Page 2 of 3

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sat 14 Feb 2015, 11:14:17by basil_hayden

ROCKMAN wrote:Pops - Lets transform you into the personification of the world's entire population.

So Mr. World (aka Pops)...you're satisfied that it has cost you ONLY $1.2 trillion to claim the bragging rights for extending PO 8 years. So says you??? LOL.

At least we got something out of that, as opposed to the home equity that vaporized, the solar business loans that bellied-up, the government in my healthcare pocket, all the exported coaland anticipated carbon cap and trade nonsense. Just to name a few. Sheesh.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sat 14 Feb 2015, 17:17:58by ROCKMAN

Basil - "At least we got something out of that...". I guess I'm dense: what specifically did we benefit from paying an extra $1.2 TRILLION for oil to extend the date of PO some number of years into the future? And that's assuming we really have extended that meaninglessness (IMHO) date.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sat 14 Feb 2015, 19:27:44by Pops

ROCKMAN wrote:what specifically did we benefit

He doesn't know, it was just a chance to play Rush.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sat 14 Feb 2015, 20:52:44by basil_hayden

ROCKMAN wrote:Basil - "At least we got something out of that...". I guess I'm dense: what specifically did we benefit from paying an extra $1.2 TRILLION for oil to extend the date of PO some number of years into the future? And that's assuming we really have extended that meaninglessness (IMHO) date.

He he Pops, that guy's scum, sorry you feel that way about me since you're so cool. For the record, I got rid the first broad and kept the doomstead. It was easier to find another broad.

Anyhow, it looks to me like it bought an economy for awhile, on top of developing petroleum directly from source rock pretty darn productively, and there's lots of it. That is, there's plenty of $100 oil.

I bet we overspend alot more on say, cellular communication, and have much less to show for it. Apple's valued almost double ExxonMobil's lately. I find the thought of essentially paying more for brains than energy kind of ridiculous.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sat 14 Feb 2015, 21:54:47by ROCKMAN

Pops - I know. Sometimes the best way to expose someone's unsupportable positions is to just sit back and let them talk. Then others can judge them on their own.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 15 Feb 2015, 12:34:01by zaphod42

Just wanted to ask, where exactly are we going to get the next $1.2 TRILLION for oil to extend the GPO date another 8 years?

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 15 Feb 2015, 13:10:46by ROCKMAN

Zap - Just ask the economists...I'm sure they have a theoretical model that shows it's possible. LOL.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 15 Feb 2015, 14:47:18by EdwinSm

ROCKMAN wrote:Zap - Just ask the economists...I'm sure they have a theoretical model that shows it's possible. LOL.

Selling wheat and other food products to oil exporting countries that can't grow enough food to keep up with their population growth ????

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sat 02 May 2015, 18:27:36by onlooker

http://www.economic-undertow.com/2015/0 ... islanders/Wow tremendous article on the current state of world economy relative to the oil industry.

the oil – credit markets have broken down. What remains is relentless decline … as resources along with purchasing power are annihilated.

This basically sums up the premise of the article. I think it is very enlightening. The economy has seized up and with it the credit markets which in turn has annihilated purchasing power and helped to drive price of oil down along of course with the glut of US tar-shale sands. I am sure more erudite thinkers in the field will find this article interesting. A caveat ,I am not sure in what order these events happened or which caused which.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 03 May 2015, 09:59:59by Pops

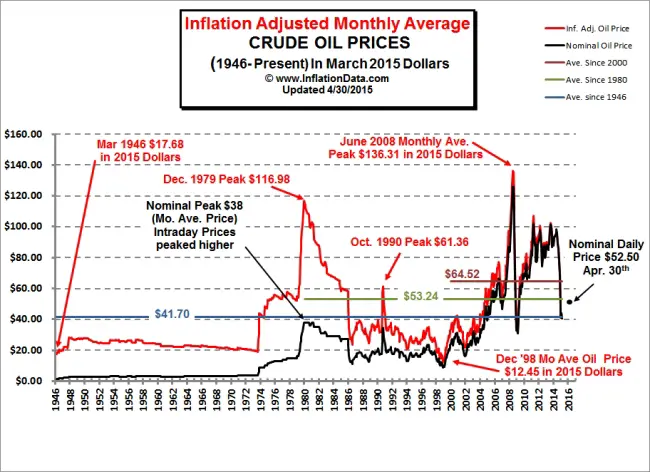

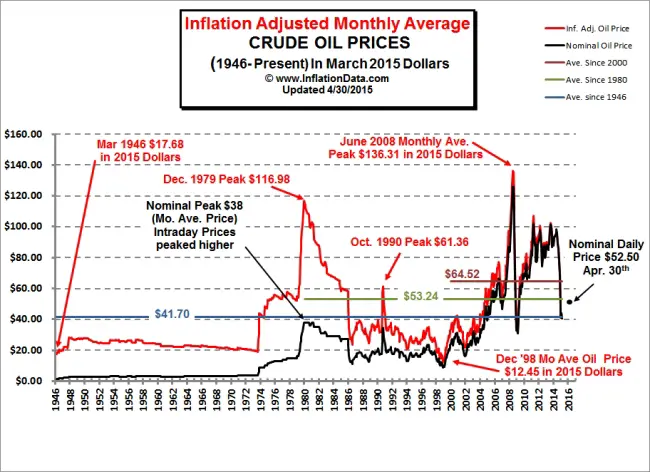

The "low" hasn't even reached the average historical price of $40.

(these are IL stripper oil prices, which were never subject to price controls in the '70s)

With this price at over $50 (WTI @ $60) it is already well over the average for the last 40 years and almost back to the average for the last 15 -- and Brent, the benchmark closer to what the world actually pays is higher still.

So, while TEOTWAWKI may be at hand, it is not signaled by "low" oil price.

[Not erudite]

V

V

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 03 May 2015, 10:16:25by Pops

If you want a dot...

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 03 May 2015, 11:15:08by Pops

Lost my comment...

Doesn't look to me like there is a shortage of credit.

Looks to me like the entire stock market is a credit bubble.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 03 May 2015, 11:21:21by onlooker

So Pops and others , when do you think oil prices will rise even more dramatically, looks like we have had some 4 months of steady rise but do you think a dramatic rise is in the cards this summer?

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 03 May 2015, 12:10:33by Pops

Obviously it's table stakes, the price can only rise as high as ability to pay allows for a given demand. I think it could go back up the limit, which is brent $120/unleaded +/-US$4 by time to go to Grandmas house for christmas.

It is all about what the various players in the market see in their crystal balls in the medium term. The floor and ceiling are set by costs at the bottom: somewhere around $75 and the ceiling, ability to pay, somewhere around $100. But in the short run it is about how the consumer reacts when they grab the nozzle.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 03 May 2015, 12:40:53by onlooker

I am venturing out on the limb a bit as my expertise here is suspect, but if what the article I linked states is correct that their is much discretionary driving occurring, then this summer might see a rise in motorists on the road. That in turn would create upward pressure on prices. OPEC is on full throttle as Shale in US, plus ample reserves. So it seems all is set up for a pretty steep and sudden rise as right now NYMEX stands at about 60 dollars and as you say Pops that it could rise to 100 based upon ability to pay.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Sun 03 May 2015, 14:44:11by Pops

LOL, you might go out on that limb ...

But I gotta tell you, I'm feeling a little dizzy ...

The whole point of this thread was to argue against the idea that oil prices will never recover, which came from a post by your guy. LOL.

Consumption was falling when prices were high, it is rising now that prices are "low" — relatively speaking, due to some slight surplus of supply and the speculative nature of oil markets.

So, yes, high prices will return with higher demand.

Which not coincidentally puts the lie to the assertion that oil is somehow losing value and that has caused the price drop. The value of oil is and will continue to increase as we waste less: more utility = more value : use less/pay more.

But the stickiness of sensational predictions never ceases to amaze me.

Which isn't to say that the economy is not FUBAR (and repair) but merely that there has not been a dramatic, fundamental shift in the value of oil.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Mon 04 May 2015, 01:38:11by ROCKMAN

Back from cruising the Med. So here's a perspective from a non-credit dependent conventional onshore oil exploration company: the Rockman has $250 million available for production acquisition and wildcat drilling. And can find very few opportunities that can be justified at the current oil price. But guess what: that was also true when oil was $100/bbl. Now factor that into what the pubcos who require bankers/investors to function.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Mon 04 May 2015, 03:20:59by onlooker

Wow that is eye opening. So drilling new areas has become cost prohibitive!

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Mon 04 May 2015, 07:52:07by ROCKMAN

looker - That's one way to put it. Or more simply there just aren't very many conventional onshore oil prospects to drill even at $100/bbl. And as I've mentioned before during the first 3 years of my 5 yo company we spent over $240 million drilling for conventional NG. And then prices fell so in the last 2 years we've spent exactly $0 drilling for conventional NG. And remember we're private...not a pubco. So there's no money to make by hyping stock. All my owner is interested in is making a nice profit.

Re: Falling Oil Price ≠ TEOTWAWKI

Posted:

Mon 04 May 2015, 08:16:52by sparky

.

with the OPEC basket at 62$/barrel and unrelenting rising in spite of a weak market ,

it seems that even the KSA cannot control , or doesn't want to, keep the prices down ,

we are now seeing the failure of keeping price at "reasonable" level.

the case of the gas price in the continental USA is a special case ,

sorry for the drillers , too much gas ,too much silly money , not enough oil .