Re: The time .... has arrived.

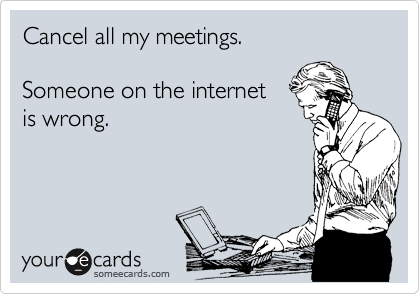

Outcast_Searcher wrote:....the random stuff you post and claim....

???????

You're the one who messed up.

You tried to argue that GDP is continuing to grow right now in Japan and Germany by linking to out-of-date data in an old news article. Well.....it isn't. Thats just reality.

Get a clue, man--- you made a mistake. Its no big deal. Everyone makes mistakes. You can't look at old data to determine what is going on now and what is likely to occur in the future. You have to look at the most recent data to understand what is happening right now. AND the most recent data shows that rather then growing, as you claim, GDP fell in both Japan and Germany during the third quarter of 2018.

We'll have to see what happens in the fourth quarter, but IMHO the drops in GDP in the third quarter in both Japan AND Germany are worth keeping an eye on.

Cheers!

Now it's barely 2 pages and the biggest thing going on in it are 2 people arguing with each other over something not even having much to do with the original topic.

Now it's barely 2 pages and the biggest thing going on in it are 2 people arguing with each other over something not even having much to do with the original topic.