Page 1 of 8

Seneca Cliff

Posted:

Mon 24 Oct 2016, 12:40:34by Revi

The idea of the Seneca Cliff has been getting out there quite a lot lately. Uno Bardi, who worked on the first Limits to Growth coined the term to describe the quick deterioration of a culture once a peak was reached. I think it was first spoken by Seneca back in Roman times when he said "increases are of sluggish growth, but the way to ruin is rapid."

It's been on Zero Hedge, SRSRocco report and a lot of other places lately.

It makes a lot of sense in light of what the Hills Group is saying. Basically that the useful energy in each barrel of oil is going down and down as we get it in more and more difficult ways. They say that by 2022 there won't be any net energy in a barrel of oil. Scary stuff. What do you think? I think they might be right, and that the backside of Hubbert's Peak may be way steeper than the way up!

Re: Seneca Cliff

Posted:

Mon 24 Oct 2016, 12:42:54by Revi

Here's Ugo Bardi's explanation of his theory. It makes a lot of sense.

http://cassandralegacy.blogspot.com/201 ... lapse.html

Re: Seneca Cliff

Posted:

Mon 24 Oct 2016, 12:49:59by GHung

A house can burn down much more quickly than it can be built. Seneca knew that societies work in much the same way, especially when disenfranchised and under-served segments of the population become larger and more angry due to many factors. Sound familiar? They will rarely identify the real underlying causes, but blame each other.

Re: Seneca Cliff

Posted:

Mon 24 Oct 2016, 16:24:07by Peak_Yeast

We can probably see the problem in action in all those countries with wars. - Iraq for example:

Down is easy. Up is difficult.

Same with Kuwait:

The rise is slower than the drop.

I am not sure if seneca only refers to exploitation of the field / resource. But it seems certain that "above ground" factors is to be the defining variables of the cliff.

Re: Seneca Cliff

Posted:

Mon 24 Oct 2016, 17:00:51by sparky

.

the good point of a collapse is that it strip the delusion from reality ,

those brutal readjustments were simply the blowing of the froth from the beer

that's why it is so sudden

inversely for rise to happen , some degree of caution is counterbalanced by measurable gain

until exuberance and speculation run ahead again.

same with societies colapse , it's a readjustment to sustainability , a hard reset of the system

Re: Seneca Cliff

Posted:

Mon 24 Oct 2016, 22:49:11by AdamB

Revi wrote:The idea of the Seneca Cliff has been getting out there quite a lot lately. Uno Bardi, who worked on the first Limits to Growth coined the term to describe the quick deterioration of a culture once a peak was reached. I think it was first spoken by Seneca back in Roman times when he said "increases are of sluggish growth, but the way to ruin is rapid."

It's been on Zero Hedge, SRSRocco report and a lot of other places lately.

It makes a lot of sense in light of what the Hills Group is saying. Basically that the useful energy in each barrel of oil is going down and down as we get it in more and more difficult ways. They say that by 2022 there won't be any net energy in a barrel of oil. Scary stuff. What do you think? I think they might be right, and that the backside of Hubbert's Peak may be way steeper than the way up!

Ugo Bargi has been pimping this idea pretty hard. Just another blogger who got it wrong the last time around, trying to recycle yet another version of already discredited ideas.

Re: Seneca Cliff

Posted:

Mon 24 Oct 2016, 23:23:23by AdamB

Choose your references carefully, lest you innocently become trapped by a already discredited source.

Oopsy Ugo.

http://cassandralegacy.blogspot.com/201 ... ady_7.htmlOopsy Ugo. And my favorite. How many factual errors can you find in the 2nd paragraph? You really want to put your faith in someone that doesn't even know the history and science of the topic he is pretending to understand?

http://cassandralegacy.blogspot.com/201 ... ncept.html

Re: Seneca Cliff

Posted:

Tue 25 Oct 2016, 08:20:16by Revi

What are the factual errors? I agree that the shale gas industry is peaking a little later than Ugo Bardi predicted. The other article talks about the difference between the bell shaped Hubberts curve and the Seneca Cliff that he proposes. Which do you think will be the trajectory?

Here's a quote from the above article:

"What happened, instead, was that large amounts of financial resources were invested into the exploitation of everything that could possibly be drilled, fracked, smashed, squeezed, boiled, or otherwise processed in order to get a few drops of precious, combustible liquids, and that is what has avoided decline, up to now." Ugo Bardi 2013

He was well aware that we had not hit the all liquids peak at that time.

What's the problem? Did you read the whole article?

Re: Seneca Cliff

Posted:

Tue 25 Oct 2016, 09:24:20by AdamB

Revi wrote:What are the factual errors?

Revi, come on, you made a movie about this stuff, and can't spot how much Ugo misrepresents?

Revi wrote: I agree that the shale gas industry is peaking a little later than Ugo Bardi predicted.

Peaking? You mean, after they created so much new supply that they crashed the price, and then chose to stop drilling because of it? That isn't the kind of peak that peakers usually consider a "peak", it is just a response to price signals. Same as if you were faced with $12/gal gasoline and your gasoline usage "peaks" because you decide even if its cold out there you're taking the electric. When the price drops, and its cold, you'll be back into whatever the gas powered alternative is.

The US as a whole represents exactly this profile, give industry the price to make a little coin and what do they do? Repeak the US and drown the world in oil and become the largest producer in the planet of natural gas.

Revi wrote: The other article talks about the difference between the bell shaped Hubberts curve and the Seneca Cliff that he proposes. Which do you think will be the trajectory?

We already know that Hubbert's curve doesn't work, so if the Seneca curve just makes it look steeper on the far side, and we know that instead of dropping places like the US drop slowly and then increase all over again in response to price and applied technology, I'm guessing it is a non-starter from the get go.

Revi wrote:Here's a quote from the above article:

"What happened, instead, was that large amounts of financial resources were invested into the exploitation of everything that could possibly be drilled, fracked, smashed, squeezed, boiled, or otherwise processed in order to get a few drops of precious, combustible liquids, and that is what has avoided decline, up to now." Ugo Bardi 2013

He was well aware that we had not hit the all liquids peak at that time.

Was he? Ugo was right there cheering on the claims of peak circa 2005 and earlier at the ASPO conferences. And we didn't drill everything that could possibly be drilled, yet another hiccup in his knowledge, typical though among those who know little or nothing about the resource base. He isn't a geologist, and his inexperience on the topic is stamped on nearly everything he writes and conclusion he draws. He really needs to go to AAPG meetings instead of blogging get togethers.

Re: Seneca Cliff

Posted:

Tue 25 Oct 2016, 09:55:22by eugene

It's always interesting to watch the argument shift from the concept to "the guys wrong, he's wrong". How do you know he's wrong? He's been wrong before. What is he wrong about? Well, he didn't dot an I and forgot to cross a T. Obviously, except to some, we are in one hell of a bind with energy. But if nit picking is your game, have at it.

Re: Seneca Cliff

Posted:

Tue 25 Oct 2016, 13:16:36by GHung

AdamB said; "We already know that Hubbert's curve doesn't work..."

In what way? I don't know that. How do you expect it to work? Most folks I know who claim Hubberts curve isn't valid have invalid ideas about what it was intended to do. Others know that but repeatedly make misleading assertions about Hubbert's work. It's like the same a'holes who continue to repeat that "solar power doesn't work".

Re: Seneca Cliff

Posted:

Wed 26 Oct 2016, 08:15:41by Revi

I appreciate the way Adam B gets the discussion going, but I really don't understand his points. He is really into tearing down our idols. I guess that makes him an iconoclast, sort've.

Re: Seneca Cliff

Posted:

Wed 26 Oct 2016, 09:37:37by shortonoil

"AdamB said; "We already know that Hubbert's curve doesn't work..."

The primary reason that anyone would say that is probably because they don't understand the difference between a CDF and a PDF. The PDF (Probability Distribution Function) is the first derivative of the the CDF (Cumulative Distribution Function). The PDF is a measure of the time rate of change that production is accumulating. The CDF is a measure of the total accumulation. What is commonly displayed as Hubbert's curve is the PDF of the cumulative production function (CDF); which must have been computed first to derive its first derivative, the PDF.

According to the EIA, the cumulative production of 1335.37 Gb between 1960 and 2009 deviated from the logistic function (Hubbert's curve) by 0.07 Gb. That is an amazingly accurate determination. It is an error of 0.005%.

Here is the family of cumulative curves from 2,000 Gb to 2,700 Gb. Through interpolation we derived the maximum accumulated production that will ever be extracted (P140), and came up with 2285.65 Gb. It seems rather doubtful that the world will ever make 2285.65 Gb!

1900 is year 0 (zero) in this graph. Such as, 100 would be year 2000.

Re: Seneca Cliff

Posted:

Wed 26 Oct 2016, 10:58:19by Revi

I did some back of the envelope math and came up with about 392857 miles left for every vehicle on the planet at 2.2 trillion barrels ultimately recoverable resource. That's the best case scenario. I think we have a lot less than that in reality. Maybe 200,000, which is not much for a diesel. We could be on our last cars now. We'll see...

Re: Seneca Cliff

Posted:

Thu 27 Oct 2016, 09:07:08by Revi

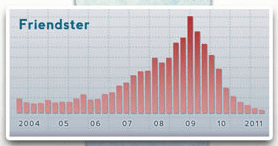

Here's Ugo Bardi's Seneca Cliff in action. Before Facebook there was a program called Friendster. It came up slowly and then crashed hard, leaving a perfect Seneca Cliff.

http://cassandralegacy.blogspot.com/201 ... cliff.html

Re: Seneca Cliff

Posted:

Thu 27 Oct 2016, 10:26:34by ROCKMAN

Ghung - So much of the debate seems to focus on a relatively rapid decrease in oil production due to the current LOWER oil price. And as pointed out many times some of the confusion results from misusing the term "production" for the amount of NEW oil coming on line instead of the amount of existing oil being produced. Thus when folks argue the current price of oil will cause a "cliff in oil production" it can be difficult to understand what the are implying.

But as far as the LOWER prices causing even a modest decrease in production from EXISTING WELLS let alone a cliff-like fall is just silly, in a word. But again the confusion comes from misusing the "cost of production" metric: the correct term is LOE...Lease Operating Expense. Estimates of $25+/bbl as a general "cost to produce" (IOW LOE) oil is rediculous. Difficult for many to understand that the current price of oil is many times greater then the vast majority of LOE's...in some cases as much as 20X as high as the cost to produce some oil. Using $X/bbl to produce oil is not the correct context to consider because using $5 to $15 per bbl is difficult for many to accept.

But that's the reality. Here's a way to grasp the realty of the situation:

Don't think that $2 to produce (LOE) a bbl of oil is cheap. If you’re producing 100 bopd your LOE would be $6,000/month. I have a well in La making 250 bopd and its LOE is $3,000/month. Lower then other onshore wells but fairly representative.

But forget my cheap little onshore well. Let’s talk about a very expensive N Sea offshore platform that’s costing not $2,500/month or even $6,000/month. Let’s use $300,000 per month to run that platform. That’s $3.6 MILLION PER YEAR! Now that’s expensive, eh? And it isn’t one of those big fields making 100,000 to 300,000 bopd…just 5,000 bopd. So let’s see: 5,000 bopd X 30 days = 150,000 bbls per month. And $300,000 per month/150,000 bbl per month = $2 per bbl LOE. WTF! I thought $2/bbl was cheap? LOL.

Obvious one can’t look at a production cost of $X/bbl and decide if that’s cheap or expensive. Consider one of our big DW GOM fields doing 150,000 bopd. And if the LOE is running $2/bbl that means it’s costing the operator over $100 MILLION PER YEAR to produce that field. That's about $250,000 PER DAY. Much higher then is typical. IOW folks are thinking $X/bbl is cheap because the are putting into the context of what oil is selling for. Obviously wrong: the proper context is what the total cost to produce a field compared to the gross revenue it’s generating.

Let’s look again at the relatively small 5,000 bopd N Sea field and assume it’s not costing $3.6 million/year to produce but about $40 million per year. Now that’s expense production. So it’s costing about $22/bbl to produce (LOE). So with an LOE about 10X the $2/bbl value this relatively small but extremely expensive ($40 million/yr) field to produce is currently yielding a $40 million net revenue with oil selling for about $42/bbl.

Bottom line: oil price could fall 50% from $45/bbl and it would have an insignificant affect on the production rate from EXISTING WELLS. So no "Seneca cliff". Which implies nothing about production rates from wells NOT DRILLED YET. That's a different dynamic. If starting tomorrow not a single bbl of oil were brought on line EVER AGAIN oil production would not "fall off a cliff". The current decline rate of existing global production doesn't come close to a "cliff" profile.

Re: Seneca Cliff

Posted:

Fri 28 Oct 2016, 07:14:05by sparky

.

Maybe a telling example is a motor car , getting it cost you plenty but running it is way cheaper

even if it's depreciating , it's still doing its job ,

in fact the depreciation is a problem for the finance company not for the user as long as he can get some millage

Yes Rockman , I know , it's not a very good example , give me points for trying

Re: Seneca Cliff

Posted:

Fri 28 Oct 2016, 09:40:33by ROCKMAN

Sparky - No, a great example and can make it even more fitting. You buy a $120,000 BMW, put $60k down and finance the rest. No problem since you make $100k per year. Not very wealthy but you can handle the note. But then you get laid off and start your new job at $24k/yr. You can still afford to buy fuel and drive around but can't handle that note now. Two options: file bankruptcy and lose the car or sell it cheap not getting all your money back but salvaging some of it.

And that is the story of many of the shale players today. They have enough positive cash flow (can put fuel into that BMW) to produce their wells but not enough to service debt. But just like that BMW the oil production doesn't disappear...it just gets transferred to a differernt owner.

We have most of the wells producing today as we did when oil was $90/bbl. Maybe even a few more...don't forget Kashagan Field. If drilling activity stays depressed long enough it's not difficult to draw the future production curve: go back and look at the pre-shale boom and subsequent price collapse production curve. What does it look like for the US? And globally what does it look like: a plateau of sorts over a number of decades with a somewhat increasing climb. Of course with low oil prices forcing producers to increase their rates it give a false sense of a lot of NEW oil being found. Of course it won't last indefinitely but for now low oil prices have created a Seneca "hill" and not a "cliff".

You heard it hear first, folks: SENECA HILL. Damn, I wonder if I should start a thread by that name. It would really piss off some folks. LOL. What do you think, sparky?

Re: Seneca Cliff

Posted:

Fri 28 Oct 2016, 09:55:18by GHung

Gosh, Rock, a "Seneca Hill" assumes there are enough buyers to maintain that fat tail. Plenty of things can prevent that besides crashing oil production. It's a chicken/egg thang, eh? If credit dries up, it'll effect more than the oil patch. That's the horn Gail has been tooting for years.

Re: Seneca Cliff

Posted:

Fri 28 Oct 2016, 10:36:09by ROCKMAN

Ghung - "...a "Seneca Hill" assumes there are enough buyers to maintain that fat tail." It isn't an ASSUMPTION...it's a FACT that no one can deny. The numbers are there in black and white: as a result of lower oil prices global oil production has increased. We have rode up the Seneca Hill the last two years and have not driven off the Seneca Cliff.

Of course how long we stay on that Seneca Hill top is a different question. As is what the slope on the backside will look like: gradual vs cliff. Even if all of OPEC cuts production 4% we'll still be sitting on Seneca Hill. And even if total global oil production decreases 4% we'll still be sitting on the Seneca Hill we topped in 2012.

Just some friendly advice: before we spend too much time talking about a Seneca Cliff perhaps we should wait at least until we can see over the top of the Seneca Hill. Don't you agree? After all we'll have plenty of time later to run around like our hair is on fire. But for right now we're still in the shower washing it. LOL. The doomers will eventually have their day. But it ain't today, tomorrow or even in the next few years.