Page added on January 4, 2018

America could become oil king of the world in 2018

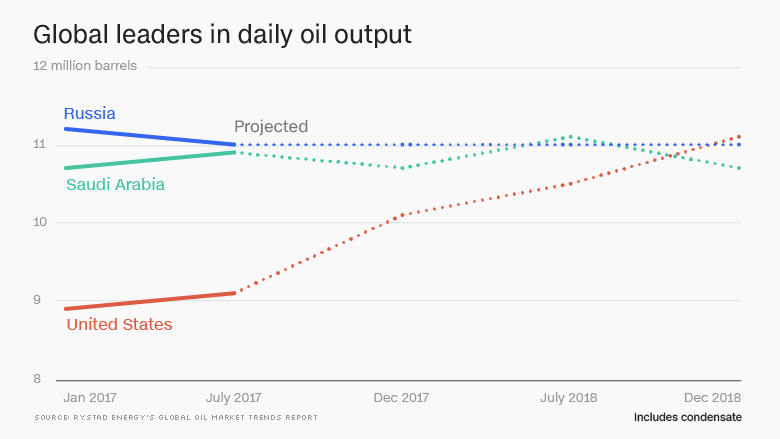

The United States is poised to ramp up crude oil production by 10% in 2018 to about 11 million barrels per day, according to research firm Rystad Energy.

Surging shale oil output should allow the United States to dethrone Russia and Saudi Arabia as the planet’s leading crude oil producer, Rystad predicted in a recent report. The U.S. hasn’t been the global leader, nor ahead of both Russia and Saudi Arabia, since 1975.

“The market has completely changed due to the U.S. shale machine,” said Nadia Martin Wiggen, Rystad’s vice president of markets.

The prediction shows how the fracking revolution has turned America into an energy powerhouse — a transformation that President Trump has vowed to accelerate by cutting regulation. This long-term shift has allowed the U.S. to be less reliant on foreign oil, including from the turbulent Middle East.

U.S. oil production slipped — but didn’t completely collapse — after Saudi-led OPEC launched a price war in late 2015 aimed at reclaiming market share lost to shale and other players. A massive supply glut caused crude to crash from around $100 a barrel to a low of $26.

Cheap prices forced shale companies in Texas, North Dakota and elsewhere to dial back. Domestic output bottomed at 8.55 million barrels per day in September 2016, down 11% from the recent peak in April 2015, according to the U.S. Energy Information Administration.

Related: 6 ways life in Saudi Arabia will change in 2018

But the resilient oil industry, led by the shale hotbed of the Permian Basin of Western Texas, rebounded nicely last year. The comeback was driven by higher crude prices as well as new technology that makes it cheaper and easier to frack.

The EIA recently forecasted that U.S. crude oil production would jump to an average of 10 million barrels per day in 2018. That would take out the previous annual record of 9.6 million barrels set in 1970.

Rystad Energy is even bullish on American oil. The Norwegian firm sees U.S. crude output hitting 11 million barrels per day by December, narrowly surpassing global leader Russia and OPEC kingpin Saudi Arabia.

Others are skeptical. Byron Wien, vice chairman of Blackstone’s (BX) private wealth solutions group, predicted this week that fracking production would be “disappointing” in 2018, lifting crude oil prices above $80 a barrel.

Crude climbed above $61 a barrel on Wednesday for the first time in 2-1/2 years. The recent bump in prices has been driven by a pipeline explosion in Libya and protests in Iran.

Bigger picture, the oil rebound has been caused by solid demand and the whittling down of the epic supply glut that caused prices to crash in the first place. A big key behind fixing the oversupply problem has been OPEC and Russia dialing back their pumping. In late November, OPEC and Russia agreed to extend oil production cuts until the end of 2018. The production cuts have helped stabilize oil prices, paving the way for U.S. shale output to ramp up.

Related: Crude closes above $60 a barrel

By contrast, Trump has vowed to usher in an era of “American energy dominance,” in part by reducing red tape around oil drilling.

Last week, a U.S. safety regulator proposed rollbacks to offshore drilling rules. The Bureau of Safety and Environmental Enforcement, which was formed in the wake of the deadly 2010 BP oil spill, estimates the revisions would slash industry “compliance burdens” by at least $228 million over 10 years.

The rule change “moves us forward toward meeting the Administration’s goal of achieving energy dominance without sacrificing safety,” BSEE director Scott Angelle said in a statement on December 28.

Rystad Energy said market forces, not deregulation, has underpinned the upswing in U.S. oil output.

“I don’t think it’s had a significant impact,” Rystad’s Martin Wiggen said of Trump’s efforts to roll back environmental regulations.

She added though that there is “not a fear under the Trump administration that he will suddenly outlaw shale.” Bernie Sanders called for a national ban on fracking during the 2016 campaign.

Regardless of the driver, the ramp-up in oil pumping has lessened the need for the U.S. to rely on oil from unstable places like Venezuela and the Middle East.

“The fact that the U.S. produces more oil is a fantastic development in terms of security,” said Martin Wiggen.

U.S. oil imports have dropped by 25% over the past nine years, according to the EIA. At the same time, the U.S. oil exports have flourished since the 40-year ban on shipping crude overseas was lifted in 2015. Exports have more than tripled over the past year to record highs. The U.S. still imports more oil than it exports, but that gap is shrinking.

70 Comments on "America could become oil king of the world in 2018"

Boat on Thu, 4th Jan 2018 9:30 pm

MM,

Think Canada x 2….the amount of foreign born living immigrants. 40 million. Muslims are the most prolific breeders. Can you train your brothers? Can you pocket your pecker.

MASTERMIND on Thu, 4th Jan 2018 9:59 pm

Boat

We got ten years left max to live buddy! Those little pups they breed will end up being the worst mistakes they ever made! You are just a trying to find any reason you can to hate them. You just want to bring others down with you! ITS YOUR FAULT YOU ARE A LOSER!

Antius on Fri, 5th Jan 2018 12:14 am

Caring about the future and not being completely selfish is a mental illness?

“When the economic collapse hits! It will be every man for himself! Even families will turn on one another! Goons will turn your white woman into their personal fuck toys! White people will stroke out while goons breed their daughters after they kick in your front door!”

You welcome shit like that and you think other people are mentally ill.

Cloggie on Fri, 5th Jan 2018 12:27 am

“When that wealth disappears and people see their hopes and dreams shattered, do you really think they will tolerate a borderless world in which foreign people are free to compete for what little they have left? “

Exactly right Antius. My largest complaint with Rchard Heinberg is that he didn’t deliver with his peak oil shit. On the one hand it is nice to live in an affluent booming society like Holland, on the other hand everybody is so focused on gathering wealth that it eclipses everything else. Everything is being made subservient to The Holy Economy. Labour shortages? Import them. Yet when I look around in the offices of the current hightech company I work for, it is virtually all white… and older, apart from one or two young Indians.

But you know in advance that the West, to begin with the US, where by far the most low quality cultural nihilistic Marxists are like millimind, is going to crash and descend into a Yugoslavia scenario of everybody against everybody.

Makati1 on Fri, 5th Jan 2018 12:30 am

Antius, MM IS mentally ill. I think he shares a cell in the asylum with Davy. He is fixated on sex and gore like some teenager. There is no middle ground future in his mind. All total destruction everywhere. I think he is in for a severe shock when the SHTF and those who have prepared survive and thrive. I plan to be one of them.

Cloggie on Fri, 5th Jan 2018 12:45 am

Millimind, a dumb sort of apneaman, who is at least a smart nihilist Marxist.

What happened to our resident climate terrorist anyway? Stuck in a blizzard in his gas guzzler near Vancouver?

Oh wait, now I know what happened to apneaman:

https://qz.com/1169540/sharks-are-freezing-to-death-in-the-us-due-to-a-record-cold-winter/

“It’s so cold in the US that sharks are freezing to death”

These are good days for Trump, for climate extremists like apneaman not so much.

Cloggie on Fri, 5th Jan 2018 12:51 am

Global Warming USA, the pictures are in:

http://www.spiegel.de/fotostrecke/bomben-zyklon-in-den-usa-fotos-fotostrecke-156866.html

Cloggie on Fri, 5th Jan 2018 12:59 am

http://www.spiegel.de/wirtschaft/unternehmen/erneuerbare-energien-oekostrom-verbrauch-steigt-auf-rekordhoch-a-1186312.html

Germany new record renewable electricity: 95%

OK it was only for a few seconds and it happened on Monday January 1, virtually a Sunday. But still. The old record of 88% dated from April 30, 2016 (88%).

The economy is booming, which explains that CO2 emissions are stagnant, not decreasing as was the plan.

Dooma on Fri, 5th Jan 2018 3:49 am

America has no problems with the Muslim world when they were getting cheap oil. They still love the KSA but want to destroy Iran because of 79.

I say let them pump chemicals into their water table with gay abandon.

deadly on Fri, 5th Jan 2018 4:23 am

Last Thursday it was -29° Fahrenheit at 3:00 in the afternoon. It was a little chilly outside at the farm.

If you haven’t seen the forecast for the next ten days for Boston, don’t look, it is going to be cold.

I can’t generate a lot of sympathy for the poor saps in Boston, they’ll have to suffer all by themselves. I have troubles of my own.

Oil and natural gas will have to be king, they can and will keep you warm.

Freezing to death has to be avoided. Heating fuel, coal heat, wood burning stoves, carbon based energy sources save the day.

Thems the facts.

Davy on Fri, 5th Jan 2018 5:40 am

Peak oil is dead to those who are blind and in a delusional not yet actualized future. Peak oil is alive and well and it is taking a parasitic toll daily on the quantity and quality of our foundational energy. It is more than oil production it is also systematic where many more of its dynamics appear.

The problem with humans is they get habituated and they have time sensitive expectations. Take someone who claims PO is dead, these kind of people live in an optional reality. Many of them actually live in a future they have created. The thing about PO is it was temporally mitigated through economic means that transformed technological efforts and markets. This is temporary as in over time the effects of this mitigation will decline and again PO dynamics will be more prominent. The economics of quantitative easing, the repression of interest rates and bastardization of price discovery mechanisms will always cycle back to a normal that is more reality based…Always. Resources deplete and that is a reality. PO is still relevant because it is unclear how long the economy will maintain both unconventional oil exploitation and support a renewable effort at an energy transformation. This transformation effort is vital but also transitory to mitigate the decline of the quality and quantity of conventional oil discoveries that are at an all-time low.

Ideally we may see a type of demand mitigation for fossil fuels by a combination of a stagnating economy and stabilizing population combined with some help from technology through renewables and others. This is the alternative to the mythological manifest destiny of unending growth and development. This could free up enough oil to buy us time and still maintain many of the vital efforts needed to maintain civilization across many different spectrums of life. Civilization decline is more than energy and many who only think with energy in mind don’t factor this into what matters for survival. This demand destruction and supply mitigation that could buy us time is still likely an end game because the global economy is growth based. All the problems we create growing must be fixed and paid for by more growth. This can’t last because it is a linear reality in a planetary cyclical ecosystem within earth cycles.

Peak oil is not dead but techno optimism can end tomorrow. Techno optimism and its economic component of market based capitalism doesn’t have a physical element of being. Techno optimism is a mythology of human exceptionalism. It drives human behavior now. It is not a concrete resource. This mythology combined with market forces creates meaning and motivation. It is now a pseudo “god” behind all other meaning. We equate this mythology of exceptionalism with who we are. This can end very quickly because it is nothing more than a narrative. Economic liquidity is confidence and this mythology that could end tomorrow drives this confidence.

Techno optimism and market based capitalism is perception and it is behavior. Perception and behavior are both rational and irrational. It is clear our perception and behavior wrapped up in market based capitalism, corrupted liberal democracy, and delusional techno optimism are becoming increasingly irrational as civilization turns late term. We will see increasing economic abandonment, dysfunctional networks, and irrational policy dragging vital growth down until one day there is no aggregate growth. This may be the case now because of all the overcapacity, bad debt, and unfunded liabilities apparent in the global economy are in reality just a call on the future.

Social ills of wealth transferred poverty to ever increasing segments of populations towards ever smaller affluent groups will destroy the foundation of civilization. War is increasingly likely and wars today with the destructive tools of war can end modernism overnight. Disruptions to vital nodes to globalism can bring everything to a standstill. As you can see this is more than the mere idea of peak oil. That alone can be claimed dead for a short time by fudging what is oil and what is left. The real peak oil is all wrapped up in the catch 22 trap of human linear growth and the necessity of degrowth through resource limits and planetary constraints.

Davy on Fri, 5th Jan 2018 6:00 am

“Germany new record renewable electricity: 95% OK it was only for a few seconds and it happened on Monday January 1, virtually a Sunday. But still. The old record of 88% dated from April 30, 2016 (88%). The economy is booming, which explains that CO2 emissions are stagnant, not decreasing as was the plan.”

What is the primary energy component? Of that component what was from solar and wind? Solar and primarily wind are most of your basis for an energy transition. Explain what booming is. Your definition of booming is a few rounding errors between decline and growth. Nothing to crow about and this just points to how desperate we have become when we lie to ourselves. The economy is repressed and various schemes for easing money supply to support demand are a primary factor for supporting the economy which in reality is just economic levity. If you want to say it is booming because it’s on drugs OK, I agree. CO2 emissions are rising faster than ever. Europe is just outsourcing its CO2 indirectly. What fossil fuels it does not burn will be burned elsewhere.

I admire what Europe is doing with alternatives but for different reasons. I am hoping we can engineer energy systems that will buy us time and before it is too late and the global economy cannot produce them anymore. So this does not mean there is anything to really brag about in Europe yet. Maybe they will succeed in an energy transformation but that will likely be dated. An energy transition will have to be a global construction. A real energy transition will have to support the global networks driven by economies of scale and just-in-time production and distribution wrapped up in global comparative advantage. That is what drives life sustaining growth of a civilization in overshoot not solar panels and wind turbines. This is a systematic process beyond human understanding and we will only understand its realization or not in the review mirror. Bragging about a future that is not even here is what clowns do. We want clowns to make us happy and laugh. Maybe this clown is really a killer.

Davy on Fri, 5th Jan 2018 6:39 am

Budding energy demand management?

“Why Germans Are Being Paid To Use Power”

https://tinyurl.com/yaa4rqm4

“Germany’s drive to use renewable sources of energy seems to be bearing fruit. Beginning last weekend, prices for electricity in the country declined below zero. That means consumers are being paid to use the power, rather than the other way around. This isn’t even the first time this has happened. According to one of Europe’s largest electricity trading exchanges (the EPEX Spot), it has happened more than 100 times in 2017. All of this would seem to bode well for German households, long regarded as operating under the highest energy prices on the continent. Well, not quite. But someone else is getting paid. And the whole matter has crucial implications for where the energy industry is going next…Given the heavy amount of taxes and fees charged for power, the wholesale cost factors in only about 20 percent of the real price charged to the average residence.”

“Experts are pointing toward the major revision both Germany and the wider European grid system must now undertake. Until this spasm of negative pricing, the older view of global power systems had been considered adequate. Not any longer. As one specialist noted this week, “we now have technology that cannot produce according to the demand, but is producing according to the weather.” This has become the main uncertain ingredient in the new age of rising renewable sourcing. And one thing that’s becoming increasingly evident is that the new environment is providing a new stress on the wider power system. This sets the stage for a range of possible changes in regulations and fee structures meant to encourage average households to tailor their energy use to periods of energy supply. That would seem to oblige some “carrot rather than stick” approaches. Of course, that would mean benefits in lower costs moving directly down to the household level. That may take a bit more politics than just oddities in the energy grid. Which means the push for renewables and energy storage will continue unabated in 2018.”

Davy on Fri, 5th Jan 2018 6:51 am

“Global Debt Hits Record $233 Trillion”

https://tinyurl.com/y85ewurj

“Global debt rose to a record $233 trillion in the third quarter of 2017, more than $16 trillion higher from end-2016, according to an analysis by the Institute of International Finance. Private non-financial sector debt hit all-time highs in Canada, France, Hong Kong, South Korea, Switzerland and Turkey. At the same time, though, the ratio of debt-to-gross domestic product fell for the fourth consecutive quarter as economic growth accelerated. The ratio is now around 318 percent, 3 percentage points below a high set in the third quarter of 2016, according to the IIF. “A combination of factors including synchronized above-potential global growth, rising inflation (China, Turkey), and efforts to prevent a destabilizing build-up of debt (China, Canada) have all contributed to the decline,” IIF analysts wrote in a note. The United Nations calculates the global population is 7.6 billion, suggesting the world’s per capita debt is more than $30,000. The debt pile could end up acting as a brake on central banks trying to raise interest rates, given worries about the debt servicing capacity of highly indebted firms and government, the IIF analysts wrote.”

Antius on Fri, 5th Jan 2018 7:09 am

South Australia would appear to be a perfect opportunity for fossil fuel upgrading (i.e. coal to methanol) using renewable energy.

There is a large, low-grade stranded coal deposit along the coast that is presently unexploited and likely to remain so.

http://www.minerals.org.au/file_upload/images/coal/coal_maps/13-7856-1_large.jpg

The region has good solar resources (2000kWh/m2-year) and excellent wind resources (7.2-7.6m/s near the coast).

http://www.hotspotenergy.com/DC-air-conditioner/australia-solar-map.php

http://www.renewablessa.sa.gov.au/files/121219-windresourcemappingaustralia.pdf

All of these resources can be exploited by constructing a coal to methanol plant say 30km inland and piping the methanol to a tanker jetty along the coast. Pumping the methanol through a pipeline and into a tanker will be substantially cheaper than attempting to haul the coal by rail car and convey it into a ship’s hold. The solar energy could be exploited using large solar thermal power plants which store heat in molten salt, thus allowing continuous power. Much of the energy required to dry and pyrolyse the coal and heat the synthesis reactor can be provided by direct solar heat. Wind power could be used for more intermittent activities such as transporting coal to the plant, sorting and milling.

MASTERMIND on Fri, 5th Jan 2018 7:38 am

Davy

Actually according to the BIS global debt is around 330 Trillion

https://imgur.com/a/3usX7

Antius on Fri, 5th Jan 2018 7:56 am

“Davy

Actually according to the BIS global debt is around 330 Trillion

https://imgur.com/a/3usX7

”

Wow, the world sure did turn to crap in 2007 didn’t it. Looking at the gradient of the curve, that is when the Chinese miracle really started to unravel as well. I wonder how long that Ponzi scheme has left to run?

Davy on Fri, 5th Jan 2018 8:21 am

“Davy Actually according to the BIS global debt is around 330 Trillion”

Who really knows what global debt is. Basically it is a moving target and subject to definition. Debt is generally supported by assets so if the supporting assets are clouded with value issues the real global debt level will be much higher. If the debt service is suspect or encumbered then again there are valuation issues related to the debt. Bad debt is a much higher amount than actual stated debt amount. Once debt goes bad it takes on a life of its own infecting good debt and the system itself.

bobinget on Fri, 5th Jan 2018 11:52 am

https://www.zerohedge.com/news/2018-01-03/petro-yuan-looms-how-china-will-shake-oil-futures-market

onlooker on Fri, 5th Jan 2018 12:17 pm

King of Nothing

End of the “Oilocene”: The Demise of the Global Oil Industry and of the Global Economic System as we know it.

http://www.feasta.org/2017/01/22/end-of-the-oilocene-the-demise-of-the-global-oil-industry-and-of-the-global-economic-system-as-we-know-it/