Page 14 of 15

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Sun 05 Oct 2014, 22:05:44by copious.abundance

ROCKMAN wrote:c-a: Given that on numerous occasions you've pointed erroneous less then optimistic prediction isn't your critique of others doing the same a bit hollow?

Sure, nobody is right all the time. But some of the doomers on this site have prediction records at least as bad as Yergin, and my own record, while certainly not perfect, has been a helluvalot better than most of the doomers here.

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Sun 05 Oct 2014, 22:46:57by ROCKMAN

CA - A valid point. BTW lend me a hand: I've lost my list of optimists who, about 10 years ago, predicted a 300% increase in oil prices as we winged our way towards "energy inference". Oh...oh...I also can't find my list of optimists that back in '08 predicted NG to continue rising above $12/mcf. Thanks in advance.

"...not perfect..." A tad of an understatement. LOL. Here's a challenge to anyone: name just one price predictor (and provide documentation), either optimistic or pessimistic, that was reasonably accurate over, hmm... let's say over a dozen year period.

What's interesting is that not once in my 40 years have I seen one company predict future oil/NG prices to be either significantly higher or lower then they were at the time that the forecasts were made. And typically the projections run forward at least 15 years. Which means that the folks who should be the best at predicting oil/NG prices have always been incorrect in the long run. Looking at the price volatility proves that.

But the reason is simple: if someone in the company proposed using a significantly higher or lower oil/NG price in their future revenue they would immediately be pressed to DOCUMENT the data to support their numbers. And since that can't be done they'll stand there looking like a deer in the headlights. Of course this also means using current prices in their forecast will eventually be proved incorrect also. But it's no harm/no foul: the philosophy being one can't make dependable long term projections so we don't try. IOW in 4 decades I've not seen one company come even close to predicting future prices correctly more than a few years out. And many not even that far. A reminder about Devon contracting every drill rig they could in early '08 for their east Texas shale gas play anticipating just the continuation of current prices. And then paying $40 million in contract cancellation penalties just 12 months later when NG prices collapsed as they dropped 14 of the 18 rigs they had running. And Devon was one of more savvy companies I've ever worked for.

I'll leave that magic up to the experts who play the futures market. The futures market where for every expert that makes a $ there's another expert that loses a $. LOL

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Mon 06 Oct 2014, 08:43:26by Pops

SeaGypsy won the guessing contest here either 3 or 4 years, someone figured the odds that it was just luck and they were pretty high.

You can't really blame Yergin for optimistic forecasting, or the EIA either for that matter, for 125 years the best way to predict oil production has been population, and vice versa – great way to make a living.

At least OF2 provides an alternate set of press releases to go with his trolling, which to be honest is the only reason he hasn't gone the way of others whose only contribution was eye-poking provocation. After a while those who read here often could probably put half the regular posters on ignore and not miss anything; our hobby horses are that familiar.

Even a broken clock is right twice a day, but the reading is always the same so no one pays any attention.

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Mon 06 Oct 2014, 10:29:45by ROCKMAN

Pops - That's why I suggested looking at anyone's prediction record on a 10+ year cycle. It's like the joke about someone being clairvoyant because they picked the winning lottery number. When everyone of the millions of possibilities is picked someone is bound to be correct. Obviously that doesn’t mean they are better at predicting the number than anyone else.

What I find more interesting is the reason presented for a prediction more than the actual number itself. That can lead to an interesting chat. Arguing whether a number is correct or seldom does.

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Mon 06 Oct 2014, 22:41:44by ralfy

It may be difficult to predict prices because the global economy might crash each time the price reaches a particular level. In which case, one should look at the cost of production.

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Tue 07 Oct 2014, 07:18:31by dashster

Plantagenet wrote:Yergin puts out exactly the kind of BAU propaganda that the Obama administration likes. How appropriate that they would create a new medal in "energy" and select Yergin to be the recipient of the first energy medal.

I think it would be very difficult to make a case for giving Yergin an "Energy" medal, but in this case it is an "Energy Security" medal. What exactly does a Cornucopian do to deserve a medal in that regard? How could saying "there's gonna be enough oil for decades" make us more secure? Only documenting a danger and getting people to take action can increase security. Saying there is no danger doesn't make you more secure.

I guess in Washington, words and spin are more important than deeds.

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Tue 07 Oct 2014, 07:21:33by dashster

Pops wrote:You can't really blame Yergin for optimistic forecasting, or the EIA either for that matter, for 125 years the best way to predict oil production has been population, and vice versa – great way to make a living.

That is true. But for some reason they think it must always be so, as if we are living in an infinite world.

But I did read that Yergin in the 1970's was supposed to have been pessimistic about oil.

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Wed 08 Oct 2014, 13:49:03by JuanP

An article on the subject by Kurt Cobb originally published by Resource Insights:

http://www.resilience.org/stories/2014- ... chlesinger

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Wed 08 Oct 2014, 19:41:00by 35Kas

"About Us

Peakoil.com was started in 2005 by Dan C., a software engineer coming to a realization about the importance of understanding then improving the world’s hydrocarbon energy systems."

I always thought this website was his attempt to balance out his karma. Its an older joke of course but you can never tell for sure...

Re: U.S. grants first medal on energy to oil historian Yergi

Posted:

Fri 10 Oct 2014, 03:34:03by careinke

pstarr wrote:35Kas wrote:"About Us

Peakoil.com was started in 2005 by Dan C., a software engineer coming to a realization about the importance of understanding then improving the ...

Dan's Karma must be awfully powerful because it went back in time and created my account before

my account even existed

Obviously a simple time warp would be all it would take to cause this.

Daniel Yergin at Davos on Bloomberg Surveillance tv show

Posted:

Sat 24 Jan 2015, 05:03:48by dashster

Cornucopian Bloomberg TV host Tom Keene was in Davos at the conference for the world's extremely wealthy and elite and interviewed Cornucopian author Daniel Yergin. This is a transcript of the part of their interview that was put into a clip:

B: How many victory laps have you taken, crushing the Peak Oil people?

Y: Well.. <laughs>

B: <laughs> Do you feel like, just, YES I got it right!

Y: Well, I, I had the sense there was a lot of, it’s hard, I mean even here, I remember 8 years, 6 years ago. People say “You you don’t believe in Peak

Oil?”. Well said, you know, not really, because we’ve seen Peak Oil, every, and every time we’ve seen Peak Oil it’s been followed by a glut because new areas get opened up, new technology. And this remarkable thing, 2008 it was Peak Oil, US oil production is up 80% since 2008.

B: Right. For, for our viewers in the Middle East today or for that matter the Middle West of the United States, in 86 the price came down and went flat for a number of years. Do you predict that again?

Y: Well I think that, uh, we’re, I think there are analogies there. I think it’s a different circumstance because the US is, is so flexible. We think it’s gonna be quite flexible in it’s production. And the kind of prices where we are now would not sustain production over any period of time.

B: I get great confusion in interviews about the Canadian tar sands. That that’s different, it’s a different dynamic.

Y: Or Canadian, Canadian oil sands is what.

B: Well, well, what’s the PC correct, help me here. Where’s the politically correct surveillance police. They’re over there with a fondue pie But whatever, it’s tar sands, whatever. How will Canada adapt?

Y: Well actually Canada in the next, uh, this year and next year is gonna add about 500,000 barrels a day to the world market because it’s already in motion. If you’re an existing producer there it’s maybe about 30 dollars. Obviously new investment will slow down. But Canada is one of the sources of growth. Just as we’ve grown 4 million barrels a day since 2008, Canada’s grown 1 million barrels.

B: You have behind you an historical confidence. You’re an International Relations doctorate out of Cambridge, and you move on to a whole series of books that say essentially, read history or you don’t know the present. From the past what can you bring forward for Americans to say “Don’t panic about the plunge in oil”.

Y: Well I think it’s that we, say, this is the 4th time in the last 80 years that we’ve seen a big surge of oil come into the market. And every time you have weak prices. Uh, you, it happened in the late 50’s, as you were talking about, when the Middle East when Saudi Arabia came on. In 86 and actually back in 1931 when oil went to 10 cents a barrel, and if you pulled into a gas station they’d give you a chicken, a free chicken as a premium to try and get business. So every time, you know, the market comes back and stabilizes. What’s interesting now is this role as the US now the swing producer.

-------------------------------------------------------------------------

The host is proclaiming Yergin right, and yet Yergin admits - bolded above - that these price levels if sustained would force a US production drop. Even without a price increase, the EIA predicts fracking to peak in 2019/2020. Yergin never foresaw the oil plateau before the recent plummet. But Yergin wins and Peak Oil loses?

If these financial people did any research the obvious question would have been - where are oil production increases going to come from once fracking peaks in a few years?

Not to mention the obvious flaw on thinking about Peak Oil like a comet heading for the earth - a problem that goes away after a certain moment in time.

Re: Daniel Yergin at Davos on Bloomberg Surveillance tv show

Posted:

Sat 24 Jan 2015, 09:10:35by westexas

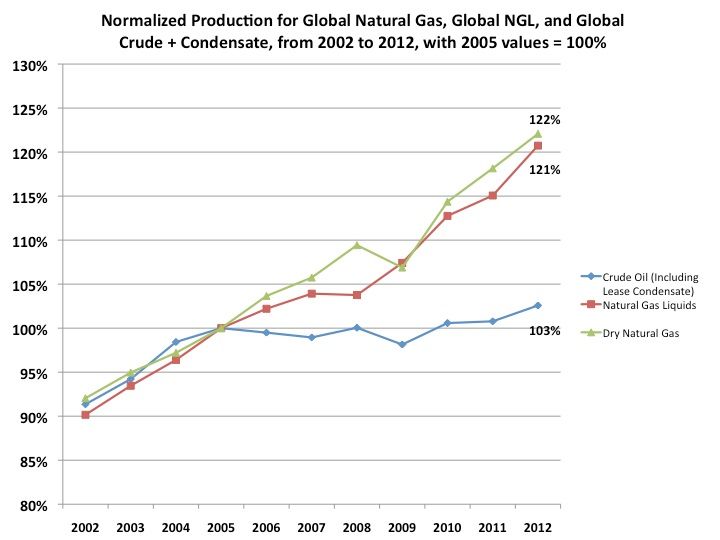

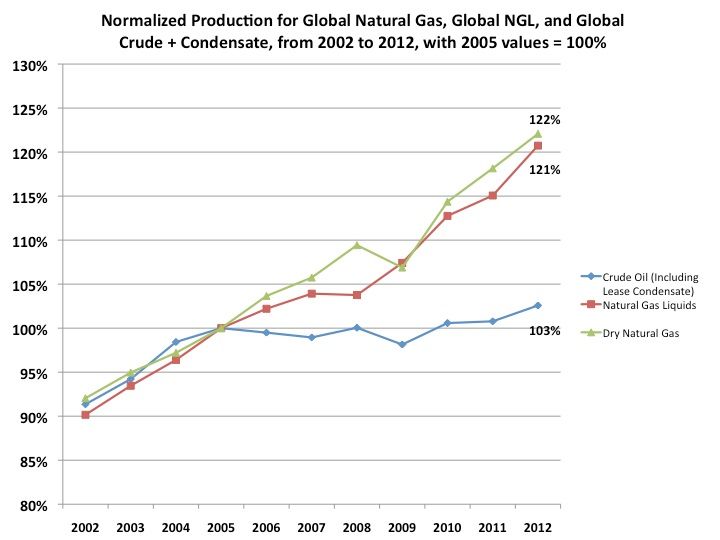

If actual global crude oil production (45 and lower API gravity crude) effectively peaked in 2005, but global natural gas production and associated liquids, condensate and natural gas liquids, continued to increase, what would the global petroleum liquids data look like? Perhaps something like the following? (Same trends continued in 2013.)

Re: Daniel Yergin at Davos on Bloomberg Surveillance tv show

Posted:

Sat 24 Jan 2015, 10:08:28by Tanada

B: wrote: You have behind you an historical confidence. You’re an International Relations doctorate out of Cambridge, and you move on to a whole series of books that say essentially, read history or you don’t know the present. From the past what can you bring forward for Americans to say “Don’t panic about the plunge in oil”.

Yes yes, we should all take our advice about the future of world oil production from a PhD in International Relations. Heaven forbid we listen to actual geologists or oil field workers, heck most of those people only have real world experience in the field we are concerned about backed up by advanced degrees IN THAT TOPIC!

Re: Daniel Yergin at Davos on Bloomberg Surveillance tv show

Posted:

Sat 24 Jan 2015, 10:48:12by forbin

" the International Energy Agency, the US Department of Energy, and the US Geological Survey all issued forecasts that world oil production would grow steadily to achieve 120 million barrels per day by 2020, while prices would remain at the level of $20 per barrel (in 1998 dollars) even beyond that date....."

Mon, 02 July 2012

Peak oil is just a point in time , nothing more , nothing less

but its good sometime to look back at forecasts on both sides and I a mindful to point out that the USA is the only region to have increased its production despite the higher oil prices , now fallen to only double their historical value .

I'd welcome posts from other commentators on which other regions have , when faced with such bounty , have increased their production - Iraq has I know but 3.5 million when values of 5-9 were predicted is not inspiring .

We shall see

Forbin

Re: Daniel Yergin at Davos on Bloomberg Surveillance tv show

Posted:

Sat 24 Jan 2015, 10:55:57by Paulo1

Remember this one?

"He who laughs last, laughs longest"

Now, many of us we'll have a fading sick tone to our laugh, "heh heh, I told that idiot not to use that old ladder, but....." And many of us have felt embarrassed at laughing when someone does something slapstick and hurting, but maybe in this case.....

When this unfolds, as it will with shale plays closing and reluctant (burned) investors holding back on the funds to get it going again, you will have lots of opportunity to laugh.

Those letters to editors will feel good to write.

Patience, Grasshopper.

Re: Daniel Yergin at Davos on Bloomberg Surveillance tv show

Posted:

Sat 24 Jan 2015, 12:50:13by GHung

I never 'got' Yergin anymore than I 'got' Peewee Herman. It baffles me as to how these folks ever rose to prominence.

Re: Daniel Yergin at Davos on Bloomberg Surveillance tv show

Posted:

Sat 24 Jan 2015, 13:49:57by BobInget

It took no less then 1,700 Private Jets to get delegates, media, including we presume

Daniel Yergin to that Davos conference.

One would think, if these dudes were concerned about GW they could have at least 'jet pooled'.

Facts seem clear. Since no personal single act has an appreciable effect on ice melt or ocean temps or drought in California, Sahel, Brazil, lets all enjoy while we are able.

http://www.careclimatechange.org/public ... -change=42

Re: Daniel Yergin at Davos on Bloomberg Surveillance tv show

Posted:

Sat 24 Jan 2015, 14:02:02by BobInget

I need to get two of the stupidest things I read about today, off my chest.

1) Sarah Palin is running for president.

2) A plastic container lid that repels yogurt.