'Carbon Bubble' Could Wipe Trillions From Global Economy

'Carbon Bubble' Coming That Could Wipe Trillions From Global Economy

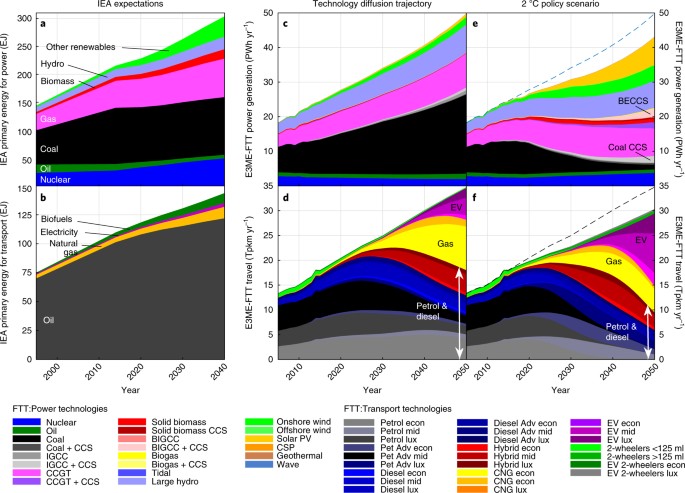

Fossil fuel stocks have long been a safe financial bet. With the International Energy Agency projecting price rises until 2040, and governments prevaricating or rowing back on the Paris Agreement, investor confidence is set to remain high.

However, new research suggests that the momentum behind technological change in the global power and transportation sectors will lead to a dramatic decline in demand for fossil fuels in the near future.

The study indicates that this will now happen regardless of apparent market certainty or the adoption of climate policies—or lack thereof—by major nations."Our analysis suggests that, contrary to investor expectations, the stranding of fossil fuels assets may happen even without new climate policies. This suggests a carbon bubble is forming and it is likely to burst."

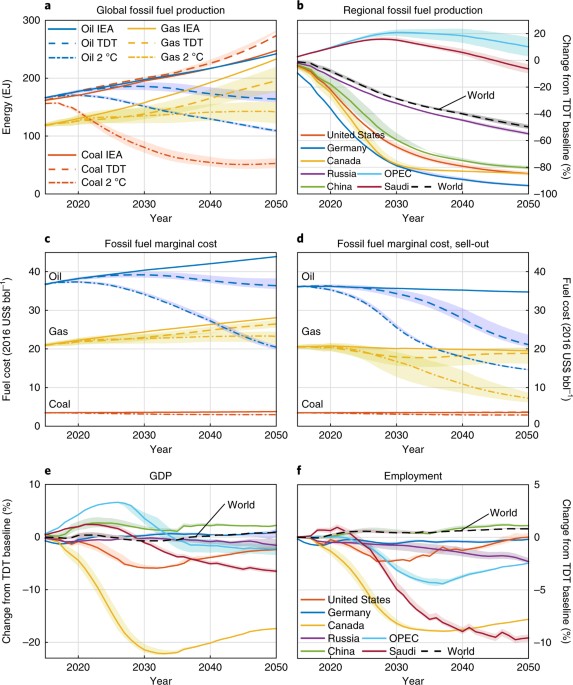

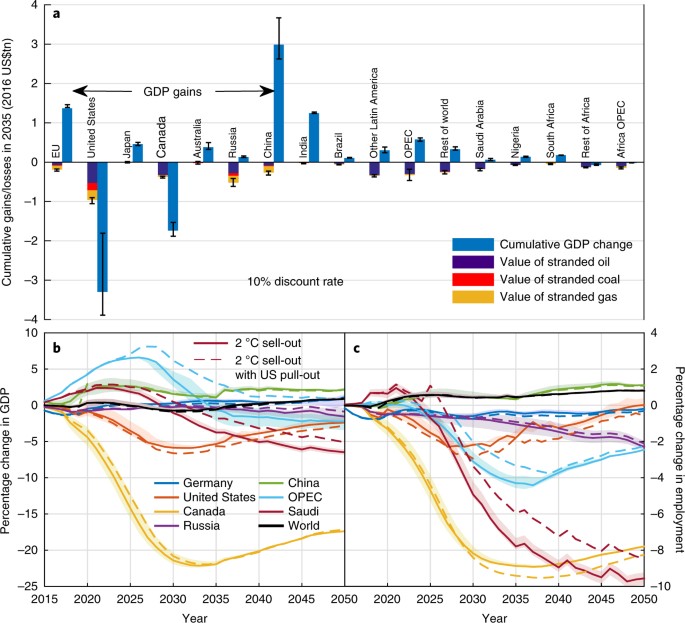

Detailed simulations produced by an international team of economists and policy experts show this fall in demand has the potential to leave vast reserves of fossil fuels as "stranded assets": abruptly shifting from high to low value sometime before 2035.Such a sharp slump in fossil fuel price could cause a huge "carbon bubble" built on long-term investments to burst. According to the study, the equivalent of between one and four trillion US dollars could be wiped off the global economy in fossil fuel assets alone. A loss of US$0.25 trillion triggered the crash of 2008 by comparison.

Japan, China and many EU nations currently rely on high-cost fossil fuel imports to meet energy needs. They could see national expenditure fall and—with the right investment in low-carbon technologies—a boost to Gross Domestic Product (GDP) as well as increased employment in sustainable industries.

However, major carbon exporters with relatively high production costs, such as Canada, the United States and Russia, would see domestic fossil fuel industries collapse. Researchers warn that losses will only be exacerbated if incumbent governments continue to neglect renewable energy in favour of carbon-intensive economies.

"Individual nations cannot avoid the situation by ignoring the Paris Agreement or burying their heads in coal and tar sands," he said. "For too long, global climate policy has been seen as a prisoner's dilemma game, where some nations can do nothing and get a 'free ride' on the efforts of others. Our results show this is no longer the case."

However, one of the most alarming economic possibilities suggested by the study comes with a sudden push for climate policies—a 'two-degree target' scenario—combined with declines in fossil fuel demand but continued levels of production. This could see an initial US$4 trillion of fossil fuel assets vanish off the balance sheets.

"If we are to defuse this time-bomb in the global economy, we need to move promptly but cautiously," said Hector Pollitt, study co-author from Cambridge Econometrics and C-EENRG. "The carbon bubble must be deflated before it becomes too big, but progress must also be carefully managed."

One of the factors that may contribute to the tumult created by fossil fuel asset stranding is what's known as a "sell-out" by OPEC (Organisation of the Petroleum Exporting Countries) nations in the Middle East.

"If OPEC nations maintain production levels as prices drop, they will crowd out the market," said Pollitt. "OPEC nations will be the only ones able to produce fossil fuels at the low costs required, and exporters such as the US and Canada will be unable to compete."

Viñuales observes that China is poised to gain most from fossil fuel stranding. "China is already a world leader in renewable energy technologies, and needs to deploy them domestically to tackle dangerous levels of pollution. Additionally, stranding would take a higher toll on some of its main geopolitical competitors. China has a strong incentive to push for climate policies."

The study authors suggest that economic damage from adherence to fossil fuels may lead to political upheaval of the kind we are perhaps already seeing. "Mass unemployment from carbon-based industries could feed public disenchantment and populist politics," Viñuales said.

J.-F. Mercure et al, Macroeconomic impact of stranded fossil fuel assets, Nature Climate Change (2018)