Page added on January 21, 2014

Tech Talk – Production, Profit and Projection

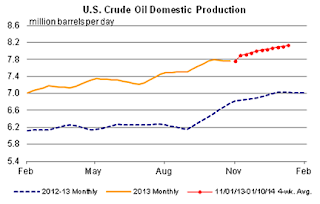

As we move steadily through the first month of this new year, US production of crude has continued to increase, with the EIA now showing levels of around 8.2 mbd production.

Figure 1. US Domestic Crude production through the end of 2013 (EIA TWIP)

Finished gasoline production has been floating around a level of 9.2 mbd.

Figure 2. U.S. Finished gasoline production at the end of 2013. (EIA TWIP)

At the same time ethanol production continues at around 0.9 mbd.

Figure 3. U.S. Ethanol production at the end of 2013 (EIA TWIP)

US gasoline demand, on the other hand, has fallen below 9 mbd, in the normal seasonal decline during the winter months.

Figure 4. US gasoline demand at the end of 2013. (EIA TWIP)

In the latest Director’s Cut of the news from the North Dakota Department of Mineral Resources the state reports that production averaged 973 kbd in November, up from 945 kbd in October). The rig count is running around 190 rigs (below the all time high of 218 – roughly 18-months ago) and the agency notes that companies are moving toward a higher density for horizontal wells as a means of enhancing oil recovery. They estimate that at the current rig count there will be enough work under this program to sustain the industry for more than 20-years. However production will decline as the richer spots are drained, and in the most favorable scenario production will rise for another 2 to 3 years before stabilizing and then declining. At present the rate of growth in production is in the range of 300 kbd per year.

Figure 5. North Dakota Oil Production – historical and projected (ND Dept of Mineral Resources )

This is roughly similar to the growth in production from the Eagle Ford Shale in Texas over the past year.

Figure 6. Changes in production from the Eagle Ford Shale in Texas (Texas Railroad Commission )

Growth in production from the deep waters of the Gulf are likely to be closer to 50 kbd. Even combined, and recognizing that there may be some additional production from developing shale prospects, it is difficult, as the above three regions hit production peaks in the near future, to anticipate that US production will increase by the 2 mbd that is projected by some forecasts.

Some of this doubt comes from North Dakota agency itself, which has some concerns over the continued ability of the industry to attract drilling capital, as well as the impact of additional regulations. This limit of available funds is something that Gail Tverberg has pointed out in a recent post. Shell is only one of the major companies recognizing that the increasing costs of development in more difficult parts of the world are not being offset by compensating increases in production, price and profit. As operations around the world continue to attest, (offshore Brazil being but one example) just because the money is invested does not mean that production will of a certainty arrive on the original date forecast, nor will it be at the original price estimated. In the case of Brazil, while new fields show the promise for the future with a steady increase in the reserves that the country projects, this has yet to be reflected in increased production.

Figure 7. Growth in projected reserves offshore Brazil over the past 30 years (Offshore )

The problems of development are being blamed on a lack of available drilling rigs as well as budget constraints. This may be a considerably simplified version of the realities which are likely to continue to see delays in production against target figures into the medium term future. This is unfortunate since there remain few places where global production can be expected to increase in the near future.

In the latest Monthly Oil Market Report (MOMR) OPEC notes that non-OPEC supply growth is anticipated to be 1.2 mbd this year, with the bulk of that growth coming from the United States, Canada, Brazil and the two Sudans. Oil production from the Canadian oil sands is anticipated to reach 3 mbd by 2015 on its way to a total production estimate of around 6 mbd by 2035, at an approximate growth rate of 100 kbd per year.

Figure 8. Anticipated growth in Canadian oil production (NEB )

Perhaps more than most the Canadian growth is likely to follow the projected path, although there, as in other parts of the world, the need to ensure future capital for the increasingly expensive operations, and the provision of sufficient infrastructure to handle the increased production are matters that will continue to provide caveats to the overall levels achieved.

And as regards the increase in production from Sudan and South Sudan, certainly the conditions in South Sudan are not encouraging to hopes for increased production at any time in the near future. Fighting in the regional capital of Malakal shows the increasingly tribal nature of the conflict and this may well indicate that fighting will not easily be stopped and order (let alone oil flow) restored. This is of concern to China, which imported some 14 million barrels of oil from the region in 2013 but is now faced with the problems of sustained investment in the face of lost production and facilities after seeing a similar collapse in production from Libya. And while these problems are considered relatively small at the moment, at this time when global production and supply are relatively closely tied, the continuation of problems will mean the China must look elsewhere for that production, with consequent impacts on overall prices.

The problem, as the very short list from OPEC illustrates, is that there are not that many places around the world where increased production is likely and where China can invest to achieve the levels that it anticipates that it will need as demand continues to grow. And as the market becomes more competitive, so prices are unlikely to decline much (apart from regional short term issues such as the recent desire in the US to produce more diesel from refineries). Yet while this will give some reassurance to those seeking to invest capital in the industry it comes at a time where there remain concerns over regulation in some countries, and conflicts in others both of which cause investors to hesitate in their commitment. The problem is that there aren’t that many alternative strategies that hold much hope for working.

3 Comments on "Tech Talk – Production, Profit and Projection"

robertinget on Tue, 21st Jan 2014 2:41 pm

With Keystone XL apparently on hold for the foreseeable. Canada, China, Japan may wind up in a threesome.

rockman on Tue, 21st Jan 2014 5:05 pm

Keystone XL Pipeline (600,000 bopd capacity) is not on hold. It is scheduled to begin flowing oil directly from Alberta to Texas refineries TODAY! While the permit for the border crossing section of KXL hasn’t been granted the Keystone Pipeline, which has been moving oil sands production across the border since Oct 2010, has been connected to KXL. This multiline system now allows Alberta oil to bypass the choke point at Cushing, OK, Additional pipelines, such as the reversal of Seagate, have already alleviate part of the choke point. The southern leg of KXL adds to that capability. Now Alberta producers can sell directly to Gulf Coast refiners and not be held hostage by the Cushing situation.

China et al may eventually end up with some of the Canadian oil. But for the moment virtually all of it is being exported to the US with the estimate that more of that oil will be exported to the US in 2014 then ever before in the entire history of Canadian imports to the US.

DC on Tue, 21st Jan 2014 8:04 pm

Canadian oil LOL! There is no such thing. ‘Canada’s energy policy is decided in US boardrooms and washington. We dont even own the resources anymore in any real (thanks NAFTA). Fossil-fuel energy from the street to the refinery is owned lock stock and barrel by amerikan and other foreign corporations. There is no ‘Canadian’ energy industry to speak of rockman. We are allowed to collect some taxes and levy a few token fees here and there, but thats it.

Even the CBC admits this in a roundabout way. When reporting on energy issues always refers to energy corporations as ‘Calgary-based’. A curious term dont you think? The reason they have to say ‘based’ is because in a cursory examination would reveal that most of corporations they report on, are in fact, foreign, that just happen to have offices in Calgary.

Small wonder amerikans constantly regard ‘Canadian’ and (Mexican oil too), as if its 100% amerikan. Because sadly, it is.