Re: The time .... has arrived.

Was talking about views of the future. But cheap is good.

Exploring Hydrocarbon Depletion

https://peakoil.com/forums/

https://peakoil.com/forums/the-time-has-arrived-t74290-80.html

derhundistlos wrote:Cog wrote: However I do see a serious flirtation with socialism ending in disaster for the USA. That is a sort of doom I suppose and a great deal of violence over that is not out of the question.

Social Security and Medicare are two popular and classic forms of socialism. Thank you Presidents Roosevelt and Johnson. The Republicons have tried for years to undermine both plans; however, Republicon pols. also know the consequences of their elimination would be catastrophic for society and their reelection.

The results of implementing these socialist policies provide an important safety net for our seniors and resulted in anything but "doom" for America.

Outcast_Searcher wrote:

For example, I'm in favor of seriously looking at some kind of Medicare For All option. However, I am NOT at all in favor of the current "Medicare For All Act of 2019", which from what I've read in articles, eliminates copays, and says NOTHING SPECIFIC ABOUT HOW IT WILL BE PAID FOR, OR WHAT IT WOULD COST.

yellowcanoe wrote:Outcast_Searcher wrote:

For example, I'm in favor of seriously looking at some kind of Medicare For All option. However, I am NOT at all in favor of the current "Medicare For All Act of 2019", which from what I've read in articles, eliminates copays, and says NOTHING SPECIFIC ABOUT HOW IT WILL BE PAID FOR, OR WHAT IT WOULD COST.

The existing Medicare system is expensive in part because politicians have made it so at the behest of the pharmaceutical and health care industry. For example the Secretary of the Department of Health and Human Services (HHS) is explicitly prohibited from negotiating directly with drug manufacturers on behalf of Medicare Part D enrollees. For a single payer system to work, politicians would need to realize that their role is to try to reduce medical costs.

copious.abundance wrote:I can't quote myself in the thread linked below anymore because it's been locked.

But note my observation here, posted on May 24, 2017:copious.abundance wrote:I think you probably have to wait some more before deciding whether or not that chart is really going to show a sustained downturn. It could still be a temporary halt that continues resuming upward. Even if all it did was go sideways for a while, still might not indicate a recession.

Furthermore, it's always a danger relying on just one indicator to predict a recession, because you never know when that one indicator might do something it's never done before. The best method is to devise an index composed of several indicators, such as this one here or this one here. Neither are flashing a recession in the next year or so. That said, I think most economic data nerds will probably agree we are somewhere in the late stages of the current cycle. But that could still mean more expansion for another two years, or more.

That was a year-and-a-half ago as i write this.

The sun, is setting.

marmico wrote:The Conference Board LEI has not turned down.

https://www.conference-board.org/pdf_fr ... 202019.pdf

The time....has not arrived.

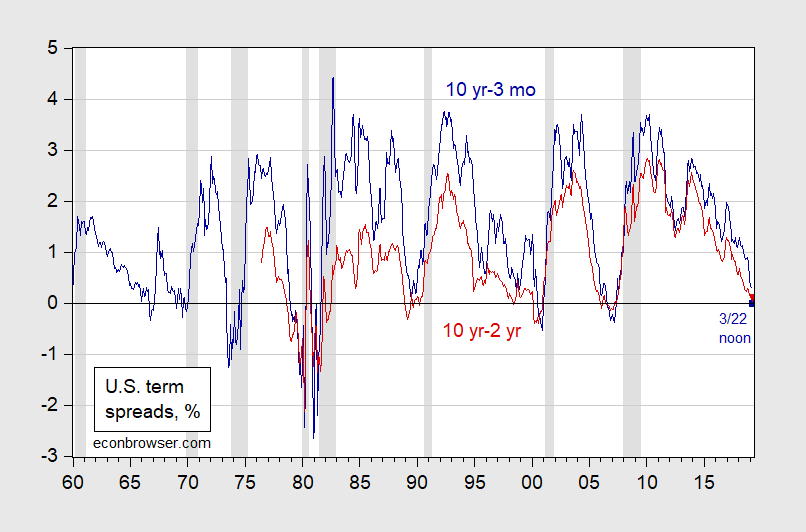

The yield curve as measured by the spread between the 3-month Treasury bill and the 10-year note inverted for the first time since 2007, following a sharp rally in longer-dated notes. The spread between the two maturities stood at around negative 3 basis points. On Friday, the 10-year note yield fell nearly 10 basis points to 2.434%, while the 3-month bill was down a single basis point to 2.462%, Tradeweb data show. Bond prices move inversely to yields. The last nine times the yield curve has inverted, a recession has followed, according to the San Francisco Fed.

Yes, the time has arrived.

copious.abundance wrote:1 false positive and 9 true positives. I'll go with the odds.

Newfie wrote:How does this piece about the effect of trade barriers on global trade fit into this picture? Essentially it’s saying trade barriers can effect energy markets more than renewables.

https://gcaptain.com/opinion-energy-has ... e-to-fear/

The Conference Board Leading Economic Index® (LEI) for the U.S. increased 0.2 percent in April to 112.1 (2016 = 100), following a 0.3 percent increase in March, and a 0.2 percent increase in February.

marmico wrote:The time .... has not arrived.

Harvey, a finance professor at Duke University’s Fuqua School of Business and senior adviser at Research Affiliates, is experiencing no such equivocation. His original analysis at the University of Chicago in 1986 identified the three-month to five-year spread as the relevant indicator on the curve. His work shows it needs to stay negative for a full quarter to reliably predict a recession. Harvey says this metric predicted the slumps of 1991, 2000-2001 and 2008, and has given no false signals. And those who’ve relaxed, or even bounded into fresh trades since broader sections of the yield curve have begun to steepen, should take note: This one has been inverted since March 12.

On June 12th, the yield curve of the 3-month and 5-year treasuries will have been inverted for 3 months.