Page added on July 22, 2019

US Shale: Peak Oil Finally Arrives

Shale seems to be hitting a plateau, and at the very least the rate of increase will taper off.

It is also possible that in absolute terms it could fall in the months ahead.

This has real impacts for the oil market.

Discussion follows.

This idea was discussed in more depth with members of my private investing community, The Daily Drilling Report. Get started today »

Introduction

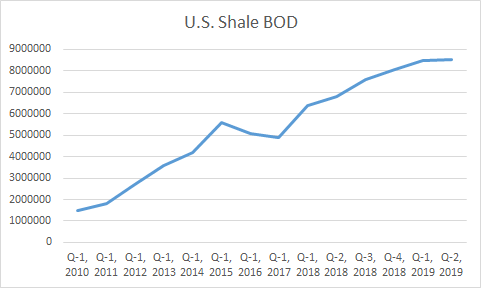

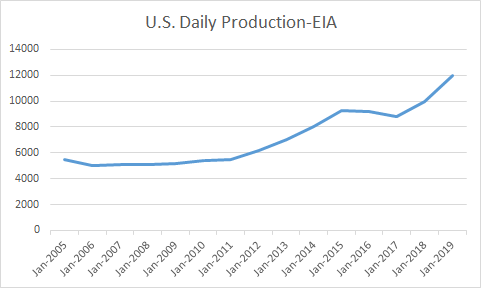

The shale growth story has been a very seductive dialogue the past 15 or so years. Who can argue with a chart like this?

You really can’t. The proof is in the pudding as shale goes, and shale heretics have been made to sit in the corner with a pointy cap on their heads.

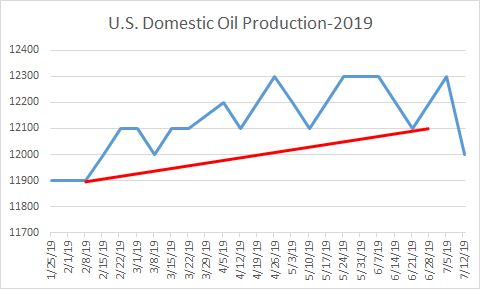

This year, for a variety of reasons, and some we will touch on in this article, domestic production and shale growth in particular have hit a wall. The latest report from EIA shows a decline that breaks the upward trend line.

EIA, chart by author

In this article we will look at a couple of key data points behind what well could be signs of shale… tapping out.

A reversal of trend for oil vs EIA oil production predictions

First, I want to briefly opine on the impact of this trend reversal for the world oil market. It is priced currently for what I would call perfection. Iran and the U.S. are still only calling each other names. China and the U.S. are making jaw-jaw once again on the topic of a trade deal. As a result, oil has sagged down about $5.00 a barrel over the first couple of days this week. All in the face of large crude storage builds in the U.S. over the past month.

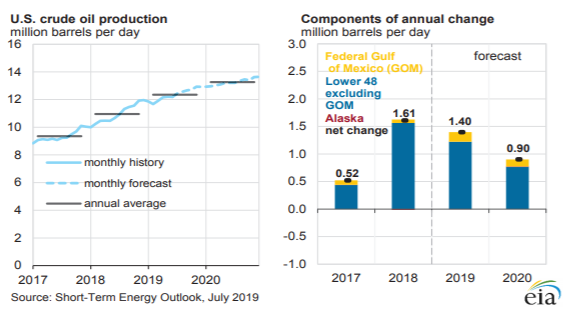

Meanwhile, the world market seems well supplied: Everyone has all the oil they need and expects to maintain that situation for the foreseeable future. Everything is rosy. The linchpin in that warm glow of market satiety is the 15%-20% year-over-year growth of U.S. production over the last decade. Every prognosticator on the planet now refers to the U.S. as the swing producer, able to fill all the pots and pans globally. The EIA is the worst of the lot. Their robust growth projections are contained in the graphic below.

STEO A nice looking graph that moves sharply upward from the lower left quadrant to the upper right quadrant, as most forecasts are prone to do.

But suppose the growth rate in U.S. shale can’t rise forever. What if the good folks over at the EIA (an arm of the federal government, which we all know is infallible) have been having their weekly brunches in California or Colorado? What if shale production actually dropped? Now, let me be clear: No one, absolutely no one, is forecasting that eventuality… yet. And that’s what worries me.

Harking back to an earlier shale demise prediction

Think I’m a worry wart? Let’s take a trip back to September of 2014 when a pundit by the name of Andrew John Hall forecast $150 oil in Business Insider, a respected publication. He wasn’t alone in holding that general opinion for oil; Goldman Sachs had reached that conclusion in 2012.

But young Andrew’s predictions were historically so reliable, as regards oil prices, that he was referred to in the market as “God.” You can’t get much more authoritative than that, and reliability on a deity-like level was probably among the attributes that have led him to become CEO of Phibro, a commodities trading house.

In terms of his prediction of the demise of U.S. shale, Hall based his reasoning on the supposition that the Saudis would be successful in bringing down the shale oil juggernaut that had begun to gore their ox from a market share standpoint. In his scenario oil would then rise due to scarcity as a result of shale cratering. He believed this so passionately that he opined in a newsletter to clients thusly, as he bought oil futures contracts for their accounts:

“When you believe something, facts become inconvenient obstacles.”

(If Hall is still lurking about someplace, I’ll bet he wishes he could cram that little gem back in the bottle! Note to self: never use the words “facts” and “inconvenient obstacles” in the same sentence!)

We all know what happened to oil over the next couple of years. American shale frackers proceeded to pull a hat trick. They recapitalized, cut their break-even costs by 50%, and upped production per foot of interval. Oil production from the U.S. resumed its upward march. The Saudis threw in the market-share towel by mid-2015 and closed the choke a hair on their side of the planet, with hopes of improving prices. Supply and demand then fell into a pseudo-balance over the next year, and by mid-2017 we were off on another nice ramp in the oil price.

Someone else is now CEO of Phibro. I have no inkling as to whether that fact relates to this monster missed market call. Hall may have gone back to his main job of running the universe.

But suppose Hall was right? Way early, and right for all the wrong reasons, but right nonetheless? That is the scenario we find ourselves discussing five years hence. What if shale has peaked, and is about to begin a slow decline in absolute terms? I’ll leave that thought for you to consider and provide some commentary later in this article. For now, let’s take a look at some of the indicators I’ve mentioned above.

Signs of fatigue in shale

As discussed in my recent piece on the impact crude quality may play on oil supplies, American production is starting to flatten in the 12 million-BOD range. We may even see production dip down as certain economic realities begin to grip the heretofore freewheeling shale-drilling business. Realities that include, but are not limited to:

- Well spacing and inter-well harmonics (frac hits)

- Rock quality and growing scarcity of tier 1 acreage

- Capital discipline edges out “growth at any cost”

- Takeaway capacity

EIA, Chart by author

As we move from the fourth quarter of 2018 through the second quarter of 2019 we can see there is a definite flattening of the curve. There is beginning to be a bit of a schism in the EIA’s STEO domestic crude production between projections and reality. Early signs, but there nonetheless. This report projects U.S daily production approaching 13.8 million BOED by the end of 2020, an increase of about 1.6 million BOED from present levels. Even if achieved, that would represent a growth rate of 11.5%, down from 2018’s pace of 17% production growth.

Worth noting: Baked into the EIA’s forecast is growth from the Gulf of Mexico of 200,000 BOED in 2020. I have my doubts about this as well given the under-capitalization of this space for the last few years, but let’s focus on shale, as I have promised.

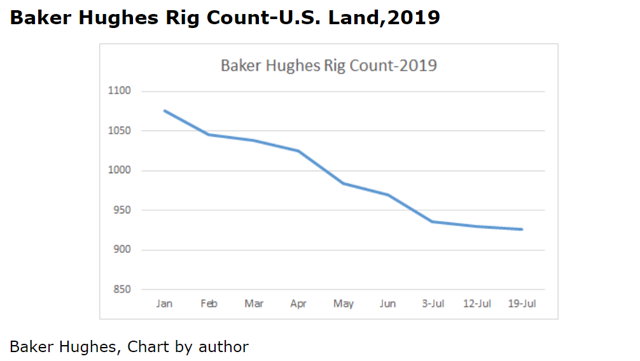

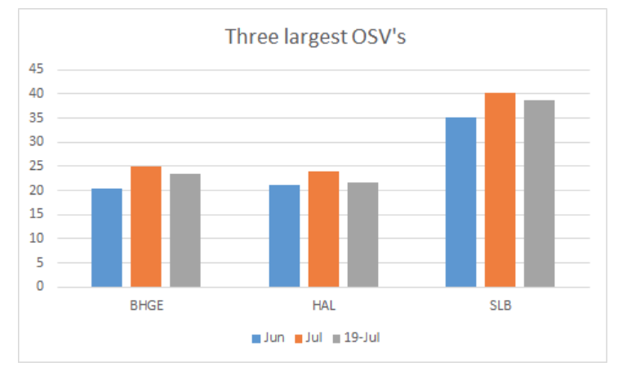

U.S. land, drilling as well are off markedly from the first of the year.

I suppose the icing on the cake would be the Schlumberger (SLB) conference call last week, where outgoing CEO Kibsgard commented thusly:

The cash flow focus amongst the E&P operators confirms our expectations of a 10% decline in North America land investments in 2019.

As an aside, that comment didn’t do the service company stocks any favors, I can tell you! All of the big ones dropped 5% just as he was speaking.

Seeking Alpha, Chart by author

So, wrapping up this section, I am going on record as saying that even if only the growth rate for shale declines, it is going to leave the world market under-supplied by a considerable amount. If shale production actually declines in real numbers, Anthony Hall’s rosy forecast of $150.00 oil is likely to become a reality in a very short period of time.

Will offshore deepwater bail us out?

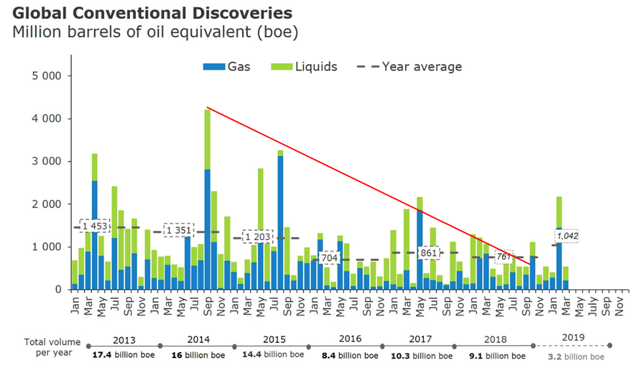

The other big compartment from which the world take its oil lies in the deepwater marine environment. This area has been famously under-capitalized in recent years, as has been well documented.

You can see from the Rystad graphic above that as capex declined, the discovery rate of conventional oil dropped from 16 billion BOE in 2014 to 9.1 billion in 2018. With only 3.2 billion bbl discoveries announced so far in 2019, the success rate will have to run pretty hard to reach 7.0 billion for the year. This would equate to a 45% decline over five years. The math isn’t working very well here.

I am not ready to make a call as to the likelihood of the EIA’s projections being wrong (horribly so), or not. But, I am ready to say that the trends I am seeing aren’t supportive of that outcome.

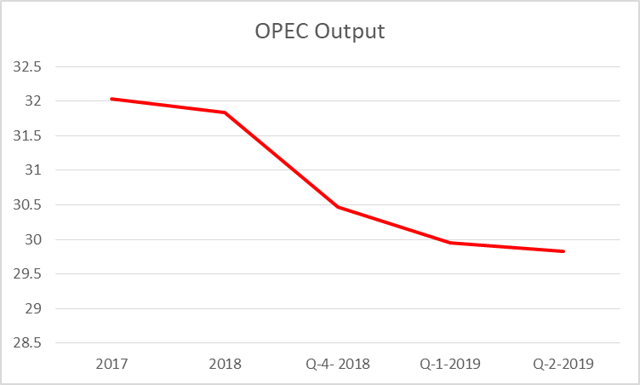

Can OPEC come to the rescue?

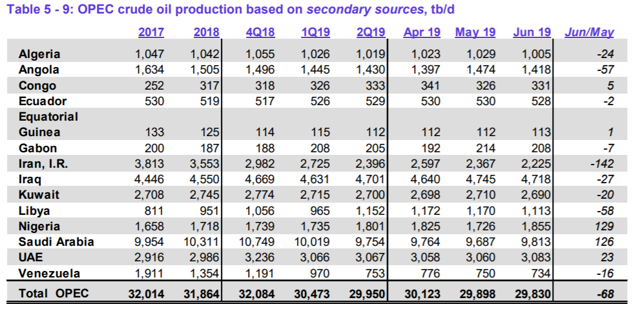

For the last couple of years OPEC voluntarily withdrew a half a million barrels a day from the market, at first, to shore up the price. When that didn’t work, it went to a million barrels a day, and then to 1.4 million. The graph below reflects that fairly well. Saudi Arabia has taken the bulk of those cuts, but some of it is reflective of some OPEC members simply being unable to pump their quota. Here again, the data is not supportive of any ability of the cartel to fill a gap of a million barrels a day or more.

OPEC monthly report, Chart by author

The troubles of some of these countries have received a lot of press in recent times for various reasons unique to their own situations. As we all know, Venezuela, Libya, and Iran will not be ramping up much anytime soon.

Inside the cartel, that leaves Saudi to make up any shortfall. They are famous for claiming that they have several million barrels a day of excess capacity to do just that. That may indeed be true. But, in recent times rumors to the contrary have been making the rounds. Rumors that didn’t get a lot of traction as there was no way to prove for or against. Until recently during the roadshow for the ARAMCO (ARMCO) IPO.

In conjunction with the ARAMCO IPO, the proverbial camel got to stick its “nose under the tent”. Field production data of the massive Ghawar oil field was observed by third parties for the very first time. It was revealed that Ghawar has entered a sharp decline in recent years, and even secondary and tertiary recovery methods will not restore it to greatness.

So, absent a new find to replace Ghawar, the Saudis may be more talk than substance when it comes to restoring oil production.

Your takeaway

Oil stocks have a radioactive glow about them these days. If the trends I’ve discussed in this report bear out, they could shed that pretty quickly as oil moves up.

In the Daily Drilling Reports Oil Trends Tracker, we discussed the inventory stats put out by the EIA and several other sources. They add up to a massive draw for the coming week.

We have recommended taking proactive positions in advance of this report. Companies like Shell (NYSE:RDS.A) (NYSE:RDS.B), and BP (BP) are on sale as a result of recent adverse price movement in oil. The type of draw we are expecting could change that course in a hurry. Both are yielding around 6% right now, and won’t stay there long.

W&T Offshore (WTI), a company we covered in a recent article, might also pop nicely. WTI is off quite a bit, and has the potential for a 50% rebound from present prices when the narrative for oil becomes less negative.

USO (USO) and several other oil ETFs are off in the 10% range, and might be a good bet as well.

We also like California Resources (CRC) as a play on heavy, non-shale oil. It has slumped way out of proportion recently due to Brent falling toward $60.00, and could be setting up for a nice rebound on news of the type I anticipate from the API and EIA.

124 Comments on "US Shale: Peak Oil Finally Arrives"

Anonymous on Mon, 22nd Jul 2019 10:12 pm

This is peak oilers every time a few month slowdown occurs. But hey…hope springs eternal. Paging Ron Patterson…

makati1 on Tue, 23rd Jul 2019 12:28 am

Peak Petroleum NET energy was a long time ago. The oily folks are trying to keep the oily financial house warm by burning any liquid that they can pass as petroleum. While there may be articles that actually show that NET petroleum energy has fallen, it is not my concern as I have zero investments or interest in that field.

BTW: A million barrels of Heineken, is NOT equal to a million barrels of Jack Daniels. Ask any sober alcoholic for confirmation.

Outcast_Searcher on Tue, 23rd Jul 2019 12:50 am

Mak: And of course, don’t mention how efficiency has generally increased GREATLY, making a BTU of energy go much further over the decades.

Or how wind, solar, geothermal, etc. only require minimal fossil fuels (maintenance / repairs, occasionally) to produce energy for decades, once installed.

makati1 on Tue, 23rd Jul 2019 1:45 am

Sorry, Outcast, but true “efficiency” has not increased. I’m talking the net energy that ends up at the end user, not at the well head.

As for ‘alternates’, they are a fantasy only possible with huge amounts of hydrocarbon fuels from mines to your roof top. They will NOT exist for long after the wells shut down, or the economy collapse’. All your efficiency will pop when the next solar flare blinks on earth. Maybe today or…? Gone!

BAU, as you or I know it, is a short blip in history, not forever. We have made our lives more “efficient” at what cost”? The wheel will be around long after tech dies but we will not need it because we will not be here. Humans are committing species suicide in the name of “tech”. So be it! It was a wild ride, but the end is near.

Cloggie on Tue, 23rd Jul 2019 1:59 am

Renewable energy will replace fossil fuel eventually. The 17th century Dutch global empire was built on thousands of hand-made windmills like these, sawing the planks for the tens of thousands of commercial ships:

https://www.youtube.com/watch?v=Q6FxG3ll-lw

Today we are technically in an infinite better position than in those days. There is sufficient conventional fossil fuel left to set up a renewable energy base, that will guarantee reasonable living conditions, perhaps not as affluent like in the past decades, but hey, do we really want 500 million tourists visiting Amsterdam or Venice every year?

https://www.cnbc.com/2019/06/14/too-many-tourists-from-amsterdam-to-venice-tourism-sparks-outrage.html

Don’t think so.

The real luxury in the future will be peace and quiet. Get lost, Asian tourist, African/Muslim invader! I would love to see private car owner ship to vanish, a lower-energy, national shared, autonomous car robot is just as good. Any idea how beautiful a city can be without these stinking, noisy, dangerous cars, driving or parked? Go to Venice (for a last time) and verify for yourself, or better stay at home and watch this:

https://www.youtube.com/watch?v=JphHw6iU4m8

makati1 on Tue, 23rd Jul 2019 2:59 am

Cloggie, you and Outcast should read and contemplate what this author is saying.

“The Planetary Insanity of Eternal Economic Growth”

http://charleshughsmith.blogspot.com/2019/07/the-planetary-insanity-of-eternal.html

“”I’ll be impressed with renewable installations when they can power the fabrication of their replacements.”

This is the inconvenient reality few want to discuss publicly: none of the renewable energy sources is remotely capable of generating enough energy to smelt and mold industrial metals at scale, fabricate silicon wafers and so on.

The technological fantasy is that new efficiencies will magically make eternal growth possible. But all these fantasies overlook 1) that markets cause the destruction of everything that isn’t being monetized for profit in the moment; 2) that “renewable” energy all depends on cheap hydrocarbons in essentially limitless quantities and 3) that replacing everything every generation creates what my colleague Bart D. calls The Landfill Economy.’

Renewables are not renewable without an endless supply of affordable hydrocarbons.

http://sunweber.blogspot.com/2011/12/machines-making-machines-making.html

Nuff said.

Cloggie on Tue, 23rd Jul 2019 3:45 am

“The Planetary Insanity of Eternal Economic Growth”

I completely agree with this. We have enough “stuff” already. We need to abandon narcistic individualism and identify more with collectivistic efforts, like building new empires in space or Europe and China colonizing (make that: sponsoring) third world territories like Africa and North-America.lol

I can’t wait to dress myself in 19th century colonial outfit, complete with white tropical helmet, cut my way through the bush of the Ozarks, shake hands with the locals, while saying “ Davy, I presume?”.lol

https://images.app.goo.gl/iiKn37V1DYPgfnJKA

Anonymouse on Tue, 23rd Jul 2019 4:14 am

The only thing you’ll be dressing yourself in, tomorrow, and the day after that, an and the day after that, cloggedsphincter is an incontinence diaper.

You haven’t gotten off your ass in how many years now? You sure as hell wont be making any trips to the Ozarks to consummate your relationship with the demented one. In fact, the very idea of you actually doing any kind of physical work cloggjude, IE ‘cutting through the bush’, is laughable.

stalker on Tue, 23rd Jul 2019 4:21 am

Anonymouse on Tue, 23rd Jul 2019 4:14 am

Davy on Tue, 23rd Jul 2019 4:33 am

“Oil Will “Go Bust” If Recession Hits”

https://tinyurl.com/y4wdw9m9 oil price dot com via zero hedge

“The investment bank sees U.S. oil demand only rising by 89,000 bpd this year, while the EIA expects a stronger 248,000-bpd increase. Standard Chartered says U.S. oil demand “appears consistent with a slowing economy.” The worrying thing for the oil market is that the U.S. economy has held up better than elsewhere. In China, GDP growth has slowed to its weakest pace in nearly three decades. India, which is widely seen as the most important source of oil demand growth in the medium- and long-term, has also disappointed. The International Energy Agency (IEA) said that global oil demand only grew by 0.45 mb/d in the second quarter. That contributed to a surprise 0.5 mb/d supply/demand surplus in the second quarter. As recently as June the IEA anticipated the oil market would see a 0.5 mb/d deficit. The agency said that there were many reasons for tepid demand in recent months. “European demand is sluggish; growth in India vanished in April and May due to a slowdown in LPG deliveries and weakness in the aviation sector; and in the US demand for both gasoline and diesel in the first half of 2019 is lower year-on-year,” the IEA wrote in its July Oil Market Report.”

“Weak demand and rising supply are creating a perfect storm heading into 2020. The IEA said that the “call on OPEC” could fall by 0.8 mb/d next year, and even that is based on the agency’s rather optimistic demand growth figures. As a result, OPEC+ has a serious problem on its hands. On the one hand, it can continue to cut production in order to prevent oil prices from collapsing. But that would require mustering up consensus and taking on deeper sacrifice. The alternative is not much better. OPEC+ can keep the current production cuts in place (or abandon them altogether) and let prices crash.”

majece majece on Tue, 23rd Jul 2019 4:40 am

You can find useful info about Cause and Effect Essay writing on https://domyhomework.guru/blog/cause-effect-essay. It will help you to get a high grade

Davy on Tue, 23rd Jul 2019 4:55 am

“United States Boasts 24 Gigawatts Of Wind Capacity Under Construction”

https://tinyurl.com/y2z5bqp2 clean technica

“The United States currently boasts 24 gigawatts (GW) of wind energy capacity under construction, according to the latest preliminary figures from Windpower Intelligence, a 26% increase over the same period a year earlier…Windpower Intelligence is tracking a pipeline of nearly 3.7 GW of projects which have received permitting in New Mexico, while Missouri, Wyoming, and South Dakota each have pipelines in excess of 1 GW. Across the rest of the United States, there is a further 5.8 GW of capacity in permitted-development. Overall, however, Windpower Intelligence is tracking a US wind energy pipeline of 80 GW as being in the early stages of development — ranging from preliminary planning to the final stages of the permitting process. Further, of this 80 GW, an impressive 17.7 GW is expected to be delivered offshore. Texas, unsurprisingly, boasts the largest pipeline of projects in various stages of development, with 29 projects equalling 11.3 GW, while large pipeline of 3 or 4 GW exist in states such as Illinois, Iowa, Wyoming, South Dakota, New York, and Nebraska.”

Davy on Tue, 23rd Jul 2019 5:04 am

“EV Transmissions Are Coming, And It’s A Good Thing”

https://tinyurl.com/y3j2decq clean technica

“There’s a problem, though. Electric motors do not generate the same torque from zero to maximum RPM. They all put out full power until a certain speed, and then their torque begins to drop off. Efficiency is also not consistent across the full range of speeds the motor is capable of going. The speeds at which they’re most efficient can vary, but the “sweet spot” is usually around ⅓ to ½ power at 30–40 MPH (50–65 km/h). While an EV will work at anywhere from 0 RPM to max motor speed, it will have lower power and/or less range at highway speeds if its single gear is optimized for city driving. Making this gear “taller” could help, but then the car would suffer from lower performance and efficiency in the city.”

“Ultimately, Tesla ended up finding another way to have two different gears: put one in the front and one in the back. Dual-motor Model S, Model X, and Model 3 vehicles all have different gear ratios in their front and rear drive units. At lower speeds, at least half of the power goes to the rear drive unit, which is optimized for lower speeds. When you get up to highway speeds and have “range mode” enabled, the car’s computers direct power to the front drive unit, which has a better highway gear ratio.”

“At the end of the day, it all comes down to cost. For a cheaper vehicle that largely gets driven in the city, one gear is fine. For a performance car, or one that is going to spend more time at higher speeds, it makes sense to find ways to get at least one more gear ratio. That’s what Tesla did. At the end of the day, though, the era of “city-only” electric vehicles is coming to an end. People expect their vehicles to be broadly usable in many different environments. Customer demands are going to keep the pressure up. To get the performance people expect, manufacturers are going to be putting in multi-speed gearboxes. And you’re going to love it!”

Davy on Tue, 23rd Jul 2019 5:08 am

“Soil to sand: Spain’s growing threat of desertification”

https://tinyurl.com/y6jy36d9 faster than expected

“SNIP: If carbon emissions remain unabated, Madrid will have a climate more like present-day Marrakesh by 2050, according to a recently published study by Swiss researchers…Experts from the European Environment Agency (EEA) told Anadolu Agency that the most extreme climate scenarios also project precipitation decreasing by more than 40% in parts of Spain during the summer months by the end of the century, leading to longer and more severe droughts across the Iberian Peninsula. And with at least 74% of Spain at risk of desertification (18% at high or very high risk), according to official data from 2008, could some parts of Spain come to look more like the Moroccan Sahara within our lifetimes? “The process of desertification will never produce a desert. Desertification creates something much worse than that – a landscape formed by opportunistic ecosystems and land degradation,” explained Gabriel del Barrio, a researcher at the Experimental Station for Arid Zones (EEZA) in Almeria, Spain. “Deserts are formed over thousands of years by mature ecosystems and contain abundant biodiversity.” According to research published in 2016 in the journal Science, unless temperature increases are held within 1.5C above industrial levels, the Mediterranean basin is likely to undergo dramatic changes, including expanding deserts and a loss of traditional vegetation, which haven’t been seen in the last 10,000 years.”

Davy on Tue, 23rd Jul 2019 5:11 am

Thanks for the helpful link majece majece. As one of PO.coms most prolific and widely read essayists, I am always on the lookout for new tools, tips, and techniques to make my REAL GREEN word-salads, the very best they can possibly be. I feel I owe it to everyone here, after all, without their support and encouragement for my highly sought after compositions, I feel like I would letting them down if I were to rest on my laurels. Or just copying and pasting crap from garbage sites that no one reads or cares about. Not that anyone here does anything like that. Not that I know of.

Way I look at it majece, edumication never ends, no matter how old you are, or even if you are lacking in intelligence, common sense, integrity, or even regular decency. If you can express yourself, and by express I mean, bombard the whole page with rambling but impressive looking ,lengthy, well-constructed and cogent sounding word-salads, then all these dumbasses will stop being extremist haters and start loving America.

Or you just steal someone elses words and copy and paste. That works too, but I only do that a couple times an hour. I mean day.

Essays are supposed to be your work, except when they are not. A lot of people plagiarize in America. I know this, but, it is ok if you do it for a good cause. That cause, is making America great again. Great essays that is.

PS: Is your resource free?

I am going to check that out, right now.

Free right?

Davy on Tue, 23rd Jul 2019 5:16 am

“Peak Oil Review: 22 July 2019”

https://tinyurl.com/y36rrdwd resilience

“LNG growth: The U.S. will surpass current market leaders Australia and Qatar to become the world’s biggest liquefied natural gas (LNG) exporter in 2024, a high-ranking official at the International Energy Agency (IEA) said on Tuesday. The U.S. exports of LNG are expected to exceed 100 billion cubic meters (bcm) in 2024. (7/17)”

ID theft on Tue, 23rd Jul 2019 5:16 am

Davy on Tue, 23rd Jul 2019 5:11 am

Davy on Tue, 23rd Jul 2019 5:19 am

“Elizabeth Warren Is Warning That An “Economic Crash” Is Coming”

https://tinyurl.com/yc3wpq2 economic collapse blog

“Democratic presidential candidate Elizabeth Warren is sounding the alarm. In an opinion piece that she put out on Monday, she boldly warned that an “economic crash” is coming. Actually, much of her article sounds like it could have come directly from the pages of the Economic Collapse Blog, and her analysis of the current state of the U.S. economy was right on the money. Of course her proposed “solutions” are completely and totally nuts, and we will discuss that later in the article. But it is quite remarkable that a woman that has a really, really good chance of becoming the next president of the United States is saying so many of the exact same things that I have been saying.”

Cloggie on Tue, 23rd Jul 2019 6:05 am

Conservative party leadership announcement. Audio track of Churchill, who singlehandedly destroyed the largest empire in world history. Leave it to Boris to park the UK into the US as 51st state.

The hour of European liberation from Anglo-Zionism is near.

BoJo elected as next PM. He will probably be unable to take the UK out of the EU. Leave to the EU to throw these anti-Europeans out once and for all without a deal.

De Gaulle was right all along.

Britain was never anything else but a stadholder of the US. Good riddance to them both. Enter Russia that is thoughly post-jew, unlike the US-UK. Together with Russia (and China) we can develop an iron fist to keep the globalist predator at bay.

Davy Sock Puppet on Tue, 23rd Jul 2019 6:14 am

stalker on Tue, 23rd Jul 2019 4:21 am

JuanP on Tue, 23rd Jul 2019 6:27 am

“Good riddance to them both.”

clog, you appear miffed

Mick on Tue, 23rd Jul 2019 7:08 am

Totally agree mak renewables are just sending us back ito the Stone Age faster that if we just stuck to fossil fuels not to mention all the millions of tons of extra waste

Cloggie on Tue, 23rd Jul 2019 7:18 am

“clog, you appear miffed”

That’s correct but missed the upbeat part.

Cloggie on Tue, 23rd Jul 2019 7:20 am

“renewables are just sending us back ito the Stone Age“

https://www.cleanenergywire.org/news/renewables-cover-about-100-german-power-use-first-time-ever

#Wilmaaaaaaaa!

Cloggie on Tue, 23rd Jul 2019 7:42 am

Dutch heat record of 38.6C of 1944, based on solid German data, probably going to be broken:

https://www.nu.nl/binnenland/5969001/meteorologen-kans-dat-hitterecord-sneuvelt-stijgt-boven-70-procent.html

joe on Tue, 23rd Jul 2019 7:57 am

Now the phase of crisis in the Brexit drama. Up to now, the quiet optimism was to refuse all deals until a pm got tired and cancelled art50 and called either for a general election or a Ref2.0. Oddly both those things have not yet happened and almost 3 full years since Britian voted to leave the EUSSR somhow the Remainer Parliament in conjunction with the Elites in the Lords have contrived, cojoled and colluded to keep a breath of life in UK membership.

Now the most unlikely first Lord of the Treasury is going to be offered the task of fulfilling the agenda of parliament as per the Queens speech in 2017

“A bill will be introduced to repeal the European Communities Act and provide certainty for individuals and businesses. This will be complemented by legislation to ensure that the United Kingdom makes a success of Brexit, establishing new national policies on immigration, international sanctions, nuclear safeguards, agriculture, and fisheries.”

Should the Blairite Trotskists now masquerading as neoliberalis on the labour party seek to undermine and ally with specific interests within the Tory party seek to prevent the queen from getting her wishes then I have no doubt that Johnson will not sit long as PM and will throw the dice and see if indeed Farage is actually capable of dislodging both neocommunism and antisemitism of labour as well as back sliders in the Tories.

Want Farage to deliver Brexit? Not me. I’d rather a deal. Let Boris have a go……

joe on Tue, 23rd Jul 2019 8:02 am

“Cloggie on Tue, 23rd Jul 2019 3:45 am

“The Planetary Insanity of Eternal Economic Growth”

I completely agree with this. We have enough “stuff” already. We need to abandon narcistic individualism and identify more with collectivistic efforts, like building new empires”

Cloggie the fake Dutch commie. You keep giving yourself away.

We’re you squished out of a collective pussy or did you come out individually?

Sissyfuss on Tue, 23rd Jul 2019 8:07 am

Clogenfluffer, your Bojo looks and act like the 4th Stooge, Moe, Larry, Curly, and Doofy. Your favorite gossip rag, the Daily Male will have a field day covering this comedy. Much like Infowars and the bellicose Bonespur.

The Management on Tue, 23rd Jul 2019 8:07 am

Dvay,

Your post of 5:11 AM is a refreshing bit of candor. Glad to see you are beginning to recognize special attention tantrums will get you nowhere, except being sent to the rubber room, which you are all too familiar.

Keep it up, kid.

Signed,

The Management

I AM THE MOB on Tue, 23rd Jul 2019 8:30 am

Clogg

Posting industry propaganda just proves how laughable renewable’s truly are..

You are as dumb as they come..And you are not fooling anyone but yourself..People who come to this site have done math on renewable s and know its a false hope..

Cloggie on Tue, 23rd Jul 2019 8:31 am

“your Bojo looks and act like the 4th Stooge, Moe, Larry, Curly, and Doofy. Your favorite gossip rag, the Daily Male will have a field day covering this comedy. Much like Infowars and the bellicose Bonespur.”

He is not my BoJo, he is yours. All yours. This clown will be unable to deliver Brexit by himself because in Westminster there are still more brains then in the country, that considers geopolitics as merely a football match.

In the end of the day it will probably be the EU, fed up with the toxic presence of typical limey Fromage, that will give the English a good kick under its arse and ram them back to their rainy island.

Later this week NYC born mystery meat BoJo will present the darkest cabinet in British history, to finalize the demise of the white Anglo. We in Europe are comfortable with that. Perhaps we can later create an English reserve between Stoke-on-Trent and the Hadrian Wall, that is between Caliphate London and ultra-white Scotland. After we have saved a few bushrangers from the Heartland.

But first we are going to enjoy the spectacle of the demise of the white Anglo, both US and UK, at the hands of floppies tribe.

Give us a call when you are desperate enough to receive arms deliveries from us. Just throw a few tea bags in Boston harbour.lol

Cloggie on Tue, 23rd Jul 2019 9:06 am

Oopsie, looks like the US will be too absorbed with “internal affairs” in the near future to have much time left for “geopolitical affairs”:

https://youtu.be/Bu1r5njd8O8

“Doug Casey: we are on the cusp of civil war”

On a positive note, such an event would provide Europe/Russia and China with considerable geopolitical options.

Cloggie on Tue, 23rd Jul 2019 9:58 am

BoJo is PM for a few hours and already the likely truth comes out:

https://www.dailymail.co.uk/news/article-7276005/Boris-Johnson-prime-minister-Carrie-Symonds-seen.html

They have long split up but agreed to be silent about it until the nomination.

Davy on Tue, 23rd Jul 2019 10:14 am

“Doug Casey: we are on the cusp of civil war”

It is ongoing but soft. The deep state coup against a sitting president failed and now the investigators are being investigated. So much for your versions of civil war Cloggo. You want mass death in the streets because you are a disgusting evil person. You are so absorbed in your eurotard PBM empire fantasy you can’t tell the difference between reality and your blind passions. FRAUD

I AM THE MOB on Tue, 23rd Jul 2019 10:22 am

Clogg

The only civil war is in your deluded mind..The US has been through much darker days like in the 60’s and 70’s.

You just want a civil war because you are angry, bigoted and paranoid..And you are a total loser in life..And you want to take out on others..

I AM THE MOB on Tue, 23rd Jul 2019 10:25 am

Doug Casey is a fear mongering crank trying to sell gold like all the other gold scaremongers..

Clogg this blog isn’t full of retards like you..

I hope you are getting paid for all your work and effort you put in daily..I would hate to think you are working day and night as a white trash spamming carnival barker.

JuanP on Tue, 23rd Jul 2019 10:33 am

“Dvay,”

Who is that?

JuanP on Tue, 23rd Jul 2019 10:35 am

Mueller’s FBI ‘Attack Dog’ Weissmann Begged Ukrainian Oligarch For Dirt On Trump

As the FBI investigated whether Donald Trump was working with Russia, top bureau attorney Andrew Weissmann secretly approached a Ukrainian Oligarch’s US attorneys seeking dirt on President Trump, according to The Hill’s John Solomon. In exchange, the FBI was willing to drop an ongoing case against the Ukrainian – Dmitry Firtash, who was hit with 2014 corruption charges in Chicago alleging that he engaged in corruption and bribery in India linked to a US aerospace deal. According to a defense memo recounting Weissmann’s contacts, the prosecutor claimed the Mueller team could “resolve the Firtash case” in Chicago and neither the DOJ nor the Chicago U.S. Attorney’s Office “could interfere with or prevent a solution,” including withdrawing all charges. “The complete dropping of the proceedings … was doubtless on the table,” according to the defense memo. -The Hill Dmitry Firtash at the supreme court in Vienna on June 25 It was a desperate move for the FBI – which was grappling with a lack of evidence against Trump as the Steele dossier was turning out to be an embarrassing dud (“There’s no big there there,” lead FBI agent Pete Strzok texted a few days before Weissmann’s overture, writes Solomon). At the same time, the DOJ’s evidence against Firtash in the 2014 case was also falling apart. Two central witnesses were in the process of recanting testimony, and a document the FBI portrayed as bribery evidence inside Firtash’s company was exposed as a hypothetical slide from an American consultant’s PowerPoint presentation, according to court records I reviewed. -The Hill In short, the DOJ had two high profile cases which were unraveling as Weissmann reached out. Two weeks before the offer was made, Robert Mueller was appointed special counsel – tasked with continuing and expanding upon the FBI’s substantial investigative efforts (including espionage) against Donald Trump and anyone in his orbit. Firtash’s legal team thought Weissman was probably overstepping his authority, as the special counsel’s office was still subject to DOJ oversight. They were also taken aback after Weissmann went to extraordinary lengths to enlist the Ukrainian by sharing prosecutorial theories the FBI was forming about Trump and his team. Prosecutors in plea deals typically ask a defendant for a written proffer of what they can provide in testimony and identify the general topics that might interest them. But Weissmann appeared to go much further in a July 7, 2017, meeting with Firtash’s American lawyers and FBI agents, sharing certain private theories of the nascent special counsel’s investigation into Trump, his former campaign chairman Paul Manafort and Russia, according to defense memos. For example, Firtash’s legal team wrote that Weissmann told them he believed a company called Bayrock, tied to former FBI informant Felix Sater, had “made substantial investments with Donald Trump’s companies” and that prosecutors were looking for dirt on Trump son-in-law Jared Kushner. Weissmann told the Firtash team “he believes that Manafort and his people substantially coordinated their activities with Russians in order to win their work in Ukraine,” according to the defense memos. And the Mueller deputy said he “believed” a Ukrainian group tied to Manafort “was merely a front for illegal criminal activities in Ukraine,” and suggested a “Russian secret service authority” may have been involved in influencing the 2016 U.S. election, the defense memos show. -The Hill Despite being ‘holed up’ in Austria for five years while fighting extradition charges to the US, Firtash turned down Weissmann’s plea overtures. His lawyers told John Solomon that he rejected the deal because he didn’t have credible information or evidence against Trump, Manafort, or anyone else Weissmann laid out in his theories. In sealed Austrian court filings earlier this month, Firtash’s attorneys compared the DOJ’s 13-year investigation to medieval inquisitions, citing Weissman’s approach as politically motivated – and noting the “possible cessation of separate criminal proceedings against the applicant if he were prepared to exchange sufficiently incriminating statements for wide-ranging comprehensively political subject areas which included the U.S. President himself as well as the Russian President Vladimir Putin.”

Hilariously, the DOJ won a ruling in Austria to secure Firtash’s extradition to Chicago – Austrian officials reversed course after his legal team filed new evidence that included the Weissmann overture, according to the report. That new court filing asserts that two key witnesses, cited by the DOJ in its extradition request as affirming the bribery allegations against Firtash, since have recanted, claiming the FBI grossly misquoted them and pressured them to sign their statements. One witness claims his 2012 statement to the FBI was “prewritten by the U.S. authorities” and contains “relevant inaccuracies in substance,” including that he never used the terms “bribery or bribe payments” as DOJ claimed, according to the Austrian court filing. That witness also claimed he only signed the 2012 statement because the FBI “exercised undue pressure on him,” including threats to seize his passport and keep him from returning home to India, the memo alleges. That witness recanted his statements the same summer as Weissmann’s overture to Firtash’s team. Firtash’s lawyers also offered the Austrian court evidence of alleged prosecutorial wrongdoing. -The Hill Embarrassingly for the DOJ, a key document they submitted to Austria in support of Firtash’s extradition allegedly from his corporate files and purportedly showing evidence that he sanctioned a bribery scheme in India was actually a slide from a powerpoint presentation created by the McKinsey consulting firm as part of a hypothetical presentation on ethics for the Boeing Corp. Firtash’s U.S. legal team told me it alerted Weissmann to DOJ’s false portrayal of the McKinsey document in 2017, but he downplayed the concerns and refused to alert the Austrian court. The document was never withdrawn as evidence, even after the New York Times published a story last December questioning its validity. -The Hill “Submitting a false and misleading document to a foreign sovereign and its courts for an extradition decision is not only unethical but also flouts the comity of trust necessary for that process where judicial systems rely only on documents to make that decision,” Firtash’s US legal team told Solomon. “DOJ’s refusal to rescind the document after being specifically told it is false and misleading is an egregious violation of U.S. and international law.”

Antius on Tue, 23rd Jul 2019 11:06 am

Interesting document that puts into perspective how difficult it will be for Germany to enact its transition to renewable energy.

https://tinyurl.com/y3hdfhm2

Renewable energy supplied 12.6% of German energy in 2018. Biofuels of various types accounted for more than half of that; wind energy 2.1% of total energy production; photovoltaics, just 1%.

Since 2009, over 100billion Euros have been spent on wind and solar projects with apparently little to show for it. This is difficult to reconcile with claims that wind and solar power are now the cheapest options for generating electric power.

The figures within the document illustrate the difficulty of attempting to integrate intermittent renewable energy into the existing German grid system. Lulls in wind power output can last for days or even weeks. It will be very difficult and expensive to scale energy storage to a level sufficient to provide reliable electricity supply without consumers accepting substantial periods without power. Storage of electrical energy is relatively expensive and is only cost effective for balancing short term grid fluctuations.

As difficult as this problem is, there would appear to be no alternative to finding ways of living on intermittent renewable energy. Officially, there is no shortage of fossil fuel energy on planet Earth. The reality is that whilst total production has yet to show a decline, the EROI has fallen steadily since the 1990s, to the point where even zero interest rate policy is failing to stimulate economic growth in OECD countries and is rapidly leading to credit exhaustion. EROI has now declined to the point where even developing countries with less complex economies are started to hit diminishing returns (i.e. China). The end point is likely to be another great depression, leading to crashing GDP and falling energy use. Nuclear power has been rendered unworkable by regulatory ratcheting and the extreme risk aversion that the public appear to have towards this energy source. Even if we started a breeder reactor programme today, it would be difficult to scale nuclear energy up sufficiently to replace fossil fuel inputs before about 2050 and declining fossil fuel EROI will ruin developed world economies long before then.

More Davy Identity Theft on Tue, 23rd Jul 2019 11:08 am

JuanP on Tue, 23rd Jul 2019 6:27 am

JuanP on Tue, 23rd Jul 2019 10:33 am

JuanP on Tue, 23rd Jul 2019 10:35 am

I AM THE MOB on Tue, 23rd Jul 2019 11:33 am

Anitus

Shhhh..

Cloggy don’t like that..

The DavyFraud Report on Tue, 23rd Jul 2019 12:12 pm

Dearest Davy,

We are well accustomed to your frequent bouts of ID Theft and Nonsensical Word Salad Magic.

Now you are including plagiarism in your repertoire. How low can you go.

In regard to your following ID Theft, at least include a source.

JuanP on Tue, 23rd Jul 2019 10:35 am

I AM DAVY-TURD

HEAR ME ROAR, PEOPLE.

Cloggie on Tue, 23rd Jul 2019 12:18 pm

The people behind Antius’ link:

https://carbon-sense.com/

Australian fossil fuel promotion club.

Climate deniers.

https://saltbushclub.com/

This of course is not a rebuttal of their 44p article, which I am not going to read.

Suffice it to say that thanks to decades of R&D, in which Germany played a crucial role, we advanced from 20 kW, two-blade windturbines into 12+ MW giants and offshore windparks of 1.4GW, rolled out in a matter of months. The wind energy sector is now really picking up steam, if you forgive me the expression.

I hope I hurt nobodies feelings in saying that we will remain on course with the transition, to be delivered in 2050, at the latest.

Antius on Tue, 23rd Jul 2019 12:22 pm

From Cloggie’s referenced article.

https://tinyurl.com/yxb8vhac

“Germany has crossed a symbolic milestone in its energy transition by briefly covering around 100 percent of electricity use with renewables for the first time ever on 1 January. In the whole of last year, the world’s fourth largest economy produced a record 36.1 percent of its total power needs with renewable sources.”

Actually, not the good news it’s made out to be. In 2017, wind and solar together accounted for about 26% of German electricity production and a smaller percentage of consumption. Biomass accounted for 8.7%. In 2019, the total renewable contribution is 1.5% higher – meaning that wind and solar account for maybe 28% now. Yet already, the huge variability in intermittent energy production is close to topping out what German consumers can absorb – even if fossil fuel and nuclear capacity drops to zero as wind and solar power hit their peaks.

If Germany were to triple its current wind and solar power capacity, on paper it would be producing 100% of the electricity it consumes. It would still need substantial back-up power plants to produce power when wind and solar output were low. And it would need dump loads capable of absorbing 100GW of peak power, when wind and solar were producing 3-4 times what the grid could consume. Exporting this much power to smaller neighbouring countries is out of the question – this is as much power as all of Western Europe uses. As things stand, the infrastructure needed to deal with excess power production on this scale is not even close to realisation. And if you want to generate enough to cover transport and heating requirements, you double the problem again.

It would be foolish to underestimate how difficult it will be to run modern economies on intermittent renewable energy. Keep in mind as well that you will be attempting to do this at a time when fossil fuel EROI is falling and the world is teetering on the brink of its worst recession since the 1930s.

JuanP on Tue, 23rd Jul 2019 12:26 pm

“The DavyFraud Report on Tue, 23rd Jul 2019 12:12 pm”

Who the fuck is that??

Antius on Tue, 23rd Jul 2019 12:35 pm

“The people behind Antius’ link”

I don’t care who wrote it Cloggie. The graphs in the report speak for themselves.

There is no avoiding the fact that a close to 100% wind and solar energy system, will require a grid that must handle several times present peak generation rates (i.e. 3-4 times present electricity consumption and any extra power needed for transport and heat) and would still fail to generate enough power for substantial periods of time. That isn’t a cheap or easy problem to solve. It implies that energy storage facilities of various types must be sized to absorb over 100GW of power. And the transmission grid must be sized for several times it’s present capacity.

Is Germany at all close to achieving this in your opinion? What about Holland?

Davy on Tue, 23rd Jul 2019 12:43 pm

It is amazing how many times these facts antius commented on need to be read to cloggo and still the cloggo insists on projecting his fraudulent aura of huge achievements in Europe with alternative energies. I admire what Northern Europe is trying to accomplish. Still Germany is kidding themselves if they expect to make their decarbonization goals and not deindustrialize. These two conditions go together. Deindustrialization means being poorer relative to the way Germans live now. These conditions go together. Yet, we can learn to be poorer with dignity. How much of the shit we have today do we really need? The other problem is the systematic condition of getting poorer. How much can economic activity drop without a cascading collapse? Is there a break point? Nobody knows for sure so all this is a great experiment with serious consequences. I am a passionate renewable energy proponent but I preach REAL Green Deep Adaptation meaning let’s build out what we can before SHTF. Lets don’t deceive ourselves into thinking everything is fine when it is not.

JuanP on Tue, 23rd Jul 2019 12:43 pm

Great comments Antius. I save them to my notes.

muhamaddelpedoalameriki-akafmr on Tue, 23rd Jul 2019 12:54 pm

Borris Johnson is grilled by big muzzie FGM imam?

“Lo you’re the best of humanity Allah ever created you’re superior 7th century muzzie monkey part ape part pig and you can halal slaughter cow in HD lot”

More Davy Identity Theft on Tue, 23rd Jul 2019 1:18 pm

JuanP on Tue, 23rd Jul 2019 12:26 pm

JuanP on Tue, 23rd Jul 2019 12:43 pm