Page 11 of 15

The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 01:56:11by Graeme

The lowdown on offshore oil reserves

U.S. offshore oil fields could hold enough crude to supply all of the country's needs for more than 11 years.

Or they might not. No one knows for certain because, with new offshore oil drilling banned on the east and west coasts, no one has gone looking for oil there in years.

Now congressional Republicans are pushing hard to make offshore drilling a key issue in the presidential campaign, hoping to channel the anger Americans feel over historically high oil and gasoline prices. More oil, they argue, will bring lower prices.

The federal government estimates the nation's outer continental shelf might hold 85.9 billion barrels of crude, including 10.13 billion barrels off California. For comparison, the United States consumes about 7.56 billion barrels of oil per year. The nation's sea floor could also could hold 419.9 trillion cubic feet of natural gas, equal to U.S. consumption for 14 1/2 years. But the federal estimates are just that - estimates.

"You don't really know what's there until you go out and drill a well," said Ken Medlock, an energy research fellow at Rice University's James A. Baker III Institute for Public Policy. "And even then, you're not 100 percent sure of what you're going to get."

In addition, offshore oil exploration is slow and costly.

If the federal government opened California's coast to drilling tomorrow, the first exploratory wells probably wouldn't be drilled for at least six years, Medlock said. Bringing newly discovered oil fields into full production would take longer.

sfgate

Re: The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 08:03:55by ROCKMAN

There are prospective areas already identified off the Cal coast. There area had been explored to a fair degree prior to the ban. Certainly companies would want to shoot new seismic data which would take a year or two. The process for the Feds to offer offshore leases takes a couple of years. So, maybe the first wells could be drilled as quickly as 3 years. But whether its 3 years or 6 years doesn't matter. For a significant amount of new production to come from this area would take 10+ years.

So...it may take 10 years. The 18% of US oil production coming from the offshore areas to 10 to 15 years to develop. Does that mean the 1.5 mmbopd + were getting now is unimportant? Ask yourself how high oil prices would be now if we didn't have that oil today.

As far as how much oil may be there I repeat my previous opinion: it's a fool's game to try to maximize or minimize the potential. The only way to determine with an even fair bit of accuracy is to drill. In the oil patch the definition of "probable reserves" is that there's not enough info to prove me wrong. That's a far bit from knowing what's really there.

Re: The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 10:10:56by dohboi

rockman wrote:

"Does that mean the 1.5 mmbopd + were getting now is unimportant? Ask yourself how high oil prices would be now if we didn't have that oil today."

I'm not sure I follow you. Isn't this out of ninety some mmbopd? Yes it would increase prices, but not by that much. Am I missing something?

Re: The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 11:23:01by WildRose

What about the cost of bringing that oil to the market? If a couple million more barrels a day come from offshore fields eventually, would oil prices decrease given the cost it takes to produce them?

Re: The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 11:37:17by shortonoil

Most of that oil is probably in pretty deep water. How many deep water drill ships can be sent to those areas in the next few years, with so few in the world’s fleet. At 4 successful wells per year/ship the end of the oil age will long be over before much of it is developed.

Of course any little bit helps, but whether it will help enough to make a difference is doubtful at best. Maybe it’s time we gave up on oil and put our efforts into rebuilding our society for the enviable new world that will soon be here. The End of the Oil Age world!

Re: The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 11:41:48by 3aidlillahi

dohboi wrote:rockman wrote:

"Does that mean the 1.5 mmbopd + were getting now is unimportant? Ask yourself how high oil prices would be now if we didn't have that oil today."

I'm not sure I follow you. Isn't this out of ninety some mmbopd? Yes it would increase prices, but not by that much. Am I missing something?

Oil prices generally have a few components, none of which are either demand or supply levels independently. What really matters is, AFAIK, is potential (opening of new land to development, tax increases/decreases, new rigs/tankers being built, etc) as well as the over/undersupply. If oil production is 90 mpd and demand is 80 mpd, then that's roughly the same as 70mpd of production and 60 mpd of demand. So losing 1.5 mpd of production would be very significant when we have spare capacity of probably less than that.

Losing 1.5 mpd, such as during the coming hurricane system for example, could be truly devastating to our economic system as oil prices would absolutely be amazing in how high they'd go.

Re: The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 14:26:12by ROCKMAN

dohboi,

It's a relative question: it may be 1.5 mmbopd out of a world consumption of 90 mmbopd but we only produce 5 mmbopd domestically. At $130/bbl it would also represent a loss of $11+ billions dollars to the federal treasury. Even Saudi's production is just a little more than 12% of global consumption. It can be misleading to use percentages to gauge the value of anything. Just a month or so ago Bush humbled himself by begging Saudi to increase their production just 300,000 bopd.

My point was that there's now additional production from any area of the US that can change the arrival of PO though it might delay it a year or two. But I think it's misleading to label any effort to modify the future as being too small or take too long. All the good ideas on alternatives, etc will take decades to have a significant impact. But that doesn't mean they should be dismissed as options to improve our collective futures just because they won't change oil prices in the next 5 or 10 years.

Re: The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 14:35:06by dohboi

Thanks for the clarification, rockman. It's a global market, so I guess I see the global numbers as most relevant. And indeed, every little bit is becoming more and more valuable. The longer we wait, the more valuable it will become. Wny not keep that valuable stuff iin the bank a while and let it become a whole lot more valuable. Nice thing to do for our kids after all the crap we're leaving 'em.

But I'm sure near term greed for us will trump any concern about the future, as usual.

IMVHO, we need gas to get much, much higher as soon as possible to spare us the illusion that there is any viable future of cheap oil we can depend on.

Re: The lowdown on offshore oil reserves

Posted:

Tue 22 Jul 2008, 17:00:26by ROCKMAN

dohboi,

I agree. I was with Jimmy Carter way back when he wanted to bump gas taxes up to drive demand down. But no one wanted to follow his lead. I think the only quick adjustment we can make right now is pushing taxes up but that'll be a cold day in hell when any politician will throw himself on that sword.

Re: The lowdown on offshore oil reserves

Posted:

Thu 24 Jul 2008, 15:26:33by Anjorni

Here's a question - may be naive or not, but what if we keep that ban in place another 10 years? Why dont we keep that oil in the ground for another 20 years (ban lifted + 10 years to extract)?

Basically we'd be drawing down everyone elses reserves, and while yes - we're in a horrible depression with respect to living standards today, we'd still have enough production to keep he farm tractors going to feed us poor souls who lost everything but are still alive and kicking.

Wonder if that argument would hold any water in washington?

Re: The lowdown on offshore oil reserves

Posted:

Thu 24 Jul 2008, 15:35:49by Twilight

Anjorni wrote:Here's a question - may be naive or not, but what if we keep that ban in place another 10 years? Why dont we keep that oil in the ground for another 20 years (ban lifted + 10 years to extract)?

Basically we'd be drawing down everyone elses reserves, and while yes - we're in a horrible depression with respect to living standards today, we'd still have enough production to keep he farm tractors going to feed us poor souls who lost everything but are still alive and kicking.

Wonder if that argument would hold any water in washington?

It would not. The political establishment would have to implicitly acknowledge that tomorrow does not look like today. That remains unpalatable. Until then, you are stuck with the Deplete America First policy.

Re: The lowdown on offshore oil reserves

Posted:

Fri 25 Jul 2008, 12:12:51by ROCKMAN

Anjorni,

Your point is very valid. But the key question is how much will the economy need that extra production in 10 years? I don't know exactly nor do I think anyone else can give a qualified answer. But if you believe that PO is approaching quickly you might want to start developing additional production now to lessen the blow. PO won't be stopped by drilling. I've been a petroleum geologist for 33 years and know what our limitations are. But I also have seen the impact of high oil prices in the past yielding unemployment rates of 10+% and ten's of millions of folks pushed below the poverty line. If we wait to see how bad things get it could be too late to do much to change them.

It may seem a little silly but I'll make the analogy to waiting to put your seat belt on until you're about to have an accident. You can get away with that plan…until you have an accident.

Re: The lowdown on offshore oil reserves

Posted:

Fri 25 Jul 2008, 13:00:52by Peleg

Anyone noticed how CPI jumped as oil fell. I think the people who wonder where gas starts to hurt the US need wonder no more. With the housing slump on $4 is plenty high enough to change everything. I suppose if we still had equity in our homes we might cahs out and not complain too much until $5, but the cold facts are plain to see.

Now Congress is going to try to squash out any speculation. But is'nt that market interference? What if they say this.

1) Only contracts by consumers and suppliers can be entered into, a contract once purchased must be taken posession of at the contract price on the specified date.

So then the market acts much more like some of the grain markets. Does that stop a price signal. It definitely hinders it. So where do you go once you put the fear of the man in all those evil speculators and the pric eonly drops to $120, still far too high to be sustained by our economy? Well now you start to tell suppliers and the supply chains they should cut their profit margin, do you mandate a percentage or do you mandate a flat rate per barrel? All the while you are slowly and methodically strangling the price signal so that your population is edging ever more toward that real awakening, a shortage of finished fuels. And then, if we do not properly account for the way oil is connected to everything else that shortage leads to starving Americans and a political backlash. A new party could be birthed from the ashes, if we are lucky.

When finite resources face exponential growth we know that they conspire to form a logistic s-curve for total production. Time is on our side ladies and gentlemen, and it is working against the cornucopians. Does it matter who is right. I hope they are, I would rather be labelled a cult member, a kook, a false prophet and have there be a way out of peak oil. Unfortunately if they are wrong we need to sound the alarm now just to have hope of mitigating. This year's sorrow is not over with, and next year's will be worse. The world will have to face peak oil. The world will have to get of off oil before the end of my natural lifetime, and it will one way or the other.

It would be pragmatic to get going now, but wisdom is not the way of the Dodo.

Re: Drilling on the Atlantic shelf?

Posted:

Mon 28 Jul 2008, 10:57:32by dorlomin

dpm

Re: Drilling on the Atlantic shelf?

Posted:

Mon 28 Jul 2008, 10:58:51by dorlomin

Do you mean off of the shelf, the shelf is where the continental land mass basicaly comes to an end.... if so then....

http://www.peakoil.com/fortopic42946.html

mostly due to the thinness of the crust on the oceanic shore and steep heat gradient inside the rock leaving a narrow oil window (woo look at me, sounds like I know what I am talking about )

Re: Drilling on the Atlantic shelf?

Posted:

Mon 28 Jul 2008, 10:59:38by Tyler_JC

There probably isn't any oil off the coast of Maine if that's what you're thinking about.

But there might be oil off the coasts of Florida, Georgia, and the Carolinas.

When they're talking about offshore atlantic drilling, they are talking about Florida.

Re: Drilling on the Atlantic shelf?

Posted:

Mon 28 Jul 2008, 11:21:15by ROCKMAN

Folks,

Before you write off the east coast you might search Hibernia Field...discovered in 1979. It's on the Canadian side of the eastern OCS just north of Maine. It has an est. UR of 1.2 to 1.9 billion BO. Recently a 240 million BO was made near to it. They also found a 700 billion cubic ft gas field out there. It's a tough environment to drill and produce but it was done. Drilling down south would be a lot easier.

But geology does change over distances. Might not be as much potential going south...might be twice that much. As a petroleum geologist for 33 years I can tell you no one can predict with any degree of accuracy without drilling...and maybe drilling a lot. A reminder: the great North Sea Basin, with it's 25 billion bo produced to date, took 92 wells drilled before the first big field was discovered. I'll explain again what the oil patch definition of "probable reserves" is": there not enough data for you to prove my number is wrong (be it a big or little number).

Re: Drilling on the Atlantic shelf?

Posted:

Mon 28 Jul 2008, 22:44:40by copious.abundance

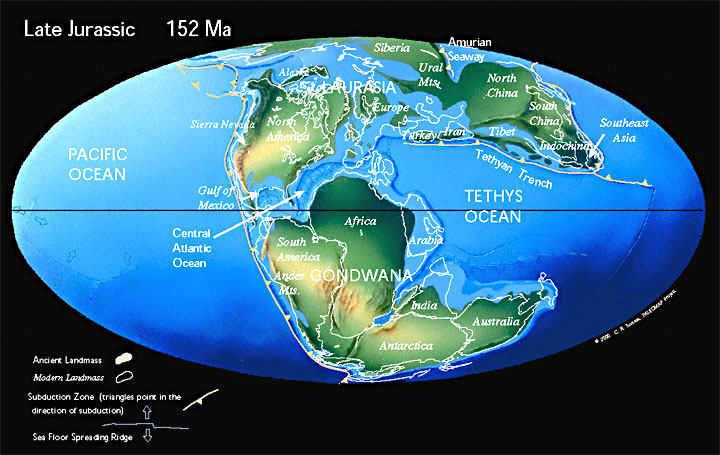

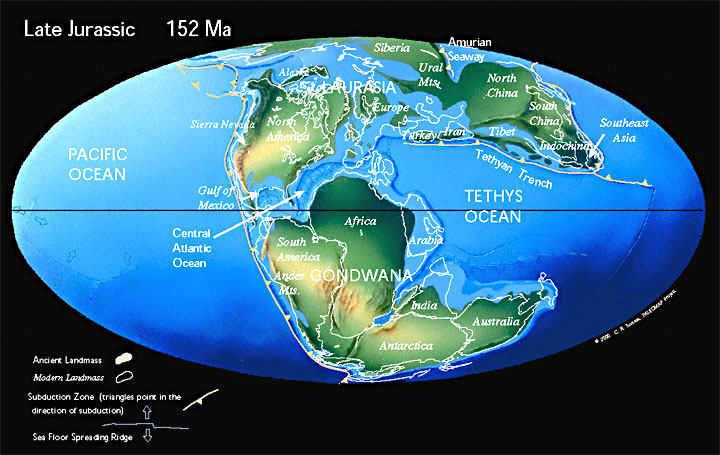

There are large deposits of oil up and down the west African coast, plus they're making large discoveries off the coast of Brazil. Then of course there's lots of oil in the Gulf of Mexico. All these areas were formed around the same time (though the North & Central Atlantic is a bit older). Age, at least, shouldn't be a factor.

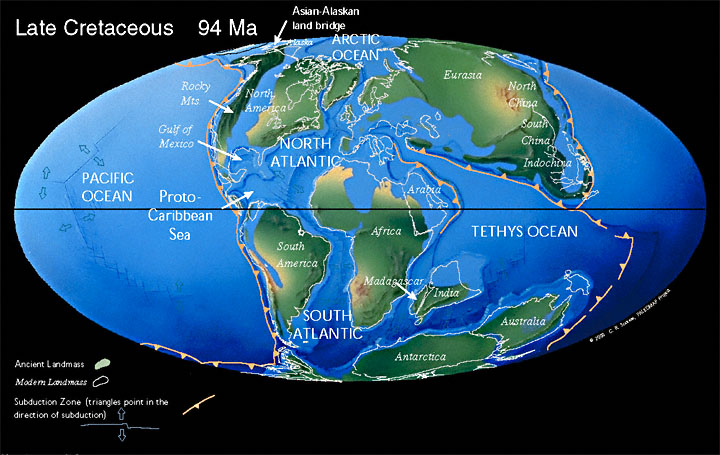

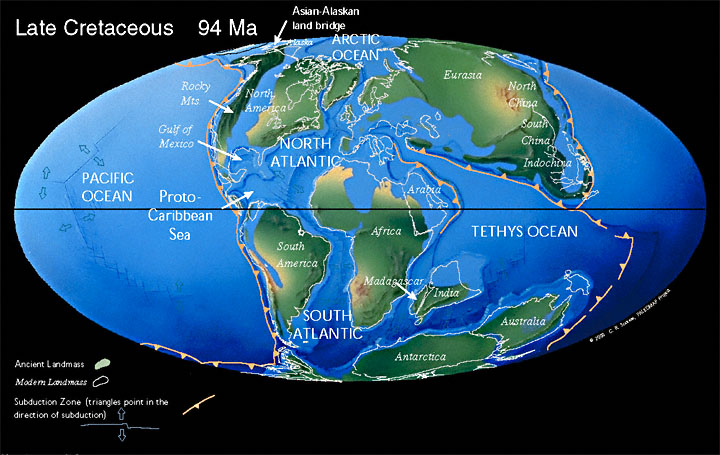

Late Jurassic

Late Cretaceous