years. When it does hit the highway, and it will hit the highway, Darrow said, it will do so with significant destructive force. After reaching the highway, the debris lobe would strike the roadway with a 50 tons of material per day, according to Darrow.

Not only would the situation become a headache for DOT as well as oil companies driving up and down the highway, but the roadway’s position could also create a serious problem for the pipeline that runs just to the west. Instead of slowing the debris lobe, hitting the edge of the road could actually speed the mass up.

Known as “Frozen Debris Lobe A,” the offending mass of earth first came to the attention of transportation crews in the 1970s during the construction of the Dalton Highway, though it would not receive a name for another 30 or 40 years. When they first noticed the debris lobes coming down out of the mountains, crews thought the masses of earth were dormant, no-longer moving leftovers of some past geologic event.

For years that was the accepted narrative.

Interesting margin of error there regarding when they gave the thing a name. $68 million to move the highway, that'll happen without question, but what about TAPS? And they've only recently began to study these things in the first place!

Check out the links in the comments - you can really see the slide coming down the mountains, especially on LIDAR. TAPS runs just west of the Dalton highway according to the story, although on the Google Street View you don't really get a clear view of it; but there are various access roads leading over to it. Actually I don't see how moving the highway would buy them much of any time here - to permanently get out the slide's way they'd have to reroute to the other side of the river west of the highway/TAPS, which I'm guessing is the Middle Fork of the Koyukuk. But is there room there in the first place?

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Who is online

Users browsing this forum: No registered users and 251 guests