But that argument is old hat now that you're on the right page. But as I think about it, CHK obviously does have reserve problems, they're just overestimating and selling them.

You've said exactly that several times, CHK cornered the market by buying huge tracts of land, produced gas on some, then proceeded to sell off the less good pieces for big money. But here is the difference in our POV, you say it's just oil boys being themselves, I say observers concluded all those leases sold for 10's of thousands per acre were actually worth something but it's turning out they really weren't. That is the story here this time the hype affects everyone because they hear the PR and believe we're Saudi America.

GW reserves were overestimated and subsequently written down by 25%: $1.2 billion to $800M; and the SEC did zilch.

A half billion ain't peanuts yet nary a peep from the SEC. The simple fact is CHK overestimated, they were wrong and no action was taken so obviously overestimating reserves is now par.

In the case of granite wash CHK sold to investors and subsequently marked down the reserves. Shell bought some land as well and now the Moneybeat guys assessment is, they bought: "shale assets in the wrong place..." what does that mean? a place with no oil? LOL

I don't know if the "assets in the wrong place" came from CHK or not but it doesn't matter, I don't care about CHK or Shell or which investor gets caught holding the bag. Again, I care about counteracting the hype such as the PR fluff in the OP of this thread.

What is more central here is the production boom in the sweet spots has been financed by selling off the "wrong place" assets. Which in itself is no big deal either but since the SEC now allows reserves to be booked based on operating profit rather than life-cycle profit it's like a big ponzi pyramid with folks in the US thinking we have it made and the Kochs just itching to export our newfound windfall while everyone is in the throes of Saudi America euphoria.

But here is what's happening in the real world:

BloombergNorth American oil and gas deals, including shale assets, plunged 52 percent to $26 billion in the first six months from $54 billion in the year-ago period, according to data compiled by Bloomberg. During the drilling frenzy of 2009 through 2012, energy companies spent more than $461 billion buying North American oil and gas properties, the data show.

...

Firms depending on asset sales to help finance drilling may not have enough money to pay for higher oil and gas production, said Eric Nuttall, who oversees C$70 million ($68 million) at Sprott Asset Management LP in Toronto. That could slow output growth, especially as companies try to avoid taking on more debt.

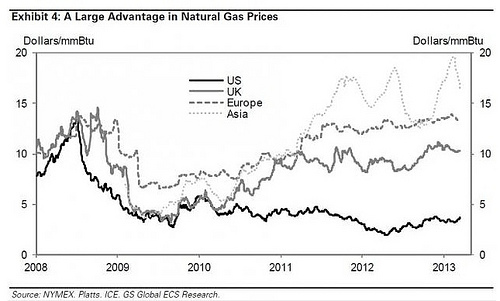

Now look at gas price:

And more from Bloomberg:

Shell, based in The Hague, paid $6.7 billion for North American energy assets in seven transactions since 2009, according to data compiled by Bloomberg.

Did Shell think gas prices were going back up to $14 when they bought all those leases?