Nearly everyone wonders, “Why is Donald Trump crazy enough to impose tariffs on imports from other countries? How could this possibly make sense?”

As long as the world economy is growing rapidly, it makes sense for countries to cooperate with each other. With the use of cooperation, scarce resources can become part of supply lines that allow the production of complex goods, such as computers, requiring materials from around the world. The downsides of cooperation include:

(a) The use of more oil to transport goods around the world;

(b) The more rapid exhaustion of resources of all kinds around the world; and

(c) Growing wage disparity as workers from high-wage countries compete more directly with workers from low-wages countries.

These issues can be tolerated as long as the world economy is growing fast enough. As the saying goes, “A rising tide raises all boats.”

In this post, I will explain what is going wrong and how Donald Trump’s actions fit in with the situation we are facing. Strangely enough, there is a physics aspect to what is happening, even though it is likely that Donald Trump and the voters who elected him would probably not recognize this. In fact, the world economy seems to be on the cusp of a shrinking-back event, with or without the tariffs. Adding tariffs is an indirect way of allowing the US to obtain a better position in the new, shrunken economy, if this is really possible.

The upcoming shrinking-back event is the result of too little energy consumption in relation to total world population. Most researchers have completely missed the possibility that energy limits could manifest themselves as excessive wage disparity. In fact, they have tended to assume that energy limits would manifest themselves as high energy prices, especially for oil.

The world’s networked economy doesn’t work in the simple way that most researchers have assumed. Too much wage disparity tends to lead to low energy prices, rather than high, because of increasing affordability issues. The result is energy prices that are too low for producers, rather than too high for consumers. Producers (such as OPEC nations) willingly cut back on production in an attempt to get prices back up. The resulting shortage can be expected to more closely resemble financial collapse than high prices and a need for rationing. Trump’s tariffs may provide the US a better position, if the world economy should partially collapse.

Let me try to explain some pieces of this story.

1. Energy is needed to power the world economy. This fact has been missed by politicians and most economists.

Economist Steven Keen recently developed a graphical explanation of the role energy plays in the world economy. In his graphic, he shows that workers need food (an energy product) just as machines need some sort of energy product to operate. In Steve Keen’s words, “Labor without energy is a corpse: capital without energy is a sculpture.”

Figure 1. Graphic by Steven Keen, depicting the role of energy in the economy. Energy in the form of food is necessary for human labor, just as energy (in one of its many forms) is needed for physical transformations that make the activities underlying GDP possible. These physical transformations necessarily lead to both the desired products and multiple types of waste.

In fact, there is a physics reason why energy consumption is needed in the economy. Energy “dissipation” is needed for the physical actions underlying GDP. For example, transportation requires a physical movement of people or objects. This can only happen with the use of energy. Even the use of heat or of electricity requires energy dissipation.

2. China’s huge growth in energy consumption since it joined the World Trade Organization (WTO) in December 2001 is truly amazing. It has changed the world order in a few years.

China’s energy consumption ramped up very quickly after joining the WTO in late 2001. At the same time, the energy consumption of the US and the EU stagnated, as manufacturing moved to China and other Emerging Markets.

Figure 2. Energy Consumption for the United States, China, and European Union, based on data from BP’s 2018 Statistical Review of World Energy.

As the shift in energy consumption occurred, jobs shifted elsewhere. Also, the competition with China and other low-wage countries tended to hold down wages of workers whose jobs could be shifted overseas. When we look at labor force participation rates for the US, we see that these seem to have turned down about the same time that China joined the WTO. This suggests that workers started leaving the workforce about the time competition with China ramped up.

3. China is now facing a problem with Peak Coal. Its level of coal production is barely sustainable because of depletion and low coal prices.

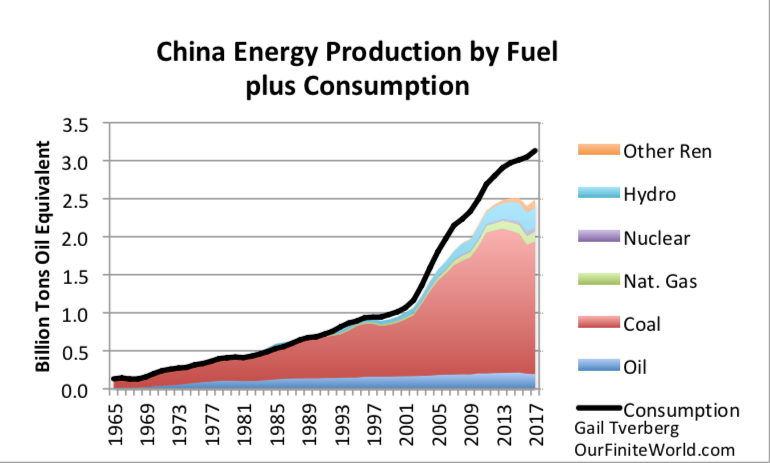

Figure 4. China energy production by fuel, based on BP Statistical Review of World Energy 2018 data. “Other Ren” means Other Renewables. This includes wind, solar and other renewables, such as wood burned for fuel.

If China is to manufacture goods and services for the world economy as well as its own people, it needs a growing supply of cheap-to-produce energy. China’s largest source of energy is coal. China’s coal production hit a peak in 2013 and has been on a bumpy plateau, or falling, since. The problem has been a combination of (a) a higher cost of coal production, because existing mines are depleting, combined with (b) coal prices that do not rise high enough to make production from these mines profitable.

Of course, if coal prices were to rise higher, China would have a different, but equally serious problem: The cost of finished goods created for the world marketplace would be quite a bit higher, making it difficult to export them profitably. If customers’ wages rose at the same time coal prices rose, there would be no problem. The problem could be described in some sense as growing mining inefficiency because of coal depletion. Unfortunately, the world economy does not reward a shift toward inefficiency.

4. With Peak Coal occurring in China, it makes little sense for the United States, the European Union and others to depend as heavily on China as in the past.

The economy of every country today is built on debt. If the world economy is growing, this debt pile can rise higher and higher. If interest rates can be brought ever lower, this also helps the pile of debt rise higher and higher.

China’s economy also uses increasing debt to sustain its economic growth. If the economy of China should slow down or start shrinking because of energy limits, debt defaults could start overwhelming the system. Uprisings from laid-off workers might become difficult to quell. The situation could easily spiral out of control.

Economies around the world depend on China for many manufactured goods. In fact, for many minerals, China’s usage amounts to over half of the world’s consumption. This arrangement doesn’t really make sense because (a) China cannot really be depended on for the long term because of coal depletion, (b) jobs that pay well in Advanced Economies are being lost to China and other Emerging Markets, and (c) the level of concentration of manufacturing in China puts the world system at risk if China has any kind of adverse shift in its economy.

5. The whole idea of buying fuels from other countries only works as long as there is enough to go around.

Many people are of the opinion that if there is not enough fuel of a particular kind, fuel prices will rise, and the market will continue to operate normally. There are at least two reasons why this doesn’t make sense:

Reason #1. The issue underlying rising costs of fossil fuels is nearly always depletion. For example, with coal mines, the coal closest to the surface in the thickest seams is extracted first. As this is depleted, deeper coal in thinner seams can also be extracted, but the cost tends to be higher. When depletion takes place, it is nearly always possible to extract more of the given fuel if some combination of more human labor and more technology (powered by energy) is used. Of course, adding labor and/or technology leads to a higher cost of production.

But the prices of commodities are not determined based on the cost of production; prices are determined in the marketplace. They reflect the quantity of finished goods and services made with these commodities, that consumers (in the aggregate) can afford. Extracting coal or another fuel in what is essentially a less efficient manner doesn’t add to what consumers can afford. The combination of flat prices and higher costs leads to unprofitable producers–precisely China’s problem. Producers tend to cut back on production.

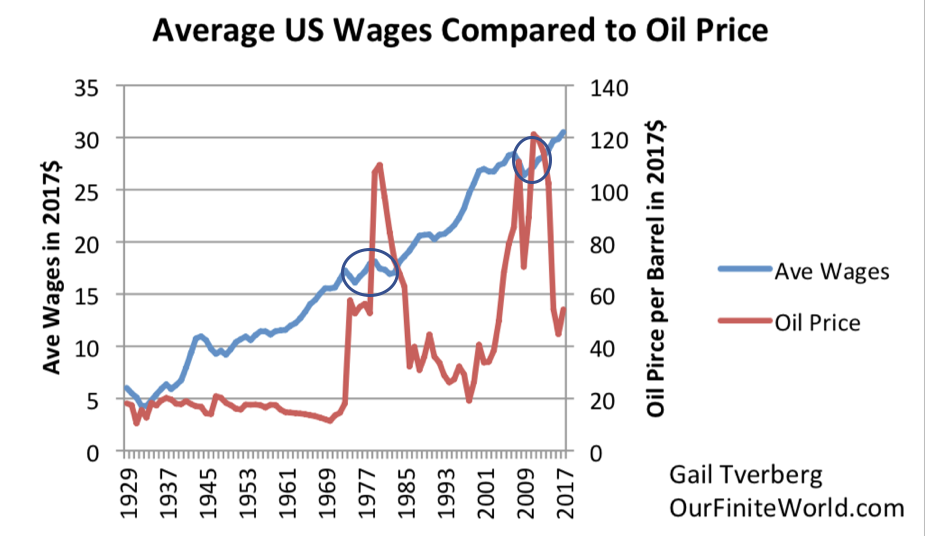

We can see that higher energy prices don’t lead to higher wages by looking at what happened when oil prices rose a few years ago in the US. We see that higher oil prices led to lower average wages because of recession.

Figure 5. Average wages in 2017$ compared to Brent oil price, also in 2017$. Oil prices in 2017 dollars are from BP Statistical Review of World Energy 2018. Average wages are total wages based on BEA data adjusted by the GDP price deflator, divided by total population. Thus, they reflect changes in the proportion of population employed as well as wage levels.

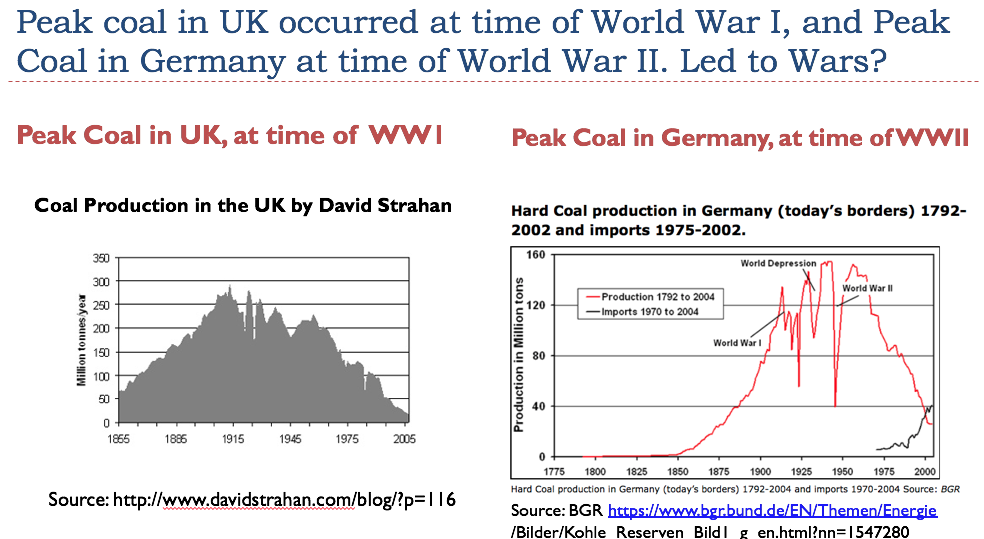

Reason #2. If we look back at the timing of Peak Coal in the UK and in Germany, it looks very much as if depleting coal supply was one of the causes of both World War I and World War II. Governments know that energy supplies are required to operate their economies. If they cannot get enough energy products internally or though trade, they will fight other countries for access to supplies.

Economists, sitting in their ivory towers, have not stopped to think through the obvious. Their standard supply and demand curve does not work for energy because an adequate supply of cheap energy is needed for both the demand for goods and services (coming from wages workers earn) and the supply of goods and services. Once affordability becomes a problem, because too many people have low wages, the prices of fuels stop rising. It is the fact that prices don’t rise high enough that causes the “peaking” of oil, natural gas, and coal production. Extraction stops, even though there seem to be plenty of resources still available with current technology.

6. A major energy issue today is the fact that China and India have run through their own energy supplies and now need to import energy from outside their countries to supplement domestic supplies.

As shown in Figure 4 (above), China’s coal production stopped rising in 2013, keeping the total amount of energy it produces close to flat. To compensate for this shortfall, China has started to import oil, coal and natural gas. The difference between the thick black line and the top of the “stack” of types of energy produced in China (in Future 7 below) represents the quantity of fuel that it has needed to import. Clearly, this quantity has been increasing.

Figure 7. China energy production by fuel plus its total energy consumption, based on BP 2018 Statistical Review of World Energy data.

India’s coal supply is not yet decreasing, but it is running into a similar problem. It needs to import more and more energy products from abroad, as its energy consumption (thick black line) rises above its energy production “stack.”

Figure 8. India’s total energy consumption compared to its energy production by type, based on BP 2018 Statistical Review of World Energy. “Other Ren” includes wind, solar, and other commercially traded renewable types of renewable energy, such as geothermal.

7. Worldwide, there is a growing need for imported fuels of many kinds.

Figure 9 shows the imports needed for five major areas of the world. In this analysis, the European Union is treated as a single unit. Thus, in this analysis, the imports it receives are only those from outside the European Union, taken as a whole.

Figure 9. Required energy imports for five major areas of the world, based on the difference of energy consumption and energy production shown in BP’s 2018 Statistical Review of World Energy.

We can see from Figure 9 that the European Union and Japan have been major importers of fuels for a very long time. India and China have only in recent years become energy importers. At the same time, the US is becoming more and more energy sufficient with its own fuel production.

Figure 10 shows the ratio of imported energy to total energy consumption for these five areas.

Figure 10. Percentage of energy imported in 2017 in Japan, India, the EU, China, and the US. Imports calculated as the difference between Total Energy Consumption and Total Energy Production based on data from BP 2018 Statistical Review of World Energy. The European Union is treated as a single unit. Thus, energy imports are those from outside the EU.

The US is clearly in a better position than other countries/groups shown, with a smaller share of energy imported in Figure 10 and a declining trend in imported energy in Figure 9. Japan, the EU and India are all subject to substantial risk if available imports should fall.

8. The ramp up of “clean energy” to date has proven to be a major disappointment. The quantities added are far below what the IEA believes is needed.

Partial confirmation of this statement can be seen by observing the tiny orange “Other Ren” bands on Figures 4, 7, and 8 for China and India, which include wind, solar, and other non-hydroelectric renewables. China is the largest user of wind and solar in the world, yet its use of these devices provides only a tiny portion of its total energy consumption.

We have known since the 1950s that fossil fuel supply would eventually become a problem. Academics, with their focus on making models, have been able to come up with hypotheses regarding what might act as substitutes. But these models tend to miss a lot of things, including the following:

- Adverse events, such as Fukushima for nuclear.

- The need for electricity storage and extra long distance transmission lines, as wind and solar usage are ramped up. The cost-benefit analysis is much less favorable with these added.

- Issues that affect only some installations, such as workarounds to keep long-distance transmission lines from starting fires in dry areas, or the high cost of underground transmission lines.

- The best sites are taken early.

It is not until the actual experience arrives that we see how these substitutes are working in practice. If we think back, the nuclear promise of producing electricity that was hoped to be “too cheap to meter” hasn’t really panned out. In fact, many Advanced Economies are cutting back on their use of nuclear.

With respect to “renewables,” (including hydroelectric, wind, solar, and others), the amount of new generation added each year seems to have hit a plateau. It may be that the additional need for storage and transmission lines are already slowing the growth of renewables.

Figure 11. IEA Renewable Net Capacity Additions as of May 2019. Source: Chart from India Times.

The IEA has started pointing out that far more energy investment is needed if sustainable development goals are to be met–about 300 GW per year, instead of the current 177 per year in additions, on average, between 2018 and 2030.

9. Donald Trump and his advisors have sensed that the current economic system is not working because of too much wage disparity. If the economic system is destined to break in one way or another, Trump can influence which way the break will occur by the imposition of tariffs.

Trump and his advisors no doubt recognize the importance of a cheap, available energy supply. They also realize that energy is an important enough factor of production to fight over. Furthermore, many past wars have been resource wars. Tariffs are, in some sense, a step toward a resource war.

One of the immediate problems at hand is too much wage disparity. Strange as it may seem, excessive wage disparity can be a sign of inadequate energy supply because in a networked economy, high prices of commodities and low wages of workers are almost “mirror images” of each other. High commodity prices tend to cut off consumption of commodities (such as oil or coal) by prices of finished goods that are too high for consumers.

Excessive wage disparity works in reverse: It sends prices of commodities (such as coal and oil) too low, cutting off production because prices fall too low for producers of these commodities. Production falls because producers cannot make a profit. When wage disparity is very high, a large share of workers have very low wages, leaving them unable to purchase more than a small amount of high-priced goods (such as cars and homes) made with commodities. It is this low “demand” that holds down commodity prices.

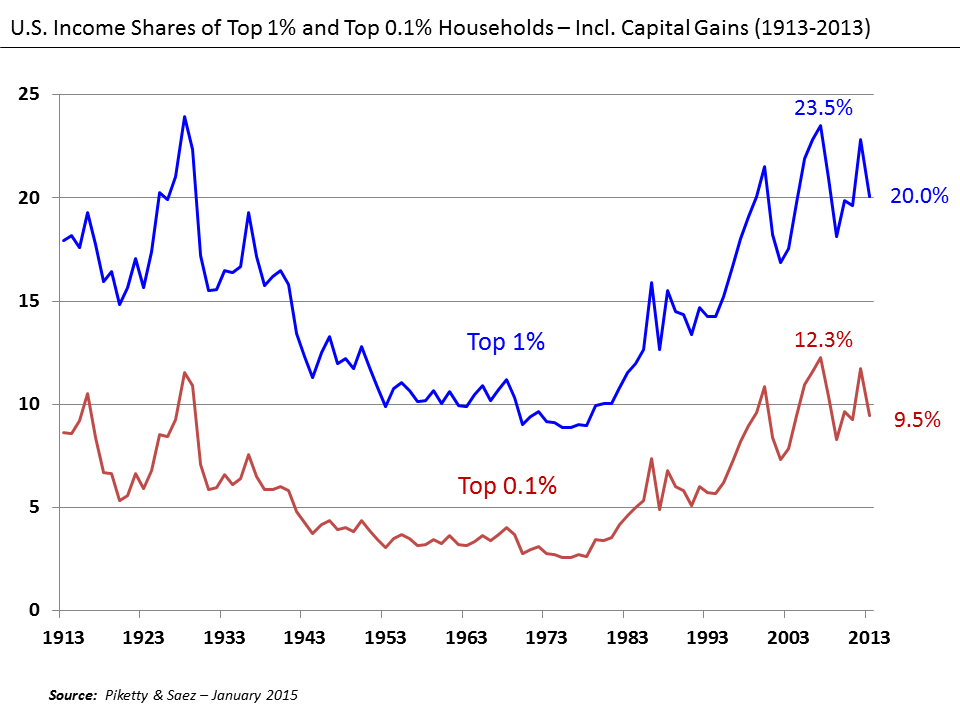

Figure 10 shows that wide income disparities were issues both at the time of the Great Depression and in recent years. Commodity prices have been relatively low each of these times. The problems didn’t look like shortages; they looked like gluts because of issues related to lack of affordability.

Figure 12. U. S. Income Shares of Top 1% and Top 0.1%, Wikipedia exhibit by Piketty and Saez.

The US has raised tariffs in the past. One time was immediately before the US Civil War. Tariffs were again raised in 1922 and 1930, when wage disparities were at a high level.

Unfortunately, there is a significant chance that major parts of the world economy will start collapsing, with or without Trump’s tariffs and the trade war, because energy supplies worldwide are not growing sufficiently. In fact, some of these energy supplies are purposely being removed by producers, such as Saudi Arabia, because prices are too low.

By putting tariffs on some goods, Trump is providing a substitute for the missing high oil prices needed to slow the growth of globalization, if the issue of ever-increasing wage disparity is to be solved. The tariffs tend to raise the value of the US dollar relative to other currencies, making the cost of commodities (including fossil fuels) cheaper for US consumers than for other consumers around the world. The tariffs tend to encourage new investment in US production of many types, at the same time that they make investment in other countries, such as China, less appealing.

All of these changes indirectly give the US an advantage if there should be a partial collapse of the world economy. With the benefit of the tariffs, perhaps the partial collapse would leave some combination of countries, including the US and Canada, mostly unaffected. There might be other groups remaining as well. Weak economies, such as Venezuela, Cuba, and Haiti, would likely be pushed aside. Even Europe and Japan would likely have major problems.

Conclusion

Most observers have missed the point that excessive wage and wealth disparity can be a sign of serious energy problems, just as high prices can be a sign of short supply. They have also missed the point that coal supply is very important, just as oil supply is very important.

In the real world, when there is not enough to go around, wars are a definite possibility. A trade war is a somewhat reduced version of a war. Trump and his advisors, whether or not they understand the real situation, seem to be trying to guide the US to as good an outcome as possible, in the current situation of excessive wage disparity.

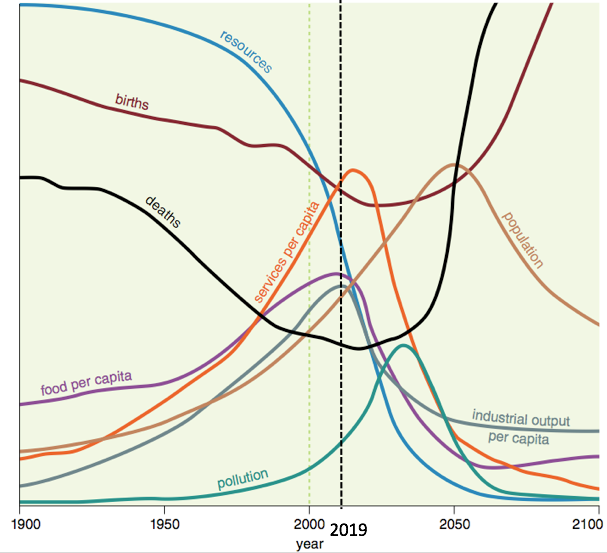

The underlying issue is likely the Limits to Growth problem modeled in the 1972 book, The Limits to Growth, by Donella Meadows, et al.

Figure 13. Base scenario from 1972 Limits to Growth, printed using today’s graphics by Charles Hall and John Day in “Revisiting Limits to Growth After Peak Oil,” with dotted line added corresponding to where I see the world economy to be in 2019.

As resources become depleted, it becomes increasingly difficult to maintain economic growth. Industrial output per capita (for example, the number of new cars or number of smart phones per 1000 people) starts falling. The 1972 computer simulations did not consider wages or prices, only physical quantities of various items.

Now, as we can see how the limits are playing out in the real world, it appears that the most prominent manifestation of the world’s low resource problem is excessive wage disparity–an issue most people have never considered as being related to shortages of resource supplies. Few people have stopped to think that goods made with energy products are equally unaffordable whether the problem is prices being too high, or wages of most people being too low.

Davy on Wed, 22nd May 2019 8:00 pm

I have often said that degrowth will only come from lower consumption and affluence. We are not going to tech are way out of this with efficiency and performance. If people want less emissions because of climate change they should be happy with the current trade war. This trade war means lower economic activity for all sides and those not part of it. Europe is going to get hammered because of it. Yet, watch what you wish for if degrowth and lower emissions are what you want because this global economy probably has a limit to degrowthing. When that threshold is breached it might be a cascade instead of a gentle decline. A degrowth also means all that fancy renewable tech might never get going. We are locked into this trade off situation without good solutions. Personally I feel this trade war is a good thing if we can keep it from turning into a hot war. The world needs to decouple into regions instead of a global economy. Maybe not completely but at least at first we need a winding down of globalism into regionalism. I see a future with a Chinese economic sphere and a US sphere with Europe somewhere in between.

makati1 on Wed, 22nd May 2019 8:28 pm

The main and only problem is greed. Gail sidesteps that situation as it is not going to sell whatever it is that she is trying to sell.

That same greed is causing the climate changes, but those who are in power know they will be dead before the worse happens. They have no consideration for future generations, only themselves.

The world’s resources, evenly spread would provide all of us a decent lifestyle that was renewable and not destructive. We do not “need” all the tech junk sold for $$$. We do not need all the “conveniences”. We need food, shelter, water and community. All else is luxury. Most Westerners don’t realize that fact. They think an I-phone is a necessity. Well, they are soon in for a very hard lesson in reality. So be it.

Chrome Mags on Wed, 22nd May 2019 10:46 pm

One thing Gail writes about is she suggests Trump understands the problems associated with the wealth divide.

Uh, so what was with the super massive permanent tax cuts that benefitted mostly the wealthy?

Shortend on Thu, 23rd May 2019 3:12 am

Looks like peak coal in China will lead to war and conflict if History repeats itself.

Something to look forward to at the End of the World Party

majece majece on Thu, 23rd May 2019 3:37 am

Information from http://celltrackingapps.com/how-to-spy-on-cell-phone-without-having-access-to-the-phone/ will help you to spy on cell phone. I know what I am talking about

Davy on Thu, 23rd May 2019 4:28 am

“World Trade War I: US Asks South Korea To Join Anti-Huawei Campaign”

https://tinyurl.com/y5mml7yr zero hedge

“The bilateral trade war between the US and China is gradually becoming a global trade war of global geopolitical and commercial dominance between the US and Chinese spheres of influence.”

“According to the Chosun Ilbo newspaper, the US recently asked South Korean government to support and join its anti-Huawei campaign.”

“adds, citing members of the telecom and IT industry, if the Korean government stops importing Huawei equipment at the request of the United States, it is estimated that the damage to the enterprise amounts to billions of dollars. If China takes retaliation against our company, the damage can snowball.” On the other hand, South Korea’s own telecom giant, Samsung stands to benefit if Huawei, the world’s second-biggest smartphone vendor (having recently supplanted Apple) is crippled. Of course, if Seoul concedes to US demands, and joins Japan, Australia, New Zealand and other Pacific Rim nations in launching their own trade war against Beijing, China’s retaliation will be furious and will likely result in further collapse in trade among these nations. Which is a problem considering that just yesterday we pointed out the unprecedented plunge in South Korean exports for the first 20 days of the month. As such, the longer the trade war between the US and China drags on, the more nations will join both either US or China in retaliating against the adversary, in the process plunging global trade even further. Which is also a problem, because as we showed last week, global trade has already plummeted to near depression levels last seen during the financial crisis. Should trade get even worse, not even central banks will be able to “print” the trillions in trade and commerce that will be indefinitely mothballed.”

Sunspot on Thu, 23rd May 2019 5:06 am

And of course, the most important thing about all this is ignored: Global Dimming. All this economic activity puts aerosol “pollution” into the atmosphere, reflecting a great deal of sunlight back into space. As industrial activity lessens, and becomes “cleaner”, the world will heat up even faster. We know that, at the current level of CO2 in the atmosphere, temps should be much higher. This is why.

I’ll say it again. We have two choices. We can cease burning all fossil fuels immediately and civilization will collapse immediately. Or we can continue with civilization, but we have to burn fossil fuels to do that. This will heat up the atmosphere until we can’t grow food anymore. Of course, this is not really a choice – we will continue on the way we have been. We have known for decades that burning fossil fuels is suicide for our species, and extermination of most others, but clearly we don’t care. We are doing NOTHING meaningful. And we never will.

Davy on Thu, 23rd May 2019 6:15 am

“Toshiba Joins Huawei Blockade, Suspends Hard-Drive Shipments”

https://tinyurl.com/y6gc7d6d zero hedge

“As more companies scramble to comply with the White House executive order prohibiting telecommunications equipment deemed a national security risk – even as the administration extended Huawei a 90-day reprieve – Japan’s Toshiba said Thursday that it had suspended shipments of electronics to Huawei, according to the Nikkei Asian Review. The suspension will allow Toshiba time to figure out whether any US-originated parts or technologies are being packaged into Toshiba products sold to Huawei. If it were to ship US-made components to Huawei in violation of the ban, Toshiba would risk drawing the ire of the White House. Toshiba is at least the third major Japanese supplier to cut ties with Huawei, the other two being smartphone chip-maker ARM and Panasonic, which also supplies parts for Huawei phones. Japan’s enthusiastic support of the White House’s crackdown on Huawei shows that the world’s third-largest economy has picked a side in the battle between China and the US, potentially risking the trade war (and possibly even a hot war) across the East China Sea.”

Darrell Cloud on Thu, 23rd May 2019 7:20 am

I was in China last summer on a tour with a bunch of high school kids. The traffic, the high rises and the pollution was amazing. Everyone wants a good apartment close to a good school with a flat screen and a SUV in the garage. Coal fired plants keep the lights on. Australia will keep the lights on in China a while longer. Even with that, China’s growth cannot continue.

Davy on Thu, 23rd May 2019 7:20 am

“Sea Of Red”: S&P Futures, Bond Yields Tumble As All Out Trade War Becomes “Base Case”

https://tinyurl.com/yyp4zrp5 zero hedge

“Yesterday’s modest selloff has become an all-out rout, dragging world stocks lower for 4 of the past 5 days, with US equity futures tumbling and global markets a “sea of red” as fears grow that the China-U.S. trade conflict is fast turning into a “technology cold war” (something we warned about last December) and as Wall Street’s denial is finally shifting to acceptance that a lengthy, all-out trade war is now inevitable, and the only way out and for someone to concede is for markets to plunge. Sure enough, that’s what they are doing this morning. “It’s tin hats on and battening down the hatches for a fair bit of volatility for the next few months,” said Tony Cousins, Chief Executive of Pyrford International, the global equities arm of BMO Global Asset Management. “We are as defensively positioned as we could be,” he said, adding it was impossible to predict what steps Trump was likely to take next in the trade war with China. Analysts at Nomura warned in a note that “without a clear way forward during an intensifying 2020 U.S. presidential election, we see a rising risk that tariffs will remain in effect through end 2020.”

Robert Inget on Thu, 23rd May 2019 9:29 am

Endless trade wars, endless oil wars;

https://www.cnbc.com/2019/05/23/china-says-trade-talks-cant-continue-unless-us-addresses-its-wrong-actions.html

http://www.livecharts.co.uk/MarketCharts/crude.php

Robert Inget on Thu, 23rd May 2019 9:49 am

China has run a small-scale test of the “nuclear option” in its trade war with the US by selling $20 billion worth of US government debt.

If China sold its $1.2 trillion in US Treasurys, it could raise America’s borrowing costs, weaken the US dollar, and plunge global markets into chaos.

A fire sale, however, would strengthen the yuan, making Chinese exports less attractive, and could spin the currency out of control.(30)

Watch THIS reaction;

http://www.livecharts.co.uk/ForexCharts/dollarindex.php

(weaker dollar makes OUR exports cheaper)

including oil; making a small comeback…..

http://www.livecharts.co.uk/MarketCharts/crude.php

IMO, If china places huge tariffs on ‘rare earth’

THAT will be the real nuclear option.

We should already know, China ain’t gonna finance one more American adventure on Iran.

China is deeply dependent on Iranian oil.

Just let ANYONE try to take China’s oil and ‘rare earth’ becomes a whole lot more than rare.

ANY attack on Iran’s nuclear set-ups make

then entire region radio active.

Infrastructure is said to be Trumps first strike target, (not US infrastructure BTW, he’ll be needing that money for lawyers)

Robert Inget on Thu, 23rd May 2019 10:00 am

Selling USD at this point would be a smart move for anyone. The question remains, what to buy?

Treasury Sec. Steven Mnuchin is buying precious

art:https://www.artsy.net/article/artsy-editorial-jeff-koonss-rabbit-sell-70-million

Apr 19, 2019 · And now, one of the four copies of Rabbit (1986) in the world, previously owned by Condé Nast owner S.I. Newhouse, has been consigned to Christie’s, where it is expected to sell at the May 15th evening sale for between $50 million and $70 million—setting it up to perhaps break the Koons record, set in 2013 when Balloon Dog (Orange) (1994–2000) sold at Christie’s for $58.4 million.

When Trump gets overwhelmed by debt, he borrows more from his boss Putin.

I’m waiting for the blowback when, not if, rump stiffs the real Mob Boss, Putin.

For going on three years I’ve wondered just how Trump would get us all killed, now we know.

Davy on Thu, 23rd May 2019 11:11 am

“Bill Blain: “Xi Is In Much More Trouble Than We Think”

https://tinyurl.com/yyu59bnq Bill Blain via zero hedge

“In terms of market action, trade fears really seem to have settled in as the dominant theme on markets. But if markets are simply wondering when there will be a solution, then they may be waiting for the wrong thing. While the mood remains negative as the market waits for a US/China agreement/resolution, maybe the new long-term reality is an increasingly and deliberately bifurcated global economy? The US and its allies vs China. If it sounds familiar – it should in terms of 1945-89.”

“Expect to see this theme develop in coming months. This is no longer a trade spat – this is morphing into full economic war. The US is willing to take a short-term hit in the form of higher consumer prices, and welcome inflation, from Chinese imports until global supply chains re-adjust and new domestic and international lines open, knowing the long-term damage is limited. Meanwhile, the hit to China is long-term and directly on production, thus right across the economy right at the most difficult phase of economic transition. Chinese economists are talking about a 1-2% hit to GDP. I suspect much more plus increased domestic social and political tension. Xi is in more trouble than we think.”

Davy on Thu, 23rd May 2019 11:11 am

“China’s Insurmountable Global Weakness: Its Currency”

https://tinyurl.com/yyquf8qv Charles hughs smith

“Quick history quiz: in all of recorded history, how many superpowers pegged their currency to the currency of a rival superpower? Put another way: how many superpowers have made their own currency dependent on another superpower’s currency? Only one: China.”

“Second question: is pegging your currency to a rival power’s currency a sign of strength? The obvious answer is no. It’s a sign of weakness. A real financial power issues its own currency and let’s the global FX (foreign exchange) market discover the relative price / value of the currency. The financial power trusts the market to discover the value / price of its currency, and it responds by raising or lowering the yields on its government bonds and other pricing inputs. If the issuing nation won’t allow users and owners of its currency price discovery, few will want the currency because they can’t trust the state’s arbitrary, non-market price.”

“Why does China cling to state control of its currency’s valuation? The obvious answer is that China’s economy and global role are too fragile to absorb a major revaluation of its currency up or down: a major loss in purchasing power would raise the cost of energy and other imports, while a major strengthening of the yuan would crush the global competitiveness of China’s goods and services.”

“As for the idea that China will unpeg its currency when it backs it with gold, recall that “backed by gold” means “convertible to gold.” If the yuan weakens and other nation-state owners of the currency decide gold is the safer bet, China will have to exchange yuan for gold if it wants to make good on its claim to be backing its currency with gold. If the currency isn’t convertible to gold, it isn’t backed by gold at all; it’s just another fiat currency backed by nothing. If China wants superpower status, it will have to issue its currency in size and let the global FX market discover its price. Anything less leaves China dependent on the U.S. and its currency, the dollar. If China is so powerful, why doesn’t it let its currency float on the FX market like other trading nations? Until its currency floats freely like other currencies and the yuan’s price is discovered by supply and demand, China’s global role in currency payments, loans and reserves will remain near-zero. That is a weakness that appears to be insurmountable.”

Davy on Thu, 23rd May 2019 11:12 am

“Could China Dump Its US Treasuries? A Contrarian View Emerges From Beijing”

https://tinyurl.com/y4aasqtu south china post

“the government may use the securities as a “weapon of last resort”. China’s US$1.12 trillion holdings account for just 5 per cent of total US national debt, which may mean any material damage on the US economy stemming from a bond sales would be limited. In addition, even if it did cause market volatility, China’s remaining holdings would also be hurt, which the Chinese may view as a move that is too risky, US sceptics have said. “While we think China will continue to sell Treasuries, as it has for most of the last year, we do not think that the pace at which they sell will increase as a direct response measure for tariffs. Rather, we believe that the pace at which they sell Treasuries will continue to track the pace at which they see capital inflows,” said Matthew Hornbach, an analyst at Morgan Stanley.”

“However, one line of thinking is that because the trade war could remove the US as a viable market for Chinese exports, a strengthening yuan against the dollar – which would make Chinese goods more expensive for American buyers – may be seen as an acceptable outcome by Chinese policymakers. “This will only happen when China has no other option. It is a weapon of last resort,” said David Chin, the founder of Basis Point Consulting. “If China is not exporting to the US any more, then they do not need to have a weak yuan and strong dollar to encourage Americans to buy.” However, China would have to sell strategically to maximise profits while triggering enough panic in the global financial markets, Chin said.”

“For now, the notion of escalating the trade war with monetary weapons is seen as just talk, particularly on the US side – from Wall Street pundits to regulators. “They could certainly sell them if they want to. But since global markets are global markets, I’m not sure there’d be much of an effect,” St Louis Federal Reserve Bank president James Bullard, a member of the US central bank’s policymaking Federal Open Market Committee said at a conference in Hong Kong on Wednesday. He noted that the slide in China’s foreign reserves, which could been partially due to sales of US Treasuries, by nearly US$1 trillion between mid-2014 and early-2017 had been a “non-event in global markets”. “I don’t think it as much of a threat as it’s made out to be,” he said.”

Anonymouse on Thu, 23rd May 2019 12:08 pm

Take a page from Cloggjudes book.

The more zeroIQ cut and pastes

you puke up here,exceptionalturd, the ‘smarter’ it makes it you look.

Bonus points if they feed your Sinophobic, Rossophbic and or Venezuela….phobic paranoia(s).

Stalker on Thu, 23rd May 2019 12:33 pm

Anonymouse on Thu, 23rd May 2019 12:08 pm

Retard on Thu, 23rd May 2019 12:42 pm

Davy on Thu, 23rd May 2019 12:08 pm

Davy Sock Puppet on Thu, 23rd May 2019 12:43 pm

Stalker on Thu, 23rd May 2019 12:33 pm

So it is Written and so it Shall be Done on Thu, 23rd May 2019 1:03 pm

DavyTurd-

You are the world’s WORST hypocrite. You routinely engage in identity theft and the use of sock puppets, yet you have the audacity to whine and complain when same is done to you in retaliation.

Grow up. You are the son of a rich family (surprise, surprise, RepubliCON) that has spoiled you rotten.

JaunP on Thu, 23rd May 2019 1:37 pm

JuanP the other stalker posted these

Retard on Thu, 23rd May 2019 12:42 pm

Davy on Thu, 23rd May 2019 12:08 pm

Davy Sock Puppet on Thu, 23rd May 2019 12:43 pm

Stalker on Thu, 23rd May 2019 12:33 pm

So it is Written and so it Shall be Done on Thu, 23rd May 2019 1:03 pm

DavyTurd-

You are the world’s WORST hypocrite. You routinely engage in identity theft and the use of sock puppets, yet you have the audacity to whine and complain when same is done to you in retaliation.

Grow up. You are the son of a rich family (surprise, surprise, RepubliCON) that has spoiled you rotten.

More Davy Identity Theft on Thu, 23rd May 2019 1:42 pm

JaunP on Thu, 23rd May 2019 1:37 pm

JuanP on Thu, 23rd May 2019 1:44 pm

More juanpee stalking

More Davy Identity Theft on Thu, 23rd May 2019 1:42 pm

JaunP on Thu, 23rd May 2019 1:37 pm

Davy Identity Theft on Thu, 23rd May 2019 2:02 pm

JuanP on Thu, 23rd May 2019 1:44 pm

[email protected] on Thu, 23rd May 2019 4:20 pm

JaunP on Thu, 23rd May 2019 1:37 pm

makati1 on Fri, 24th May 2019 7:16 pm

One should be careful when boasting of the US being “food independent/secure”. Mother Nature may decide to reshuffle the deck and deal a bad hand to the braggart.

“E. coli risk leads to recall of more than 62,000 pounds of raw beef before Memorial Day”

“Rain, flooding expected in U.S. Southern Plains after deadly storms”

“Forget the ‘Polar Vortex.’ Here comes the ‘Death Ridge’ and record heat for the Southeast”

“U.S. Corn Planting Is Slowest on Record for This Time of Year”

“High temperatures make April 2019 second hottest month on record”

“Jet Stream Detour Leaves Midwest Farmers Drenched, Canadians Dried Out”

“Researchers Analyze Risk for ASF Introduction into the U.S. Via Airports”

“Americans Brace For Shock Surge In Everyday Food Prices”

“Flooded Farmers In Missouri Want Federal Disaster Assistance Like Nebraska and Iowa”

http://ricefarmer.blogspot.com/

Today’s weather pattern. Clockwise = High pressure. Counterclockwise = Low pressure (rain).

https://earth.nullschool.net/#current/wind/isobaric/700hPa/orthographic=-103.56,36.16,700

Arctic vortex’, floods, tornadoes, and the hurricane and fire season has not even begun. Gonna be a rough year in Exceptional Land. Buckle up! GO TRUMP! TRUMP IN 2020!

Antius on Sat, 25th May 2019 5:07 am

Whilst I cannot corroborate whether or not this article is true, it is certainly consistent with what I have seen elsewhere in Britain recently.

https://tinyurl.com/y4ycg6yy

A country that is nakedly totalitarian, where intellectual freedom does not exist.

The country increasingly resembles Soviet era East Germany – a surveillance state, where individuals were encouraged to inform on each other and where believing and speaking the wrong thing would lead to incarceration and death.

Thanks a lot Peter Mandelson. I’m so glad we rescued your family from persecution, so that you could visit oppression and destruction upon us.

Davy on Sun, 26th May 2019 4:22 pm

“Tariffs On China Do Not Solve Lack Of US Competitiveness”

https://tinyurl.com/y57jlcsd zero hedge

“I’ve been making arguments for months that Donald Trump’s trade war with China is the height of stupidity. While Trump has the power to do what he’s been doing – sanctioning actors and applying tariffs – some power is best left not used.”

“The simple fact is that America is uncompetitive. This is at a deep and structural level. It’s at an education level. And this is something Trump’s trade team and his adherents refuse to admit.”

“When it comes to manufacturing and assembly, U.S. workers are not worth the money they are paid. Period.”

“It’s all just a reflection of a society unwilling to look itself in the mirror and realize that we’ve met the enemy and he is us.”

JuanP on Sun, 26th May 2019 5:30 pm

Juanpee posting

Davy on Sun, 26th May 2019 4:22 pm

“Tariffs On China Do Not Solve Lack Of US Competitiveness”

https://tinyurl.com/y57jlcsd zero hedge

“I’ve been making arguments for months that Donald Trump’s trade war with China is the height of stupidity. While Trump has the power to do what he’s been doing – sanctioning actors and applying tariffs – some power is best left not used.”

“The simple fact is that America is uncompetitive. This is at a deep and structural level. It’s at an education level. And this is something Trump’s trade team and his adherents refuse to admit.”

“When it comes to manufacturing and assembly, U.S. workers are not worth the money they are paid. Period.”

“It’s all just a reflection of a society unwilling to look itself in the mirror and realize that we’ve met the enemy and he is us.”

Davy on Sun, 26th May 2019 7:10 pm

“How To Prevent Debate While Claiming To Be In Favor Of It”

https://tinyurl.com/y27b9cjd Zero hedge

“I think there are people who really do not want others to debate and discuss.”

“They don’t want people to come to a better understanding of each other.”

“They want, instead, to keep very tight control over what can and can’t be said and can and can’t be debated.”

“Such people don’t want to ever be accused of shutting down debate. They want to be seen as the champions of debate – rational debate, but all the while managing to prevent it. And the way they do it is by insisting they do not have assumptions. Only the ‘other’ side does. The ‘good’ side has science or evidence or just the moral high ground as their platform. This is a profound danger. Everyone has assumptions. The essential thing is to admit it, and be willing to discuss them.”

JuanP on Sun, 26th May 2019 7:13 pm

juanpee is unable to debate he is a stalker

juanpee post

Davy on Sun, 26th May 2019 7:10 pm

“How To Prevent Debate While Claiming To Be In Favor Of It”

https://tinyurl.com/y27b9cjd Zero hedge

“I think there are people who really do not want others to debate and discuss.”

“They don’t want people to come to a better understanding of each other.”

“They want, instead, to keep very tight control over what can and can’t be said and can and can’t be debated.”

“Such people don’t want to ever be accused of shutting down debate. They want to be seen as the champions of debate – rational debate, but all the while managing to prevent it. And the way they do it is by insisting they do not have assumptions. Only the ‘other’ side does. The ‘good’ side has science or evidence or just the moral high ground as their platform. This is a profound danger. Everyone has assumptions. The essential thing is to admit it, and be willing to discuss them.”

Davy on Sun, 26th May 2019 7:27 pm

To the person that keeps stealing JuanP’s identity.

JuanP is on a sailing adventure and he won’t be back until late June or early July.

stupid

confused-fmr-paultard-the-third on Sun, 26th May 2019 7:59 pm

i don’t know why this site attacks supertard so much. he seems reasonable to me when he pushes “real green”. i have different opinion regarding permacultism but why descend into hate? supertard even waved the olive branch to aswang. i’m very confused right now. the intardweb is satanic but then supertard is also with his ‘sky daddy’ smear

makati1 on Sun, 26th May 2019 8:07 pm

Today’s US weather pattern:

https://earth.nullschool.net/#current/wind/isobaric/850hPa/orthographic=-107.34,41.46,700

Today’s Jet Stream:

https://earth.nullschool.net/#current/wind/isobaric/500hPa/orthographic=-107.34,41.46,700

Looks like rain….

You need help Davy on Mon, 27th May 2019 12:07 am

confused-fmr-paultard-the-third on Sun, 26th May 2019 7:59 pm

JuanP on Mon, 27th May 2019 5:18 am

mindless Juanpee low IQ mental puke

Davy on Sun, 26th May 2019 7:27 pm

To the person that keeps stealing JuanP’s identity.

JuanP is on a sailing adventure and he won’t be back until late June or early July.

stupid

confused-fmr-paultard-the-third on Sun, 26th May 2019 7:59 pm

i don’t know why this site attacks supertard so much. he seems reasonable to me when he pushes “real green”. i have different opinion regarding permacultism but why descend into hate? supertard even waved the olive branch to aswang. i’m very confused right now. the intardweb is satanic but then supertard is also with his ‘sky daddy’ smear

You need help Davy on Mon, 27th May 2019 12:07 am

confused-fmr-paultard-the-third on Sun, 26th May 2019 7:59 pm

JuanP on Mon, 27th May 2019 8:35 am

PBOC Panics: Threatens Yuan Shorts With “Huge Loss”

China has a problem. Historically, when the PBOC wanted to exert a little influence on its FX market, it had merely to suggest intervention, or prompt its bankers to bid the yuan to squeeze the shorts… and it worked. In January 2017, when officials grew upset about the yuan’s weakness, they choked cash supply in Hong Kong and sent the currency’s deposit rates to record highs. That helped drive a rally in the offshore yuan. And the last six months have seen numerous significant squeezes. But something has changed. After the recent plunge took the currency to the brink of the critical 7 per dollar level, Guo Shuqing, head of China’s banking and insurance regulator, warned in a speech last night that speculators “shorting the yuan will inevitably suffer from a huge loss.” The reaction was as expected, Yuan started to accelerate higher as the speech, delivered by a spokesman for the agency in Beijing, was run on front-page articles among local media, as Guo attempted to placate fears (and capital flight) claiming that higher U.S. tariffs will have a “very limited” impact on China’s economy even if it raises levies to the maximum level, and would hurt the U.S. about as much. However, the short-squeeze in yuan lasted around an hour, before sellers returned… Erasing all Guo’s hard jawboning work. Perhaps it was his additional jab at recent chatter from Washington around currency manipulation as he exclaimed, how “ridiculous” it was that developed countries have long asked for more currency flexibility, but when the yuan’s rate become more market oriented, some of them showed fear. Either way, it appears – outside of direct intervention – China’s jawboning policy is beginning to lose its mojo.

Davy on Mon, 27th May 2019 11:11 am

Your so stupid juanpee. When you do a Zerohedge plagerize these are my rules.

Title has to have quotations

Link has to be a tiny URL

Than zero hedge in small letters only 2 words

Than the artical can be copied and pasted properly

Like this dumbass

“PBOC Panics: Threatens Yuan Shorts With “Huge Loss””

https://tinyurl.com/y6qukupx zero hedge

“China has a problem. Historically, when the PBOC wanted to exert a little influence on its FX market, it had merely to suggest intervention, or prompt its bankers to bid the yuan to squeeze the shorts… and it worked. In January 2017, when officials grew upset about the yuan’s weakness, they choked cash supply in Hong Kong and sent the currency’s deposit rates to record highs. That helped drive a rally in the offshore yuan. And the last six months have seen numerous significant squeezes. But something has changed. After the recent plunge took the currency to the brink of the critical 7 per dollar level, Guo Shuqing, head of China’s banking and insurance regulator, warned in a speech last night that speculators “shorting the yuan will inevitably suffer from a huge loss.” The reaction was as expected, Yuan started to accelerate higher as the speech, delivered by a spokesman for the agency in Beijing, was run on front-page articles among local media, as Guo attempted to placate fears (and capital flight) claiming that higher U.S. tariffs will have a “very limited” impact on China’s economy even if it raises levies to the maximum level, and would hurt the U.S. about as much. However, the short-squeeze in yuan lasted around an hour, before sellers returned… Erasing all Guo’s hard jawboning work. Perhaps it was his additional jab at recent chatter from Washington around currency manipulation as he exclaimed, how “ridiculous” it was that developed countries have long asked for more currency flexibility, but when the yuan’s rate become more market oriented, some of them showed fear. Either way, it appears – outside of direct intervention – China’s jawboning policy is beginning to lose its mojo.”

Davy on Mon, 27th May 2019 11:24 am

Hears another example for you stupid

“Crop-tastrophe In The Midwest – Latest USDA Progress Report Signals Nightmare Scenario”

https://tinyurl.com/y5de97h8 zero hedge

“The last 12 months have been the wettest in all of U.S. history, and this has created absolutely horrific conditions for U.S. farmers. Thanks to endless rain and historic flooding that has stretched on for months, many farmers have not been able to plant crops at all, and a lot of the crops that have actually been planted are deeply struggling. What this means is that U.S. agricultural production is going to be way, way down this year. The numbers that I am about to share with you are deeply alarming, and they should serve as a wake up call for all of us. The food that each one of us eats every day is produced by our farmers, and right now our farmers are truly facing a nightmare scenario.”

“Farmers in the middle of the country desperately need conditions to dry out for an extended period of time, but so far that has not happened.”

“In fact, last week the heartland was hit by yet another string of devastating storms.”

“One of the tornadoes that was spawned absolutely devastated the capital city of Missouri. It was reportedly a mile wide, and it stayed on the ground for almost 20 miles…”

“A clearer picture emerged Friday of the size and scope of the powerful tornadoes that tore across Missouri on Wednesday night, leaving a trail of destruction in their paths. The state’s capital, Jefferson City, was among the hardest-hit places, struck overnight by a tornado with a peak wind speed of 160 mph that has been given preliminary rating of EF3.”

JuanP on Mon, 27th May 2019 12:47 pm

JuanPee gets an education.

Davy on Mon, 27th May 2019 11:24 am

Hears another example for you stupid

Davy on Mon, 27th May 2019 11:11 am

Your so stupid juanpee. When you do a Zerohedge plagerize these are my rules.

JuanP on Mon, 27th May 2019 1:42 pm

https://www.zerohedge.com/s3/files/inline-images/US%20China%20bank%20liabilities.jpg?itok=Km10Sivg

Belly Bandit Review on Mon, 19th Aug 2019 8:10 pm

It’s really a nice and useful piece of information. I’m satisfied that you

just shared this useful info with us. Please stay us informed

like this. Thanks for sharing.

windowserrors on Wed, 27th Nov 2019 11:45 pm

Yes, I found the whole topic very informative and you did great research to make this article user friendly.