In the past decade this website has gone from being full of people believing almost universally in Peak Oil due to resource limits (a belief mostly destroyed by the torrent of new production released by a decade of high prices and the shale oil revolution ) to believing in Peak Demand due to Climate Change initiatives rewriting business as usual. With many believing demand already peaked in 2020 due to COVID-19 accelerating this global transition to the way we work and live.

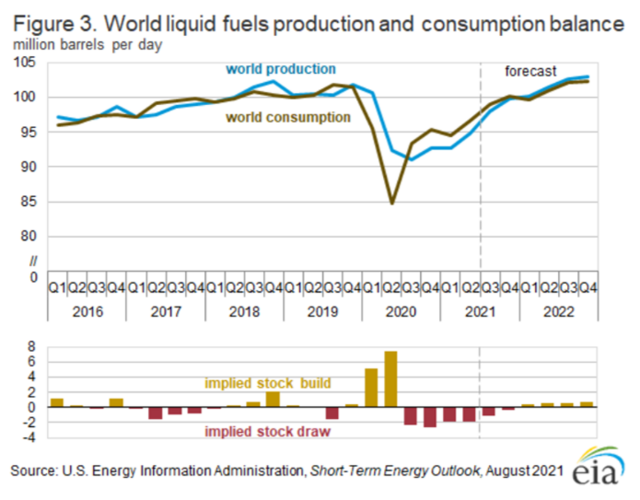

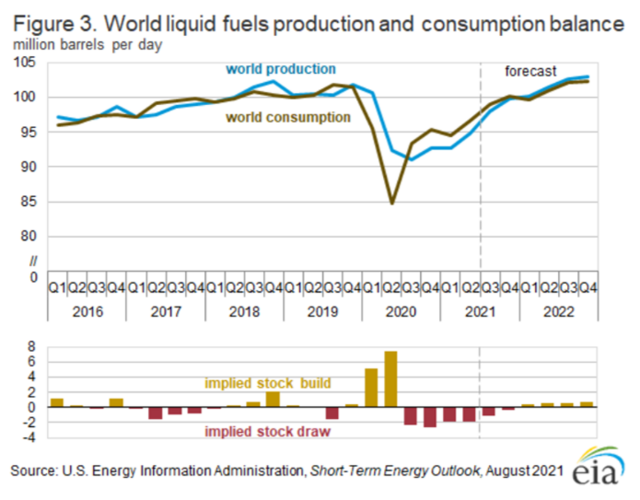

Now we are seeing a rebound in oil demand that will likely exceed the 2020 peak next year and accompanying this resurgent demand is a return of high prices in oil, gas and coal. Many market analysts are predicting record high prices for oil next year and for many years to come due to this under investment in oil and gas and coal while demand continues to increase. By backing the IEA/Paris Accord/ESG narrative, Liberal democratic governments have created a self fulfilling climate where fear of stranded assets and years of litigation has caused big oil and coal producers and investment bankers to shun investment in new production. And low investment is going to lead us back to Peak Oil as natural production decline isn’t waiting for the energy transition to catch up. Should make for interesting mid-terms for Joe and the Dems.

Traders once again are betting that the U.S. oil benchmark will surge above $100 a barrel, from a recent $82, as early as December. U.S. crude, known as West Texas Intermediate or WTI, is up 10% this month, and 70% this year, but it hasn’t hit $100 since the oil crash of 2014. Wagers across the Atlantic are even more aggressive. Some traders are betting Brent crude, the global benchmark, will hit a record high of $200 a barrel by December 2022, according to data from provider QuikStrike.

https://www.wsj.com/articles/crazy-bets ... _lead_pos2

Total global investment into oil and gas exploration and production fell by 34% last year to $261 billion, the lowest since 2004, according to a December report from the International Energy Forum and the Boston Consulting Group.

Annual spending at that level won’t satisfy the world’s energy needs in the coming years, the report said. Annual investment needs to be 25% higher over the next three years to stave off a supply crisis, the report estimated. That’s much faster than the pace of recovery after the 2014 to 2016 slump. The coming year will be crucial in determining whether the industry is capable of rising to that challenge.The IEF report estimated that upstream investment would drop by another 20% in 2021, but prices have already rallied since it was published last year and “capex is likely to be higher than our initial estimates,” said Jamie Webster, senior director at the Boston Consulting Group.[/b]

https://www.worldoil.com/news/2021/1/29 ... t-declines

Peak Oil > Peak Demand > Peak Investment > Peak Oil

First unread post • 7 posts

• Page 1 of 1

Peak Oil > Peak Demand > Peak Investment > Peak Oil

Don't deny the peak!

- jawagord

- Lignite

- Posts: 313

- Joined: Mon 29 May 2017, 10:49:17

Re: Peak Oil > Peak Demand > Peak Investment > Peak Oil

Interesting.

Thanks

Thanks

-

Newfie - Forum Moderator

- Posts: 18504

- Joined: Thu 15 Nov 2007, 04:00:00

- Location: Between Canada and Carribean

Re: Peak Oil > Peak Demand > Peak Investment > Peak Oil

I think you are partly correct, LTO and the media narrative around Saudi America did impact whatever larger fear there was regarding depletion and that of course impacted this site. I don't know that a majority of the 6 people who still post here necessarily think demand will decline before supply, I think they for the most part don't know or care, most discussions are about what they saw on Tucker Carlsen last night.

The belief COVID caused peak demand was a bit of click-bait rolled out by the 24 hour news cycle.When was the last time you heard that bit of blather.

But I also notice while you poo-poo po.com for believing in peak demand due to the pandemic you seem to make the same argument that the decline in investment in new production during the pandemic is an omen of the future. That 34% decline in investment I'm pretty sure is just as temporary.

Generally I'm ambivalent to the idea liberals demonizing fossils will cause a lack of supply. As you point out, the price of oil is already at a 8 year high. That means profit in most places and where there is profit there will be investment. Democratic representatives are just like republicans, they make rules to please their sponsors and it is pretty obvious our sponsors don't want to address climate change at this time.

Which, of course is not to say that there will be no mal-investment, The global economy and global energy is a self-organizing system, it tries to make a profit no matter what. I think it is likely there will be too much investment, too little investment and totally or maybe tragically wrong investment... and hopefully just enough right investment ... all at the same time. That is the nature of the invisible hand.

Oh by the way the last peak was a year prior to the pandemic.

The belief COVID caused peak demand was a bit of click-bait rolled out by the 24 hour news cycle.When was the last time you heard that bit of blather.

But I also notice while you poo-poo po.com for believing in peak demand due to the pandemic you seem to make the same argument that the decline in investment in new production during the pandemic is an omen of the future. That 34% decline in investment I'm pretty sure is just as temporary.

Generally I'm ambivalent to the idea liberals demonizing fossils will cause a lack of supply. As you point out, the price of oil is already at a 8 year high. That means profit in most places and where there is profit there will be investment. Democratic representatives are just like republicans, they make rules to please their sponsors and it is pretty obvious our sponsors don't want to address climate change at this time.

Which, of course is not to say that there will be no mal-investment, The global economy and global energy is a self-organizing system, it tries to make a profit no matter what. I think it is likely there will be too much investment, too little investment and totally or maybe tragically wrong investment... and hopefully just enough right investment ... all at the same time. That is the nature of the invisible hand.

Oh by the way the last peak was a year prior to the pandemic.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Peak Oil > Peak Demand > Peak Investment > Peak Oil

Also, there is a lot more peak oil discussion at peakoilbarrel.com although it is not this same forum style. OilPrice.com I think has a forum.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Peak Oil > Peak Demand > Peak Investment > Peak Oil

Pops wrote:As you point out, the price of oil is already at a 8 year high. That means profit in most places and where there is profit there will be investment. Democratic representatives are just like republicans, they make rules to please their sponsors and it is pretty obvious our sponsors don't want to address climate change at this time.

Which, of course is not to say that there will be no mal-investment, The global economy and global energy is a self-organizing system, it tries to make a profit no matter what. I think it is likely there will be too much investment, too little investment and totally or maybe tragically wrong investment... and hopefully just enough right investment ... all at the same time. That is the nature of the invisible hand.

Oh by the way the last peak was a year prior to the pandemic.

Exactly. The usual suspects looking for doom around every corner will claim that malinvestment tends to imply doom.

Wrong. As long as businesses which are dealing in highly volatile commodity prices, there will nearly ALWAYS be SOME malinvestment, since by their nature, such prices are super-hard to predict.

But as long as the industry makes a generally healthy profit over time, then the economic sustainability for that business is just dandy. (Not talking about resources or the biosphere here -- just moderate term economic viability).

I make all kinds of "wrong" trades in the stock market every year, without fail. Because I almost never buy right at the bottom of a moderate term cycle or sell right at the top. But I can live with that just FINE, as long as over time, my typical buy price is far enough below my typical sell price to make an acceptable profit to me, on average, over time.

Just as inconvenience isn't doom, a "reasonable" amount of human inefficiency, re being unable to accurately see the future (esp. re small details) isn't doom.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Peak Oil > Peak Demand > Peak Investment > Peak Oil

Pops wrote:Also, there is a lot more peak oil discussion at peakoilbarrel.com although it is not this same forum style. OilPrice.com I think has a forum.

POB has the worst back and forth format I've ever seen. And while some might interpret previously discredited cheerleading and analysis as "discussion", it strikes far to close to the bad old days of acolytes reading from the Bible in the pews, and reciting back whatever the hymnal says. Dennis is about the only one who appears to have given any thought to the matter, and doesn't seem to possess the rabid intensity of the normal acolytes.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak Oil > Peak Demand > Peak Investment > Peak Oil

jawagord wrote:... we are seeing a rebound in oil demand that will likely exceed the 2020 peak next year and accompanying this resurgent demand is a return of high prices in oil, gas and coal. Many market analysts are predicting record high prices for oil next year and for many years to come due to this under investment in oil and gas and coal while demand continues to increase. By backing the IEA/Paris Accord/ESG narrative, Liberal democratic governments have created a self fulfilling climate where fear of stranded assets and years of litigation has caused big oil and coal producers and investment bankers to shun investment in new production. And low investment is going to lead us back to Peak Oil as natural production decline isn’t waiting for the energy transition to catch up. Should make for interesting mid-terms for Joe and the Dems.

Based on current trends oil should be significantly higher next year.....most likely over $100+/bbl and possibly as much as $200/bbl.

jawagord wrote: Annual investment needs to be 25% higher over the next three years to stave off a supply crisis

Its hard to see that happening when the current Biden administration is actively hostile to oil and NG leasing, drilling, and fracking.

And some large banks now are disinvesting from fossil fuels....where is all the capital supposed to come from to increase oil production if major banks eschew loans to oil companies?

bank-of-america-joins-big-u-s-banks-that-wont-finance-oil-

Cheers!

Never underestimate the ability of Joe Biden to f#@% things up---Barack Obama

-----------------------------------------------------------

Keep running between the raindrops.

-----------------------------------------------------------

Keep running between the raindrops.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

7 posts

• Page 1 of 1

Who is online

Users browsing this forum: No registered users and 104 guests