Peak Oil Barrel dissects the various reports put out by EIA etc and other stuff, lots of good comments in the box if you can follow, thanks to Ovi and Ron for these

Some Items:

https://www.ogj.com/general-interest/ec ... d-recoveryIEA: Omicron variant will not upend oil demand recovery

Dec. 15, 2021

Emergence of the COVID-19 Omicron variant and the surge in new COVID-19 cases is expected to temporarily slow, but not upend, the recovery in oil demand that is under way, the International Energy Agency noted in its December Oil Market Report.

OGJ editors

https://www.worldoil.com/news/2022/1/3/ ... f-capacityRussia’s weak December oil production signals lack of capacity

1/2/2022

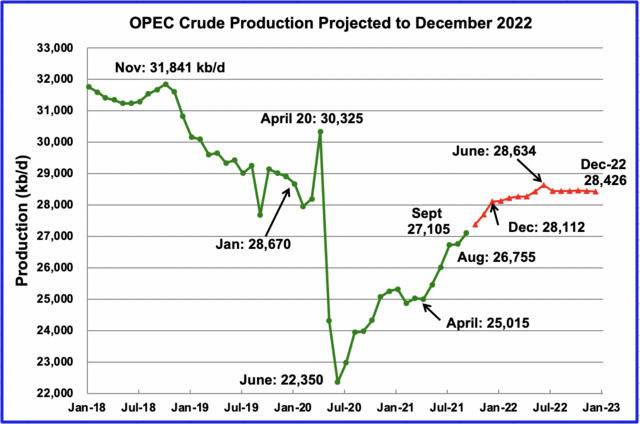

(Bloomberg) --Russia failed to boost oil output last month despite a generous ramp-up quota in its OPEC+ agreement, indicating the country has deployed all of its current available production capacity.

With OPEC+ meeting in two days to consider output policy in the face of the fast-spreading omicron variant, Russia’s lack of growth highlights the limits of the group’s attempt to boost supply if demand continues to recover. Saudi Arabia, Iraq and the UAE can raise output, but others such as Angola, Nigeria and Kuwait are struggling to meet their quotas.

https://www.upstreamonline.com/producti ... -1-1096556In a first full interview since his appointment to the post in November 2020, Nikolay Shulginov told Moscow business daily Kommersant that the country’s oil and condensate production may rise to a plateau of 560.3 million tonnes (11.25 million barrels per day) in 2023 and 2024.

https://www.spglobal.com/platts/en/mark ... conference[global] Spare production capacity has shrunk significantly due to underinvestment, the head of Saudi Aramco said Nov. 9, warning that the potential rebound in jet travel and continued power plant demand for liquid fuels could create a worryingly tight market in 2022.

"Unfortunately, there is not enough investment in the sector to increase supplies and maintain that spare capacity," Aramco President and CEO Amin Nasser said at the Nikkei Global Management Forum.

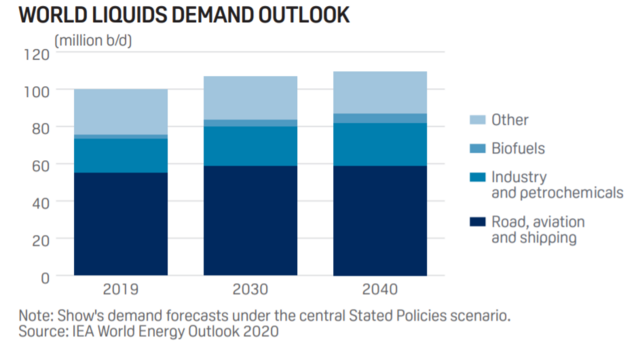

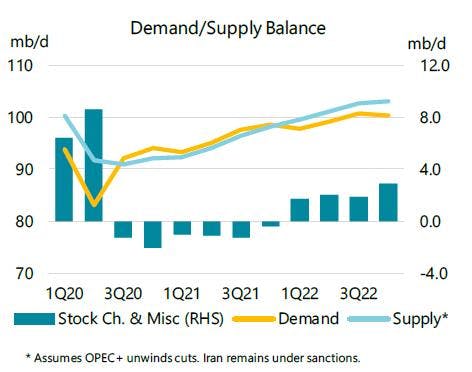

He estimated that global oil demand would surpass pre-pandemic levels of some 100 million b/d next year. Jet fuel demand remains about 3 million-4 million b/d below where it was before the pandemic, and a recovery in air travel would quickly consume the world's spare production capacity, he said.

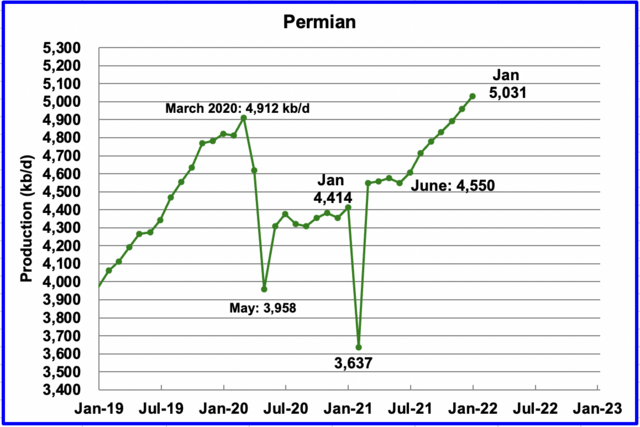

https://www.oilystuffblog.com/single-po ... few-placesTake those "few places," those heavily saturated core areas, the hearts of the two watermelons, out of the Permian Basin picture and America's last hope for long term oil supply and long term energy security goes from 4. 5MM BOPD down to less that 400,000 BOPD...

And remember, please, 70% of all Permian Basin tight oil production, from just those few counties, gets exported, most of it to Asia, some to China. In spite the bullshit from the tight oil sector and its paid cheerleaders, US crude oil exports offer very little benefit to the American consumer.

The public is being horribly misled about tight oil longevity and that our nation has enough tight oil reserves to spare, to export to other countries. We do not. Our children deserve the hydrocarbon option while the renewable transition occurs.

---

This is a general thread for news and discussion of peak oil topics this year.

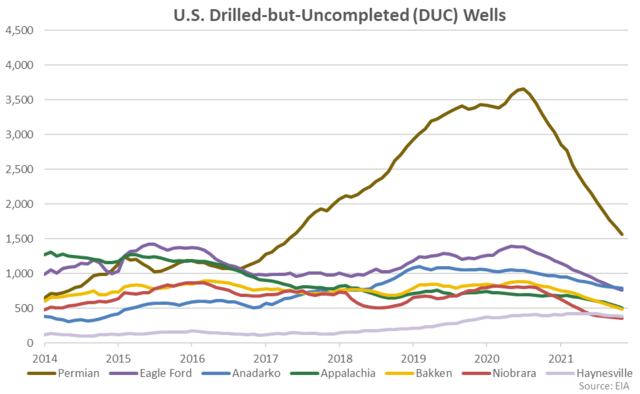

I think the big news for me is LTO growth in the US hinges entirely on the Permian and just a few counties at that. All other basins are either falling or flat and below their pre-pandemic high.——POB.

Conventional of course is continuing to decline as it has been since '72. Permian is the lone exception and has exceeded its previous max. Much of the Permian growth is coming from previously drilled well just now being completed. The number of uncompleted is falling fast and after that its back the the Red Queen.

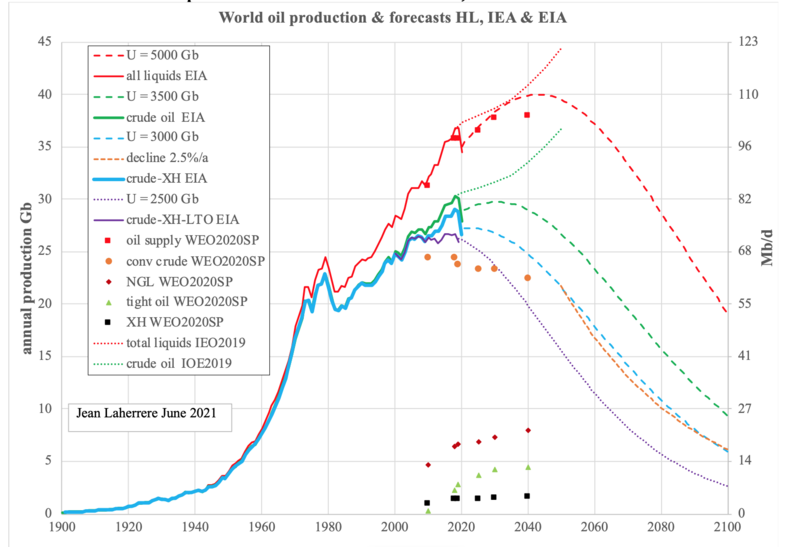

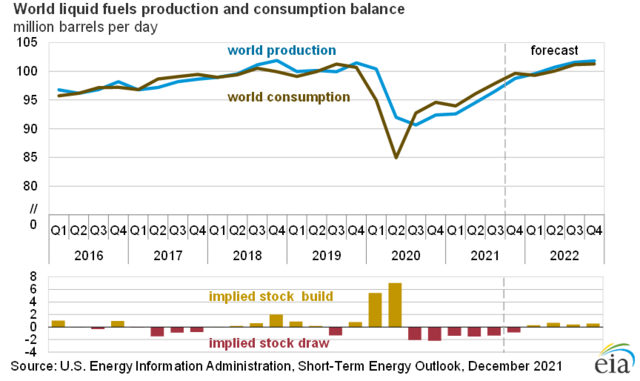

This year could be interesting, can we exceed the previous peak or not. I would guess demand will exceed the previous high unless omicron's little brother is more deadly. IEA and EIA and KSA & RU all say there will be supply & stock builds this year but EIA and IEA have been dialing back their Dec. 22 projections just about monthly.

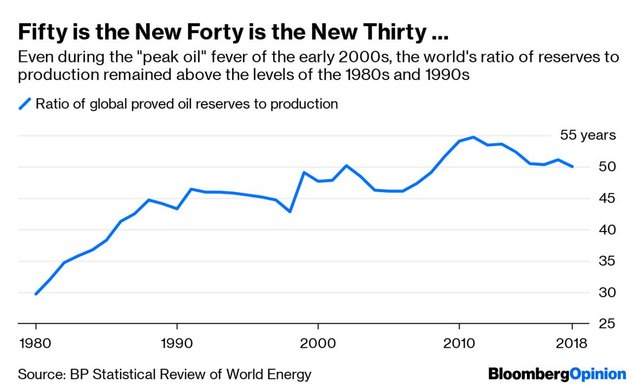

One thing for sure, forecasts of impending peak demand were as wrong as any peak supply prediction. In fact the IEA predicts no reduction in global oil supply and demand to 2050 except in the most extremely restrictive policy scenarios, in which the developed countries support all the countries that depend on exports and those that want to become "developed." We're more likely to bomb them back to the caveman days.

My WAG is for a few more years of supply growth... but I've been wrong before.

For as much energy news as you can stand: The Energy Bulletin by Tom Whipple