Page added on November 9, 2012

China Vs. U.S.: Who Is Leading The Natural Gas Transportation Race?

Will China lead the U.S. in the adoption of natural gas transportation? Before I answer this question, let’s take a look at some background information.

The United States’ #1 economic advantage against all other countries on Earth is its abundant natural gas reserves combined with its 1 million-plus mile natural gas pipeline distribution system. No other country has the combination of high natural gas production, low natural gas prices, and the ability to economically deliver natural gas to every major metropolitan city as well as to tens of millions of homes and businesses. It is an advantage the country cannot afford to squander.

Meantime, the biggest economic problem facing the U.S. is its reliance on foreign oil. September foreign oil imports totaled 314,000,000 barrels (57% of all oil consumption) at a cost of $35.4 billion. Annually, that is over $400 billion a year being sent out of the country for oil. Foreign oil is by far and away the major component of the U.S. trade deficit. Clearly, this is an economically unsustainable addiction.

China, as the following figure illustrates, also has a current and growing foreign oil import problem.

The logical question is: can the U.S. and China use natural gas to solve their foreign oil problem? The obvious answer is yes, they can use natural gas transportation to significantly reduce foreign oil imports.

So how is the U.S. doing vs. China on this effort? Not so good. The difference here is China’s policymakers are pragmatic and run by engineers, while U.S. policymakers are largely lawyers under the thumb of special interests. Consider the following:

At an energy conference some years back, a Chinese energy policymaker said if his country had the natural gas pipeline distribution system the U.S. had, adopting natural gas transportation would be a no-brainer. It took over 100 years for the U.S. to build such a system, and it would be very difficult for China to catch up considering the magnitude of the task combined with an urban infrastructure built without gas lines being laid first. More importantly, since Chinese domestic natural gas production is very low, the country imports its natural gas by coastal terminals and needs to distribute it to the country’s interior. Despite these challenges, it is clear the Chinese acknowledge the importance of adopting natural gas transportation to reduce demand for oil and to help solve its enormous environmental problems.

China’s LNG Terminals

A couple weeks ago, Reuters reported on a new China policy to prioritize natural gas transportation, particularly LNG, to rein in the growth of expensive and dirty foreign oil. For the first time, the Chinese government has targeted the transport sector, covering buses, taxis, trucks and vessels as preferred users of natural gas, according to a document published on the website of the National Development and Reform Commission (ndrc.gov.cn). From the Reuters’ article:

The world’s top energy user is poised to triple natural gas use to meet about 10 percent of total energy demand by the end of this decade, to cut emissions from coal use, and dependence on oil imports.

The policy push would lead to the world’s biggest fleet of LNG-fuel led vehicles, as it is both cheaper and more efficient than the conventional gasoline and diesel, experts have said.

While it is great to see China take these steps, it saddens me to no end that Chinese policymakers are able to implement an energy policy the U.S. government has clearly failed on. Despite the built in advantage the U.S. has (described in the first paragraph of this article), the U.S. government seems incapable of acting on this important and strategic issue. Worse yet, the current U.S. Energy Secretary, Steven Chu, is “agnostic” about natural gas transportation. The so-called “Nat Gas Act” has languished on the back burner of Congress for years now.

According to NGV America, China currently has 1 million NGVs operating and it ranks sixth in the world in total NGVs:

| Natural Gas Vehicles (NGVs): The Top 10 Countries | ||

| Country | Number of

Vehicles |

% Total NGVs

Worldwide |

| Iran | 2,859,396 | 18.82 % |

| Pakistan | 2,850,500 | 18.76 % |

| Argentina | 1,900,000 | 12.50 % |

| Brazil | 1,694,278 | 11.15 % |

| India | 1,100,000 | 7.24 % |

| China | 1,000,000 | 6.58 % |

| Italy | 779,090 | 5.13 % |

| Ukraine | 390,000 | 2.57 % |

| Thailand | 300,000 | 1.98 % |

| … | … | … |

| United States (17th) | 100,000 | >1 % |

There is the U.S., down at #17. There is no bigger testament to the lack of an strategic, comprehensive, and long-term energy policy in the U.S. than this sad statistic.

And China is growing at a very fast pace. Some reports indicate that China is adding nearly 100,000 new NGVs each year. One report indicates that China added 378,000 new NGVs in a one year period. Like the U.S., China also is said to have huge natural gas shale resources, and it is looking to take advantage of that in transportation.

The unthinkable has become reality. Indeed, the U.S. is squandering its #1 economic advantage and is allowing the Chinese to turn it around into their advantage.

So how can investors play this game-changing trend? My guess is it will take at least 5-10 years for the Chinese to develop the infrastructure and technology to significantly develop their shale assets. Expect LNG imports to rise rapidly. Who will China rely on for its natural gas supplies?

These considerations put geographically advantaged Australian gas producers in the limelight. ConocoPhillips (COP) has an excellent position here:

ConocoPhillips’ Australia Pacific LNG

Upstream

Upstream

Operator: Origin Energy (42.5%)

Co-venturers: ConocoPhillips (42.5%), Sinopec (15.0%)

Downstream

Operator: ConocoPhillips (42.5%)

Co-venturers: Origin Energy (42.5%), Sinopec (15.0%)

Two initial 4.5 MTPA LNG trains (nameplate capacity) are anticipated, with approximately 16,000 gross wells ultimately envisioned to supply both the LNG development and the domestic gas market.

In 2009, it was announced that the LNG facilities would be located near Laird Point on Curtis Island.

COP signed a definitive agreement with Sinopec (SHI) for the supply of up to 4.3 MTPA of LNG for 20 years. The agreements specified terms under which Sinopec subscribed for a 15 percent equity interest in APLNG, with both ConocoPhillips’ and Origin Energy’s ownership interests diluting to 42.5 percent. Completion of this equity subscription occurred in August 2011.

ConocoPhillips’ Darwin LNG Facility

Operator: ConocoPhillips (56.9%)

Co-venturers: Santos (11.5%), INPEX (11.4%), Eni (11.0%), Tokyo Electric/Tokyo Gas (9.2%)

The Darwin LNG facility, located at Wickham Point, Darwin, was completed and began full operation in 2006, processing natural gas from the Bayu-Undan Field. The facility is meeting gross contracted sales to Tokyo Electric Power Company, Incorporated and Tokyo Gas Co., Ltd. of approximately 3 MTPA of LNG per year. As is typical with LNG sales contracts to the Japanese market, contract pricing is linked to the JCC Crude Index.

In addition to these projects, COP also has a 30% interest in the Greater Sunrise project in the Timor Sea, a 60% interest and operatorship in the Caldita and Barossa field of the Timor Sea located offshore the Northern Territory, as well as operations in the Browse and Canning basins.

Chevron (CVX) also has large Australian natural gas operations including its Gorgon and Wheatstone projects.

Chevron’s Gorgon Project

Gorgon is one of the world’s largest natural gas projects and the largest single resource natural gas project in Australia’s history. The project will develop the Gorgon and Jansz/Io gas fields, located within the Greater Gorgon area, about 130 kilometers off the north-west coast of Western Australia.

It includes the construction of a 15 million tonne per annum (MTPA) Liquefied Natural Gas (LNG) plant on Barrow Island and a domestic gas plant with the capacity to provide 300 terajoules per day to supply gas to Western Australia.

Gorgon LNG will be off loaded via a four kilometer long loading jetty for transport to international markets. The domestic gas will be piped to the Western Australian mainland.

Chevron’s Wheatstone Project

The Wheatstone Project will include an onshore facility located at Ashburton North Strategic Industrial Area (ANSIA), 12 kilometers west of Onslow in Western Australia’s Pilbara region. The foundation project includes two LNG trains with a combined capacity of 8.9 million tonnes per annum (MTPA) and a domestic gas plant.

The Wheatstone Project will include an onshore facility located at Ashburton North Strategic Industrial Area (ANSIA), 12 kilometers west of Onslow in Western Australia’s Pilbara region. The foundation project includes two LNG trains with a combined capacity of 8.9 million tonnes per annum (MTPA) and a domestic gas plant.

The Wheatstone Project is a joint venture between Australian subsidiaries of Chevron (64.14%), Apache (13%), Kuwait Foreign Petroleum Exploration Company (KUFPEC, 7%), Shell (6.4%), and Kyushu Electric Power Company (1.46%), together with PE Wheatstone Pty Ltd (part owned by TEPCO, 8%).

Both COP and CVX have extensive oil operations and sport nice dividends (4.6% and 3.3% respectively).

And of course there is the elephant in the room: Exxon Mobil (XOM). Exxon is the largest producer of natural gas in the U.S. and roughly 50% of the company’s energy production is now natural gas. XOM recently won approval to export LNG from America. XOM also has a “mega” LNG gas facility in Qatar – one of the largest in the world.

Then of course there is Russia’s natural gas giant Gazprom. And don’t forget the Iranians.

Tangential plays might be Norway’s Statoil (STO) and the Australian iShares MSCI Australia Index ETF (EWA).

Statoil is the second largest supplier of natural gas to the European market, with a market share of approximately 14 percent. Statoil also markets liquid natural gas from the Snøhvit field in the Barents Sea. The gas is transported in purpose-built ships to customers all over the world. STO sports a 3.7% dividend.

EWA would be a broad based bet on the increased economic activity of Australia based on the natural gas exports and as a multi-commodity supplier to Asia-Pac.

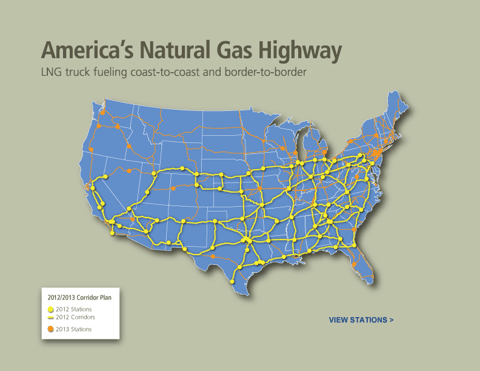

Last but not least is Clean Energy Fuels (CLNE). If the U.S. government ever gets behind natural gas transportation, CLNE’s experience on the Natural Gas Highway has them in a great position to prosper.

6 Comments on "China Vs. U.S.: Who Is Leading The Natural Gas Transportation Race?"

BillT on Fri, 9th Nov 2012 3:39 pm

As China pulls ahead in yet another area, the Us falls farther behind. No new news here. And no, there will never be more than 10% of Us vehicles that run on NG.

GregT on Fri, 9th Nov 2012 5:10 pm

Sorry guys.

Natural gas is also a finite resource.

According to the BP Statistical Review of World Energy:

“World proved natural gas reserves at end-2011 were sufficient to meet 63.6 years of production.”

Ramp up production to meet an increase in consumption and it doesn’t take a rocket scientist to see that we will run out in a very short period of time.

Kenz300 on Fri, 9th Nov 2012 5:20 pm

Anything that helps to end the oil monopoly on transportation fuels is a good thing. A monopoly is only good for the monopoly and not good for the consumer.

Bring on the CNG and LNG vehicles. Long haul truckers are converting to LNG to save money. Businesses like WalMart, UPS, Staples, Waste Management, FedEx and others are moving to a combination of electric, flex-fuel, CNG and LNG vehicles as they replace older vehicles.

The old saying of “don’t put all your eggs in one basket” still holds true.

We need to diversify our sources and types of energy.

GregT on Fri, 9th Nov 2012 5:35 pm

As demand increases for alternates, so will the price.

Others on Sat, 10th Nov 2012 3:08 am

Here are some latest stats

http://www.ngvjournal.com/en/statistics/item/911-worldwide-ngv-statistics

Pakistan 3,100,000

Iran 2,900,000

Argentina 2,100,000

Brazil 1,700,000

India 1,500,000

China 1,200,000

jim on Sat, 10th Nov 2012 5:09 pm

Greg is wrong. The AGA shows 100+ years of PROVEN reserves, with much more not expored or developed yet. Plus, advancements in making Natural Gas renewable are being proven and economically feasable in Europe and pilot projects in the US. After all, it is call NATURAL gas.