Page added on December 31, 2010

Is the Peak Oil Debate Really Dead?

Peak oil is back in the news, mostly for its apparent failure. The story starts with a five-year-old wager.

In 2005, John Tierney of The New York Times bet $5,000 with peak-oil supporter Matt Simmons (the late energy investment banker and author of Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy) on the future price of oil. Simmons predicted that the average price of oil this year would be $200 or higher; Tierney bet it would fall short.

As Tierney wrote earlier this week:

The past year the price has rebounded, but the average for 2010 has been just under $80, which is the equivalent of about $71 in 2005 dollars — a little higher than the $65 at the time of our bet, but far below the $200 threshold set by Mr. Simmons.

What lesson do we draw from this? I’d hoped to let Mr. Simmons give his view, but I’m very sorry to report that he died in August, at the age of 67. The colleagues handling his affairs reviewed the numbers last week and declared that Mr. Simmons’s $5,000 should be awarded to me and to Rita Simon [she shared in Tierney’s side of the bet] on Jan. 1, but Mr. Simmons still had his defenders.

One of his friends and fellow peak-oil theorists, Steve Andrews, said that while Mr. Simmons had made “a bet too far,” he was still correct in foreseeing more expensive oil. “The era of cheap oil has ended,” Mr. Andrews said, and predicted problems ahead as production levels off.

It’s true that the real price of oil is slightly higher now than it was in 2005, and it’s always possible that oil prices will spike again in the future. But the overall energy situation today looks a lot like a Cornucopian feast, as my colleagues Matt Wald and Cliff Krauss have recently reported. Giant new oil fields have been discovered off the coasts of Africa and Brazil. The new oil sands projects in Canada now supply more oil to the United States than Saudi Arabia does. Oil production in the United States increased last year, and the Department of Energy projects further increases over the next two decades.

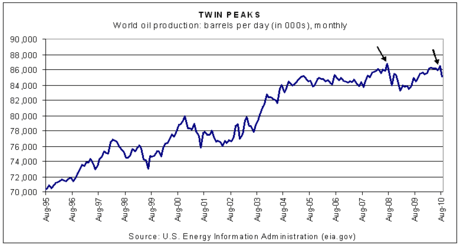

Is the peak oil debate really dead? Maybe, but the front line on this topic is, of course, oil production. No one really knows what production will look like in the years ahead, but the past is relatively clear. Consider the last 15 years of global oil production on a monthly basis, courtesy of data from the U.S. Energy Information Administration (click to enlarge):

For the moment, oil production has peaked—twice. The first crest came in July 2008, just as the price of crude oil was also peaking. Global production that month was a bit more than 86.7 million barrels per day, according to EIA. Production subsequently fell, no doubt in sympathy with the sharp drop in oil prices, thanks to the Great Recession and the financial implosion in late-2008. But oil prices have recently rebounded, reaching more than $90 a barrel this week–the highest in over two years.

Earlier this year, global oil production also rallied, although the surge came up short of the July 2008 output high. Close, but no cigars. This past July, global crude output nearly reached 86.5 million barrels per day, or slightly below the all-time peak set in July 2008.

Will the old peak hold? Or are we headed for a new all-time high in production levels? Maybe it’s time for a new five-year bet: $200 by 2015? Was Simmons wrong—or just early?

3 Comments on "Is the Peak Oil Debate Really Dead?"

papa moose on Fri, 31st Dec 2010 9:35 am

early

Mike Hoy on Fri, 31st Dec 2010 10:35 am

Of course Simmons was wrong. As the piece points out, he lost his bet. Who disputes that peak oil will happen (if it hasn’t already) and that oil prices will rise to be tremendously high at some point. The only debate and question is about WHEN. Simmons flat got it wrong. To excuse him by suggesting he was “just early” is nonsensical. That was the whole point.

Tom Coburn on Fri, 31st Dec 2010 11:42 pm

Matt Simmons and almost all of us in the peak oil camp missed the tremendous economic downturn in the OECD countries, that has relieved demand driven price pressure. That only changes the time line of peak oil, not the eventuallity. Matt may have lost the bet, but he will be vindicated on peak oil.