An interesting paper was published by S.H. Mohr, J. Wang , G. Ellem , J. Ward , and D. Giurco in Feb 2015 entitled, Projection of world fossil fuels by country. It updates Steve Mohr’s earlier work in 2010 and can be found at the link below.

https://www.researchgate.net/profile/Steve_Mohr

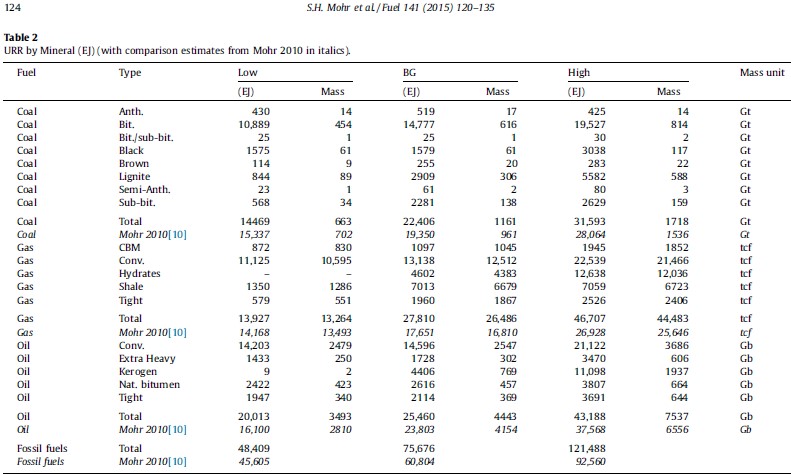

The table below is table 2 from page 124 of the paper which summarizes the URR estimates with comparisons to Mohr’s earlier estimates from 2010.

The best guess (BG) and High URR estimates both include considerable quantities of kerogen and gas hydrates.

Both comments below discuss the high case for oil and natural gas.

From page 127 (section 5.2.2):

The projection is heavily dependent on the rapid growth in kerogen oil in the USA. Historically kerogen minerals were exploited for synthetic oil production such as in Australia, and kerogen is currently exploited in Estonia as an energy source for power stations. However, kerogen is only being exploited as a source of liquid fuel in small quantities in countries such as China, Brazil and Estonia [109]. Given the limited current production in kerogen, any projection of future kerogen oil production needs to be taken with considerable caution. Production from kerogen oil could easily fail to materialise due to delays in technological advances needed to reduce the cost of the oil, or due to scarcity in fresh water needed to process the kerogen into a synthetic crude oil.

From p 127 section 5.2.3

After conventional gas peaks, gas hydrates are anticipated have strong growth before peaking in the latter half of the 22nd century. The hydrates projection needs to be treated with considerable caution, as methods of extracting natural gas hydrates are still being researched. It is uncertain when or even if, technological advances will make gas hydrates extraction technically and economically feasible.

The Best case for natural gas has the comment below from p. 128 Section 5.3.3.

As with the High case, projection of hydrates needs to be taken with considerable caution. Hydrates could be delayed if technical advances are slow in developing or unfavourable economically; alternatively the recent shale gas boom in North America highlights that technical advances could happen suddenly if a technical breakthrough occurs.

In my opinion, the recent shale gas boom was due to high natural gas prices leading to the combination of fracking and horizontal wells, which was not a technological breakthrough. So citing this as being the reason that a methane hydrate technological breakthrough might be imminent seems dubious. Also the assumption that high enough natural gas prices can be maintained to allow the profitable large scale exploitation of gas hydrate is doubtful in my view, even over the long term.

To consider the case that no significant kerogen or gas hydrate resource is extracted in the future, I excluded these resources from both the BG and high cases to create two new cases called BG-mod and High-mod.

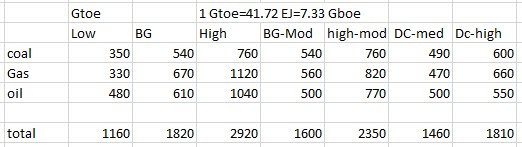

In zettajoules (ZJ)= 1000 exajoules(EJ) we have:

For the more familiar gigatonnes of oil equivalent (Gtoe), where 1 Gtoe=41.72 EJ we have:

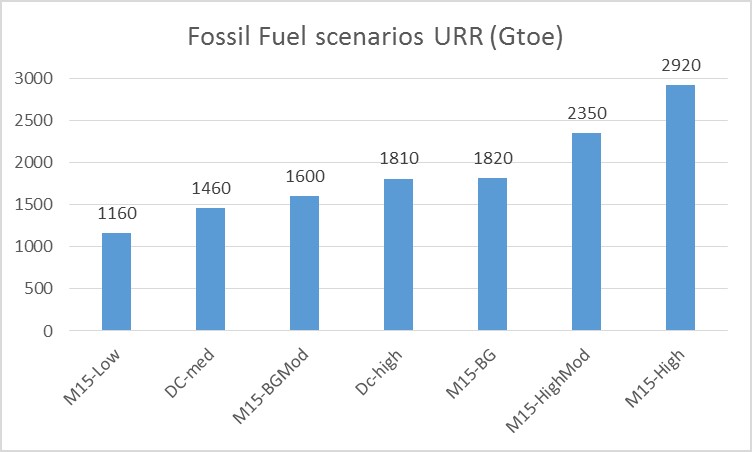

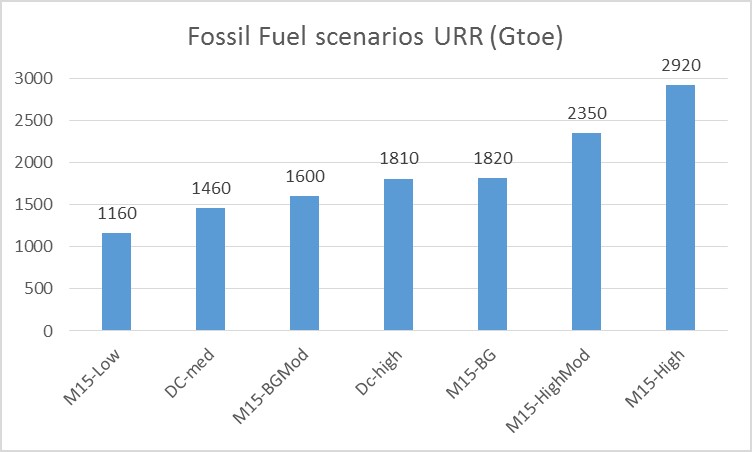

The DC-med and DC-high cases are my medium and high fossil fuel scenarios from earlier posts at Peak Oil Barrel (oil, natural gas, and coal), my high scenario is similar to the Mohr et al 2015 (M15) BG, my medium scenario is slightly lower than the modified BG case (BG-Mod). The M15 high case is 2 times higher than my medium scenario and seems overly optimistic with Gas and oil resources that are almost 2 times higher than my high scenario, mostly due to high estimates of shale gas, tight oil, bitumen, and extra heavy oil as well as kerogen and gas hydrate resources. My low scenario is similar to the M15 low scenario and is not presented. The chart below makes for easy comparison.

Based on this new information a medium case of about 1700 Gtoe +/- 600 Gtoe for World fossil fuel URR seems reasonable.

Leave a Reply