Conventional oil - the $35 onshore, gusher kind has already failed, that's why we're at $110. No matter how much we Yergin the data, we aren't going to see $35 again - not in a good way anyhow. So the answer is some time around 2004 for the oil we've been using for 150 years.

So the next question is, how fast and is it even possible for unconventional oil production to grow enough to compensate for the decline of existing Clampett Oil? And/Or how much demand will high prices kill?

The answer to that isn't clear, we've inched up total numbers by about 1% a year since 2005 by drilling like crazy, long term the growth had been more like 2.5% using much less effort and CAPEX. Even though there are more drilling rigs active in the US today than there were even in 1980.

The difference is today most are directional and horizontal wells and fracked wells costing many times the plain old vertical wells of the 1860s-2010s. There is no difference in concept between the rotary rig vertical wells that replaced the cable rigs my grandfather used in Oklahoma in the 1920's and the vertical wells of today.

But the difference between the old fields and the new fields is the difference between a straw in an shaken Pepsi bottle and a straw in a turnip. Wells today only flow a fraction of what they did 40 years ago initially and go on to deplete much more rapidly to boot.

The scary part is that the economists were right and peakers wrong about high prices enabling "substitutes". Hubbert was an optimist. He thought the substitute would be to something better than oil - like nukes. But he was wrong about the extent we'll go to in order to postpone change. So what we see now, expending huge amounts of sweet light crude and natural gas to "upgrade" what is basically asphalt for example,

is the worst case scenario. We're burning good oil after bad and raising the peak higher and higher and pushing it further and further down the road. The effect is that of changing the familiar "bell curve" with a smooth slope into a cresting wave with a steep drop.

Where we're at right now is the remaining cheap, easy, sweet, $30 oil is being rapidly depleting out of sight behind the Amazing Shale Oil Glut headlines. The result I'm afraid will not be the long slow slope enabling a gradual transition like I've always hoped. Because the "new" well technology inherently nets less flow initially but also depletes faster, the eventual peak and decline of these wells will be even sharper than the conventional oil and conventional gas peaks in the oughties. That's my forecast.

If you must have real numbers

here is the Megaprojects postat TOD from last year with guesses about as good as any.

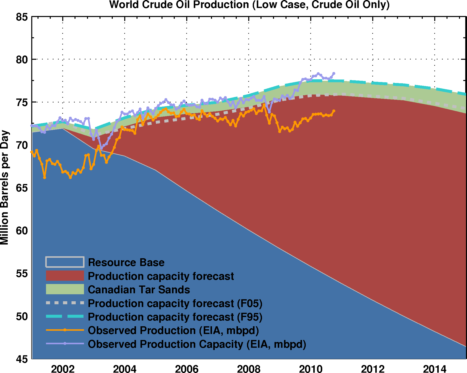

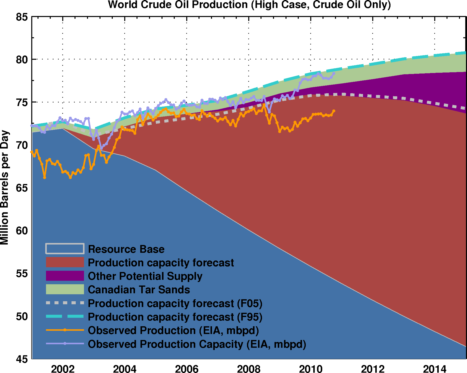

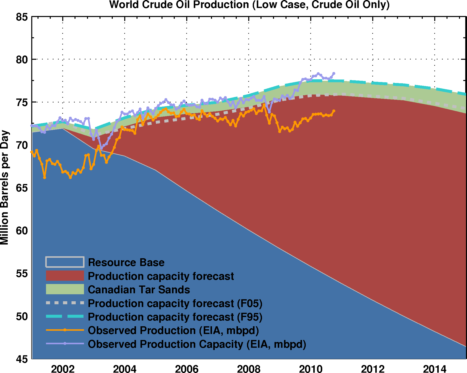

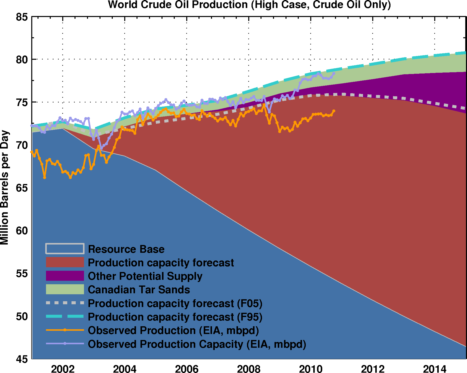

High Case scenario for the world production capacity (conventional oil and Canadian tar sands). Low Case scenario for the world production capacity (conventional oil and Canadian tar sands) is based on the Wikipedia megaproject database. The implied resource base decline rate is 3.6 percent. The F05 forecast represents a low case estimate with a 5 percent probability Monte Carlo simulation of a lower decline rate value. The F95 is the high case estimate with a 95 percent probability of a lower value.

Low Case scenario for the world production capacity (conventional oil and Canadian tar sands) is based on the Wikipedia megaproject database. The implied resource base decline rate is 3.6 percent. The F05 forecast represents a low case estimate with a 5 percent probability Monte Carlo simulation of a lower decline rate value. The F95 is the high case estimate with a 95 percent probability of a lower value.