ROCKMAN wrote:Pops – “But ignoring or even denying that main dynamic, the underlying curve - "what the geology can offer", is to miss - or ignore, the whole point.” I don’t think I ever “denied” geology wasn’t part of the dynamic. But back to the point I made earlier: if the “geology” is the “main dynamic” please explain how the geology produced $140+ oil in 2008 and then $50+ oil in 2009 and then $100 oil in 2013. Did the geology change that much in just a few years? I think it’s much easier to explain those price swings as well as what’s going on in the world today by analyzing all the components of the POD.

Hi Rockman,

It seems you and Pops are arguing about something that you mostly agree on. It seems to me that the peak oil dynamic mostly is looking at the interaction between economics and geology and its effect on the energy industry and society in general. I don't think Pops is denying that the price of oil has an effect or should be ignored, I think for him and for many of us, the geological fact that oil resources are finite is the starting point of our analysis. One does not need to argue that the date of the peak is of paramount importance, one only needs to point out that at some point (my guess is within 10 years, but we have all heard that kind of guess before) a peak will be reached. Nonsense you say, what if real oil prices rise to $500/barrel?

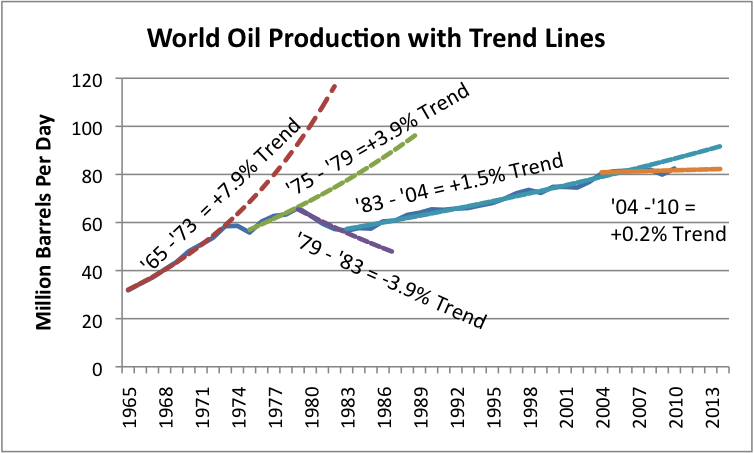

I would respond that the demand for oil is unlikely to be higher than current levels of output at $500 or even $250/barrel (in May 2013 $) in 2023. One can easily explain the oil price movements since 2004 with an analysis that starts with geological constraints.

The inability of world supply to ramp up sufficiently over the 2004 to 2008 period to bring prices back to the 30 dollar level spooked the markets and drove prices to very high levels, these high energy prices were a major factor (I think this overstates the case) in the ensuing economic meltdown. The great recession reduced demand for oil causing oil prices to drop, the lowered energy prices played some part in the recovery of the economy (though this recovery was pretty anemic). A better economy resulted in increased demand for energy which drove prices back up to $100/barrel.

If one claims that such an analysis can be done without talking about both oil prices and underlying geological constraints (that is how easy is it to extract oil), then I would disagree. If the POD attempts to say you cannot just focus on geology you also have to look at the economics (and maybe politics as well), then I am in complete agreement. I think Pops might agree, but he would say the geological part is more important, and you might say the price aspect is more important, but I think you might claim they are equally important and that the political and maybe even sociological aspects need to be included to get a full picture. This may be correct, but it is difficult to throw too much into the mix and make any headway from an analytical perspective.

DC