Re: Peak Oil 2020/2021

Revi wrote:It seems like the cost of extracting liquid fuel from anything other than petroleum is too high to create anything like the $2-3 gas we're used to getting.

I think this is key. It isn't so much that there are no alternatives, it's that there are no replacements.

Economists divide the economy into sectors; primary, secondary and so on. The primary sector is that which extracts basic raw materials, and there is none more basic than fossil energy. Oil is the master resource, conventional was basically too cheap to meter. One can tiptoe around the fact but it remains.

Scavenging the waste stream of fossil fueled agriculture as in TDP, methane digestion, etc is part of the secondary industrial sector—and if there is a "secondary" secondary, recycling would be that. As are all such processes to create synthetic liquid fuel, they rely on a cheap energy primary stream and the built infrastructure of waste enabled by decades of that same cheap fossil fuel.

That we have a waste stream at all is due to fossils. You can't lose step one and expect step three to continue apace.

Even the non-conventional, energy intensive sources of fossil fuel that are highly mechanized don't really belong in a primary category, CTL, tar-sand flushing, SAGD, and LTO are more akin to manufacturing. I don't know what the dividing line is, it's the old question of drawing EROEI boundaries I suppose. But at some point their need for vast quantities of actual raw materials; water, sand, steel, diesel, disposal space, etc will likely reveal their dependence on cheap primary energy.

The only real solution is to reduce use to the point we can meet our need with dispersed sources.

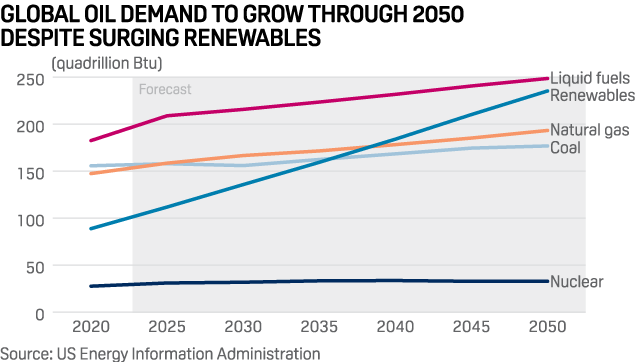

That is an infinity of life change in one sentence. My horizon is maybe 20 years plus or minus and I don't really have a clue as to how much of that change I might see. The next year or two will give me some insight as to whether I need to hunker down again. The EIA is forecasting evermore production, right up 'till the arrival of the Jetsons makes fossils obsolete.

.

he is an Earth Science's major. Digging into crude I got my recent data mostly from the EIA and Platts. Im tired of providing links for things most anyone here can find for themselves.

he is an Earth Science's major. Digging into crude I got my recent data mostly from the EIA and Platts. Im tired of providing links for things most anyone here can find for themselves.