Pops wrote:I'm not convinced we've reached peak. What with the various political and market manipulations afoot, a pandemic, possible resultant recession, ongoing shale troubles, etc, etc, the fog is deep.

I'm not convinced either. All the current demand side effects, while substantial, aren't a guarantee of peak oil today. But for awhile (as with the others before), it will certainly look like it.

Pops wrote:

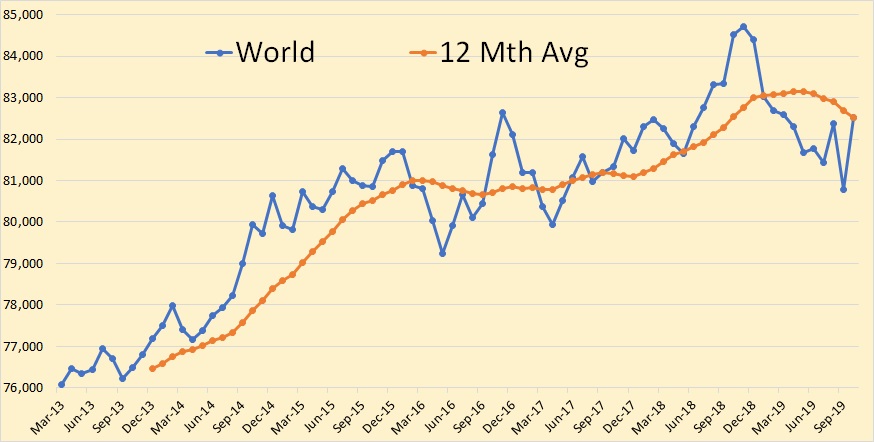

Having said that, for the purposes of discussion, let's stipulate that peak is past. Seems reasonable since outside KSA, RU, USA everyone else seems to have peaked and since 2017 have declined about 6%, Ron says C+C is past, EIA and IEA projecting it not recovering next year at least.

As we all now know, past peaks are not indicative of a lack of future ones. However, as it is an operative assumption at some of the higher levels of academia, government, and think tanks, I'm good to go, operating with this stipulation.

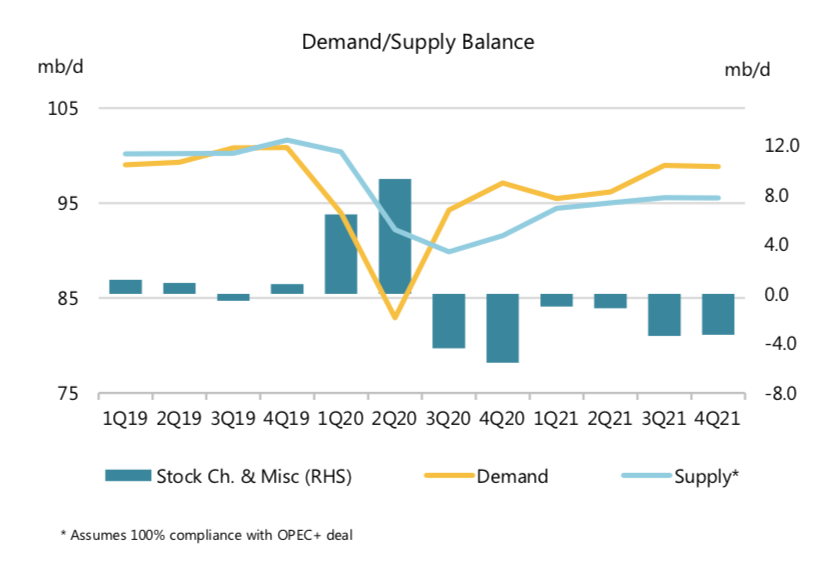

Pops wrote:Let's further stipulate that this from EIA (h/t globalpeak.info) indicates the nature, if not the reality of the future, namely demand exceeding supply—notice the red bars indicating continous stock draw all next year.

If we are arguing peak demand as the cause of recent peak oil, it is difficult to then claim a reversal without breaking the stipulation of no more peak oils. The EIA is bound to their international model used for the IEO estimates. That model is based primarily on GDP and population, and at the last release of said IEO document they were asked about modeling peak demand, and they said that they do not do that. Might be can not do that, if independent variables are GDP and population. You would have to predict those go down to reverse the growth trend built into a system like that. The IEA does back of the envelope type calculations, so they aren't bound by basic modeling rules. Throw out independent variables and anything is possible.

Pops wrote:And finally, lets just say that supply never catches up to demand. In the real world, that's all that matters. When the market wants just one more barrel than can be supplied, the bidding war starts and doesn't stop until enough buyers are eliminated to balance the market. The "want" is still there, it's the ability to pay that is the limit. Of course with high price comes increased capital for drillers to drill and frackers to frack but let's just imagine the point of diminishing returns.

No other stipulations, just high price on limited supply.

What happens?

What do "people" do?

What do you do?

So this is just a artificial "lets talk about the doomer porn we used to when we thought this was all going to be real" exercise. The answer is obvious of course. Locking down a particular supply/demand profile allows only the variable of price, and in your scenario is designed to drive price higher, at least initially. What happens next is exactly what is expected. Conservation and substitution.

I would mention that demand isn't consumption, in the economic world. So consumption will be capped at whatever your supply profile is, even if the demand remains high and becomes higher with time, continuing the expected price pressure.

I'll keep driving my EV, powered at least in part by the solar panels on the garage roof. In order to avoid higher fuel prices, I'll get an EV with longer range, and put up with the charging needs at 200-300 mile intervals during my cross continental travels.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"