Re: EIA's IPM confirms 2005 as peak production

Oily? Auntie? Where are you when we need you?!

-G

-G

Exploring Hydrocarbon Depletion

https://peakoil.com/forums/

https://peakoil.com/forums/the-eia-thread-pt-3-merged-t69543-60.html

Cyrus wrote:Oilfinder2 care to step in and try to debate this?

dukey wrote:pretty big news.

This from the weekly petroleum status report was also fairly big news ..Over the last four weeks, motor gasoline demand has averaged about

9.2 million barrels per day, up by 0.5 percent from the same period last year.

especially considering the fact we are in a huge recession right now

pstarr wrote:Ah. There you are. The point here I believe is that oil demand is somewhat inelastic and that in time of economic decline neither the market, nor conservation, nor efficiencies, nor replacements can stem the flow from declining reservoirs.

It's almost as if we are floating in a vast toilet of petroleum with our own hands on the flusher handle. Do we yank? Or do we just enjoy the float?

OilFinder2 wrote:Source

Gasoline product supplied

First week of August 2006 = 9,620 thousand bpd

First week of August 2007 = 9,659 thousand bpd

First week of August 2008 = 9,410 thousand bpd

First week of August 2009 = 9,144 thousand bpd

gnm wrote:Oily? Auntie? Where are you when we need you?!

-G

This is the worst news I've gotten all year. *sniff*

This is the worst news I've gotten all year. *sniff* ![crybaby2 [smilie=crybaby2.gif]](https://peakoil.com/forums/images/smilies/crybaby2.gif) (maybe you meant Anti-Doomer?)

(maybe you meant Anti-Doomer?)

TheDude wrote:What was your other data point...YOY, oh right. So since the economy will grow once more now, consumption will increase, and we will be right back where we started from. Or not. "Increaseless Recovery," damn, I'm on a roll.

Auntie_Cipation wrote:gnm wrote:Oily? Auntie? Where are you when we need you?!

-G

I'm being lumped with WHO???This is the worst news I've gotten all year. *sniff*

(maybe you meant Anti-Doomer?)

gnm wrote: So even if its 2015 we better hurry ....

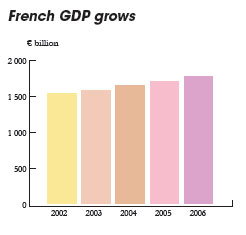

Transport in France relies on one of the densest and most efficient networks in the world with 146 km of road and 6.2 km of rail lines per 100 km2. It is built as a web with Paris at its centre.[1] France is currently one of the world leaders in railway technology and is also in the forefront of modern tramway developments.

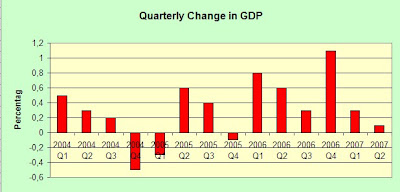

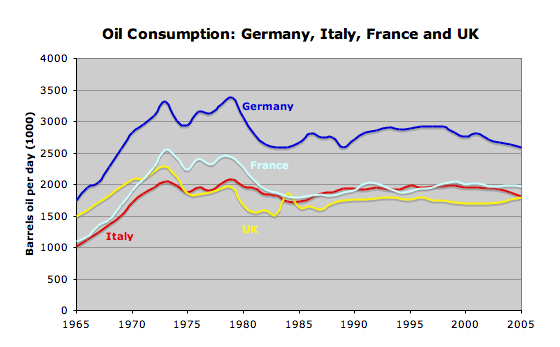

OilFinder2 wrote:Increasing oil consumption is not a prerequisite for economic growth. Really!

Cherry picking is the act of pointing at individual cases or data that seem to confirm a particular position, while ignoring a significant portion of related cases or data that may contradict that position.

TheDude wrote:I'll try one more time: The nations you selected as your examples have vast investments in mass transit, thus have buttressed themselves against increases in the price of crude oil by not having such a great dependency on fossil fuel powered personal transport . . .

TheDude wrote: hence my graph of change in oil consumption divided by region, which shows that increase in demand proceeds apace, regardless of changes in individual countries.