THE Bakken Thread pt 3 (merged)

Re: Bakken shale production will surprise Wall Street, Goldm

It would have been interesting to hear what the transport costs per barrel are from North Dakota to Philly, I have read about $12 per barrel, as long as the Brent/WTI differential stays above the rail transport cost per barrel from North Dakota, then oil can be sold for the WTI price at the well head in North Dakota.

On a completely off topic note, have you checked out Ron Patterson's(aka Darwinian at TOD) blog http://www.peakoilbarrel.com ?

Jeffrey Brown posted there recently.

DC

On a completely off topic note, have you checked out Ron Patterson's(aka Darwinian at TOD) blog http://www.peakoilbarrel.com ?

Jeffrey Brown posted there recently.

DC

- dcoyne78

- Coal

- Posts: 476

- Joined: Thu 30 May 2013, 19:45:15

Re: Bakken shale production will surprise Wall Street, Goldm

DC – Interesting chart here: http://www.ogj.com/articles/print/volum ... rican.html

They estimate the p/l cost for ND to Texas Gulf coast is $9.30/bbl with rail cost at about the same cost but it isn’t a simple calculation: Cost advantages unique to rail exist because rail moves bidirectionally and can carry product back to the origin market. Such carry-back options include diluent for use in pipelines. Rail's relatively small incremental cost of hauling diluent from crude destination back to origin reduces per unit delivery costs. And they also make an interesting point I had not thought about before: the rail cars get the oil to the refineries much faster than through a pipeline.

All in all, it’s not easy to come up with a number that fits all situations.

They estimate the p/l cost for ND to Texas Gulf coast is $9.30/bbl with rail cost at about the same cost but it isn’t a simple calculation: Cost advantages unique to rail exist because rail moves bidirectionally and can carry product back to the origin market. Such carry-back options include diluent for use in pipelines. Rail's relatively small incremental cost of hauling diluent from crude destination back to origin reduces per unit delivery costs. And they also make an interesting point I had not thought about before: the rail cars get the oil to the refineries much faster than through a pipeline.

All in all, it’s not easy to come up with a number that fits all situations.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Bakken shale production will surprise Wall Street, Goldm

ROCKMAN wrote:DC – Interesting chart here: http://www.ogj.com/articles/print/volum ... rican.html

They estimate the p/l cost for ND to Texas Gulf coast is $9.30/bbl with rail cost at about the same cost but it isn’t a simple calculation: Cost advantages unique to rail exist because rail moves bidirectionally and can carry product back to the origin market. Such carry-back options include diluent for use in pipelines. Rail's relatively small incremental cost of hauling diluent from crude destination back to origin reduces per unit delivery costs. And they also make an interesting point I had not thought about before: the rail cars get the oil to the refineries much faster than through a pipeline.

All in all, it’s not easy to come up with a number that fits all situations.

Hi Rockman,

That's interesting, I imagine the Bakken oil would have trouble competing with oil from the Eagle Ford which can be transported by pipeline for about $4/ barrel or less to the Gulf Coast. BTW I don't have a subscription to OGJ so I can't see your chart (I am too cheap to make it by the paywall).

DC

- dcoyne78

- Coal

- Posts: 476

- Joined: Thu 30 May 2013, 19:45:15

Re: THE Bakken Thread pt 2 (merged)

I could be wrong, but I would think most Bakken oil these days is going to Midwest, Northeast and West Coast destinations rather than the Gulf Coast. I know here in Washington state they've recently starting shipping in oil from ND. Also I know it's being delivered to Philly. It would make much more sense for Gulf Coast refiners to use the Eagleford/Permian oils, seems to me.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: THE Bakken Thread pt 2 (merged)

copious.abundance wrote:I could be wrong, but I would think most Bakken oil these days is going to Midwest, Northeast and West Coast destinations rather than the Gulf Coast. I know here in Washington state they've recently starting shipping in oil from ND. Also I know it's being delivered to Philly. It would make much more sense for Gulf Coast refiners to use the Eagleford/Permian oils, seems to me.

I think a lot of that decision making depends on what grade of oil the refinery is 'tuned' for. If your refinery is tuned for light grades of oil only and the nearby fields are producing medium heavy oil then importing light oil from far away makes sense in an efficiency argument. We get in the habit of talking about 'oil' as if every petroleum liquid that comes out of the ground is equal, but they aren't. Some refineries can handle much more sulfur than others, just as one example. My understanding is a lot of the refineries on the Gulf Coast of the USA were built or modified to process heavy high sulfur crude from over seas, sending light tight low sulfur ND oil to them is doable, but not nearly as efficient as sending it to the Pacific coast where refineries were built to process light low sulfur Alaskan oil. Not saying that is exactly what is happening but it seems logical too me.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17056

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Bakken prices under $80

Good article

http://www.globalpost.com/dispatch/news ... s-under-80

North Dakota crude oil prices tumbled this month to below the $80-a-barrel "sweet spot" that helps drillers attract capital from other shale areas, yet the Bakken boom shows no signs of slowing.

Even though prices have slumped to their lowest in more than a year, output keeps marching ahead thanks to falling operational costs, increasingly efficient well technology, rising reserve estimates and aggressive forward hedging programs. Experts say the 1 million barrel per day (bpd) mark will probably be reached by early next year.

http://www.globalpost.com/dispatch/news ... s-under-80

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Bakken prices under $80

Interesting article pops, puts a new view on the Bakken production situation.

I was wondering what timescale they use to calculate the breakeven points.

From this article it looks like the advances in methods are running ahead of the collapse in pricing. Of course it is preferable to start new wells when the price is higher so what is driving the continued drilling frenzy? I know miners often leave things in the ground until the price is right, so why not oil companies?

I was wondering what timescale they use to calculate the breakeven points.

From this article it looks like the advances in methods are running ahead of the collapse in pricing. Of course it is preferable to start new wells when the price is higher so what is driving the continued drilling frenzy? I know miners often leave things in the ground until the price is right, so why not oil companies?

Once in a while the peasants do win. Of course then they just go and find new rulers, you think they would learn.

- rollin

- Lignite

- Posts: 294

- Joined: Thu 06 Dec 2012, 18:28:24

Re: Bakken prices under $80

I'd think even LTO (light tight oil) wells don't start and stop on a days notice. As mentioned in the piece, some drillers have hedged way out, selling contracts for next summer (or who knows how far) at $90 so they're good for a while regardless of what the price does.

Hard to tell too what overhead different companies have, what they paid for leases, how much they are in the hole for capital expenses, etc, etc.

I'd like to say I hope they are good down to $40 but it really makes no difference to you & me. It is the cost of the last, hardest barrel that sets the price we pay so what do I care if they are making $50/bbl or 50¢/bbl? Doesn't matter if it comes from ND or Iran at these prices.

Hard to tell too what overhead different companies have, what they paid for leases, how much they are in the hole for capital expenses, etc, etc.

I'd like to say I hope they are good down to $40 but it really makes no difference to you & me. It is the cost of the last, hardest barrel that sets the price we pay so what do I care if they are making $50/bbl or 50¢/bbl? Doesn't matter if it comes from ND or Iran at these prices.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Bakken prices under $80

Also remember that mineral lease don't last for ever: don't drill before the lease term end and you've lost your investment in that lease. Given how high leases price got that could be a considerable loss. Also remember that when times are good the service companies will stick you with contracts not easily or, in particular, cheap to terminate. When NG prices bust back in '08 and devon couldn't justify as much shale gas drilling in east Texas they paid 440 million in penalties in rig cancellation.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: THE Bakken Thread pt 2 (merged)

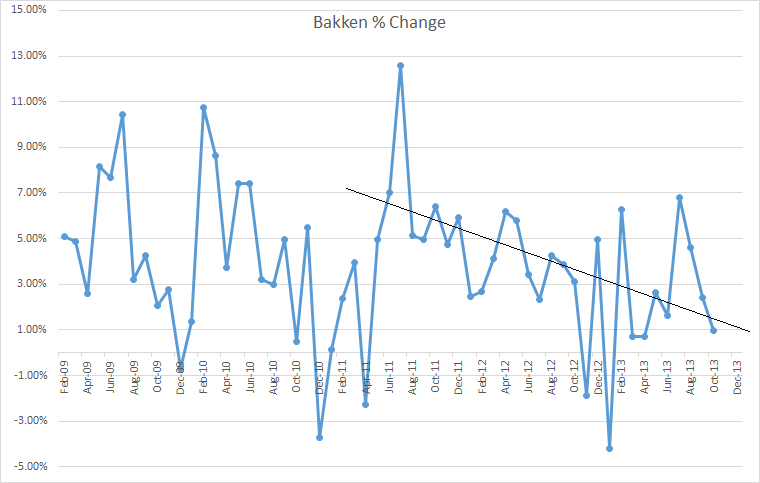

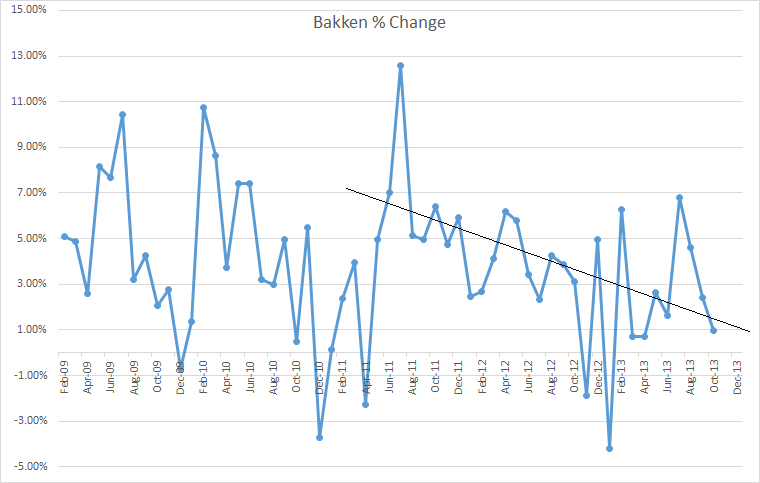

Ron Patterson has a post on the latest Bakken numbers. Also a chart on the slowing of growth:

This is even more interesting:

So with the rise in "wet" gas drilling and the so-called "tight oil" being essentially condensate perhaps the glut is of stuff the refineries are not equipped to handle as well - especially with the premium on diesel in the EU? It was the spread by API gravity was closing 'til sept...

And in fact it was looking good through Sept compared to GOM . . .

Maybe this also has to do with the new Keystone south pipe coming online soon bringing that cheap Canada asphalt to the gulf?

This is even more interesting:

Helms gives us the price of oil, presumably the price Bakken producers are getting:

Sep Sweet Crude Price = $92.96/barrel

Oct Sweet Crude Price = $85.16/barrel

Nov Sweet Crude Price = $71.42/barrel

Today Sweet Crude Price = $73.00/barrel

Apparently Bakken crude does not fetch the same price as WTI. That is understandable because Bakken crude is so light it can almost be considered as condensate. The reason for this is this is really "tight oil", so tight that only the smallest molecules can escape.

So with the rise in "wet" gas drilling and the so-called "tight oil" being essentially condensate perhaps the glut is of stuff the refineries are not equipped to handle as well - especially with the premium on diesel in the EU? It was the spread by API gravity was closing 'til sept...

And in fact it was looking good through Sept compared to GOM . . .

Maybe this also has to do with the new Keystone south pipe coming online soon bringing that cheap Canada asphalt to the gulf?

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: THE Bakken Thread pt 2 (merged)

How much advantage is there to blending super light tight oil with the heavier bitumen crude coming out of Alberta? I have seen occasional references to blending crude to get the API gravity a refinery is best suited to work with, is that what they are referring too?

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17056

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: THE Bakken Thread pt 2 (merged)

I think the reason is just to make it flow.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: THE Bakken Thread pt 2 (merged)

think the reason is just to make it flow.

its a bit of both. Pipelines generally have specs that must be met with regards to gravity so blending can get a low API oil up to spec. The Canadian low API crudes are particularily viscous so blending with a very low viscous crude can help flow characteristics (note that not all low API crudes are highly viscous). But as Tanada states certain refineries are only capable of handling certain crudes. Cracking units are often put in place to upgrade heavy oil to a spec that refiners can deal with.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Derailment in North Dakota

Wagons from a mile-long train carrying crude oil have burst into flames as they derailed after a collision in the US state of North Dakota.

A plume of thick black smoke could be seen many miles away and explosions were heard.

No injuries were reported, but officials are urging people from the nearby town of Casselton - some 2,300 people - to evacuate as a precaution.

An investigation into the incident has been launched.

A spokeswoman for the North Dakota Department of Emergency Services said the last 50 wagons of the train had been uncoupled, but another 56 remained at risk.

The derailment, after a collision involving another goods train, is reported to have happened near an ethanol plant.

Emergency and fire-fighting crews have been sent to the scene.

Cass County sheriff's office said it was "strongly recommending" that residents in parts of Casselton and anyone living five miles (8km) to the south and east evacuate.

Link and pictures: http://www.bbc.co.uk/news/world-us-canada-25556061

- EdwinSm

- Tar Sands

- Posts: 601

- Joined: Thu 07 Jun 2012, 04:23:59

Re: Derailment in North Dakota

Mushroom cloud on Beeb looked pretty scary!

Live, Love, Learn, Leave Legacy.....oh and have a Laugh while you're doing it!

-

Quinny - Intermediate Crude

- Posts: 3337

- Joined: Thu 03 Jul 2008, 03:00:00

Re: Derailment in North Dakota

According to Bloomberg the oil train hit a train that was already derailed, one which was carrying soybeans.

- Synapsid

- Tar Sands

- Posts: 780

- Joined: Tue 06 Aug 2013, 21:21:50

Re: Derailment in North Dakota

Synapsid wrote:According to Bloomberg the oil train hit a train that was already derailed, one which was carrying soybeans.

Sounds like a fryup!

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: Derailment in North Dakota

Not a moment too late, Warren Buffett is on the job.

Dec. 31 (Bloomberg) -- Berkshire Hathaway Inc. will swap about $1.4 billion in shares of Phillips 66 for full ownership of the energy firm’s pipeline-services business as billionaire Warren Buffett expands his bet on oil transportation.

Berkshire will exchange about 19 million shares, Phillips 66 said in a regulatory filing yesterday, when the energy company closed at $74.72 in New York. The exact number of shares Berkshire will pay for Phillips Specialty Products Inc. will be determined when the deal is completed, Phillips 66 said.

A U.S. drilling boom has expanded crude oil and natural gas production, prompting pipeline operators to boost capacity. Polymer-based additives, the focus of Phillips’ business unit, are used to move products through the pipe more efficiently by reducing drag. They can increase capacity at a time when approvals for new pipelines come slowly.

Dec. 31 (Bloomberg) -- Berkshire Hathaway Inc. will swap about $1.4 billion in shares of Phillips 66 for full ownership of the energy firm’s pipeline-services business as billionaire Warren Buffett expands his bet on oil transportation.

Berkshire will exchange about 19 million shares, Phillips 66 said in a regulatory filing yesterday, when the energy company closed at $74.72 in New York. The exact number of shares Berkshire will pay for Phillips Specialty Products Inc. will be determined when the deal is completed, Phillips 66 said.

A U.S. drilling boom has expanded crude oil and natural gas production, prompting pipeline operators to boost capacity. Polymer-based additives, the focus of Phillips’ business unit, are used to move products through the pipe more efficiently by reducing drag. They can increase capacity at a time when approvals for new pipelines come slowly.

- RobertInget

- Wood

- Posts: 27

- Joined: Mon 30 Dec 2013, 20:05:37

Re: Derailment in North Dakota

While there were no injuries connected with this, the second crash of oil trains, it does bring the safety issue of rail tankers to the fore.

http://www.csmonitor.com/Environment/En ... nsport-oil

This latest near disaster will give the White House the face saver

it needs to approve Keystone XL.

http://www.csmonitor.com/Environment/En ... nsport-oil

This latest near disaster will give the White House the face saver

it needs to approve Keystone XL.

- RobertInget

- Wood

- Posts: 27

- Joined: Mon 30 Dec 2013, 20:05:37

Re: Derailment in North Dakota

Trains do have accidents and oil does burn, so does propane which is moved by rail. Some of the propane fires are really phenomenal.

As far as danger to the public driving major policy changes, it generally does not happen. Generally the accidents are examined and new regulations or safety procedures are initiated.

Over 40,000 people die each year from car accidents, we still drive.

Airplanes crash killing hundreds at time, we still fly.

Coal burning kills many thousands a year and disables millions, we still burn coal.

Huge areas of the ocean and land are devastated by pollution, we still continue to pollute.

The whole world is being changed by burning carbon based fuels, we still burn carbon based fuels.

My point is that a few accidents will generally not change major policy or actions. Things will be made safer but not eliminated.

Also most of the oil being transported by trains is tight oil not tar sands bitumen, which is what the XL would carry.

As far as danger to the public driving major policy changes, it generally does not happen. Generally the accidents are examined and new regulations or safety procedures are initiated.

Over 40,000 people die each year from car accidents, we still drive.

Airplanes crash killing hundreds at time, we still fly.

Coal burning kills many thousands a year and disables millions, we still burn coal.

Huge areas of the ocean and land are devastated by pollution, we still continue to pollute.

The whole world is being changed by burning carbon based fuels, we still burn carbon based fuels.

My point is that a few accidents will generally not change major policy or actions. Things will be made safer but not eliminated.

Also most of the oil being transported by trains is tight oil not tar sands bitumen, which is what the XL would carry.

Once in a while the peasants do win. Of course then they just go and find new rulers, you think they would learn.

- rollin

- Lignite

- Posts: 294

- Joined: Thu 06 Dec 2012, 18:28:24

Return to North America Discussion

Who is online

Users browsing this forum: No registered users and 20 guests