noobtube wrote:Just got finished sweeping and vacuuming a lot of floors. All that hard work and what did it get me?

According to you, a boat and plenty of gold. But didn't imbue you with the brains to do something other than store it on a boat. And then lose it. But overall sounds like vacuuming floors did right by you.

noobtube wrote:AdamB wrote:Obviously you've never met the Amish, as they do just fine in their culture without being told otherwise by some snooty first worlder that can't see their way around a corner without a Slurpie and some mechanical beast to take them around it in their otherwise meaningless existence?

Do you live like the Amish? Nope.

Never said I did. But I do respect them. They aren't these gentlemen playboy retiree types like Lucky, they are the real deal.

noobtube wrote:You brag about motorcycles and possessions and conspicuous consumption. Why would you mention the Amish? They don't help your position at all.

A motorcycle was my first and only form of transporation for a year because I couldn't afford a car. Plus motorcycles are cool, and any trained monkey can drive a cage. Moved into my first apartment using one, one piece of furniture held by the passenger at a time. When I was homeless and living in a storage unit to save money for a semester I still had a motorcycle, air cooled, would park it in the storage unit on those cold fall nights and it would warm the place for hours. Don't ever discount the usefulness of a motorcycle.

noobtube wrote:Just because you say you're great, doesn't make it so.

True. But what do you call it when, in career #2, someone pulls you aside after yet after a national convention presentation, or new science rag article, and asks..."hey...we've got an offer for you". Popularity? Maybe you can sweep those floors SO hard they shine? Invent a new broom? And you too can get an offer you can't refuse. In a good way.

noobtube wrote:I have a simple question for you, "What is the legal definition of a dollar?" I'll wait.

Why? Do you not know how to use google? Sorry, I know, you are tired using your limited number of neurons to do much besides sweep floors and lose gold. Here is Merriam Webster. I googled it for you. It was SO hard.

dollar

noun

dol·lar ˈdä-lər

often attributive

Synonyms of dollar

1

: TALER

2

: any of numerous coins patterned after the taler (such as a Spanish peso)

3

a

: any of various basic monetary units (as in the U.S. and Canada)

see Money Table

b

: a coin, note, or token representing one dollar

4

: RINGGIT

5

: money obtained from a specific source

the tourism dollar

noobtube wrote:In your mind, American "hard work" can pull oil out of thin air, the moon, the clouds, and the stars. If that's the case, then why do Americans pay anything for oil at all?

Again, how about I google the response for you? Doesn't even need ChatGPT!

non sequitur

noun

non se·qui·tur ˌnän-ˈse-kwə-tər also -ˌtu̇r

Synonyms of non sequitur

1

: an inference (see INFERENCE sense 1) that does not follow from the premises (see PREMISE entry 1 sense 1)

specifically : a fallacy resulting from a simple conversion of a universal affirmative (see AFFIRMATIVE entry 1 sense 3) proposition or from the transposition of a condition and its consequent (see CONSEQUENT entry 1 sense 1)

noobtube wrote:Yet, when I go to the gas pump, the dollar number is higher for a gallon of gas than it was a year ago (or 10 years ago or 20 years ago, etc.). Gee.

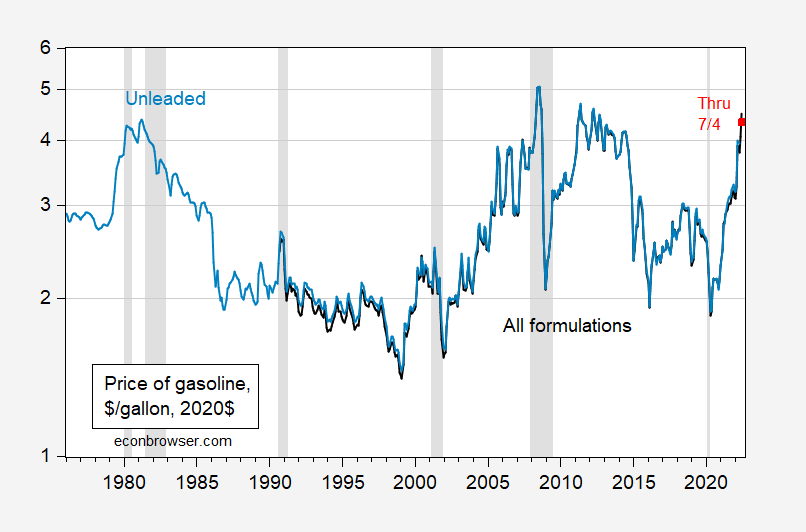

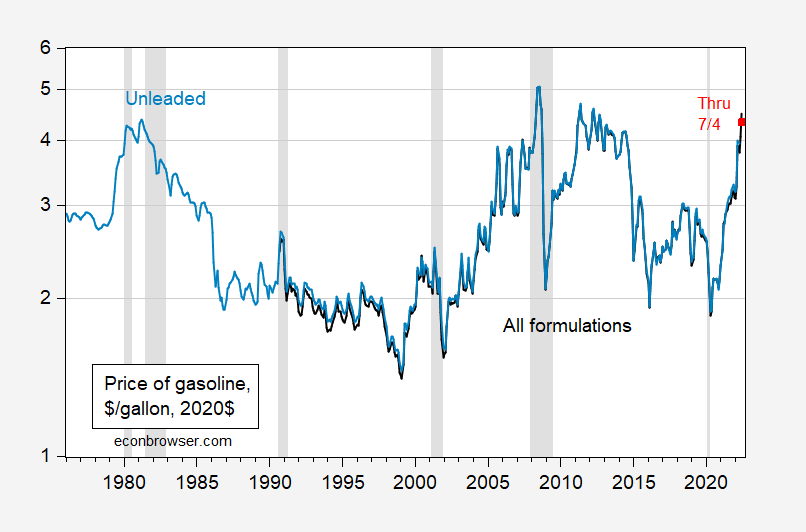

If you are so silly as to use nominal value for your calculation rather than real, you get to look as foolish as you just did. In which case, no wonder you sweep floors for a living, and here is some more learning so you won't be so uneducated in these conversations next time. Looks like gasoline is no more expensive here recently than it was 15 years ago (I split your 10 and 20 years, high level math you see)

noobtube wrote:You can teach something that doesn't make a MINT, but you made a MINT in "the markets" since the 1980s.

Well, for a poor hilly who once traded a day of baling hay to a farmer down the holler for borrowing their horse because horses were COOL back when I was a youngster, darn right compound interest has been a mint.

noobtube wrote:And, what is a MINT?

The wife and daughter want to retire to a hobby farm and they want me to buy it. That'll put a dent in a mint!

noobtube wrote:Besides, you are measuring from the late 20th century. I measure from the 21st century.

You said you experienced the 70's or 80's. Makes you someone who can easily measure from about the same time frames I can. Not my fault floor sweeping didn't teach you the value of tax deferred compound interest investments as soon as they became available through employers.

AdamB wrote:Do pay attention. WAS in the oil business. That was career #1. I'm currently on #3. #2 was the longest.

noobtube wrote:So, all this career-jumping is a sign of "hard work" in the United States?

What do you mean, jumping? 10-15 years in each one so far. Think of each career like an additional college education in different fields of science. You ever hear that 10,000 hours doing something makes you an expert? I've got 77,000 in 3 different careers. It would be like you being promoted from floor sweeper, to toilet cleaner, to car washer across a lifetime. You too could proclaim success at your progression through skill sets.

noobtube wrote:

It looks like nothing more than the instability of employment that occurs when energy resources are depleting.

Says a floor sweeper who lost all his gold because he didn't know enough science to realize that gold is denser than water and doesn't float. In my world they are called "careers". Each one building on the next. Progression. Learning. When you get promoted out of floor sweeping because of your having learned it all, you move up to toilet cleaning, add a new skill to your repetoire. I did something like that. Except each career specialized in the scientific principles of the work involved, and all 3 were different.

noobtube wrote:I see. When someone talks about the real, tangible things (e.g. gold, oil, jobs, food, health care, housing), it's just conspiracy and nonsense.

Of course not. When Lucky talks about living in a land he is irriated at because it has no twisty roads, it is just easy to blame the land of the exceptional. For everything his country can't do. Like build cars. Or subs. Military aircraft. Ferris wheels. Launch rockets. Anywhere. I'd be upset at my country to if we Americans couldn't do all of those things. Better than most, if not everyone, else. That would be like Americans being...normal...? Ick.

noobtube wrote:But, when you talk about imaginary/intangible stuff ("hard work", "smarts", "exceptionalism", "the markets", the dollar, 401k, stocks/bonds), then it's real.

It's real when I use imaginary/intangible to buy STUFF. Until then it is all some number on a tally sheet somewhere. Do you really have no idea how to get money out of a bank and turn it into something "real"?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Ohhhh Bitcoin is crashing and gold is doing so well, yea right. Au is up about 6% YTD, BTC is up 55%. Over five years Au is up 54% and BTC is up 444%. Have to say AU makes some nice jewelry for my wife.

Ohhhh Bitcoin is crashing and gold is doing so well, yea right. Au is up about 6% YTD, BTC is up 55%. Over five years Au is up 54% and BTC is up 444%. Have to say AU makes some nice jewelry for my wife.