In case you haven't seen these articles/graphs, here is a roundup of bottom-up analysis of the short term production outlook, courtesy of the gang over at TOD.

The main page is at Wikipedia:

Oil Megaprojects.

The latest detailed examination is

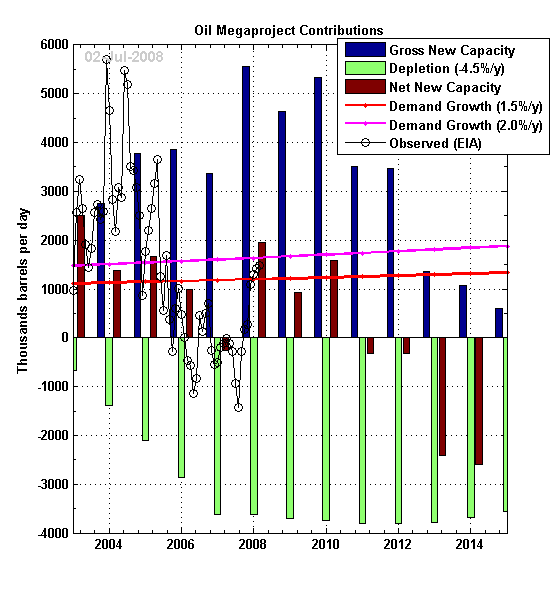

Oil Megaproject Update (July 2008). This chart neatly sums up the situation:

This is based on a 4.5% decline rate, which was announced in the CERA study from early this year:

CERA : News: Press Releases: No Evidence of Precipitous Fall on Horizon for World Oil Production: Global 4.5% Decline Rate Means No Near-Term Peak

From the press release:

CAMBRIDGE, Mass. (January 17, 2008) – The missing link for understanding the future of world oil supply – a solidly based view of oil field decline rates – has now been filled by a new field-by-field analysis of production data by Cambridge Energy Research Associates (CERA) and IHS Inc. The aggregate global decline rate is 4.5 percent, rather than the eight percent cited in many studies, based upon CERA’s analysis of the production characteristics of 811 separate oil fields.

“Some of the more gloomy, pessimistic ‘peak oil’ views about the future of oil supplies that are current today result from an assumption of high decline rates,” said CERA Oil Industry Activity Director Peter M. Jackson, author of the Finding the Critical Numbers report. “This new analysis provides the basis for more confidence about the future availability of oil.

“The absence of definitive, comprehensive analysis of production timelines and decline rates has led to widely differing estimates of the potential future availability of oil: an information vacuum that has contributed to the ‘peak oil’ theory of future liquids production capacity,” he added. “We hope that this study will contribute to a more informed understanding of the issues, both below ground and above ground.’’

This garnered a lot of puzzled responses in the peak oil camp, since a detailed bottom-up examination also suggests it will be quite difficult to overcome even a 4.5% decline. 8% was mentioned as a possiblity by Schlumberger's CEO at some point; many in the peak oil camp had considered lower declines, like 2% based on Hubbert Linerization.

Recent statements from the IEA suggest they believe the decline will be higher, specifically 5.2%:

Supply growth deriving from a concentration of new project start-ups during 2008-2010, allied to weaker economic growth, sees potential spare capacity rise in excess of 4 mb/d. However, this expansion slows from 2011 onwards when global demand growth recovers, leading to a narrowing of spare capacity to minimal levels by 2013. Since the 2007 MTOMR, significant downward revisions have been made to both non-OPEC supplies and OPEC capacity forecasts. Project delays averaging 12 months, coupled with global average decline of 5.2% - up from 4% last year – are the factors behind these revisions. Over 3.5 mb/d of new production will be needed each year just to hold global production steady. “Our findings highlight again the need for sustained, and indeed, increased investment both upstream and downstream -- to assure that the market is adequately supplied,” stated Mr. Tanaka.

3.5 mb/d is as much as Mexico produced in 2006, to put things into perspective. The IEA will release their new bottom-up study in November.

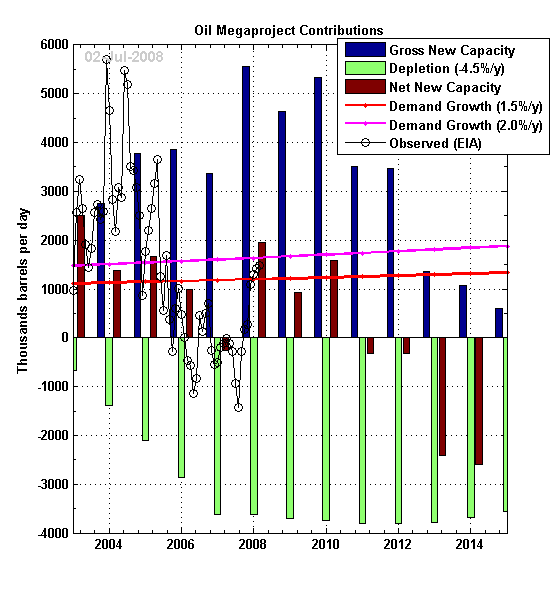

The July update on Megaprojects also included a set of charts showing how the forecast had changed with time, with delays and cutback manifesting themselves. This was animated by member rethin:

As the summary chart shows, 2007 actually yielded a net loss, which may have contributed to the recent price run up. It also shows higher gains for the next 3 years, which is why I'm not concerned about shortages for now, barring an extra vicious hurricane season or a major producer suddenly going offline. The delay involved in developing new projects means that to overcome the mild declines in 2011/12 we should be hearing announcements of major projects in the works now. The major declines experienced thereafter are even more alarming. A tally of new production announcements would be a worthy thread, along the lines of the discoveries catalog.