THE Mexico Thread Pt. 2 (merged)

Re: Mexico to reopen energy sector to foreign oil companies

What companies do you think will be willing to risk working in Mexico in the near future? Between the lack of stability and the threat of the government relapse into nationalisation again a few years in the future why risk it?

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4701

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: Mexico to reopen energy sector to foreign oil companies

I can see two kinds of private oil companies that would quickly move into Mexico.

(1) Major offshore oil and gas fields in the GOM are found eastward from Texas into Mexican waters. The same companies that drill in the US GOM waters would probably be happy to drill in Mexican GOM waters.

(2) Texas shales like the Eagle Ford extend from Texas into NE Mexico. The same little oil companies that are bidding on land and drilling and fracking shales in Texas would probably be happy to just continue across the border into the same formations on the Mexican side.

(1) Major offshore oil and gas fields in the GOM are found eastward from Texas into Mexican waters. The same companies that drill in the US GOM waters would probably be happy to drill in Mexican GOM waters.

(2) Texas shales like the Eagle Ford extend from Texas into NE Mexico. The same little oil companies that are bidding on land and drilling and fracking shales in Texas would probably be happy to just continue across the border into the same formations on the Mexican side.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Mexico to reopen energy sector to foreign oil companies

“What companies do you think will be willing to risk working in Mexico in the near future?” A valid question but needs to be broken into two categories. First, is the subcontractor industries. That’s a much simpler proposition: they supply the materials and expertise to expand energy production in Mexico for a fee. Not much risk their beyond getting the last invoice paid.

The second area is obviously risky to some degree: direct investment of foreign capital. But if you do as China is doing else where one devises a plan where Mexico benefits significantly from such efforts so they’ll have the incentive to continue to support such projects. China building and operating a refinery in Mexico that not only increases the downstream value of their oil but also allows them to reduce product imports…a win-win for them. At the same time Mexico is suffering greatly from a trade imbalance with China. Of course, they could just stop importing those $billions of products from China that their citizens require. Or they could just export more oil/products to China. Win-win-win.

It’s also good to remember that this isn’t 1938. I know a lot of folks still refuse to believe it but countries can’t make those “nationalization” moves as risk free as they once could. All countries are much more connected to each other on a global financial level than ever before. And if China appears to be content with their arrangements with Venezuela and is willing to expand there I suspect Mexico will look even more attractive. It’s also good to remember that China doesn’t have to lock up the entire new infrastructure inside of Mexico’s border. Remember that $1 billion China will spend in Costa Rica (just down the coast from all that Mexican oil) reactivating that old refinery. A refinery in a country with no oil. It’s not that China might not lose on any of their international JV investments…they will. But just like investing in the stock market: the key is making a positive net return on all of your investments. In that regards I would put my money on China.

Especially compared to the US. Exactly how much oil are we importing from Iraq after all we “invested” there? And compared to all the other investments the US govt made in future energy production from other countries how are we doing? Oh yeah…the US govt hasn’t invested a penny. Which is exactly the point: a US corporation might not be able to justify the risk of investing tens of $billions in Mexico. But a sovereign nation might. IMHO China would have a tad more stroke dealing with Mexican politicians than the CEO of ExxonMobil. The Chinese govt is working hand in hand with their energy industry to secure future supplies around the globe. This will never happen in the US IMHO. At least not until it's too late to make a difference.

The second area is obviously risky to some degree: direct investment of foreign capital. But if you do as China is doing else where one devises a plan where Mexico benefits significantly from such efforts so they’ll have the incentive to continue to support such projects. China building and operating a refinery in Mexico that not only increases the downstream value of their oil but also allows them to reduce product imports…a win-win for them. At the same time Mexico is suffering greatly from a trade imbalance with China. Of course, they could just stop importing those $billions of products from China that their citizens require. Or they could just export more oil/products to China. Win-win-win.

It’s also good to remember that this isn’t 1938. I know a lot of folks still refuse to believe it but countries can’t make those “nationalization” moves as risk free as they once could. All countries are much more connected to each other on a global financial level than ever before. And if China appears to be content with their arrangements with Venezuela and is willing to expand there I suspect Mexico will look even more attractive. It’s also good to remember that China doesn’t have to lock up the entire new infrastructure inside of Mexico’s border. Remember that $1 billion China will spend in Costa Rica (just down the coast from all that Mexican oil) reactivating that old refinery. A refinery in a country with no oil. It’s not that China might not lose on any of their international JV investments…they will. But just like investing in the stock market: the key is making a positive net return on all of your investments. In that regards I would put my money on China.

Especially compared to the US. Exactly how much oil are we importing from Iraq after all we “invested” there? And compared to all the other investments the US govt made in future energy production from other countries how are we doing? Oh yeah…the US govt hasn’t invested a penny. Which is exactly the point: a US corporation might not be able to justify the risk of investing tens of $billions in Mexico. But a sovereign nation might. IMHO China would have a tad more stroke dealing with Mexican politicians than the CEO of ExxonMobil. The Chinese govt is working hand in hand with their energy industry to secure future supplies around the globe. This will never happen in the US IMHO. At least not until it's too late to make a difference.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Mexico to reopen energy sector to foreign oil companies

The Mexican oil and gas industry is already open to foreign participation. There has been a couple of bid rounds where foreign companies were invited in to service agreements whereby they would be paid through a fee/barrel scheme as well as have all of their capital costs reinbursed. Schlumberger and a couple of others picked up blocks at very low fees.

Because the fees are low and because the current structure of the agreements does not allow for booking of reserves under SEC guidelines there has been little in the way of interest from the independents.

If Nieto changes the agreements to Production Sharing Contracts or Royalty Tax agreements then there is likely to be a flood of activity with companies interested in revisiting the old fields that haven't been subject to modern technology and the Eagle Ford trend continuity. Developing the latter would be challenging I suspect since the trend comes across the border not far from Cuidad Juarez where much of the cartel violence seems to be located. That being said oil companies are working in Iraq, although I suspect the Sinaloa cartel is better armed than Al Qaida!

Because the fees are low and because the current structure of the agreements does not allow for booking of reserves under SEC guidelines there has been little in the way of interest from the independents.

If Nieto changes the agreements to Production Sharing Contracts or Royalty Tax agreements then there is likely to be a flood of activity with companies interested in revisiting the old fields that haven't been subject to modern technology and the Eagle Ford trend continuity. Developing the latter would be challenging I suspect since the trend comes across the border not far from Cuidad Juarez where much of the cartel violence seems to be located. That being said oil companies are working in Iraq, although I suspect the Sinaloa cartel is better armed than Al Qaida!

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Mexico to reopen energy sector to foreign oil companies

Good point Doc: “Because the fees are low and because the current structure of the agreements does not allow for booking of reserves under SEC guidelines”. This again is where China has a big advantage by not being strictly ruled by rate of return. It has worked well for them in Iraq…just have to wait to see how well it plays out there. I suspect China would have an easier time dealing with Sinaloa…no big religious component to the negotiations…just $’s. In fact, if China contracts them as “consultants” this could be one of the less troublesome venues they are working in right now. LOL. Human rights certainly won’t be a big issue.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Mexico to reopen energy sector to foreign oil companies

China, at least CNPC, faces the same issues as other companies that list on the NYSE....they need to demonstrate all the profit measures others do to attract shareholders. Hence they probably can't ignore the reserves booking issue completely. I did read an opinion from one of the Ryder Scott folks that indicated his view that because of the wording in the Iraq contracts reserves could be booked whereas in Mexico under the existing contracts it would be impossible. If memory serves there are 4 or 5 issues you need to check off to make the SEC happy. I will see if I can find that article again. Beyond the reserves booking issue it is the low fees currently being paid that make deals pretty unattractive. As I remember Schlumberger bid $3/bbl .....pretty hard to make money on that unless you are actually spending say $2/bbl in capital costs and charging Pemex $6/bbl (no idea what the numbers are but understand the padding is significant).

As to China being able to work better with the cartels who knows? I did hear an opinion from someone in the security business that Mexico was much harder to deal with than Iraq. In Iraq you could hire the Al Qaida and others to work for you....they liked the money and would trade a job for not blowing up your operation. In Mexico the drug business is so lucrative that you can't possibly offer the cartel people enough money to make working for you more attractive than kidnapping you or shooting you on the street because you happened to be in the way of their drug business. We still vacation in Mexico every year, but there are a lot of places I would not go even on a bet.

As to China being able to work better with the cartels who knows? I did hear an opinion from someone in the security business that Mexico was much harder to deal with than Iraq. In Iraq you could hire the Al Qaida and others to work for you....they liked the money and would trade a job for not blowing up your operation. In Mexico the drug business is so lucrative that you can't possibly offer the cartel people enough money to make working for you more attractive than kidnapping you or shooting you on the street because you happened to be in the way of their drug business. We still vacation in Mexico every year, but there are a lot of places I would not go even on a bet.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Mexico to reopen energy sector to foreign oil companies

A little more detail as to why it’s difficult for Mexico to bring foreign capital, especially from US corporations, into their oil and gas sector. It’s not just about having foreign companies working in Mexico because that has been happening for decades:

“In the eyes of most private oil and gas companies, the Holy Grail of Mexican energy reform would be a change that allows private companies to participate in exploration and development in Mexico in a way that allows them to “book reserves”. This basically means they could then treat reserves in the ground to which they have rights as assets of their companies for accounting purposes. This would greatly expand their ability to obtain both debt and equity financing, given the resulting greater asset base. The fundamental problem with instituting any change in Mexico that would allow such accounting treatment, however, is that Article 27 of the Mexican Constitution grants direct ownership and exclusive rights of exploration and development of hydrocarbons to the Mexican state. Furthermore, the Petroleum Law of 1958 prohibits payments to operators based on a percentage of production, participation or the results of exploration.

These restrictions have required PEMEX to use service contracts where contractors receive a cash fee and, if applicable, bonuses. They have prevented PEMEX from being able to offer concessions, production sharing contracts or similar structures used elsewhere in the world that offer private companies the opportunity to book reserves. Although Mexico has amended its constitution hundreds of times, the prospects for constitutional reform on this issue seem remote as the Mexican state’s constitutional monopoly on ownership of petroleum in the ground has become an important part of Mexican culture and identity. Never say never, but making changes that would allow booking of reserves seems, at least, to be the biggest challenge on the menu of possible reforms.”

IOW ExxonMobil et al might be ready to pump $100 billion into developing Mexico oil reserves but if they can’t claim direct ownership they can’t claim their share in their annual report. Even worse, by not being able to earn a percentage of any production found they can’t balance the basic risk to reward relationship needed to do the typical economic analysis of a project.

And this is where China has a bit of an advantage since they don’t have the same “booking” requirement as corporations. But while they can’t be given a proportional share of production they can trade on aspects like “first call”: China would have the right of first refusal on a volume of Mexican oil exported. And in the case of a finery JV have the first call on any products Mexico wants to export.

“In the eyes of most private oil and gas companies, the Holy Grail of Mexican energy reform would be a change that allows private companies to participate in exploration and development in Mexico in a way that allows them to “book reserves”. This basically means they could then treat reserves in the ground to which they have rights as assets of their companies for accounting purposes. This would greatly expand their ability to obtain both debt and equity financing, given the resulting greater asset base. The fundamental problem with instituting any change in Mexico that would allow such accounting treatment, however, is that Article 27 of the Mexican Constitution grants direct ownership and exclusive rights of exploration and development of hydrocarbons to the Mexican state. Furthermore, the Petroleum Law of 1958 prohibits payments to operators based on a percentage of production, participation or the results of exploration.

These restrictions have required PEMEX to use service contracts where contractors receive a cash fee and, if applicable, bonuses. They have prevented PEMEX from being able to offer concessions, production sharing contracts or similar structures used elsewhere in the world that offer private companies the opportunity to book reserves. Although Mexico has amended its constitution hundreds of times, the prospects for constitutional reform on this issue seem remote as the Mexican state’s constitutional monopoly on ownership of petroleum in the ground has become an important part of Mexican culture and identity. Never say never, but making changes that would allow booking of reserves seems, at least, to be the biggest challenge on the menu of possible reforms.”

IOW ExxonMobil et al might be ready to pump $100 billion into developing Mexico oil reserves but if they can’t claim direct ownership they can’t claim their share in their annual report. Even worse, by not being able to earn a percentage of any production found they can’t balance the basic risk to reward relationship needed to do the typical economic analysis of a project.

And this is where China has a bit of an advantage since they don’t have the same “booking” requirement as corporations. But while they can’t be given a proportional share of production they can trade on aspects like “first call”: China would have the right of first refusal on a volume of Mexican oil exported. And in the case of a finery JV have the first call on any products Mexico wants to export.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Mexico to reopen energy sector to foreign oil companies

ROCKMAN wrote: the Holy Grail of Mexican energy reform would be a change that allows private companies to participate in exploration and development in Mexico in a way that allows them to “book reserves”. This basically means they could then treat reserves in the ground to which they have rights as assets of their companies for accounting purposes. This would greatly expand their ability to obtain both debt and equity financing, given the resulting greater asset base. The fundamental problem with instituting any change in Mexico that would allow such accounting treatment, however, is that Article 27 of the Mexican Constitution grants direct ownership and exclusive rights of exploration and development of hydrocarbons to the Mexican state. Furthermore, the Petroleum Law of 1958 prohibits payments to operators based on a percentage of production, participation or the results of exploration.

Yes.

Thats exactly why I started this thread. The new President of Mexico is going to change the Mexican Constitution to remove Article 27 and rewrite the Petroleum laws to allow foreign oil companies into Mexico.

Its happening right now----Mexico is privatizing their oil sector.

I don't think its a coincidence that this is happening right after the Chinese premiere visited Mexico. China has been very aggressive about buying up oil in countries around the world----I wouldn't be surprised if the move to privatize oil in Mexico has been triggered by China----Mexico sure as hell wouldn't be doing it for us gringos.

Mexico is rewriting their constitution to allow Chinese, US and other foreign oil companies to operate in Mexico.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Mexico to reopen energy sector to foreign oil companies

P - Yes...good timing. It will be interesting to see how long the process takes and exactly how the Chinese cut their deals with Mexico. I agree: I'm sure the Chinese had a detailed discussion with the Mexican president on exactly how to structure their deals so it would allow the easiest route to changing the constitution. And given the Chinese are also interested in the refining side they might be figuring a way to satisfy both countries with either little or no change to the constitution. China cut a per bbl fee deal with Iraq. No details, of course, but I suspect the Chinese are getting more out of the deal then pocket change. As mentioned before those "calls" and rights of first refusal can be very valuable especially as the market gets tight yet they don't show up as $'s (or yuans) on a spreadsheet. Same point again: the Chinese companies can function like no other companies can. Deal structures a US pubco could never consider are as easy as dunking an egg roll for the Chinese. And that includes paying off every politician in sight. And they are equally adept at making the natives happy by building roads, hospitals (manned by their own doctors and nurses), schools, etc. Such projects made them very popular in Venezuela.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Mexico to reopen energy sector to foreign oil companies

Thats exactly why I started this thread. The new President of Mexico is going to change the Mexican Constitution to remove Article 27 and rewrite the Petroleum laws to allow foreign oil companies into Mexico.

Its happening right now----Mexico is privatizing their oil sector.

Actually what is happening is Nieto is taking a bill forward to Mexican parliament. There is no guaranty he will be able to get the support he needs to change the constitution and he actually hasn't come out and said what exactly that change would entail. I've met with the Pemex folks in past years where they waxed long and lyrical about the rules changing but every proposed bill was blocked. We'll see where this latest initiative goes.

Same point again: the Chinese companies can function like no other companies can.

actually they can't. CNPC is listed on the NYSE and hence governed by the same rules as anyone else with respect to the SEC. Their shares trade, they want higher share price so need to be able to report the production numbers. Sinopec also trades its shares. As I mentioned Ryder Scott thought it was possible to report production from the service agreements in Iraq but not so for the service agreements in Mexico. China as a nation could say that they would bring in additional service companies (as they did in Sudan and Chad and elsewhere) but there really isn't a need for that in the Mexican industry. They have lots of rigs, they have lots of kit and access to logging equipment etc. What they don't have is new technology and understanding how to employ it and the Chinese companies haven't a real clue in that area. Big Blue and Big Red are already in Mexico (Schlumberger and Halliburton) so the tech is there it is really companies with the money and knowledge of how to properly employ that tech they need.

It really comes down as to what changes are actually made. If they have PSC's that is a different story than Royalty tax agreements and it really comes down as to what they want in terms of signature bonuses and production share retained for Pemex. They might even decide to stay with some form of amended service agreement but fees would have to rise or there would be little attention from anyone.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

North America to Drown in Oil as Mexico Ends Monopoly

The flood of North American crude oil is set to become a deluge as Mexico dismantles a 75-year-old barrier to foreign investment in its oil fields.

Plagued by almost a decade of slumping output that has degraded Mexico’s take from a $100-a-barrel oil market, President Enrique Pena Nieto is seeking an end to the state monopoly over one of the biggest crude resources in the Western Hemisphere. The doubling in Mexican oil output that Citigroup Inc. said may result from inviting international explorers to drill would be equivalent to adding another Nigeria to world supply, or about 2.5 million barrels a day.

http://money.msn.com/business-news/article.aspx?feed=BLOOM&date=20131216&id=17195903

Could we see under $2.50 a gal gas again soon, I sure hope so my motorhome cost $250 to fill her up today.

Plagued by almost a decade of slumping output that has degraded Mexico’s take from a $100-a-barrel oil market, President Enrique Pena Nieto is seeking an end to the state monopoly over one of the biggest crude resources in the Western Hemisphere. The doubling in Mexican oil output that Citigroup Inc. said may result from inviting international explorers to drill would be equivalent to adding another Nigeria to world supply, or about 2.5 million barrels a day.

http://money.msn.com/business-news/article.aspx?feed=BLOOM&date=20131216&id=17195903

Could we see under $2.50 a gal gas again soon, I sure hope so my motorhome cost $250 to fill her up today.

- Roger Rabbit

Re: North America to Drown in Oil as Mexico Ends Monopoly

"North America to Drown in Oil as Mexico Ends Monopoly "

Now that's some serious title !

Now that's some serious title !

-

Arthur75 - Tar Sands

- Posts: 529

- Joined: Sun 29 Mar 2009, 05:10:51

- Location: Paris, France

Re: North America to Drown in Oil as Mexico Ends Monopoly

Arthur75 wrote:"North America to Drown in Oil as Mexico Ends Monopoly "

Now that's some serious title !

Yea with all these new oil discovery's and now Mexico allowing foreign investment in its oil fields looks as if the Peak Oil has not Peaked yet..

- Roger Rabbit

Re: THE Mexico Thread (merged)

La Mexicano Eaglefordo!

If the United States can discover two of the largest producing oil fields in the western hemisphere poking around in crap rock, Mexi-Cans can now do the same!

I'm more interested in the Bazhenov, if the studies on the amount of oil that might have compared to pipsqueaks like Bakken and Eagleford, and then you throw in La Mexicano Eaglefordo, we are talking about the ability to make fun of Heinberg and his ilk for at least another decade.

If the United States can discover two of the largest producing oil fields in the western hemisphere poking around in crap rock, Mexi-Cans can now do the same!

I'm more interested in the Bazhenov, if the studies on the amount of oil that might have compared to pipsqueaks like Bakken and Eagleford, and then you throw in La Mexicano Eaglefordo, we are talking about the ability to make fun of Heinberg and his ilk for at least another decade.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: THE Mexico Thread (merged)

http://www.reuters.com/article/2014/04/ ... 8620140426

As of March, Mexico oil production has slipped to a new post-peak low. Output has now dropped to 2.47 mb/d while consumption is increasing, now at 2.2 mb/d. Consumption will soon, this year or next, surpass production and when that occurs Mexico will permanently transform into a net oil importer. The economic, social and political ramifications of this looming event will be adverse and profound.

As of March, Mexico oil production has slipped to a new post-peak low. Output has now dropped to 2.47 mb/d while consumption is increasing, now at 2.2 mb/d. Consumption will soon, this year or next, surpass production and when that occurs Mexico will permanently transform into a net oil importer. The economic, social and political ramifications of this looming event will be adverse and profound.

Got Dharma?

Everything is Impermanent. Shakyamuni Buddha

Everything is Impermanent. Shakyamuni Buddha

-

eastbay - Expert

- Posts: 7186

- Joined: Sat 18 Dec 2004, 04:00:00

- Location: One Mile From the Columbia River

Re: THE Mexico Thread Pt. 2 (merged)

We talked about this a few years ago but thanks for bringing us up to date Eastbay. Mexico used to get much of its social welfare budget from oil sales to the USA, but very soon now that will cease to be a source of income and will become a cost for the Government to import oil. I don't know what the price of gasoline is in Mexico City but I strongly suspect it doesn't reflect European levels of taxation. Once Mexico has to import foreign supply to make up its shortfall either the price will be suppressed by government subsidy (with what money?) or the price will have to sharply increase to reduce demand.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17055

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Mexico needs to import crude oil, not condensate

Because of declining production, Mexico no longer has sufficient domestic light, sweet crude oil production to meet the domestic demand from refineries designed to process light crude, so they are going to have to start importing light crude, although they remain a net oil exporter.

In any case, the Pemex official quoted in the following article had an interesting comment about condensate (which is basically natural gasoline that is not of much use as feedstock for producing distillates like diesel fuel).

As I have previously noted, in my opinion it is very likely that actual global crude oil production (45 and lower API gravity crude oil) probably peaked in 2005, while global natural gas production and associated liquids--condensate and NGL's--have so far continued to increase.

Jeffrey Brown

Mexico's Pemex aims to start importing light crude this year

http://uk.reuters.com/article/2014/08/28/mexico-pemex-idUKL1N0QX2TL20140828

In any case, the Pemex official quoted in the following article had an interesting comment about condensate (which is basically natural gasoline that is not of much use as feedstock for producing distillates like diesel fuel).

As I have previously noted, in my opinion it is very likely that actual global crude oil production (45 and lower API gravity crude oil) probably peaked in 2005, while global natural gas production and associated liquids--condensate and NGL's--have so far continued to increase.

Jeffrey Brown

Mexico's Pemex aims to start importing light crude this year

http://uk.reuters.com/article/2014/08/28/mexico-pemex-idUKL1N0QX2TL20140828

Aug 28 (Reuters) - Mexican state-owned oil company Pemex wants to launch light crude oil imports later this year, potentially reaching up to 70,000 barrels per day (bpd) and aimed at boosting refinery output, the head of its commercial arm said.

The imports would mark an abrupt shift from a decades-old devotion to crude oil self-sufficiency in Mexico, long a major exporter to the United States. It also comes after a sweeping energy sector overhaul which seeks to reverse many years of declining output and export volumes.

"Our objective is that (crude imports) will begin this year," said Jose Manuel Carrera, chief executive officer of PMI Comercio Internacional, Pemex's oil trading arm. His comments are the strongest signals to date on both the timing and potential volumes of light crude imports to Mexico. . . .

While U.S. companies Pioneer Natural Resources and Enterprise Products Partners have secured permission to ship a type of ultralight oil known as condensate to foreign buyers, Carrera all but ruled out the possibility.

"Condensate is not necessarily what Mexico needs. It needs crude," he said.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Mexico needs to import crude oil, not condensate

My case for a probable global crude oil peak, in 2005:

In my opinion it is very likely that actual global crude oil production (45 or lower API gravity crude oil) peaked in 2005, while global natural gas production and associated liquids (condensates & natural gas liquids) have so far continued to increase.

I’ve always thought it odd that when we ask for the price of oil, we get the price of 45 or lower API gravity crude oil, but when we ask for the volume of oil, we get some combination of crude oil + condensate + NGL (Natural Gas Liquids) + biofuels + refinery gains.

This is analogous to asking a butcher for the price of beef, and he gives you the price of steak, but if you ask him how much beef he has on hand, he gives you total pounds of steak + roast + ground beef. Shouldn’t the price of an item directly relate to the quantity of the item being priced, and not to the quantity of the item plus the quantity of (partial) substitutes?

In any case, the closest measure of global crude oil production that we have is the EIA data base that tracts global Crude + Condensate (C+C). In regard to this data base, a key question is the ratio of global condensate to C+C production. Unfortunately, we don’t appear to have any global data on the Condensate/(C+C) Ratio. Note that when the EIA discusses “crude oil” they are talking about C+C.

Insofar as I know, the only complete Condensate/(C+C) data base, from one agency, is the Texas RRC data base for Texas, which showed that the Texas Condensate/(C+C) ratio increased from 11.1% in 2005 to 15.4% in 2012. The 2013 ratio (more subject to revision than the 2012 data) shows that the 2013 ratio fell slightly, down to 14.7%, which probably reflects more focus on the crude oil prone areas in the Eagle Ford. The EIA shows that Texas marketed gas production increased at 5%/year from 2005 to 2012, versus a 13%/year rate of increase in Condensate production. So, Texas condensate production increased a about 2.6 times faster than Texas marketed gas production increased, from 2005 to 2012.

The EIA shows that global dry gas production increased at 2.8%/year from 2005 to 2012, a 22% increase in seven years. If the increase in global condensate production only matched the increase in global gas production, global condensate production would be up by 22% in seven years. If global condensate production matched the 2005 to 2012 Texas rates of change (relative to the global increase in gas production), global condensate production would be up by about 67% in seven years.

In any case, we don’t know by what percentage that global condensate production increased from 2005 to 2012. What we do know is that global C+C production increased at only 0.4%/year from 2005 to 2012. In my opinion, the only reasonable conclusion is that rising condensate production accounted for virtually all of the increase in global C+C production from 2005 to 2012, which implies that actual global crude oil production was flat to down from 2005 to 2012, as annual Brent crude oil prices doubled from $55 in 2005 to $112 in 2012.

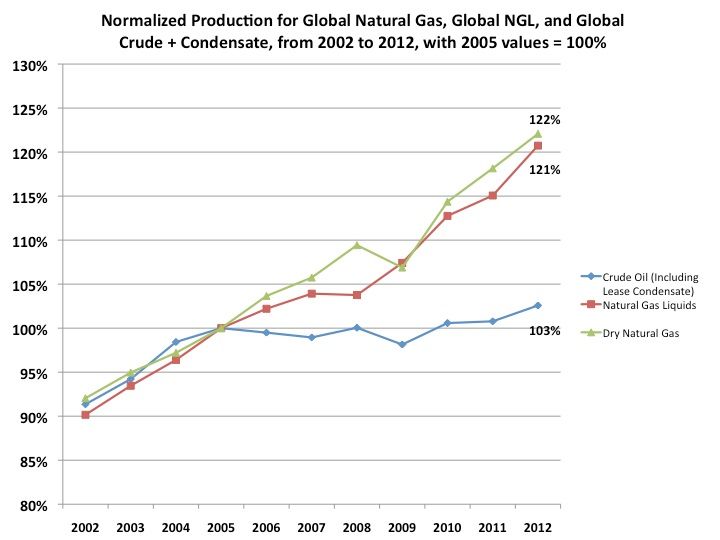

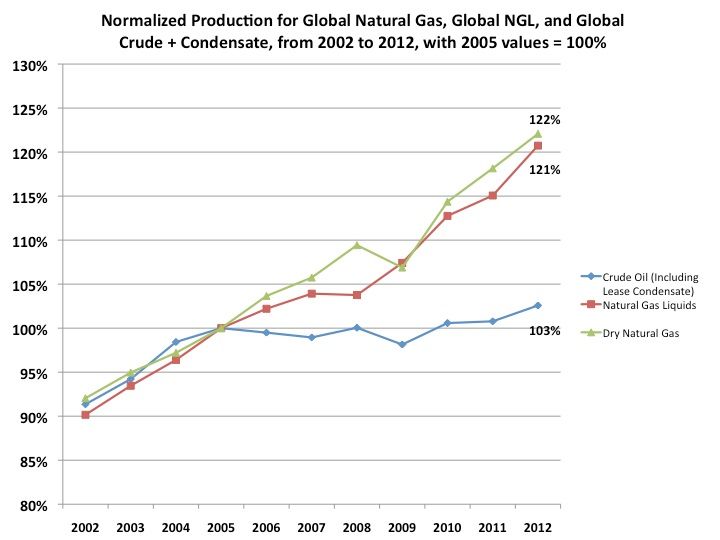

The following chart shows normalized global gas, NGL and C+C production from 2002 to 2012 (2005 values = 100%).

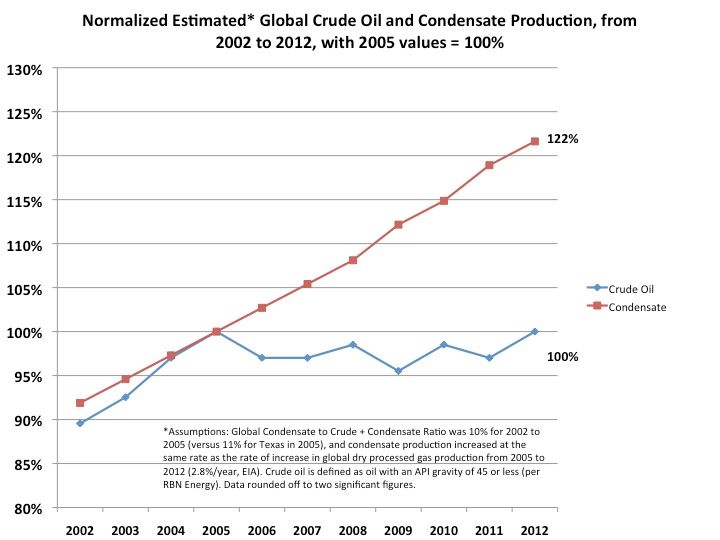

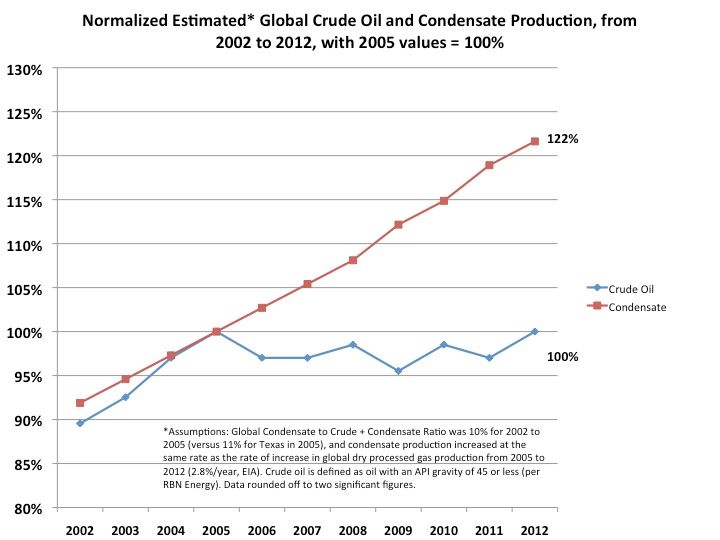

The following chart shows estimated normalized global condensate and crude oil production from 2002 to 2012 (2005 values = 100%). I’m assuming that the global Condensate/(C+C) Ratio was about 10% for 2002 to 2005 (versus 11% for Texas in 2005), and then I (conservatively) assume that condensate increased at the same rate as global gas production from 2005 to 2012, which is a much lower rate of increase in condensate (relative to the increase in gas production) than what we saw in Texas from 2005 to 2012.

Based on foregoing assumptions, I estimate that actual annual global crude oil production (45 or lower API gravity crude oil) increased from about 60 mbpd (million barrels per day) in 2002 to about 67 mbpd in 2005, as annual Brent crude oil prices doubled from $25 in 2002 to $55 in 2005.

At the (estimated) 2002 to 2005 rate of increase in global crude oil production, global crude oil production would have been up to about 90 mbpd in 2013. As annual Brent crude oil prices doubled again, from $55 in 2005 to an average of about $110 for 2011 to 2013 inclusive, I estimate that annual global crude oil production did not materially exceed about 67 mbpd, and probably averaged about 66 mbpd for 2006 to 2013 inclusive.

In my opinion it is very likely that actual global crude oil production (45 or lower API gravity crude oil) peaked in 2005, while global natural gas production and associated liquids (condensates & natural gas liquids) have so far continued to increase.

I’ve always thought it odd that when we ask for the price of oil, we get the price of 45 or lower API gravity crude oil, but when we ask for the volume of oil, we get some combination of crude oil + condensate + NGL (Natural Gas Liquids) + biofuels + refinery gains.

This is analogous to asking a butcher for the price of beef, and he gives you the price of steak, but if you ask him how much beef he has on hand, he gives you total pounds of steak + roast + ground beef. Shouldn’t the price of an item directly relate to the quantity of the item being priced, and not to the quantity of the item plus the quantity of (partial) substitutes?

In any case, the closest measure of global crude oil production that we have is the EIA data base that tracts global Crude + Condensate (C+C). In regard to this data base, a key question is the ratio of global condensate to C+C production. Unfortunately, we don’t appear to have any global data on the Condensate/(C+C) Ratio. Note that when the EIA discusses “crude oil” they are talking about C+C.

Insofar as I know, the only complete Condensate/(C+C) data base, from one agency, is the Texas RRC data base for Texas, which showed that the Texas Condensate/(C+C) ratio increased from 11.1% in 2005 to 15.4% in 2012. The 2013 ratio (more subject to revision than the 2012 data) shows that the 2013 ratio fell slightly, down to 14.7%, which probably reflects more focus on the crude oil prone areas in the Eagle Ford. The EIA shows that Texas marketed gas production increased at 5%/year from 2005 to 2012, versus a 13%/year rate of increase in Condensate production. So, Texas condensate production increased a about 2.6 times faster than Texas marketed gas production increased, from 2005 to 2012.

The EIA shows that global dry gas production increased at 2.8%/year from 2005 to 2012, a 22% increase in seven years. If the increase in global condensate production only matched the increase in global gas production, global condensate production would be up by 22% in seven years. If global condensate production matched the 2005 to 2012 Texas rates of change (relative to the global increase in gas production), global condensate production would be up by about 67% in seven years.

In any case, we don’t know by what percentage that global condensate production increased from 2005 to 2012. What we do know is that global C+C production increased at only 0.4%/year from 2005 to 2012. In my opinion, the only reasonable conclusion is that rising condensate production accounted for virtually all of the increase in global C+C production from 2005 to 2012, which implies that actual global crude oil production was flat to down from 2005 to 2012, as annual Brent crude oil prices doubled from $55 in 2005 to $112 in 2012.

The following chart shows normalized global gas, NGL and C+C production from 2002 to 2012 (2005 values = 100%).

The following chart shows estimated normalized global condensate and crude oil production from 2002 to 2012 (2005 values = 100%). I’m assuming that the global Condensate/(C+C) Ratio was about 10% for 2002 to 2005 (versus 11% for Texas in 2005), and then I (conservatively) assume that condensate increased at the same rate as global gas production from 2005 to 2012, which is a much lower rate of increase in condensate (relative to the increase in gas production) than what we saw in Texas from 2005 to 2012.

Based on foregoing assumptions, I estimate that actual annual global crude oil production (45 or lower API gravity crude oil) increased from about 60 mbpd (million barrels per day) in 2002 to about 67 mbpd in 2005, as annual Brent crude oil prices doubled from $25 in 2002 to $55 in 2005.

At the (estimated) 2002 to 2005 rate of increase in global crude oil production, global crude oil production would have been up to about 90 mbpd in 2013. As annual Brent crude oil prices doubled again, from $55 in 2005 to an average of about $110 for 2011 to 2013 inclusive, I estimate that annual global crude oil production did not materially exceed about 67 mbpd, and probably averaged about 66 mbpd for 2006 to 2013 inclusive.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: Mexico needs to import crude oil, not condensate

Thnks WT, here is a pic of the breakdown and copy from june '14 "today in Energy"

Go to original for links

I also found a Flicker feed for the EIA: https://www.flickr.com/photos/eiagov/

Lotsw of charts including API breakdown by region.

U.S. crude oil production has grown rapidly in recent years, primarily from light, sweet crude (a characteristic of crude quality, as measured by API gravity and sulfur content) from tight resource formations. Roughly 96% of the 1.8-million-barrel per day (bbl/d) growth in production from 2011 to 2013 consisted of light sweet grades with API gravity of 40 or above and sulfur content of 0.3% or less.

EIA's new forecast of U.S. crude production by quality indicates that the U.S. supply of light, sweet crude will continue to outpace that of medium and heavy crude through 2015. More than 60% of EIA's forecasted production growth for 2014 and 2015 consists of sweet grades with API gravity of 40 or above.

The growth in this particular type of crude oil (as well as many forecasts for a continuation of this trend) has sparked discussion of how rising crude oil volumes will be absorbed into the market. Given the likelihood of continued growth in domestic crude production, and the recognition that some absorption options, such as like-for-like replacement of import streams, are inherently limited, the question of how a relaxation in current limitations on crude exports might affect domestic and international markets for both crude and products continues to hold great interest for policymakers, industry, and the public.

Go to original for links

I also found a Flicker feed for the EIA: https://www.flickr.com/photos/eiagov/

Lotsw of charts including API breakdown by region.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Mexico needs to import crude oil, not condensate

westexas,

I feel it is time to thank you for the exellent insight you provide on oil production and import/export situation. I really enjoy reading your posts!

SteinarN

Edit: and Pops isn't far behind either.

I feel it is time to thank you for the exellent insight you provide on oil production and import/export situation. I really enjoy reading your posts!

SteinarN

Edit: and Pops isn't far behind either.

Last edited by SteinarN on Fri 29 Aug 2014, 12:52:17, edited 1 time in total.

-

SteinarN - Master Prognosticator

- Posts: 278

- Joined: Thu 20 Sep 2007, 03:00:00

- Location: Norway

Return to North America Discussion

Who is online

Users browsing this forum: No registered users and 36 guests