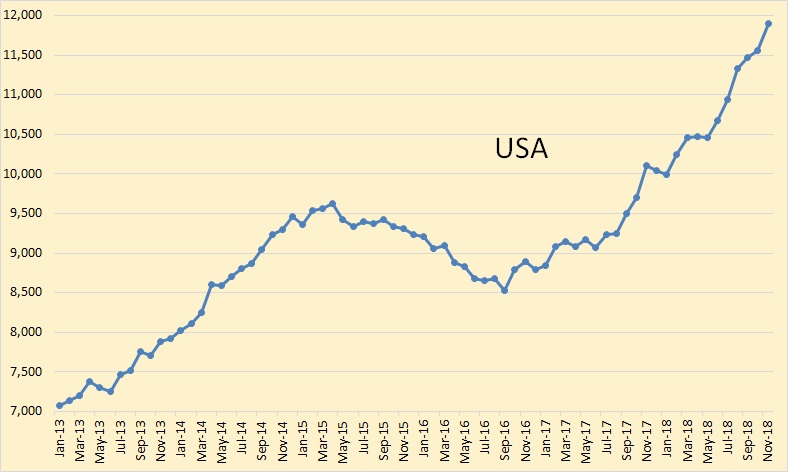

For the first three quarters of 2023, U.S. oil production has averaged 12.8 million barrels per day (bpd). The previous annual record — set in 2019 just before the Covid-19 pandemic impacted production —was 12.3 million bpd.

https://www.forbes.com/sites/rrapier/20 ... 981e9f6767U.S. NGL production was 6.3 mb/d in August. Exports of NGLs, mostly to Asia and Latin America, have risen significantly over the past several years to 2.4 mb/d in 2022. NGLs are used for myriad purposes including petrochemical feedstocks, heating and cooking, and blending into crude oil.

https://www.dallasfed.org/research/ener ... 023/en2309US field production of natural Gas Liquids. https://www.eia.gov/dnav/pet/hist/LeafH ... _MBBLD&f=AOil Poised To Become U.S.’ Single Largest Export Product https://oilprice.com/Energy/Crude-Oil/O ... oduct.html

https://www.eia.gov/dnav/pet/hist/LeafH ... _MBBLD&f=AOil Poised To Become U.S.’ Single Largest Export Product https://oilprice.com/Energy/Crude-Oil/O ... oduct.htmlCan we not connect the dots here? 12.8 - 6.3 = 6.5 million barrels per day of US "Oil" production that can be used to run cars trucks, ships and planes. The rest, nearly half, is going offshore to Asia for manufacture of plastic bags and heating and cooking. Can anyone not fathom the consequences of this? That we quite obviously have a lot less oil to power our societies but a lot more to make plastic bags. This was all spelled out nearly a decade ago.

15 Jun 2014.

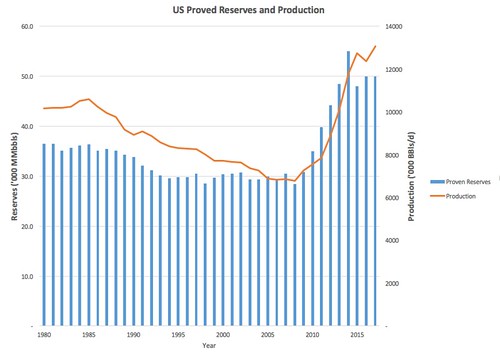

Four decades of decline in US oil output have been reversed in just five years of growth.”

“Petroleum production, including crude oil and related liquids, known as condensate, and natural gas liquids (NGLs) such as ethane, was 11.27m barrels per day in April, almost equaling the peak of 11.3m b/d reached as an average for 1970. Recent growth rates suggest that it has now exceeded that figure.

https://jeremyleggett.net/2014/06/15/us ... -included/This is why the highways and bridges are falling apart, among other societal woes. It was all built with cheap abundant oil suitable to power MACHINES. Burnable machine Oil which has been relentlessly declining for a decade and more. You can't rebuild a highway with plastic bags, you need trucks and heavy equipment for that. When I read some of the posts above I wonder if they are not written by astroturfers wanting to obfuscate the simple realities of PeakOil.