THE 2016 po.com Oil Price Challenge

OK, here we go again!

It's time to start thinking about your guesses for 2016. Make (or change) your guesses by January 5th, 2016.

Here are the rules:

Good luck!

It's time to start thinking about your guesses for 2016. Make (or change) your guesses by January 5th, 2016.

Here are the rules:

Once upon a time, pup55 wrote the initial rules for this game in the 2009 PO.com Oil Price Challenge (in italics). My corrections are in brackets.

Rules:

1. Anyone can participate. Everyone can only enter once. There is no charge to enter. Side bets are encouraged, however.

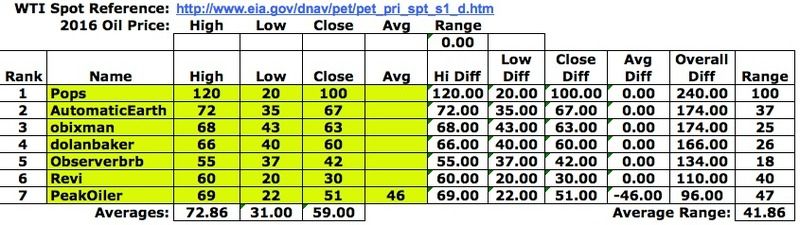

2. Each participant is to make three guesses: The high, the low, and the closing price on December 31, [2016]

We will use the Cushing OK NYMEX Futures Contract #1 from the EIA table. Note that this only gives daily closing prices, not interday intraday prices, for those who wish to factor this into your calculations.

Winners will be determined as soon as they post the December 31 price, which will be a few days into [2016]

3. [PeakOiler] will be the official tabulator [until further notice]. Entries will be allowed until January 5, [2016] You can edit your entry if you want before then, but I will record the official entries at that point.

4. The winner in each category (high, low and close) will be regarded with reverence, and generally declared to have superior intellect and/or clairvoyant powers, and get abundant respect from the fellow forum dwellers. Nothing bad will happen if you are wrong.

Special note: In light of the wild fluctuations in the oil price during the past year [2008], anyone who submits a forecast at all will be showered with respect from the forum dwellers just for entering.

5. I have a separate thread elsewhere to capture forecasts from the media and famous talking heads and other agencies on this important topic. We will of course hold them accountable for their forecasts, needless to say.

[Rule change: Please post forecasts from outside sources in this thread.]

6. Those who wish to forecast the WTI price in Euros may also feel free to do so. Those who wish to forecast an average price for the year may also feel free.

7. Other rules will be made up as we go.

[The rule I added last year was if the player is banned from PO.com, that player shall be disqualified and deleted from the scorecard.]

8. Note that per the above, anyone who puts down a prediction has moral superiority and has extra artistic license to critique the predictions of any of the industry or media experts, at least for the next year. Also, feel free to include whatever your forecasting method, logic, or theory is, if you have one.

Let the forecasting begin!

Good luck!