Mid-Year ETP MAP Update Pt. 2

Mid-Year ETP MAP Update Pt. 2

Bill Gates is saying that the world is facing an Energy Crisis.

Is he on this site trying to convince anyone?

No.

Why would he waste his time?

He created his Terra Power company and is now in a joint venture with the Chinese government to build the first plutonium reactor.

He hired a professor who have been working on solar, wind, geothermal, who came to the conclusion that they just don't work.

Will the plutonium reactor work? Fuck knows.

But at least they are trying.

Trying to convince people on site that the world is facing an energy crisis is a waste of time. What good will it do?

Is he on this site trying to convince anyone?

No.

Why would he waste his time?

He created his Terra Power company and is now in a joint venture with the Chinese government to build the first plutonium reactor.

He hired a professor who have been working on solar, wind, geothermal, who came to the conclusion that they just don't work.

Will the plutonium reactor work? Fuck knows.

But at least they are trying.

Trying to convince people on site that the world is facing an energy crisis is a waste of time. What good will it do?

- Yoshua

- Heavy Crude

- Posts: 1977

- Joined: Sat 28 May 2016, 06:45:42

Re: Mid-Year ETP MAP Update

Trying to convince people on site that the world is facing an energy crisis is a waste of time. What good will it do?

Yoshua, you will not convince people on anything when their paycheck depends on them not being convinced! In spite of that, there are a great number of people who come to this site, who are not members, and who are not posters. I know because I get their feedback all the time. They come here to read and listen. Keep up the effort. It is not in vain. Ideas posted here appear all over the world. Thanks

PS: why is oil so important among all the other energy sources; oil powers 87% of the world's transportation machinery. Without transport there is no economy, no trade, no civilization. One freight car over the Alps today supplies more goods into Europe than the combined efforts for a year of all the Middle Eastern traders of the 15th century.

We need a substitute for oil, and we need it fast.

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: Mid-Year ETP MAP Update

shortonoil wrote:What a dimwit. Here is a guy that actuality

BOLD PREDICTIONS

-Billions are on the verge of starvation as the lockdown continues. (yoshua, 5/20/20)

HALL OF SHAME:

-Short welched on a bet and should be shunned.

-Frequent-flyers should not cry crocodile-tears over climate-change.

- asg70

- Permanently Banned

- Posts: 4290

- Joined: Sun 05 Feb 2017, 14:17:28

Re: Mid-Year ETP MAP Update

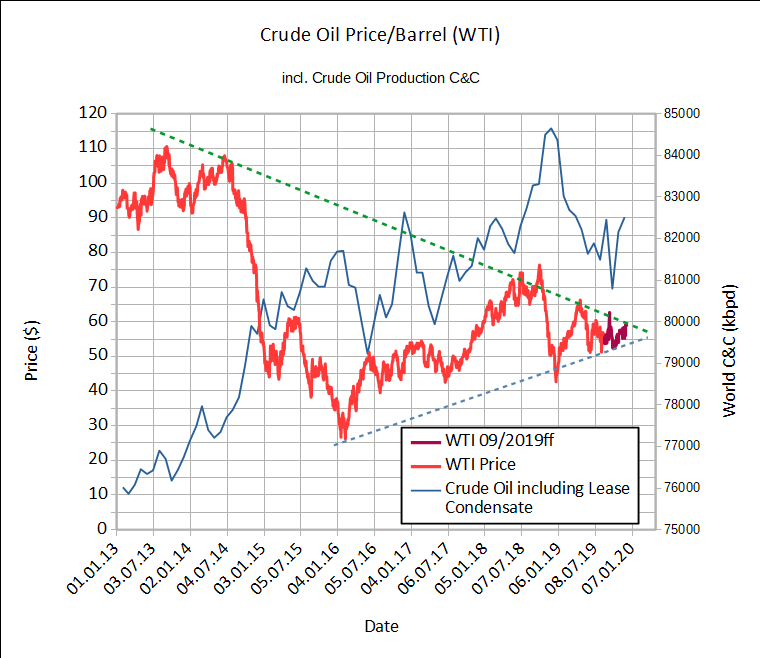

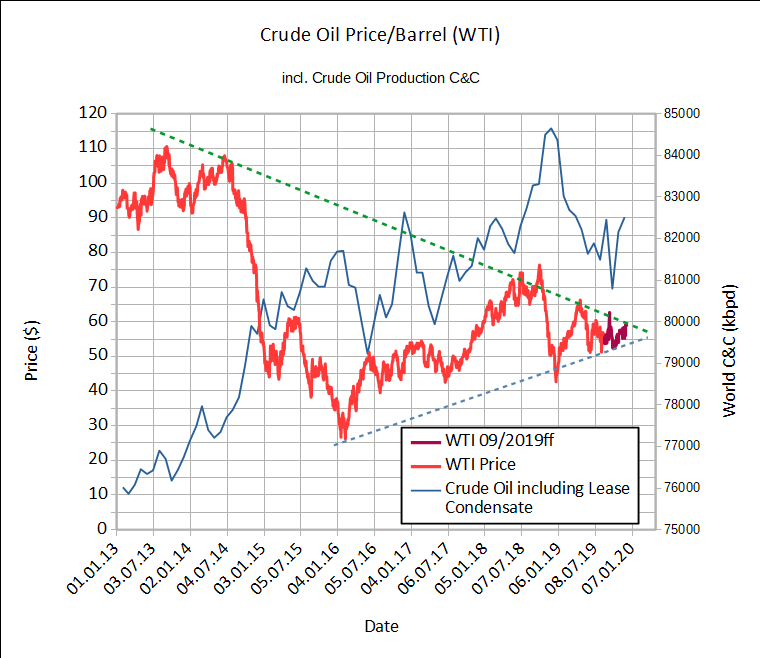

The MOMR is available, and an update of the diagram i posted about four months ago follows. The dotted lines are unchanged, new values for oilprice and production are included.

The production cut of OPEC+ has lifted the price upward in the direction of the dotted green line. Next month it will be visible if all OPEC members follow the cut.

About four month remain until both dotted lines clash. I'm curious what will happen. What are your expectations ?

The production cut of OPEC+ has lifted the price upward in the direction of the dotted green line. Next month it will be visible if all OPEC members follow the cut.

About four month remain until both dotted lines clash. I'm curious what will happen. What are your expectations ?

Take care of the second law.

Take care of the second law.- Baduila

- Peat

- Posts: 172

- Joined: Fri 26 Jun 2015, 12:44:17

Re: Mid-Year ETP MAP Update

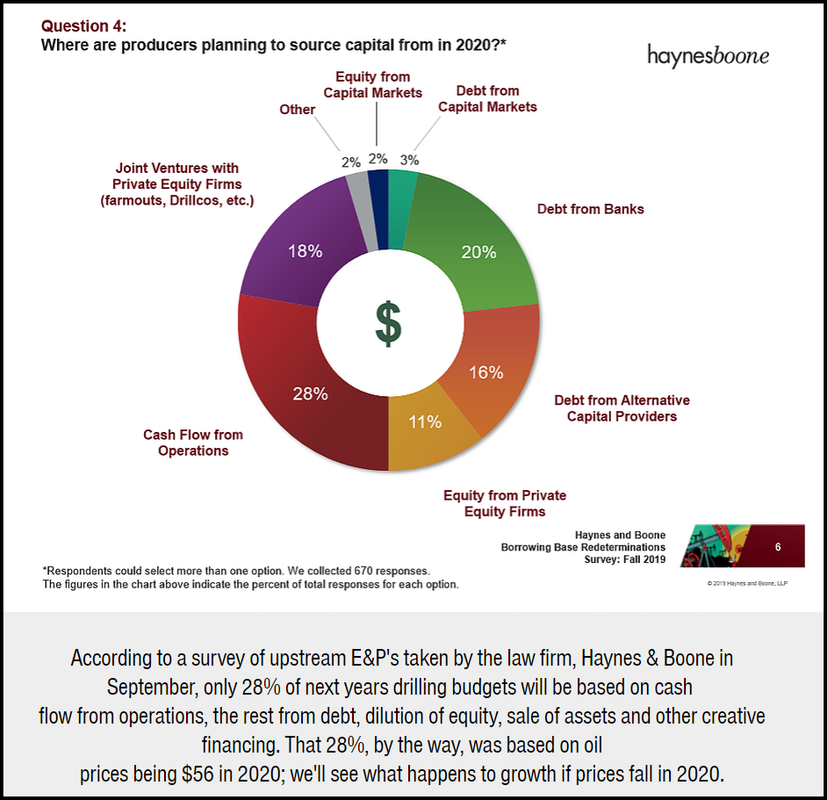

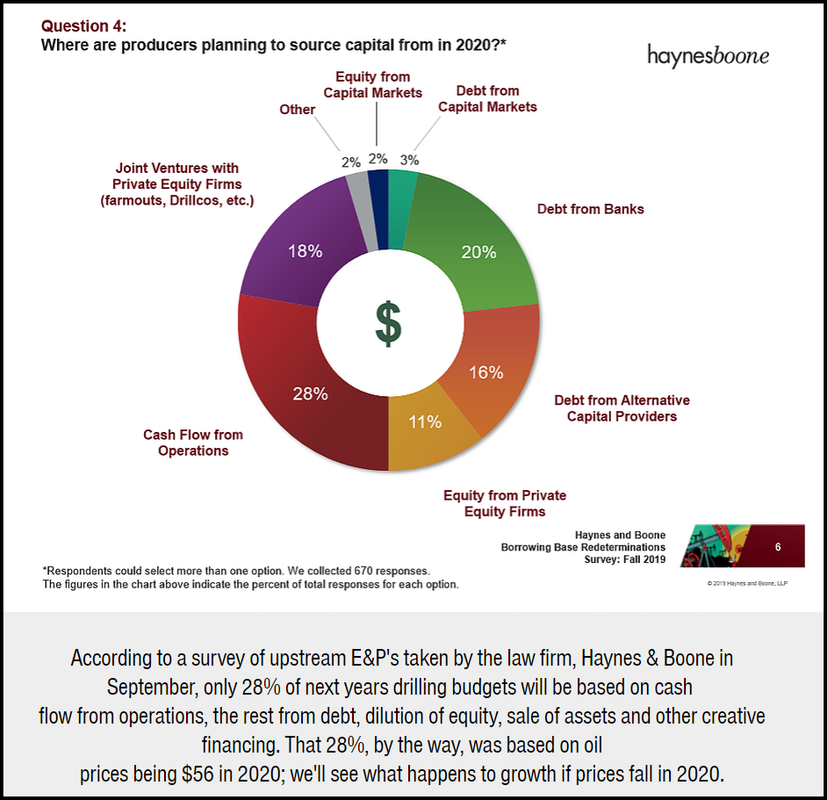

2020 Going To Be A Horrible Year For The U.S. Shale Industry

While a picture is worth a thousand words, this chart is worth $billions more of wasted money on Shale. Courtesy of the Oilystuffblog.com: https://www.oilystuffblog.com/

The recent runup in Shale Stocks will provide an excellent opportunity to short these companies are higher prices.

SRSroccoReport

While a picture is worth a thousand words, this chart is worth $billions more of wasted money on Shale. Courtesy of the Oilystuffblog.com: https://www.oilystuffblog.com/

The recent runup in Shale Stocks will provide an excellent opportunity to short these companies are higher prices.

SRSroccoReport

- SRSroccoReport

- Peat

- Posts: 82

- Joined: Wed 01 Mar 2017, 17:36:05

Re: Mid-Year ETP MAP Update

SRSroccoReport wrote:The recent runup in Shale Stocks will provide an excellent opportunity to short these companies are higher prices.

That depends entirely on what happens to oil prices and Goldman Sachs and other analysts think oil prices will be moving up from here.

Cheers!

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Mid-Year ETP MAP Update

Baduila wrote:The MOMR is available, and an update of the diagram i posted about four months ago follows. The dotted lines are unchanged, new values for oilprice and production are included.

The production cut of OPEC+ has lifted the price upward in the direction of the dotted green line. Next month it will be visible if all OPEC members follow the cut.

About four month remain until both dotted lines clash. I'm curious what will happen. What are your expectations ?

Your chart is nonsensical. If you're trying to project the prices re what the squiggly lines will do, you need to have the date scale CONSITENT at a minimum.

Sometimes, you show 10 months between data points, sometimes only 2, sometimes only 1, sometimes 11. All with the same horizontal date scale re the graph.

What the hell?

Fix the chart so the lines at least theoretically make some sort of sense re a consistent scale, then get back to us.

Meanwhile in the real world, since the ETP MAP price has been strongly exceeded by the real world WTI price consistently for years -- the map was badly broken as making any sense in 2018, and only is getting worse in 2019, so what in the world does looking for the next direction get you? Hopes and prayers that if it it will make 2020 look better for the already failed ETP MAP?

Remember, the MAP predicted WTI price for year end 2019 is about $27 and for year end 2020 is about $13 (me eyeballing shorty's MAP chart in his Version 2, March 1, 2015 ETP paper, page 34, pink 38% line), which he used to like to refer to a lot re how the MAP ensured financial doom by now. Clearly the whole paper has been shown to be a big FAIL, BTW.

Seriously, what's the point? To make the level of failure seem somehow less dismal IF the price breaks your way and the average WTI is only $40 in 2020, so the map is only off by 100% or so? Barring a major global recession REAL SOON NOW, good luck with even that. More likely, it ends up off by 200% or more for average prices for the year, and off by perhaps 300 to 500 percent or even more at end of year pricing.

And if that isn't good enough for you, what miracle do you have in mind for 2021, when the year end price is projected at perhaps $2? If WTI is at the current $60, it will be off by roughly 3 THOUSAND percent? Do you think forecasting the next chart wiggle will make salvage things at that point?

It's ironic, but what you're doing is a graphical representation of what most fast crash doomers do verbally. Try to change the rules, distort things, move the goal posts, jingle some keys, and pretend they're right, as they've always been re their predictions, so we should keep listening to them.

Sure. All COMPLETELY credible.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Mid-Year ETP MAP Update

While a picture is worth a thousand words, this chart is worth $billions more of wasted money on Shale.

Dear Lord save us from idiots.

Nearly half of the investment shown is either cashflow or other people's money (via partnerships or farmins). This is good news, not bad news. Also what is not shown here is divestments that are done yearly by these companies. The standard operating procedure in the unconventional is to pick up as much prospective land as possible, drill a few wells so you can high grade the acreage and then sell off the least prospective land which provides operating capital. As well debt is not a bad thing if it can provide higher levels of activity and the company can easily pay off the carrying charges and retirement requirements. Equity is great, there is some associated dilution to existing shareholders but I’ve never seen shareholders whine at the prospect of the overall increased share price.

That all being said the big problem with this graph is it is complete made-up BS. There is no one company that this represents. There are many companies operating who have not taken out additional debt in several years, there are many companies operating who have not issued additional equity in years and there are a number who completely financed their operations through cash flow (as I have pointed out here previously a number of times). And those companies who are doing well will end up buying or farming in on the companies who aren’t doing well.

The recent runup in Shale Stocks will provide an excellent opportunity to short these companies are higher prices.

Good luck with that. Short sellers lose their shirts more often than not and especially so if they have no idea whatsoever about market fundamentals or how to read an oil and gas balance sheet. Go ahead, though. Solidify that huge short position just before Trump announces a trade deal with China....the outcome should be humerous.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Mid-Year ETP MAP Update

Have not been around here in a while. I was checking to see if there was ferocious discussion about net energy going negative with the new negative oil price yesterday on April 20th.

Found this thread many pages back.

Were they right- was just the timing a bit off about negative oil prices ?

Found this thread many pages back.

Were they right- was just the timing a bit off about negative oil prices ?

- Rod_Cloutier

- Heavy Crude

- Posts: 1448

- Joined: Fri 20 Aug 2004, 03:00:00

- Location: Winnipeg, Canada

Re: Mid-Year ETP MAP Update

Have not been around here in a while. I was checking to see if there was ferocious discussion about net energy going negative with the new negative oil price yesterday on April 20th.

Found this thread many pages back.

Were they right- was just the timing a bit off about negative oil prices ?

Hi Rod,

Steve Angelo @ https://srsroccoreport.com/ contacted us, and asked us to do an update on the Maximum Affordability Function that was originally published on our web site. He should be posting it there in the near future.

At this point it appears that the Corona Hoax was perpetuated to slow down the velocity of money. The world's $350 trillion debt bomb was exploding as seen by the collapsing repo market, and heightened stress in the credit markets! The economy's ability to maintain its debt load is affected by how fast its money supply is turning over, and how fast the debt formation process destroys money in circulation. As a result the central banks were no longer able to keep enough currency in circulation (liquidity) for the economy to function, so they reduced the demand for money by shutting down part of the economy. That decreased the velocity of money, and as the velocity of money decreases the economy's ability to maintain the debt increases. The negative prices witnessed for oil were the result of the economy shutting down, and liquidity drying up. In short, the money was not available to buy the oil, and producers had to pay someone to haul it away. To solve that problem what they did was shift the entire World Debt vs Velocity of Money curve to the left.

Money is only an artificial abstraction created to represent real world activity. Since the value of the energy delivered by petroleum will continue to decline as a result of depletion, and the process's entropy increase the situation will only return. For now, how far the price of oil can recover will determine how much will be available for the economy to use. If that is limited by the laws of physics as laid out by the MAF, there isn't much.

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: Mid-Year ETP MAP Update Pt. 2

Update of the beloved diagram.

Based on Rystad data, it now includes a projection for C&C production for the next years.

Fasten your seat belts !

Be ready for the post peak era !

Based on Rystad data, it now includes a projection for C&C production for the next years.

Fasten your seat belts !

Be ready for the post peak era !

Take care of the second law.

Take care of the second law.- Baduila

- Peat

- Posts: 172

- Joined: Fri 26 Jun 2015, 12:44:17

Re: Mid-Year ETP MAP Update Pt. 2

Baduila wrote:Be ready for the post peak era !

Cheap oil when it was supposed to be Mad Max. How terrifying... How will I be able to get around during lockdown with oil soooo...cheap?

BOLD PREDICTIONS

-Billions are on the verge of starvation as the lockdown continues. (yoshua, 5/20/20)

HALL OF SHAME:

-Short welched on a bet and should be shunned.

-Frequent-flyers should not cry crocodile-tears over climate-change.

- asg70

- Permanently Banned

- Posts: 4290

- Joined: Sun 05 Feb 2017, 14:17:28

Re: Mid-Year ETP MAP Update Pt. 2

asg70 wrote:Baduila wrote:Be ready for the post peak era !

Cheap oil when it was supposed to be Mad Max. How terrifying... How will I be able to get around during lockdown with oil soooo...cheap?

When the lockdowns are widely over (2023 or earlier, based on epidemiologists saying we get to herd immunity by YE 2022 the hard way, or earlier if vaccines work out), it will trend toward normal.

Of course, the doomer community will cry "doooooooooooooom" no matter WHAT happens. Same as it ever was.

Meanwhile, while things seem to trend toward opening up and more economic activity, the price of oil is moving up considerably on a percentage basis.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Mid-Year ETP MAP Update Pt. 2

Outcast_Searcher wrote:Of course, the doomer community will cry "doooooooooooooom" no matter WHAT happens. Same as it ever was.asg70 wrote:Baduila wrote:Be ready for the post peak era !

Cheap oil when it was supposed to be Mad Max. How terrifying... How will I be able to get around during lockdown with oil soooo...cheap?

Two hardcore cornucopians in one thread. LOL. We just got into this and you guys think we are coming out fine becuase doomers cry doom no matter what so it can’t be?? The delay effect of systematic hysteresis is at work. Economic dislocations are ahead. These are global. Not to mention all those other problems like climate change and food insecurity. Doom is a process and the process is right in front of you and you two deny it is significant. Same as it ever was with head in the sand people. Serious shit is going to sprout up in the next 6 months or a year. Now the world is obsessed with the virus. Next year it will be famines and failed states with the virus. The virus is probably here to stay with no effective vaccine.

realgreenadaptation.blog

-

REAL Green - Heavy Crude

- Posts: 1080

- Joined: Thu 09 Apr 2020, 05:29:28

- Location: MO Ozarks

Re: Mid-Year ETP MAP Update Pt. 2

REAL Green wrote:The delay effect of systematic hysteresis is at work. Economic dislocations are ahead.

This is an ETP thread. Are you attempting to validate ETP? Then you're gonna have to do better than that.

REAL Green wrote:Now the world is obsessed with the virus. Next year it will be famines and failed states with the virus. The virus is probably here to stay with no effective vaccine.

Well, again, this is an ETP, not a coronavirus thread. Doomers have a hard time focusing on one source of doom because all they're interested in is doom itself.

And at risk of going further OT, here's vaccine developments hot off the press.

https://www.cnbc.com/2020/05/18/moderna ... trial.html

Doomers gonna doom.

BOLD PREDICTIONS

-Billions are on the verge of starvation as the lockdown continues. (yoshua, 5/20/20)

HALL OF SHAME:

-Short welched on a bet and should be shunned.

-Frequent-flyers should not cry crocodile-tears over climate-change.

- asg70

- Permanently Banned

- Posts: 4290

- Joined: Sun 05 Feb 2017, 14:17:28

Re: Mid-Year ETP MAP Update Pt. 2

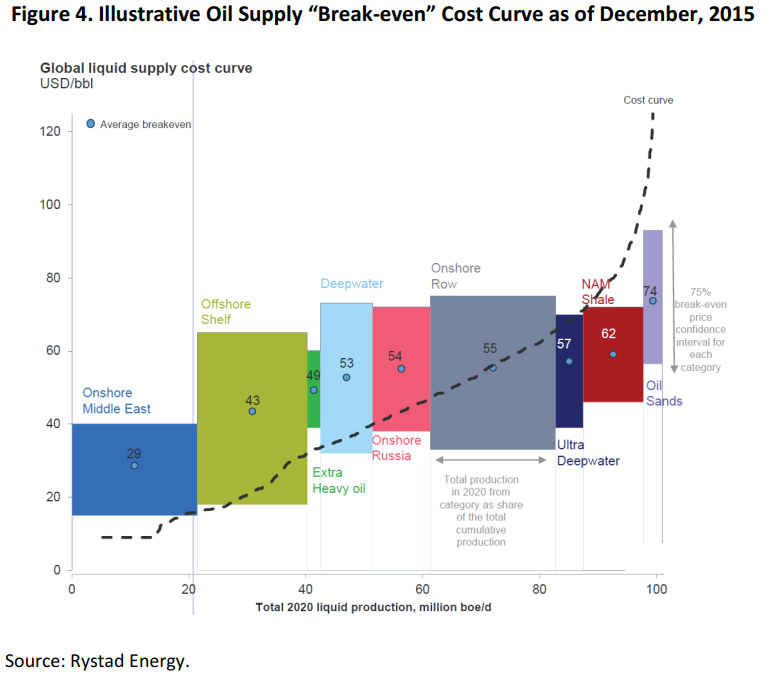

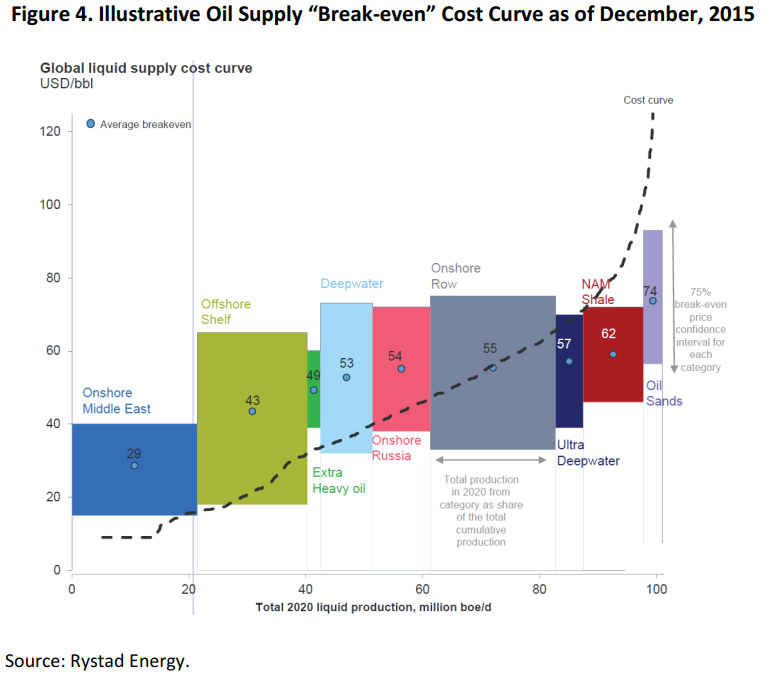

A short explanation, why the oil production will follow the dotted blue line.

The medium oil price decreases since 2008, that is a fact. It is a consequence of thermodynamics.

see: https://limitstogrowth.de/wp-content/up ... _EN_09.pdf

The connection between price and oil production can be derived from the dotted black line of the rystad diagramm.

The oil price as a function of time, combined with the price/production function derived from rystad diagram, and some dollars included for the WTI/Brent difference, gives the dotted blue line, showing the oil production decline for the next years. It is a simple projection of the data of the last 12 years.

The medium oil price decreases since 2008, that is a fact. It is a consequence of thermodynamics.

see: https://limitstogrowth.de/wp-content/up ... _EN_09.pdf

The connection between price and oil production can be derived from the dotted black line of the rystad diagramm.

The oil price as a function of time, combined with the price/production function derived from rystad diagram, and some dollars included for the WTI/Brent difference, gives the dotted blue line, showing the oil production decline for the next years. It is a simple projection of the data of the last 12 years.

Take care of the second law.

Take care of the second law.- Baduila

- Peat

- Posts: 172

- Joined: Fri 26 Jun 2015, 12:44:17

Re: Mid-Year ETP MAP Update Pt. 2

Baduila wrote:A short explanation, why the oil production will follow the dotted blue line.

The medium oil price decreases since 2008, that is a fact. It is a consequence of thermodynamics.

see: https://limitstogrowth.de/wp-content/up ... _EN_09.pdf

ETP remnants huddled in Germany calling themselves "ASPO" even though ASPO disbanded is all you've got?

BOLD PREDICTIONS

-Billions are on the verge of starvation as the lockdown continues. (yoshua, 5/20/20)

HALL OF SHAME:

-Short welched on a bet and should be shunned.

-Frequent-flyers should not cry crocodile-tears over climate-change.

- asg70

- Permanently Banned

- Posts: 4290

- Joined: Sun 05 Feb 2017, 14:17:28

Re: Mid-Year ETP MAP Update Pt. 2

^And at risk of going further OT, here's vaccine developments hot off the press.^

Asg , I can also post several links that nuclear fusion is here on the way and so are treatments for cancer and HIV . 25 years and still waiting . Don^t jump the gun .

Asg , I can also post several links that nuclear fusion is here on the way and so are treatments for cancer and HIV . 25 years and still waiting . Don^t jump the gun .

- dirtyharry

- Lignite

- Posts: 226

- Joined: Fri 07 Apr 2017, 10:53:43

Re: Mid-Year ETP MAP Update Pt. 2

dirtyharry wrote:Asg , I can also post several links that nuclear fusion is here on the way and so are treatments for cancer and HIV . 25 years and still waiting . Don^t jump the gun .

Developing a flu vaccine is hardly as challenging as mastering fusion power. Oh, and HIV is for the most part a non-lethal disease now. Progress marches on.

BOLD PREDICTIONS

-Billions are on the verge of starvation as the lockdown continues. (yoshua, 5/20/20)

HALL OF SHAME:

-Short welched on a bet and should be shunned.

-Frequent-flyers should not cry crocodile-tears over climate-change.

- asg70

- Permanently Banned

- Posts: 4290

- Joined: Sun 05 Feb 2017, 14:17:28

Re: Mid-Year ETP MAP Update Pt. 2

asg70 wrote:. Oh, and HIV is for the most part a non-lethal disease now. Progress marches on.

Let's remember how pharmaceutical companies decide which direction to take research. A vaccine is a one time injection with maybe an additional booster or two. That means 3 shots at the most. In the case of HIV it is a non lethal disease today because those testing positive are on a lifetime cocktail of anti viral medications that have to be taken daily.

Now if you are a pharmaceutical company CEO with your R&D team deciding on where to invest your research which path would you take, a one time vaccine or antivirals that are taken for a lifetime?

The Covid19 pandemic has been so disruptive to the global economy that the pressure is on for a vaccine and they probably will succeed. If there was not so much disruption though pharmaceutical companies would focus more on anti virals.

Pharmaceutical companies act a lot like pathogens. They are parasites that want to debilitate but not cure or kill their customers. You know, keep them chronic but not kill them. This is exactly what the most successful pathogens do.

I find that strangely ironic.

Disclosure: I was in the medical field in sales for almost 20 years in senior management.

Patiently awaiting the pathogens. Our resiliency resembles an invasive weed. We are the Kudzu Ape

blog: http://blog.mounttotumas.com/

website: http://www.mounttotumas.com

blog: http://blog.mounttotumas.com/

website: http://www.mounttotumas.com

-

Ibon - Expert

- Posts: 9568

- Joined: Fri 03 Dec 2004, 04:00:00

- Location: Volcan, Panama

Return to Peak oil studies, reports & models

Who is online

Users browsing this forum: No registered users and 13 guests