Booming Economic Growth?

Re: Booming Economic Growth?

Newfie Screech and doomtard onlooker - the tag team of anecdotal pseudo-scientists. Spare me your tribal affiliation and affinity bullshit.

- marmico

- Heavy Crude

- Posts: 1112

- Joined: Mon 28 Jul 2014, 14:46:35

Re: Booming Economic Growth?

Another zero content troll post.

Do I need to make myself more clear?

Do I need to make myself more clear?

-

Newfie - Forum Moderator

- Posts: 18504

- Joined: Thu 15 Nov 2007, 04:00:00

- Location: Between Canada and Carribean

Re: Booming Economic Growth?

kublikhan wrote:I think one of the biggest problems is wealth inequality.U.S. costs are high due to... inefficient regulation. It suggests that construction, like health care or asset management or education, is an area where Americans have simply ponied up more and more cash over the years while ignoring the fact that they were getting less and less for their money.

Good link. I kinda think the 2 are connected. Wealth/income inequality where not only is the upper level taking more of the profit but wealth/income dispersion where the the upper and lower incomes are farther and farther apart (CEO pay 300 times worker pay vs a paltry 30 times.

If I'm selling a thing, say plumbing services, which end of the consumer spectrum am I likely to target my prices?

Obviously I'm going to charge as much as the market will bear, it's the American way, so I charge $200 hr. And being a responsible biz owner I make sure that licensing laws are strict to limit the competition, as well as code compliance laws to make sure DIYers need a permit to change the washer on their garden hose. And of course I hold the line on my employees's compensation and evade taxes when possible because I'm smart.

All is well for those customers who are on the same program and make $200/hr themselves, just a straight trade of skills (well, winnings anyway).

But what about the actual plumbers, the employees of our example responsible biz owner who make an average of $20.40/hr. Are they ever going to hire a plumber's equivalent of a "plumber"? Not at 10 times their salary they aren't!

And that's not to mention the clerks, janitors, material handlers (greenie grunts) and assorted minimum wage flunkies hanging around the shop. They will never need a plumber because they will never have a pot to piss in that needs plumbing.

Same goes for any product/service originating domestically that doesn't face global competition; home building, infrastructure, medicine, higher ed... as compared to global commodities like walmart t-shirts 2 for $8, or Betty Crocker flour @ $1lb when the wheat in that bag is worth less than a penny. ($200 per ton/2200)

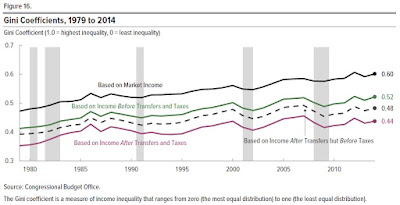

gini

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Booming Economic Growth?

Brick and Mortar Retail is still feeling the pinch, evidently:

Orchard Supply Hardware stores everywhere are closing for good by the end of the year

https://www.sacbee.com/news/state/article217121080.html

We have a new store nearby in a rapidly growing neighborhood. Still, new homes do not make for good hardware sales.

I've bought several things there, patio furniture being the higher ticket items. They have good fashion taste compared to Home Depot. Sorry to see them go.

Orchard Supply Hardware stores everywhere are closing for good by the end of the year

https://www.sacbee.com/news/state/article217121080.html

We have a new store nearby in a rapidly growing neighborhood. Still, new homes do not make for good hardware sales.

I've bought several things there, patio furniture being the higher ticket items. They have good fashion taste compared to Home Depot. Sorry to see them go.

-

jedrider - Intermediate Crude

- Posts: 3107

- Joined: Thu 28 May 2009, 10:10:44

Re: Booming Economic Growth?

jedrider wrote:Brick and Mortar Retail is still feeling the pinch, evidently:

Orchard Supply Hardware stores everywhere are closing for good by the end of the year

https://www.sacbee.com/news/state/article217121080.html

We have a new store nearby in a rapidly growing neighborhood. Still, new homes do not make for good hardware sales.

I've bought several things there, patio furniture being the higher ticket items. They have good fashion taste compared to Home Depot. Sorry to see them go.

The overall trend seems rather obvious, and I see no reason for it to abate in most cases.

An exception might be things like fresh food, for people who are picky about the quality of their food a lot.

OTOH, I am a complete idiot at picking out certain food, like ripe (but not rotting) avacados at the grocery store, so I could see a case for a business that for a reasonable premium, consistently and reliably can ship such food with quality, to the customer's needs.

I saw a piece a couple/few days ago claiming Walmart's brick and mortar business will give it a "significant advantage" over competitors like Amazon.

I read it with interest, hoping to find some meaningful insight into WHY this would be so. But all it had was management babblespeak, stupid assumptions, and denial about how the ground is shifting toward internet sales, and why.

https://www.cnbc.com/2018/08/16/ex-walm ... mazon.html

...

The internet still has a long way to go re selling things like clothes, where fit and looks matter. But they can get there. I'd like to see more details and magnified views re things like stitching, pockets, and some kind of 3D rotating zoomable view, like you can get for cars in some cases.

But just the overall customer reviews already give it a huge edge. Once I have those, why do I need to drive to a store, find it, hope the stocking info. is accurate, etc. just to look at the box -- for the vast majority of items?

It's like the idea of in-store returns. WHAT? Why in the F**K do I want to go to Walmart and experience their customer service nightmare, including long lines, to return something, when I could just throw it in a UPS box for convenient return, like I can at Amazon?

The obvious downside is less choices, but as time goes on I don't see why specialty online stores that have great service (including being able to ask salespeople questions) can't become a widespread "thing", like it already is to a large extent for complex electronic gadgets.

(Of course, that COULD have been a thing at places like Best Buy, but when the help is mostly minimum wage bozos looking for a commission, and BAD service and uncompetitive prices and poor inventory/stocking is the norm, little wonder why such B&M businesses are struggling. I have trouble feeling sorry for the effects of PERSISTENTLY BAD MANAGEMENT.)

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Booming Economic Growth?

You should examine some of Venezuela's currency and price controls for you answer. They make the US look like a model of simplicity in comparison. So much complexity has been added to Venezuela's system there are rife opportunities for corruption.noobtube wrote:To say Venezuela is corrupt implies a complex system, as I understand it. But, how could Venezuela possibly be anywhere near as corrupt as a complex system like the United States? Never understood the argument that banana republics and African dictators were corrupt. How could they be? With what complexity?

Venezuela’s Economy Suffers as Import Schemes Siphon BillionsFor years, Venezuela has had a hole in its pocket, a very big hole. The government’s complex currency system has led to exorbitant schemes by importers, who wildly inflate the value of goods brought into the country to grab American dollars at rock-bottom exchange rates. Sometimes, they fake the shipments altogether and import nothing at all.

Then they just pocket the dollars that the government provides, or sell some of the money for a gargantuan profit on the soaring black market here for American currency. Tens of billions of dollars needed for vital imports have been drained this way from Venezuela’s treasury, officials say, but the loss is especially painful now.

That has Venezuelans on the left and the right in rare agreement, clamoring for someone to be held accountable for the vanished billions. “It’s scandalous,” said Víctor Álvarez, a leftist economist and government minister under Hugo Chávez, the former president who died in 2013. “It’s like the robbery that our people were subject to in the time of the conquest and the colonies, when the gold and silver were carted off by the ton.”

During the boom years of high oil prices, little was done to stop the billions that disappeared through corruption and fraud. But today, with the country in a deep economic crisis marked by recession, crippling inflation and shortages of goods like milk, condoms and shampoo, the missing billions are particularly conspicuous.

Estimates of the import fraud vary, but a former president of Venezuela’s central bank, Edmée Betancourt, has said that up to $20 billion of the $59 billion that went to product imports in 2012 disappeared through fraudulent transactions.

At the heart of the import ploys are the country’s currency controls, which were begun in 2003 by Mr. Chávez. They are based partly on the populist notion that providing cheap, essentially government-subsidized dollars to importers translates to cheap imported goods for the masses. But economists say the controls create vast incentives for fraud. The system is rife with opportunities for abuse, the main one being wildly inflated invoices.

Such maneuvers mean automatic profits, which only multiply once the money goes through the black market. An importer can buy United States currency from the government for as little as 6.3 bolívares to the dollar, then turn around and get as many as 280 bolívares to the dollar on the black market. Venezuelans call the churning of bolívares and dollars “the bicycle” because the process can go around and around indefinitely, generating exorbitant profits in both currencies along the way.

As the economic crisis has deepened in recent months, the government has cut back sharply on the dollars available to importers, worsening shortages but still not eliminating opportunities for fraud.

Jorge Giordani, a former finance and planning minister, has often railed against the fraud that permeates the system. “It’s a financial system that operates like a sieve,” he said in a recent interview. The scale is mind-boggling, creating distortions in the regional economy.

US Charges Point to Rampant Corruption at Venezuela State Oil CompanyUS authorities are charging a network of Venezuelan elites and international financial actors with laundering over a billion dollars stolen from the state-owned oil company, illustrating once again how corruption has ransacked the South American country, and why it can be considered a mafia state.

The PdVSA officials and business people involved allegedly exploited Venezuela’s foreign currency exchange system to increase the value of company funds obtained from the oil company through bribery and fraud. Because of differences between the actual exchange rate and a government-set rate, connected individuals in Venezuela could steal huge amounts of money from the PdVSA. This is all possible thanks to the inconsistencies and complexities of Venezuela’s currency exchange system.

Moreover, PdVSA is not the only government institution in Venezuela subject to rampant corruption. As InSight Crime revealed in a recent investigation, virtually any potential avenue for graft is being exploited while the government of President Maduro turns a blind eye to secure the loyalty of those around him. Cases include members of the armed forces, members of the first family and possibly even the president, who according to the Miami Herald may have participated in the PdVSA money laundering operation, although he is not mentioned by name in the US investigation report.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5013

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: Booming Economic Growth?

And your contribution is? Frankly that post is a no content troll.

Your word salad is at room temperature. Try not to stink up the room.

The GINI that matters = income after taxes and transfers. Pretty well a nothingburger for 3 decades.

- marmico

- Heavy Crude

- Posts: 1112

- Joined: Mon 28 Jul 2014, 14:46:35

Re: Booming Economic Growth?

marmico wrote:The GINI that matters = income after taxes and transfers. Pretty well a nothingburger for 3 decades.

That's the same thing I've been noticing. With all the shrieking from the left about how income inequality is the bane of all existance and sure to destroy the economy, etc., when you look at the GINI over time, the alarm looks a lot more like political point scoring than substance.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Booming Economic Growth?

Re: Booming Economic Growth?

marmico wrote:And your contribution is? Frankly that post is a no content troll.

Your word salad is at room temperature. Try not to stink up the room.

The GINI that matters = income after taxes and transfers. Pretty well a nothingburger for 3 decades.

Really? Since there are over a dozen ways to calculate and express a Gini coefficient, I suppose it's a matter of which method is being used. I'm sure the CBO is using the method that best expresses true income distribution

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Booming Economic Growth?

No developed country on earth has a gini coefficient(after taxes and transfers) of 0.44, except the US. This kind of score puts the US in the category of a developing nation. It is one of the few metrics in the world that puts the US in the same kind of company as China or Mexico.Outcast_Searcher wrote:marmico wrote:The GINI that matters = income after taxes and transfers. Pretty well a nothingburger for 3 decades.

That's the same thing I've been noticing. With all the shrieking from the left about how income inequality is the bane of all existance and sure to destroy the economy, etc., when you look at the GINI over time, the alarm looks a lot more like political point scoring than substance.

Further, when you measure wealth and not income things get much worse:

Wealth InequalityIn the United States, wealth inequality runs even more pronounced than income inequality. Over the past quarter of a century, only America’s most affluent families have added to their net worth.

Over the past century, the share of America’s wealth held by the nation’s wealthiest has changed markedly. That share peaked in the late 1920s, right before the Great Depression, then fell by more than half over the next three decades. But the equalizing trends of the mid 20th century have now been almost completely undone. At the top of the American economic summit, the richest of the nation’s rich now hold as large a wealth share as they did in the 1920s. The 21st century has not been kind to average American families. The net worth — assets minus debts — of most U.S. households fell between 2000 and 2011. Only the top two quintiles of the nation’s wealth distribution saw a net increase in median net worth over those years.

Overall, American household wealth has not fully recovered from the Great Recession. In 2016, the median wealth of all U.S. households was $97,300, up 16% from 2013 but well below median wealth before the recession began in late 2007 ($139,700 in 2016 dollars).

Nine Charts about Wealth Inequality in AmericaBetween 1963 and 2016, families near the bottom of the wealth distribution (those at the 10th percentile) went from having no wealth on average to being about $1,000 in debt. In 1963, families near the top had six times the wealth (or, $6 for every $1) of families in the middle. By 2016, they had 12 times the wealth of families in the middle. Wealth disparities are much greater than income disparities: three times as much by one measure.

The federal government spends over $400 billion to support asset development, but those subsidies primarily benefited higher-income families—exacerbating wealth inequality. About two-thirds of homeownership tax subsidies and retirement subsidies go to the top 20 percent of taxpayers, as measured by income. The bottom 20 percent, meanwhile, receive less than 1 percent of these subsidies.

Low-income families benefit from safety net programs, such as food and cash assistance, but most of these programs focus on income—keeping families afloat today—and do not encourage wealth-building and economic mobility in the long run. What’s more, many programs discourage saving: for instance, when families won’t qualify for benefits if they have a few thousand dollars in assets or when they have to give up rent subsidies to own a home.

Promising policies to shrink wealth inequality

Federal asset-building subsidies disproportionately benefit high-income families that need them the least. Here are six recommendations that could help reduce wealth inequality and racial wealth disparities:

* Limit the mortgage interest tax deduction and use the revenues to provide a credit for first-time homebuyers.

* Establish automatic savings in retirement plans.

* Reduce reliance on student loans while supporting success in postsecondary education.

* Offer universal children's savings accounts.

* Reform safety net program asset tests, which can act as barriers to saving among low-income families.

* Provide subsidies to promote emergency savings, such as those linked to tax time.

By more efficiently and equitably promoting saving and asset building, more people will have the tools to protect their families in tough times and invest in themselves and their children.

These are much more than just "talking points of the left" Outcast_Searcher. You seem to be of the attitude that people should pull themselves up by their bootstraps. Yet the programs in place are often hostile to that goal. Don't you think if we enacted federal programs that encouraged wealth building, instead of just getting by with safety net programs, that people would have the very wealth they need to invest in themselves and their children?

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5013

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: Booming Economic Growth?

kublikhan wrote:These are much more than just "talking points of the left" Outcast_Searcher. You seem to be of the attitude that people should pull themselves up by their bootstraps. Yet the programs in place are often hostile to that goal. Don't you think if we enacted federal programs that encouraged wealth building, instead of just getting by with safety net programs, that people would have the very wealth they need to invest in themselves and their children?

We HAVE federal programs that encourage wealth building. Things like IRA's, 401-K's -- with matches in many cases, and even Obama's enhanced IRA idea, the myRA thing.

The main reason there is so much US "poverty", IMO, is despite all the programs, safety nets, and opportunities, that the people who could benefit most from such programs, don't take good (if any) advantage of them. Instead, there is the tendency to spend ALL one can earn, and borrow, and then blame the consequences on somebody, anybody else.

I've seen this with virtually every "poor" person, couple, or family I've tried to help over the years. Unless someone is willing to throw them endless money in quantity for life, they make themselves unhelpable.

I think it's largely cultural. But your response is what I'm used to hearing from the left -- no matter how much money is thrown at "the poor", the idea is that IF ONLY we'd throw lots more money, then everything would be wonderful. The 50+ year epic failure of the "War on Poverty" tells a different tale, however. How many $trillions of dollars spent is enough, when, at least according to the left, we have more "poor" than ever in the US?

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Booming Economic Growth?

Really now? Is that what I said? Let's see what I actually said:Outcast_Searcher wrote:your response is what I'm used to hearing from the left -- no matter how much money is thrown at "the poor", the idea is that IF ONLY we'd throw lots more money, then everything would be wonderful.

Hmmm, this doesn't seem to support what you just said.kublikhan wrote:The Healthcare & education systems too need an overhaul IMHO. Too much money spent for too little result.

No new revenue needed here either, just shifting spending.kublikhan wrote:Limit the mortgage interest tax deduction and use the revenues to provide a credit for first-time homebuyers

This too seems to be advocating shifting spending, not increasing it.kublikhan wrote:The federal government spends over $400 billion to support asset development, but those subsidies primarily benefited higher-income families—exacerbating wealth inequality.

Hmmm. This too does not seem to fit your stereotypical shoebox you are trying to shove me into Outcast_Searcher. It seems to be arguing that throwing more and more money at the problem is not the solution either.kublikhan wrote:construction, like health care or asset management or education, is an area where Americans have simply ponied up more and more cash over the years while ignoring the fact that they were getting less and less for their money.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5013

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: Booming Economic Growth?

O_S said; ...."The main reason there is so much US "poverty", IMO, is despite all the programs, safety nets, and opportunities, that the people who could benefit most from such programs, don't take good (if any) advantage of them. Instead, there is the tendency to spend ALL one can earn, and borrow, and then blame the consequences on somebody, anybody else. ....."

Yep. Most of that 'social safety net' money gets spent directly back into the economy where those who have sufficient enough of a surplus can scoop it up. As I've said many times, as much as some people bitch about so-called handouts to the poor, many are invested in things that benefit mightily from that wealth redistribution. Think Big Food want's SNAP to be cut? Healthcare? Big Pharma? Sub-prime lenders? Importers and sellers of cheap Chinese,,,,, everything?

Those living paycheck to paycheck are the economy's best friends because that money goes 'round and 'round. With recent tax cuts, the wealthy can snatch up even more of that money while the debts which drive those programs get socialized onto the little people.

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Booming Economic Growth?

Yes, I am sure Outcast and some others here are proponents of trickle down Economics. But, the reality is the Rich have much of the money parked in fixed assets/property deriving Capital gains and also in Tax havens and high yield Bank accounts and other investments. If it is true the statistic that says 70 % of the Economy is the Consumer economy then it stands to reason that it is the little people who in mass with their spending are propping up the Economy. More like trickle up Economics.

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: Booming Economic Growth?

kublikhan wrote:Really now? Is that what I said? Let's see what I actually said:Outcast_Searcher wrote:your response is what I'm used to hearing from the left -- no matter how much money is thrown at "the poor", the idea is that IF ONLY we'd throw lots more money, then everything would be wonderful.Hmmm, this doesn't seem to support what you just said.kublikhan wrote:The Healthcare & education systems too need an overhaul IMHO. Too much money spent for too little result.No new revenue needed here either, just shifting spending.kublikhan wrote:Limit the mortgage interest tax deduction and use the revenues to provide a credit for first-time homebuyersThis too seems to be advocating shifting spending, not increasing it.kublikhan wrote:The federal government spends over $400 billion to support asset development, but those subsidies primarily benefited higher-income families—exacerbating wealth inequality.Hmmm. This too does not seem to fit your stereotypical shoebox you are trying to shove me into Outcast_Searcher. It seems to be arguing that throwing more and more money at the problem is not the solution either.kublikhan wrote:construction, like health care or asset management or education, is an area where Americans have simply ponied up more and more cash over the years while ignoring the fact that they were getting less and less for their money.

OK. So you want to "shift" more spending instead of "spending more". And you don't like the spending that helps the non-poor (which I tend to agree), so what will the end result be? More spending on the poor. Six of one, half a dozen of the other.

And that will fix everything? Again -- look at the real world re the war on poverty for the past 50+ years. Somehow, I think human behavior will continue to trump your "shift in spending" plan.

It is nice not to hear avocation for more such social spending, until the current spending is actually working well. I'll believe that will be what actually happens starting in the 2020 administration (presuming the dems win), when I see it, however.

BTW, when you say education, I'm in agreement on that. K-12 needs to have some good solid basics on things like budgeting, spending, planning, and basic investment. Of course, that would imply a certain level of personal responsibility as an adult. That doesn't project the same message as the nanny state, so good luck getting the majority of the left to go along with that, vs. shifting more spending toward their favorite social programs.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Booming Economic Growth?

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: Booming Economic Growth?

onlooker wrote:America's Real Economy: It Isn't Booming

https://www.forbes.com/sites/petergeorg ... 66cfdf60b7\

This is all consistent with the jobless "recovery" after the 2008 meltdown. The joblessness rate remains very high and this has produced the zeitgeist that elected populist, MAGA Trump. The Democrats and the deep state and the fake stream media can scream about Hitler's second coming all they want, but they have nothing to offer the jobless millions. They are part of the whole global offshoring racket in the first place. Anyone who thinks that offshoring and the associated downsizing and right-sizing at home are the path to prosperity are certifiable.

- dissident

- Expert

- Posts: 6458

- Joined: Sat 08 Apr 2006, 03:00:00

Re: Booming Economic Growth?

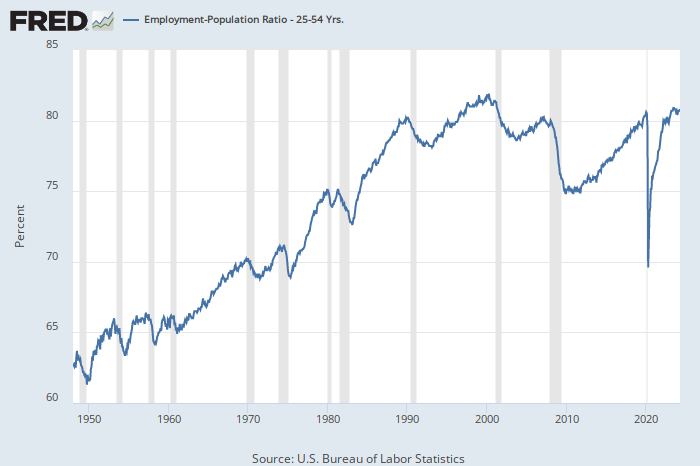

This is all consistent with the jobless "recovery" after the 2008 meltdown.

Don't think so. The employment-population ratio for the prime age (25-54) cohort is starting to approach the prior 1990, 2000 and 2007 business cycle peaks.

- marmico

- Heavy Crude

- Posts: 1112

- Joined: Mon 28 Jul 2014, 14:46:35

Re: Booming Economic Growth?

Outcast_Searcher, every developed country in the world is comprised of the same humans that make up the people in the US. And yet despite you attributing all the problems of the poor to human behavior and personal responsibility, somehow they manage to avoid the pitfalls you describe of the poor in the US. They are not a different species. They are all human. Thus there are other factors at play here besides just human behavior. This is not just the opinion of the "left" in the US either. The UN has come to the same conclusion.

UN report blames Trump administration policies for soaring income and wealth inequalityA scathing new United Nations report has found that the United States is leading the developed world in income and wealth inequality, laying explicit blame with the Trump administration for policies that actively increase poverty and inequality in the country.

The report found that the United States “is now moving full steam ahead to make itself even more unequal,” citing the $1.5 trillion in tax cuts passed in December 2017, which “overwhelmingly benefited the wealthy and worsened inequality. The consequences of neglecting poverty and promoting inequality are clear,” the report concludes. “The policies pursued over the past year seem deliberately designed to remove basic protections from the poorest, punish those who are not in employment and make even basic health care into a privilege to be earned rather than a right of citizenship.”

Alston characterized the United States as an outlier among the developed world. In Lowndes County, Alabama, the U.N. found cesspools of sewage that flowed out of dysfunctional (or nonexistent) septic systems, which has led to a resurgence in diseases that officials believed were eradicated. A recent study found that more than one-third of people surveyed in Alabama tested positive for hookworm — a parasite that thrives in areas of poor sanitation, which has not been well-documented in the United States since the 1950s.

Alston was not hopeful of the odds that the report will force the administration to change course. During his visit, “The U.S. was visibly debating what to do with $1.5 trillion [in tax cuts]. And its proposals in relation to those living in poverty was essentially to cut back on existing benefits in order to help fund the tax reforms. That made for a pretty dramatic contrast for the approach that I have found elsewhere.”

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5013

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: Booming Economic Growth?

https://www.forbes.com/sites/eriksherma ... 83578d408b

https://www.theguardian.com/business/gr ... mys-health

So, one needs to look at the present unemployment rate with some skepticism because it is not counting the many people who are not even participating anymore in the job market. Also, because of the growing percentage of part time work as part of the overall workforce.

https://www.theguardian.com/business/gr ... mys-health

So, one needs to look at the present unemployment rate with some skepticism because it is not counting the many people who are not even participating anymore in the job market. Also, because of the growing percentage of part time work as part of the overall workforce.

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Who is online

Users browsing this forum: No registered users and 120 guests