Page added on August 22, 2019

US To “Drown The World” In Oil

The U.S. could “drown the world in oil” over the next decade, which, according to Global Witness, would “spell disaster” for the world’s attempts to address climate change.

The U.S. is set to account for 61 percent of all new oil and gas production over the next decade. A recent report from this organization says that to avoid the worst effects of climate change, “we can’t afford to drill up any oil and gas from new fields anywhere in the world.” This, of course, would quickly cause a global deficit, as the world continues to consume around 100 million barrels per day (bpd) of oil.

Global Witness notes that the industry is not slowing down in the United States, notwithstanding recent spending cuts by independent and financially-strapped oil and gas firms. If anything, the consolidation in the Permian and other shale basins, increasingly led by the oil majors, ensures that drilling will continue at a steady pace for years to come.

It isn’t as if the rest of the world is slowing down either. The global oil industry is set to greenlight $123 billion worth of new offshore oil projects this year, nearly double the $69 billion that moved forward last year, according to Rystad Energy. In fact, while shale drilling has slowed a bit over the past year amid investor skepticism and poor financial returns, offshore projects have begun to pick up pace.

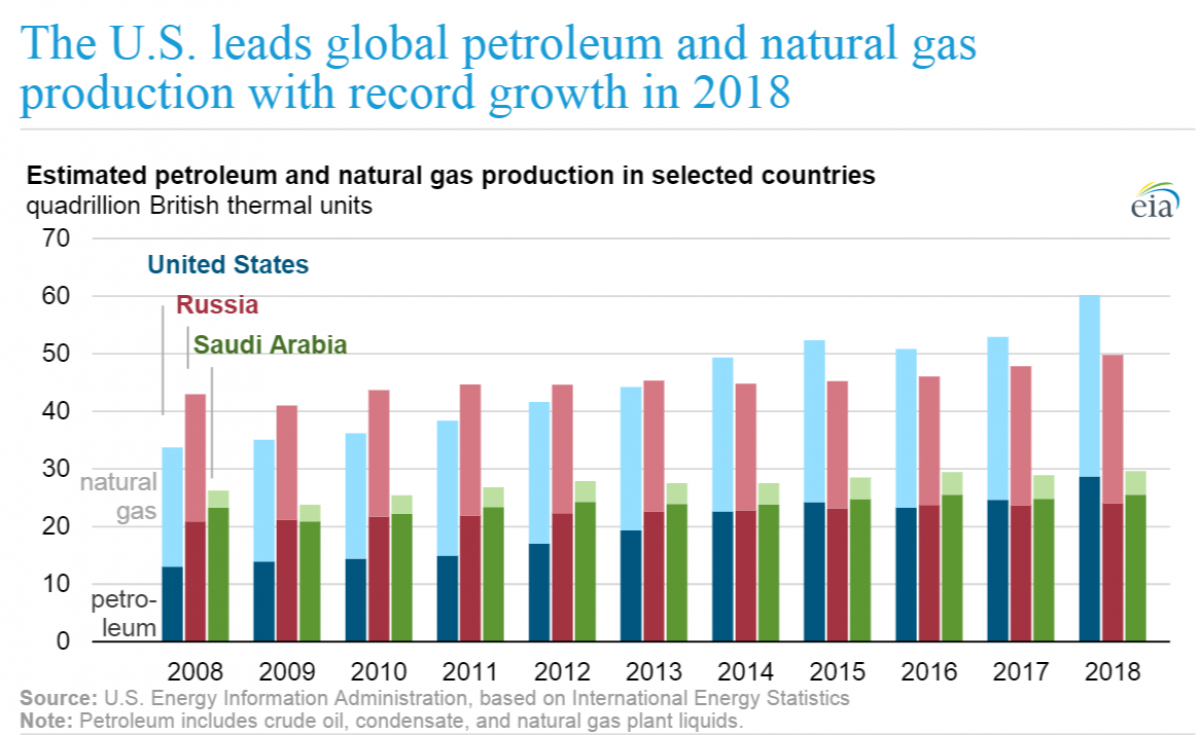

But that trend might turn out to be just a blip. The U.S. is still expected to account of the bulk of new drilling and the vast majority of new production, with much of that coming from shale. Already, the U.S. is the world’s largest producer of both oil and natural gas. And the pace has accelerated in recent years. In 2018, U.S. oil and gas production increased by 16 and 12 percent, respectively. According to the EIA, the U.S. surpassed Russia in terms of gas production in 2011, claiming the top spot, and it surpassed Saudi Arabia in oil production last year.

Going forward, new production from the U.S. will be eight times larger than the next largest source of growth, which is Canada. In fact, the U.S. will add 1.5 times more oil and gas than the rest of the world combined, according to Global Witness.

But because so much drilling in the U.S. is concentrated in a few areas, individual U.S. states on their own tower over the rest of the world. If Texas were a country, it would account for the most new oil and gas production in the world. Between 2020 and 2029, Texas could account for 28 percent of all additional output, Global Witness says.

Canada and Pennsylvania tie for second and third with 7 percent each. Then comes New Mexico at 5 percent of the growth and North Dakota at 4 percent. Oklahoma, Brazil, Colorado, Russia and Ohio are all tied at 3 percent a piece.

In other words, 7 out of the top 10 sources of new oil and gas production globally over the next decade are U.S. states.

“If things don’t change, by the end of the next decade, new oil and gas fields in the US will produce more than twice what Saudi Arabia produces today,” Global Witness said in its report.

This presents a massive challenge. “To avoid the worst impacts of climate change, our analysis shows that global oil and gas production needs to drop by 40% over the next decade. Yet, instead of declining, US oil and gas output is set to rise by 25% over this time, fueled by expansion in new fields,” the report warned.

24 Comments on "US To “Drown The World” In Oil"

dave thompson on Fri, 23rd Aug 2019 9:29 am

The U$ still imports 9 million bbl of oil per day from around the world. Where is the U$ going to get more oil? Oh yea, from melting down all the plastic trash, old sofas and used tires. Presto change-o, the new U$ oil empire takes over the world.

Buy a Koch the World on Fri, 23rd Aug 2019 2:15 pm

I kinda feel this Global Witness is just strategic BS designed to “rally the troops” against said development of the remaining shale and off-shore reserves. Shale seems ready to throw in the towel, and off-shore wells are much more expensive, have a longer lead time and are environmentally problematic is things go sideways. And many states don’t want drilling off their shores so full development has many headwinds. And of course there is the global warming impact of more fossil fuel utilization but the world seems resigned to forging a shitty future for our descendants so lets not factor that into the mix.

Dredd on Fri, 23rd Aug 2019 2:18 pm

“US To ‘Drown The World’ In Oil”

That has already happened (A Closer Look At MOMCOM’s DNA – 2).

It takes a while for a world to die.

elQuardashianalameriki-akafmr on Fri, 23rd Aug 2019 3:06 pm

why do big dredd pbuh and big lib hate Big Grab (the p) so much?

big muzzies lovers spewing hate on a supposedly objective site discussing depletion of resources. It’s as if big lib are walking about with a P. and they’re afraid Big Grab is going to grab that too. That must be it. It’s been a while so it can’t be about not getting used to not winning.

elQuardashianalameriki-akafmr on Fri, 23rd Aug 2019 3:52 pm

in the interest of full disclosure i’m a libtard.

i only became a blue republican to vote for president paul.

i didn’t vote for Big Grab but I’m for him a little bit. I don’t approve of him grabbing the p. and I definitely against him grabbing the g. (2nd).

Duncan Idaho on Fri, 23rd Aug 2019 4:09 pm

monday fireworks!! trump rause tariffs!!

Luck for Trump the US is politically illiterate (he would just be a 6 times bankrupt loser and scammer).

We shall see in 2020–

Duncan Idaho on Fri, 23rd Aug 2019 4:12 pm

Dow 30

25,628.90

-623.34(-2.37%)

elQuardashianalameriki-akafmr on Fri, 23rd Aug 2019 4:31 pm

duncan the tard pbuh. are you saying Big Grab moves the market singlehandedly. Maybe i”m stupid and I just born yesterday and too lazy to emerge from my rock, but I’ve been saying Big Goat pbuh is the master magician.

Supposed you’re correct, Big Short would’d been rich since 2016? The record speaks otherwise. stick to big muzzie love. you’re best at it.

Duncan Idaho on Fri, 23rd Aug 2019 4:31 pm

China is teaching the Fat Boy a lesson.

With 6 bankruptcies, a little learning may be appropriate.

The market is probably not going to like it Monday.

The Dog Track may get interesting.

velQuardashianalameriki-akafmr on Fri, 23rd Aug 2019 4:34 pm

excuse me but Big Doom pbuh(jay hanson may (((supremetard))) take his soul) said economic is not a science. here you are – a mere tard – contradicted BD by saying stocks move just because Big Grab (the P) caused it to move. causation == science.

Duncan Idaho on Fri, 23rd Aug 2019 4:36 pm

VelocityShares Daily 2x VIX Short-Term ETN (TVIX)

NasdaqGM – NasdaqGM Real Time Price. Currency in USD

20.40+3.85 (+23.26%)

elQuardashianalameriki-akafmr on Fri, 23rd Aug 2019 4:56 pm

it doesn’t matter what those vix numbers are. Big Grab (the P) didn’t cause it to move. There’s a case for making the study of the economy a science if you consider BIG DOOM (jay hanson pbuh may (((supremetard))) accept his soul) are still controlling the market after he’s gone . he said it’s not a science and it’s still not so he controls it.

makati1 on Fri, 23rd Aug 2019 5:57 pm

Market up! Market down! Who gives a fuck? $100 oil? $20 oil? again, it is out of YOUR control so you have to roll with it. The ONLY thing that matters is what is happening to you and yours.

If you are not prepped/prepping for the future, you are a fool and deserve the coming pain. So be it.

Mark on Fri, 23rd Aug 2019 9:48 pm

Article seems to imply that the act of drilling will create all this oil in and of itself. Call me skeptical.

Famlin on Sat, 24th Aug 2019 4:55 pm

Before coming to power, Trump floated the idea of giving “Haircut to the US $”.

What that means is for every $100 invested in US treasuries, only $95 will be returned. This will force everyone to move away from us investments and debase (lower) the US$. So all imports will become expensive and exports will be cheaper. This will help create more jobs in USA.

This is the last resort and USA will do this to protect its jobs. Excessive consumption and over imports have skyrocketed US national debt to $22.4 trillion and at least $600 billion should be paid as interest on this debt. 1 way or the other, USA has to cut down the trade deficit and the over consumption.

Davy on Sun, 25th Aug 2019 12:09 am

“Before coming to power, Trump floated the idea of giving “Haircut to the US $”.”

Famlin, you really need refences when you say these things?? I doubt on the campaign trail he would talk about $ hair cut. That would be fodder for criticism. Trump does want to lower the dollar in relation to what other economic powers are doing because it is clear many other currencies are under valued.

“What that means is for every $100 invested in US treasuries, only $95 will be returned.”

Treasuries are not going to make the dent in dollar value needed when other major powers are going negative rates and doing QE.

“This will force everyone to move away from us investments and debase (lower) the US$. So all imports will become expensive and exports will be cheaper. This will help create more jobs in USA.”

The markets don’t work simplistically this way, famlin. You can make small swings but big ones are very disruptive with large unintended consequences. Other powers will be doing the same actions so the net result is a race to the bottom. A targeted attack on another currency is another story but that is limited also by how much trade is occurring. In the case of China there is the potential for a very disruptive currency war but globally with the dollar and a basket of other currencies the effects are muted by others responding.

“ Excessive consumption and over imports have skyrocketed US national debt to $22.4 trillion”

Not really, US debt is more related to government expenditures and a significant amount of US debt is held internally. The US has a reserve currency so it has to have a trade deficit The US debt to GDP is in line with other nations. Debt is very difficult to compare because of the way nations fit into the global puzzle. You have private, corporate, and national that very considerable depending on how economies are structured.

“ and at least $600 billion should be paid as interest on this debt. 1 way or the other, USA has to cut down the trade deficit and the over consumption.”

The US has to lower government spending, raise taxes, or both that does not equate to overconsumption in general. The entire world needs to lower over consumption but that is another issue of globalism, debt, and productivity.

Davy on Sun, 25th Aug 2019 1:31 am

I post this because in the past here on this forum we have discussed the shrinking bag of tricks central banks have. We are nearer to this back hole. Where do they go from here? Will there eventually be a loss of control into economic dysfunction? Are we too far gone to remediate economic fundamentals? This is point is often missed by techno optimist when they talk about renewables, ev’s or oil. It will take a healthy economy to drive growth in these industries. What happens if the economy is not here to drive that growth for a renewable transition?

“How Negative Interest Rates Screw Up The Economy”

https://tinyurl.com/y4jbtu8x zero hedge

“Negative interest rates are terrible for banks. They destroy the business model for banks. They make future bank collapses more likely because banks cannot build capital to absorb losses. But banks are a crucial factor in a modern economy. It’s like an electric utility. You can somehow survive without electricity, but a modern economy cannot thrive without electricity. Same thing for the role commercial banking plays.”

“If interest rates go negative, the spread the bank needs in order to make a profit gets thinner. But risks get larger because prices of the assets used as collateral have been inflated by these low interest rates. At first this is OK, but over a longer period, this equation runs into serious trouble. Negative interest rates drive banks to chase yield to make some kind of profit. So they do things that are way too risky and come with inadequate returns. For example, to get some return, banks buy Collateralized Loan Obligations backed by corporate junk-rated leveraged loans. In other words, they load up on speculative financial risks. And as this drags on, banks get more precarious and unstable.”

“So that’s the issue with negative interest rates and banks. They crush banks. In terms of the real economy, negative interest rates have an even more profoundly destructive impact: They distort or eliminate the single-most important factor in economic decision making – the pricing of risk…But if central banks push interest rates below zero, this essential function of an economy doesn’t function anymore. Now risk cannot be priced anymore. The perfect example of this: Certain junk bonds in Europe are now trading with a negative yield. This shows that the risk-pricing system in Europe is kaput. When risks cannot be priced correctly anymore, there are a host of consequences – all of them bad over the longer term for the real economy. It means malinvestment and bad decision making; it means overproduction and overcapacity. It means asset bubbles that load the entire financial system up with huge risks because these assets are used as collateral, and their value has been inflated by negative yields.”

Davy on Sun, 25th Aug 2019 1:37 am

“Russian Expert Migunov: Russia Needs Time To Exit The Dollar – A Rapid De-Dollarization Of International Trade Will Not Succeed”

https://tinyurl.com/yxekzpxo memri via rice farmer

“After sustaining a series of very tough sanctions imposed by the US in 2017-2019, Russia has redoubled its efforts to modify the dollar-dominated international trade system. Russian expert Dmitry Migunov explained that Russia’s de-dollarization plan consists of two parts: the first is to lower the dollar’s share in Russia’s international reserves, and the second is the transfer of the country’s international trade from the dollar to other currencies, including the ruble. Although Russia has somewhat reduced its international transactions in dollars, there are several reasons why a rapid de-dollarization is not going to succeed and, in any case, it’s not the ruble, but primarily the euro that is substituting for the dollar. Alternative currencies, such as the Russian ruble, the Chinese RMB, the Turkish lira and the South African rand are subject to severe rate fluctuations that create extremely high risks of loss. Also, the transition to accounts in currency alternatives to the dollar inescapably incurs a rise in transaction costs. Furthermore, the dollar is popular not only thanks to the economic might of the US but mainly thanks to the worldwide existence of a system of dollar accounts. One doesn’t have to invest any efforts in order to obtain and use it in accounts. “Therefore, to speak of the full ejection of the dollar as the basic currency of trade in Russia, or in any other country, is still premature,” Migunov concluded.”

Robert Inget on Wed, 28th Aug 2019 11:56 am

*TRUMP AIMS TO MAKE BIOFUEL ANNOUNCEMENT IN CORN BELT #OOTT

Here’s the ‘rub’. Increasing ethanol content in gasoline reduces ‘gas’ milage by as much as 5%.

Increasing ethanol content in summer a No No.

Seed, Planting, Spraying, harvesting, transporting, refining ethanol uses about a gallon of diesel for every gallon of ethanol.

Trump will tell hurting corn farmers He (alone)

will increase ethanol content in gasoline.

He will not mention the fact that corn farmers won’t be getting another USDA (tariff) check.

China simply began buying pork and soybeans in South America. (instead)

Davy on Wed, 28th Aug 2019 12:27 pm

“*TRUMP AIMS TO MAKE BIOFUEL ANNOUNCEMENT IN CORN BELT #OOTT”

Bob, come on the real story is trying to reach a compromise between refiners and the ethanol industry. You got to warp this into a Trump this Trump that narrative. This is why your stories are so unreliable. You have an agenda to deliver not the truth of the matter.

Davy on Wed, 28th Aug 2019 12:46 pm

This is a great example of makato’s “East is rising” agenda:

“Martial Law Considered In Hong Kong To Crush Pro-Democracy Protests”

https://tinyurl.com/yy2z98cj summit news via zero hedge

“Authorities in Hong Kong are considering whether to impose draconian martial law powers in a bid to crush pro-democracy protests. According to a report in the South China Morning Post, Chief Executive Carrie Lam Cheng Yuet-ngor is not ruling out invoking the Emergency Regulations Ordinance for the first time in half a century. The ordinance would grant the government sweeping powers, including authorizing the entry and search of properties, censoring the media and imposing maximum terms of life imprisonment. Lawmaker Au Nok-hin warned that imposing emergency powers would lead to the “total destruction” of Hong Kong’s capitalist system, while law professor Simon Young of the University of Hong Kong said the ordinance meant “basically a state of martial law.”

Davy on Wed, 28th Aug 2019 2:41 pm

IMA. There isn’t a damn thing we can do to stop them.

juanpee shit on Wed, 28th Aug 2019 2:54 pm

Davy said Oops, sorry for getting all triggered and losing m…

Davy said IMA. There isn’t a damn thing we can do to stop th…

More mindless juanpee ID fraud said The Real Davy on Wed, 28th Aug 2019 11:50 am

more low iq davy mindless shit on Wed, 28th Aug 2019 2:58 pm

juanpee shit on Wed, 28th Aug 2019 2:54 pm