Re: Why We Should Be Concerned About Low Oil Prices

kublikhan wrote:Price elasticity is a basic concept of econ 101:ralfy wrote:So much for Econ 101?kublikhan wrote:Oil prices change quickly in response to supply/demand balances(or perceived future balances).Demand does not respond quickly to price changes.

Econ 101: Principles of Microeconomics Chapter 6: ElasticityEconomics 101Price elasticity is a concept known for measuring the responsiveness of demand and supply quantities to the changes in price.Good point. And global oil production/consumption is still rising:ralfy wrote:Why VMT and car sales in the U.S.?

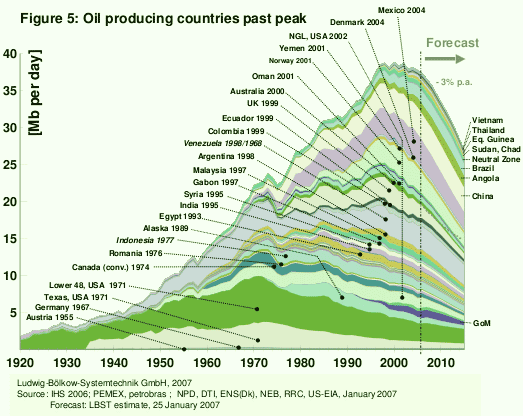

Why not look at global oil production and consumption?

Total Petroleum Consumption - World

So, consumption and supply kept rising even though prices soared and dropped.