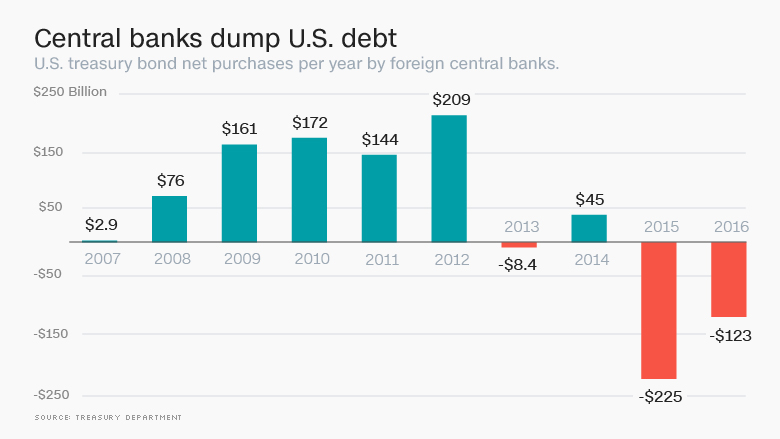

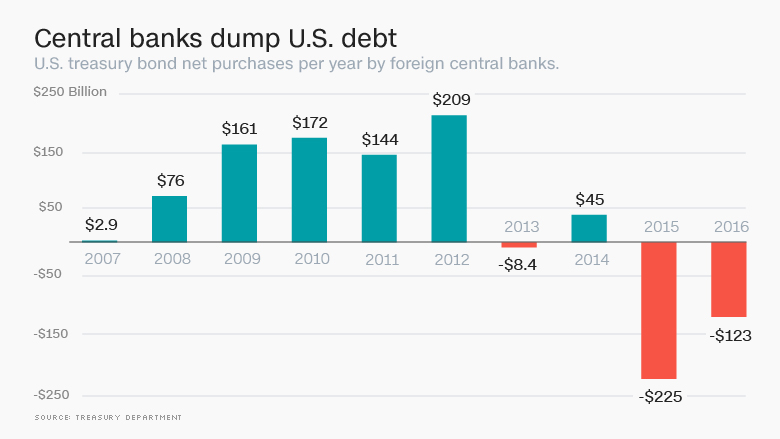

Dollar Debt Dump Underway

U.S. debt dump deepens in 2016

More: http://money.cnn.com/2016/05/16/news/ec ... -stack-dom

Doesn't seem to bode well for the US Dollar hegemony.... Other repercussions?

Central banks are dumping America's debt at a record pace.

China, Russia and Brazil sold off U.S. Treasury bonds as they tried to soften the blow of the global economic slowdown. They each sold off at least $1 billion in U.S. Treasury bonds in March.

In all, central banks sold a net $17 billion. Sales had hit a record $57 billion in January.

So far this year, the global bank debt dump has reached $123 billion.

It's the fastest pace for a U.S. debt selloff by global central banks since at least 1978, according to Treasury Department data published Monday afternoon....

Treasuries are considered one of the safest assets in the world, but some experts say a sense of panic about the global economy drove the selloff.

"It's more of global fear than anything," says Ihab Salib, head of international fixed income at Federated Investors. "There's still this fear of 'everything is going to fall apart.'"

Judging by the selloff, policymakers across the globe were hitting the panic button often and early in the year as oil prices fell, concerns about China's economy rose and stock markets were very volatile.

In response, countries may be selling Treasuries to prop up their currencies, some of which lost lots of value against the dollar last year. By selling U.S. debt, central banks can get hard cash to buy up their local currency and prevent it from losing too much value.

Also, as investors have pulled money out of developing countries, central bankers seek to replenish those lost funds by selling their foreign reserves........

More: http://money.cnn.com/2016/05/16/news/ec ... -stack-dom

Doesn't seem to bode well for the US Dollar hegemony.... Other repercussions?