Page 1 of 12

Have we hit the peak?

Posted:

Wed 18 Sep 2019, 12:12:17by Revi

Losing 5 % of the world's oil supply for a month combined with slowing fracked oil in the US has taken a lot out of the system. Will next year's oil supply be able to top 2019? Have we hit the peak? What do you think?

https://www.houstonchronicle.com/busine ... 090615.php

Re: Have we hit the peak?

Posted:

Wed 18 Sep 2019, 12:43:02by StarvingLion

I think there will be an awful lot of explosions to come in KSA.

Fake Money demands it.

I said many times that KSA would turn into Venezuela.

The Morons who think Suncor is safe are dense. Once KSA production tanks big time, forget about the Tar Sands being fundable. More oil offline.

Then the BrainDead will go nuts on EV's.

Then the lights go off.

Then the ammunition boxes are distributed.

Then its 5000 Stalingrads without the supply chain.

Then its Buzzard Meat Time.

Re: Have we hit the peak?

Posted:

Wed 18 Sep 2019, 20:05:22by Outcast_Searcher

Revi wrote:Losing 5 % of the world's oil supply for a month combined with slowing fracked oil in the US has taken a lot out of the system. Will next year's oil supply be able to top 2019? Have we hit the peak? What do you think?

https://www.houstonchronicle.com/busine ... 090615.php

1). Well, the WSJ says KSA oil production to return to normal by the end of the month.

Even if it's only close, it's not like this event was dramatic, re preventing oil from reaching customers.

2). Over time, global oil production rises as GDP rises. I'll believe that relationship has changed and that we've "peaked" when that has been shown by global production numbers from reliable sources for, say, 5 years or more, in a reasonably healthy economy. (In a real bad economy, lack of demand is likely temporary).

3). I think the peak will come from a dearth of transport demand at some point, as private transport is gradually electrified -- not because there isn't enough oil to meet demand with the technology we have.

I think that could take a couple decades or so to happen, amd a key sign will be low overall oil prices after taxes instead of ever-higher oil prices (suggesting lack of demand would be due to unaffordability).

Re: Have we hit the peak?

Posted:

Thu 19 Sep 2019, 01:45:46by EdwinSm

Taking out 5% for a month in 2019, should help with 2020's production matching that of 2019, so if production can be restored (as it is claimed it will be) then we might not be a the peak.

Conversely If the reports of returning to full production within a month are overstated then there will be a greater chance that we have hit the peak.

Time will tell (especially if Saudi Arabia keeps using western weapons to bomb Yemen and Yemen, or its allies, responds by hitting back at Saudi Arabia).

Another major attack could well usher in the "Peak Oil" point, which could be due to political (military) factors rather than geological factors. The latter is hard for me to predict, and the former almost impossible. I personally do not expect the "Peak Oil" point to have any immediate impact, but am worried when the idea finally filters to the general population causing reactions that could make a gradually increasing problem suddenly a large problem (eg riots leading to destruction of infrastructure).

Re: Have we hit the peak?

Posted:

Thu 19 Sep 2019, 14:06:09by AirlinePilot

Not yet, but we are close IMHO. Challenges ahead for the US Shale industry in growing production along with everyone else on the planet pretty much at peak mean to me there is a shot at incremental growth over the next few years, but after that I'd say we start the long slow decline globally.

I find it mildly interesting to follow this nowadays. I do believe that most of us got it wrong only for a little while. In the grand scheme of the oil age......over the course of @120 years....missing the peak prediction by less than 10% is not that big a miss. If you look at most of the bigger predictions calling it between @2008 and now, none of them were really that far off. I do think the final decline will not be catastrophic, but it will be problematic.

Re: Have we hit the peak?

Posted:

Thu 19 Sep 2019, 15:19:50by Sys1

Another major attack could well usher in the "Peak Oil" point, which could be due to political (military) factors rather than geological factors.

Geological world peak oil won't be neutral regarding politic and economic system. War will probably be a result, war which will accelerate peak oil... Worse, we will be so busy trying to figure out how to deal with future "crisis" that nobody in mainstream medias and general population will notice anything close to peak oil.

Only us here shouting in the desert.

Re: Have we hit the peak?

Posted:

Thu 19 Sep 2019, 15:45:34by Ibon

NO peak yet. May never happen if a deep recession plus electrification of transport creates enough demand destruction that we then see the slow decline of oil consumption. This actually would be peak oil but not because of geology. I do predict that peak oil will not result from the geology of depletion but rather from recessions, instability, maybe wars or further terrorist attacks and the ramping up of electric vehicles. And let's not forget Greta.

Re: Have we hit the peak?

Posted:

Fri 20 Sep 2019, 10:06:54by Revi

it's strange how it hasn't affected even the price of oil this week. Maybe we aren't anywhere near peak...

Re: Have we hit the peak?

Posted:

Fri 20 Sep 2019, 13:43:31by Outcast_Searcher

Revi wrote:it's strange how it hasn't affected even the price of oil this week. Maybe we aren't anywhere near peak...

In the real world, the people who are trading things like oil are trying to gauge the actual impact, over time, of an event. Not spew their beliefs, and back them up with utter spuriousness.

The CME WTI futures contracts are in normal backwardation. This is consistent with oil stocks not rising much at all compared to the minor spike we had in oil futures shortly after the attack -- overall, traders don't believe we have a future crude oil shortage -- either re oil stock or oil futures behavior.

Oil futures are up a few bucks or so compared to where they were before the attack, which makes sense given the likely geopolitical risk (more such attacks, tension with Iran, etc), plus the fact that we don't know when full KSA production capacity will be restored.

...

To me, any claims that this event has much at all to do with "peak oil" is completely lacking merit.

But then again, I'm not trying to sell anything.

Re: Have we hit the peak?

Posted:

Mon 23 Sep 2019, 12:09:55by Revi

Something's happening. Anyone know what's going on today? I know there has been a lot of saber rattling, but what else has affected the markets? A friend said that oil hasn't gone up despite the recent attacks because traders feel that US fracked oil will save the day. What do you think?

Re: Have we hit the peak?

Posted:

Mon 23 Sep 2019, 18:24:07by Pops

No this isn't the peak.

Iran is locked out, KSA offline, Brazil is opening their offshore, and prices are relatively low compared to the run-up to the frack bust in '15.

Ibon is right, we're due a recession, which will slow demand growth and ease scarcity pricing, while depletion continues even to the point of decline possibly.

I've said for a while that fracking will mask the beginnings of decline in C+C, it already has lent an air of abundance when reality is 15 year plateau otherwise. Still there is the problem of tight declines. Note how total EF production to 2015 falls 75% in a year without drilling, and even when the price returned it couldn't rise to the previous level. Granted the price isn't as high. Yeah there is a tail but when the sweet spots are gone their gone.

Re: Have we hit the peak?

Posted:

Tue 24 Sep 2019, 04:28:30by ralfy

Re: Have we hit the peak?

Posted:

Tue 24 Sep 2019, 07:49:19by EdwinSm

Revi wrote:Something's happening. Anyone know what's going on today? I know there has been a lot of saber rattling, but what else has affected the markets?

My 2 cents worth on this is that Saudi Arabia did have the spare capacity they claimed (to be able to ramp up production). Even though the damage seems to have been significant the bounce back in productions implies (at least to me) that they are using some equipment that had been idle.

It is good to know that they did have spare capacity and that they were able to bring in on line rather quickly.

Re: Have we hit the peak?

Posted:

Sat 28 Sep 2019, 15:57:10by Sinclarsorus

Yeah China recently made a deal for more with Saudi Arabia for 65 Billion a year. It was right before the drone attacks, so it makes you wonder what all this is about.

My theory is the Overnight Market for banking was impacted some way from the drone attacks, and either decreased the amount of investment money available for banks to sell the monthly credit card debt created, or Credit Card operations are out of control or much higher than normal. The interest on this short term debt would be much higher with either activity. I think the slowing of the Petro-Dollar out of Saudi Arabia must have impacted that OM market, there wasn't enough money to borrow basically.

I tried to calculate the value of lost oil production though from the drone attacks but it was no where close to the half a trillion bailout planned by the Fed to the middle of next month, so there must be some other liquidity problem more than just reduced oil money to banking. Its more inline with the 2008 bailout in operation. But basically banks a flooded with money at very low interest as well, so will make big gains.

Re: Have we hit the peak?

Posted:

Sat 28 Sep 2019, 16:21:40by Sinclarsorus

Revi wrote:Losing 5 % of the world's oil supply for a month combined with slowing fracked oil in the US has taken a lot out of the system. Will next year's oil supply be able to top 2019? Have we hit the peak? What do you think?

https://www.houstonchronicle.com/busine ... 090615.php

Hard to say, too many variables in play right now to predict anything. We will know in a couple of years, things don't happen overnight anymore, too many bailouts and A.I Computer control of markets, Money can be created at the push of a button as the lender of last resort. That's why everyone has been wrong about predicting a 1929 devaluations and collapsing oil markets etc. (The system is rigged)

The irony of it all, everyone is predicting a recession when where all ready in a depression technically but we don't recognize it because of all the funny money figures were given. When you have 90 million working age people out of regular employment and the GNP could have been 5 trillion higher from past performance, your already in a depression.

I have seen figures that 2050 will be the big drop off for oil at present production, but in just a few years many other countries will be consuming much more so your looking at about 2030 or so before the market dies I think. (It all depends on what figures you believe in or are reported).

Remember when we hit Peak Oil in 1970, that was 50 years ago, Now were talking 2050?

Based on past performance its too hard to tell right now. We will find out someday though.

Re: Have we hit the peak?

Posted:

Tue 01 Oct 2019, 14:44:42by Revi

This is behind a paywall, but maybe it signals that we are getting there:

https://www.wsj.com/articles/shale-boom ... 1569795047

Re: Have we hit the peak?

Posted:

Wed 02 Oct 2019, 03:59:19by EdwinSm

What I could read (before the pay wall), was that Shale is still growing, but at 1% instead of the previous 7%.

Is 1% growth from Shale able to counter the declines elsewhere?

Re: Have we hit the peak?

Posted:

Wed 02 Oct 2019, 06:05:56by Simon_R

I have thought for a while now, we are on the bumpy plateau, oil from conventional reservoirs has peaked, and we are just finding ways to use other liquids, this is a short term measure (decade/s), to keep BAU trundling along.

Question is when will Frakking start to slow down, and at what point wil Kerogen be seen to be economically viable.

Re: Have we hit the peak?

Posted:

Wed 02 Oct 2019, 07:43:04by Revi

I just saw another vid by Kirby, and he says that we are doing the whole fracking, shale oil thing just to hold up the petrodollar. He says with a lot of countries using other currencies to sell and buy oil we needed to have something to pour all those dollars into that's considered to be oil. By producing all that oil and selling it in dollars it holds the whole system of the petrodollar up. He also said that when the money goes into a hole it keeps us from having inflation.

Maybe that's the big reason we have all this fracking when it's economically unviable everywhere else.

It also signals that when the dollar goes down we will have peaked for sure. I have heard that 98% of the growth in oil production worldwide came from our shale oil.

In a way it's way scarier than just peaking, because our fate is intertwined with it...

Ignore the crap about "our dear leader", but here is the video. He talks about the petrodollar pretty early in the vid:

https://www.silverdoctors.com/headlines ... ing-truth/

Re: Have we hit the peak?

Posted:

Wed 02 Oct 2019, 10:20:32by Pops

EdwinSm wrote:What I could read (before the pay wall), was that Shale is still growing, but at 1% instead of the previous 7%.

Is 1% growth from Shale able to counter the declines elsewhere?

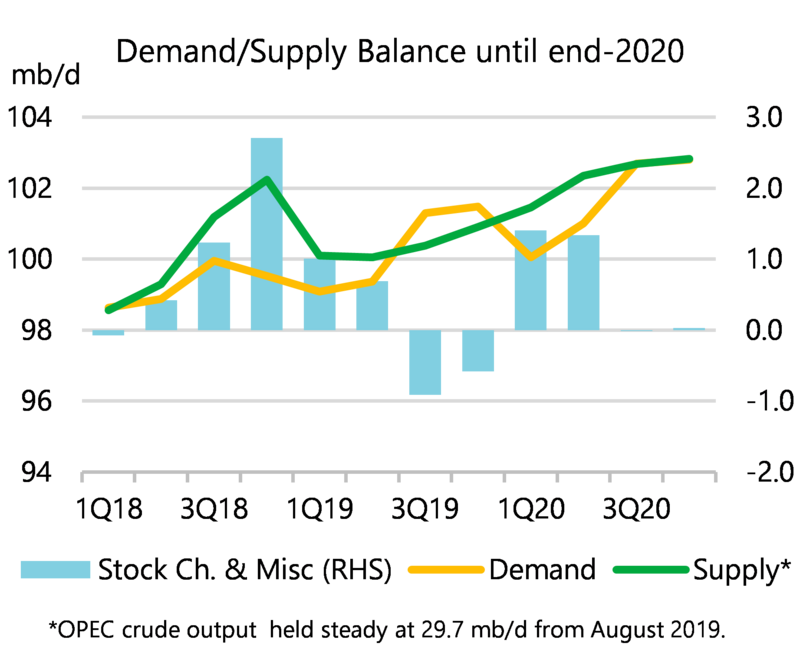

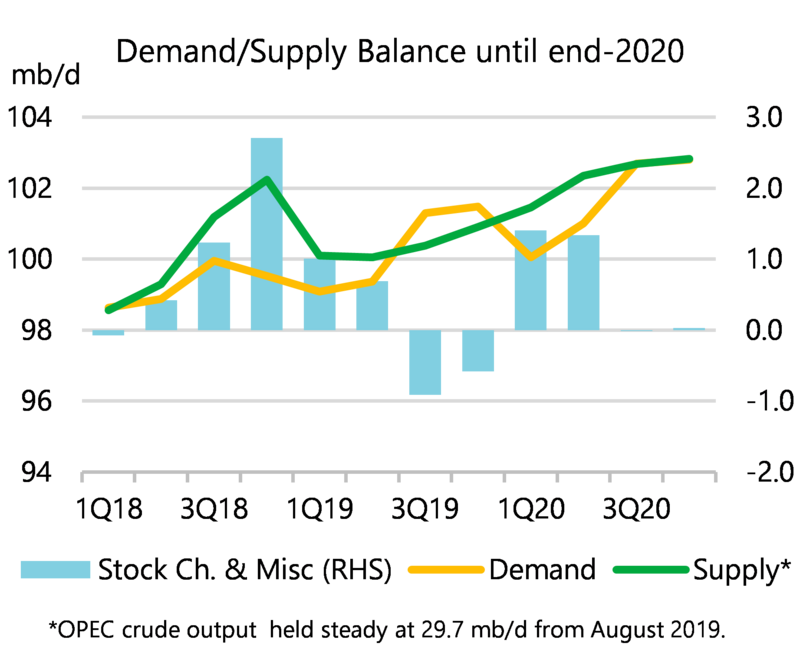

IEA OMR expects demand growth is 1.1mbd and supply growth is 1.3mbd through 2020