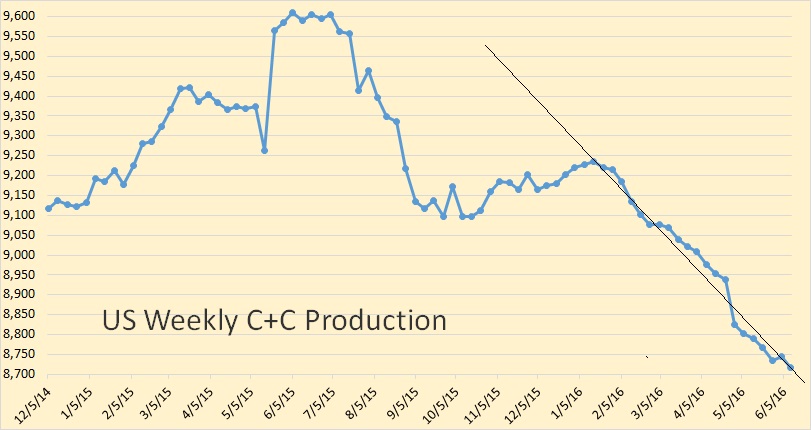

GoghGoner wrote:The STEO is hot off the press. Last December they were expecting production to start increasing by the end of 2016. Now they are saying 0.6 mbd decrease in 2017 from 2016 - wow, that tune has really changed.U.S. crude oil production is projected to decrease from an average of 9.4 million b/d in 2015 to 8.6 million b/d in 2016 and to 8.0 million b/d in 2017. The forecast reflects a decline in Lower 48 onshore production driven by persistently low oil prices that is partially offset by growing production in the federal Gulf of Mexico.

EIA estimates total U.S. crude oil production has fallen by 0.7 million b/d since April 2015 to an average of 9.0 million b/d in March 2016. The entire production decline came from Lower 48 onshore.

To be fair about it since the last STEO came out a couple large fracking companies did announce they are suspending additional drilling this month and suspending fracking operations once their backlog have been brought into production.

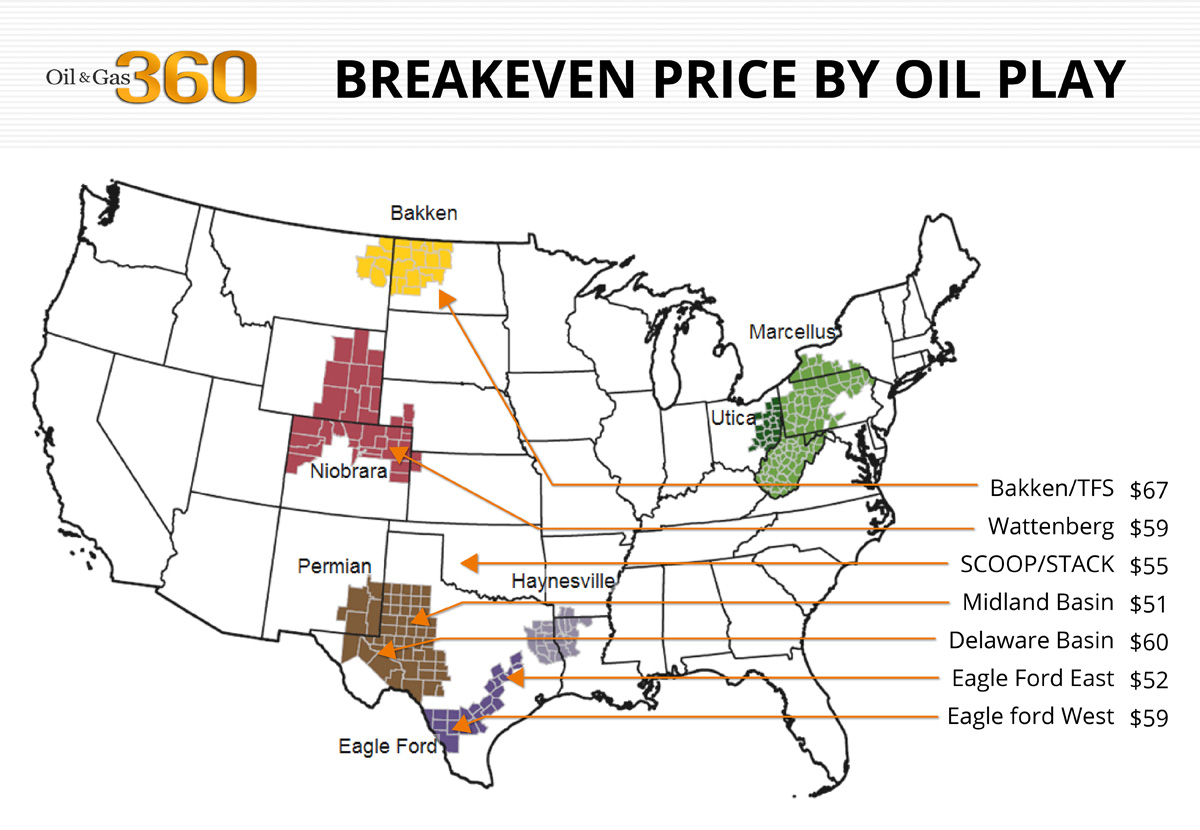

I think a lot of the stripper folks are also looking at closing in wells because of the profitability factor, here in Ohio there were a few new wells being drilled to rework old formations in my county in 2014, but when prices fell last year all that activity quickly ceased. The thing is the USA gets something like 500,000 bbl/d from stripper wells that are only economically viable at $65/bbl and up. Once those wells get shut down it is often difficult or impossible to restart production without a significant investment. As the saying goes, nobody drills to lose money on purpose.

Don't you believe in Inurgy INdependance?

Don't you believe in Inurgy INdependance?