Modern Money Theory and You

Re: Modern Money Theory and You

A few ears ago I never thought I'd ever say that, but monetary theory might be more important to our future than 99% of topics discussed on this site. A few years ago I still thought that central banks create all money, because I never cared to read about it. In case anyone is still interested, here's more on MMT, money creation and the modern banking clusterfuck:

https://positivemoney.org/2018/09/moder ... ive-money/

https://braveneweurope.com/positive-mon ... y-and-debt

"One important point should already be clear: both MMT and Positive Money constitute part of a much broader trend that began to accelerate rapidly following the global financial crisis. The capacity of the banking sector to disturb the entire economy no longer lying in doubt, many economic reformists concluded that a new perspective on money, banking and finance should be placed front and centre of the push to construct a better world.

An important fight for those who have been working for years in the heterodox economics space has been to deny the so-called ‘loanable funds’ model of how money cycles round the economy, and the attendant ‘money multiplier’. A loanable funds account claims that there is a stock of available savings in the economy that aspiring borrowers can access. As in all things according to orthodox economics, the equilibrium between the demand and supply of such funds determines the interest rate. Banks in this theoretical world act only as neutral intermediaries for this process and the central bank is able to influence the money supply by issuing reserves; loans grow in some fixed proportion to reserves – the ‘multiplier’ – as set out by reserve requirements.

According to Adair Turner, former head of the UK’s banking regulator, this model is ‘completely mythological’. This way of understanding money and banking is by now utterly discredited: the Bank of England, Bundesbank and US Federal Reserve have all released papers explaining just how far the facts of modern banking diverge from the loanable funds paradigm.

Nevertheless, the model somehow retains a hold on the academic economics establishment in the remaining bastions of orthodox practice. (For instance, papers occasionally emerge that make an attempt to salvage the theory: we know, for example, that it only works as a model ‘when there is no uncertainty and thus no bank default.’ Under what real-world conditions we can expect there to be no uncertainty is unclear from the paper in question.)

For now, suffice to say that both MMT and Positive Money are committed to a denial of the loanable funds model and a description of the much more accurate endogenous theory of money. Endogenous money creation means that the money supply expands and contracts according to decisions made within private financial entities. One major source of new money is the process of bank lending. When banks write new loans, they assign a new liability (the customer’s new deposit) and a corresponding asset (the loan) to their books. New money is created. When a loan is repaid, money (and the spending power that deposit represents) is destroyed.

What MMT and Positive Money both maintain (and here both are in line also with Post-Keynesian economists, another major heterodox school) is that because the current system works along the lines described by endogenous money theory, the orthodox approach to reforming finance and money is irremediably flawed. Money can be created, but at the moment the primary actors doing so are private banks. The next step is to urge a solution.

..."

That's where the plot thickens.

https://positivemoney.org/2018/09/moder ... ive-money/

https://braveneweurope.com/positive-mon ... y-and-debt

"One important point should already be clear: both MMT and Positive Money constitute part of a much broader trend that began to accelerate rapidly following the global financial crisis. The capacity of the banking sector to disturb the entire economy no longer lying in doubt, many economic reformists concluded that a new perspective on money, banking and finance should be placed front and centre of the push to construct a better world.

An important fight for those who have been working for years in the heterodox economics space has been to deny the so-called ‘loanable funds’ model of how money cycles round the economy, and the attendant ‘money multiplier’. A loanable funds account claims that there is a stock of available savings in the economy that aspiring borrowers can access. As in all things according to orthodox economics, the equilibrium between the demand and supply of such funds determines the interest rate. Banks in this theoretical world act only as neutral intermediaries for this process and the central bank is able to influence the money supply by issuing reserves; loans grow in some fixed proportion to reserves – the ‘multiplier’ – as set out by reserve requirements.

According to Adair Turner, former head of the UK’s banking regulator, this model is ‘completely mythological’. This way of understanding money and banking is by now utterly discredited: the Bank of England, Bundesbank and US Federal Reserve have all released papers explaining just how far the facts of modern banking diverge from the loanable funds paradigm.

Nevertheless, the model somehow retains a hold on the academic economics establishment in the remaining bastions of orthodox practice. (For instance, papers occasionally emerge that make an attempt to salvage the theory: we know, for example, that it only works as a model ‘when there is no uncertainty and thus no bank default.’ Under what real-world conditions we can expect there to be no uncertainty is unclear from the paper in question.)

For now, suffice to say that both MMT and Positive Money are committed to a denial of the loanable funds model and a description of the much more accurate endogenous theory of money. Endogenous money creation means that the money supply expands and contracts according to decisions made within private financial entities. One major source of new money is the process of bank lending. When banks write new loans, they assign a new liability (the customer’s new deposit) and a corresponding asset (the loan) to their books. New money is created. When a loan is repaid, money (and the spending power that deposit represents) is destroyed.

What MMT and Positive Money both maintain (and here both are in line also with Post-Keynesian economists, another major heterodox school) is that because the current system works along the lines described by endogenous money theory, the orthodox approach to reforming finance and money is irremediably flawed. Money can be created, but at the moment the primary actors doing so are private banks. The next step is to urge a solution.

..."

That's where the plot thickens.

- Zarquon

- Lignite

- Posts: 321

- Joined: Fri 06 May 2016, 20:53:46

Re: Modern Money Theory and You

As an introduction to the topic, here's the referenced paper from the Bank of England. It gets a little technical after page 14, but the introduction is fairly understandable, even for dummies like me:

https://www.bankofengland.co.uk/working ... is-matters

"... But in the real world, the key function of banks is the provision of financing, or the creation of new monetary purchasing power through loans, for a single agent that is both borrower and depositor. The bank therefore creates its own funding, deposits, in the act of lending, in a transaction that involves no intermediation whatsoever. Third parties are only involved in that the borrower/depositor needs to be sure that others will accept his new deposit in payment for goods, services or assets. This is never in question, because bank deposits are any modern economy’s dominant medium of exchange.

Furthermore, if the loan is for physical investment purposes, this new lending and money is what triggers investment and therefore, by the national accounts identity of saving and investment (for closed economies), saving. Saving is therefore a consequence, not a cause, of such lending. Saving does not finance investment, financing does."

https://www.bankofengland.co.uk/working ... is-matters

"... But in the real world, the key function of banks is the provision of financing, or the creation of new monetary purchasing power through loans, for a single agent that is both borrower and depositor. The bank therefore creates its own funding, deposits, in the act of lending, in a transaction that involves no intermediation whatsoever. Third parties are only involved in that the borrower/depositor needs to be sure that others will accept his new deposit in payment for goods, services or assets. This is never in question, because bank deposits are any modern economy’s dominant medium of exchange.

Furthermore, if the loan is for physical investment purposes, this new lending and money is what triggers investment and therefore, by the national accounts identity of saving and investment (for closed economies), saving. Saving is therefore a consequence, not a cause, of such lending. Saving does not finance investment, financing does."

- Zarquon

- Lignite

- Posts: 321

- Joined: Fri 06 May 2016, 20:53:46

Re: Modern Money Theory and You

Interesting ideas. I need to read that through a few times.

Gotta say I’m suspicious of that view point.

Gotta say I’m suspicious of that view point.

-

Newfie - Forum Moderator

- Posts: 18501

- Joined: Thu 15 Nov 2007, 04:00:00

- Location: Between Canada and Carribean

Re: Modern Money Theory and You

One of Global Finance's Biggest Doctors Warns: The World Economy Is About to Get Very Sick

Unless banks and governments switch gears from tax cuts to addressing inequality, we may be in for a lengthy economic downturn soon

When Claudio Borio speaks, the big bankers and investors, the economics profession, and senior policymakers listen quite carefully—even if his sentiments don’t reach the shores of the popular media. Borio, the chief economist for the Bank for International Settlements (BIS), the central bankers’ central bank, recently remarked on the fragility of the global economy, and suggested that we were on the verge of a significant relapse similar to the global crash experienced 10 years ago. Among the parallels he perceives: the proliferation of “collateralized loan obligations (CLOs), which are ‘close cousins’ of the infamous instruments known as collateralized debt obligations, or CDOs, and securities backed by residential mortgages,” the prevalence of which helped to crater the credit system in 2008.

Mindful as central bankers have been about the ready availability of liquidity, they have (as I have written before) omitted to “proactively... [charging] private market participants variable risk premiums commensurate with the risk of the underlying activity they are undertaking when providing credit.” Furthermore, Borio implies that the monetary and fiscal authorities expended excessive efforts toward restoring the status quo ante, instead of directing policy toward broader job creation and income generation, which would place the economy on sounder footing when the next downturn inevitably comes. Finally, the BIS’s chief economist also publicly mooted whether additional “medicine” of the kind that we used last time will be in sufficient supply to respond adequately when the next crisis emerges.

More: https://www.commondreams.org/views/2018 ... -very-sick

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Modern Money Theory and You

The assertion of the article Ghung posted above makes alot of sense to me. I read that roughly 70% of the US economy is via consumption. The lower classes spend their all their income for needs and some wants. It is money that is circulating in the Economy. As opposed to the rich who invest a sizable portion of their money in parked assets or keep it in bank accounts. other accounts or tax havens

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: Modern Money Theory and You

onlooker wrote:The assertion of the article Ghung posted above makes alot of sense to me. I read that roughly 70% of the US economy is via consumption. The lower classes spend their all their income for needs and some wants. It is money that is circulating in the Economy. As opposed to the rich who invest a sizable portion of their money in parked assets or keep it in bank accounts. other accounts or tax havens

https://fredblog.stlouisfed.org/2016/04 ... n=fredblog

The dollar circulation wasn't lower at any time since the FED kept these statistics.

- Zarquon

- Lignite

- Posts: 321

- Joined: Fri 06 May 2016, 20:53:46

Re: Modern Money Theory and You

Newfie wrote:Interesting ideas. I need to read that through a few times.

Gotta say I’m suspicious of that view point.

In case you mean the creation of money and the snotty old Bank of England isn't good enough for you, here's the relevant page from the German Bundesbank:

https://www.bundesbank.de/en/tasks/topi ... ted-667392

"Sight deposits are an example of book money: sight deposits are created when a bank settles transactions with a customer, ie it grants a credit, say, or purchases an asset and credits the corresponding amount to the customer's bank account in return. This means that banks can create book money just by making an accounting entry: according to the Bundesbank's economists, ""this refutes a popular misconception that banks act simply as intermediaries at the time of lending – ie that banks can only grant credit using funds placed with them previously as deposits by other customers"". By the same token, excess central bank reserves are not a necessary precondition for a bank to grant credit (and thus create money)."

- Zarquon

- Lignite

- Posts: 321

- Joined: Fri 06 May 2016, 20:53:46

Re: Modern Money Theory and You

Suspicious not that it exists but that it’s a good idea.

-

Newfie - Forum Moderator

- Posts: 18501

- Joined: Thu 15 Nov 2007, 04:00:00

- Location: Between Canada and Carribean

Re: Modern Money Theory and You

I propose that the government capitalize its citizens. I first tried to pitch the idea by saying that someone might need an F-150 truck to do business. Of course, the criticism came back that people would borrow just to get the truck, and then refuse to pay back the loan. Do you think I am proposing a type of transfer payment? That's not the case. My proposal has more to do with addressing how interest rate policy marginally effects employment more greatly than it does investment. It's not just that the Fed uses employment figures to help it decide what to do with rates. Workers are an expense. Interest rates are an expense. Businesses borrow. They also hire people to work for them. At all times they must do both. Employment is the thing which will suffer in the long run under any rising interest rate environment. It isn't just that the Fed uses employment to decide when to strike. It is that rates are not something that businesses can adjust. They can hire and fire people. They will do so before they go after something as sacrosanct as a history of paying a certain dividend, or at the expense of halving the stock price.

When I look at the economy, I see an increase in the prevalence of independent contracting. This is a device used by companies which can't achieve profitability if they have to hire employees at certain positions. Their business models wouldn't work under the more established paradigm, but they have been able to use the legal structure to redefine what an employee is, so that they can enter into relationships with people who would have been considered as employees under the old paradigm, this time considering them as independent businesses that the new type of company contracts with to do what employees used to do. It removes the burdens imposed by the power of collective bargaining on the part of employees from what would have been considered a traditional business under the old paradigm, and places them upon the independent contractors.

The independent contractor is then asked to evaluate whether they can do business under these circumstances. Maybe they can go without health insurance? They have to pay both sides of the taxes, out of whatever profits, which can be artificed. Things like workman's comp are not considered, as the independent contractor stands on their own, and the whole idea of workman's comp is that it addresses labor as a pool from which to derive coverage on a percentage of occurrence basis. Of course, they can sue any business they contract with, especially when it comes to negligent practices resulting in injury, but they have to do that on their own. The whole idea of a collective approach forcing compliance to safety standards or fairness is anathema to the relationship.

This arrangement goes against the sense of fairness engendered by the operations of the labor movement, but it is where employment in the new economy is headed. It is no more unethical than a homeowner hiring an independent contractor to fix something about their home. It's simply an extension of that thinking, circumventing the old paradigm's reliance upon the sense of fairness previously understood, brought about by petition to the people's representatives by business, so that it can be done under the law. They need the legal changes to allow for continuing operations to fall under this approach. Because it is now legal, businesses that don't engage in it will not be able to cut their costs under any interest rate environment enough to compete. The changes in the law already lobbied for and gotten assure that. You'll be seeing more of it. It will especially be important under the advent of artificial intelligence in the economy.

That's why capitalizing citizens is important. It means, for one thing, that interest rates are relevant to what needs to be done, not to a person's credit level. People, viewed essentially as small corporations of some kind, would have a credit level, but that would pertain to how much they could borrow, not what rate they would borrow that money at. Unlike bank lending, government capitalization would come with interest rates which are designed to address what is lacking. As artificial intelligence pares people from the working environment that will become increasingly important. Either companies will have to invest in the parts of their operations they currently desire to pass on to independent contractors, or they will have to deal with the owners of those now capitally intensive aspects on a contractual basis. It will become important for people to be able to take advantage of the opportunities for income under this new paradigm, as they invest in these capitally intensive niches. It would be best if they could do so by borrowing based upon the need for those things within the broader economy rather than under the rate adjustment structure as it is currently administered by the Fed. The monopolistic businesses might cry foul, having to labor under the rate structure imposed by the Fed, but they've only really brought this upon themselves.

When I look at the economy, I see an increase in the prevalence of independent contracting. This is a device used by companies which can't achieve profitability if they have to hire employees at certain positions. Their business models wouldn't work under the more established paradigm, but they have been able to use the legal structure to redefine what an employee is, so that they can enter into relationships with people who would have been considered as employees under the old paradigm, this time considering them as independent businesses that the new type of company contracts with to do what employees used to do. It removes the burdens imposed by the power of collective bargaining on the part of employees from what would have been considered a traditional business under the old paradigm, and places them upon the independent contractors.

The independent contractor is then asked to evaluate whether they can do business under these circumstances. Maybe they can go without health insurance? They have to pay both sides of the taxes, out of whatever profits, which can be artificed. Things like workman's comp are not considered, as the independent contractor stands on their own, and the whole idea of workman's comp is that it addresses labor as a pool from which to derive coverage on a percentage of occurrence basis. Of course, they can sue any business they contract with, especially when it comes to negligent practices resulting in injury, but they have to do that on their own. The whole idea of a collective approach forcing compliance to safety standards or fairness is anathema to the relationship.

This arrangement goes against the sense of fairness engendered by the operations of the labor movement, but it is where employment in the new economy is headed. It is no more unethical than a homeowner hiring an independent contractor to fix something about their home. It's simply an extension of that thinking, circumventing the old paradigm's reliance upon the sense of fairness previously understood, brought about by petition to the people's representatives by business, so that it can be done under the law. They need the legal changes to allow for continuing operations to fall under this approach. Because it is now legal, businesses that don't engage in it will not be able to cut their costs under any interest rate environment enough to compete. The changes in the law already lobbied for and gotten assure that. You'll be seeing more of it. It will especially be important under the advent of artificial intelligence in the economy.

That's why capitalizing citizens is important. It means, for one thing, that interest rates are relevant to what needs to be done, not to a person's credit level. People, viewed essentially as small corporations of some kind, would have a credit level, but that would pertain to how much they could borrow, not what rate they would borrow that money at. Unlike bank lending, government capitalization would come with interest rates which are designed to address what is lacking. As artificial intelligence pares people from the working environment that will become increasingly important. Either companies will have to invest in the parts of their operations they currently desire to pass on to independent contractors, or they will have to deal with the owners of those now capitally intensive aspects on a contractual basis. It will become important for people to be able to take advantage of the opportunities for income under this new paradigm, as they invest in these capitally intensive niches. It would be best if they could do so by borrowing based upon the need for those things within the broader economy rather than under the rate adjustment structure as it is currently administered by the Fed. The monopolistic businesses might cry foul, having to labor under the rate structure imposed by the Fed, but they've only really brought this upon themselves.

Last edited by evilgenius on Thu 04 Oct 2018, 13:14:52, edited 1 time in total.

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Modern Money Theory and You

Evil, do you propose the capital ie. money be given directly to the Indepedent Contractors or to the Businesses or Industries which transact with them?

In any case, it is a central contradiction that seems to now be most relevevant. In the chase for profit, companies wish to pare wages, but if you pare them too much, who will buy your products. Thomas Edison understood that when he referred to the need to pay his workers enough to buy his cars.

In the way the US economy is going and others, I do not see any of this happening. It is becoming a zero sum game. Meaning what benefits Big money does not benefit the little people. And as Big Govt is so inextricably tied to Big money, it is a foregone conclusion that the Government will side with Big Business. So, what is happening now is quite evident. The financial side of the Economy is cannibalizing the productive side. Via the Stock Market, via Tax breaks, via privatization and stock buybacks. Via bailouts to the "Too big too fail" . That is why when you look at statistics, you see a dramatic rise in income for the top 1% and stagnation and regression for the lower 99%. We live in a new Gilded Age on steroids.

In any case, it is a central contradiction that seems to now be most relevevant. In the chase for profit, companies wish to pare wages, but if you pare them too much, who will buy your products. Thomas Edison understood that when he referred to the need to pay his workers enough to buy his cars.

In the way the US economy is going and others, I do not see any of this happening. It is becoming a zero sum game. Meaning what benefits Big money does not benefit the little people. And as Big Govt is so inextricably tied to Big money, it is a foregone conclusion that the Government will side with Big Business. So, what is happening now is quite evident. The financial side of the Economy is cannibalizing the productive side. Via the Stock Market, via Tax breaks, via privatization and stock buybacks. Via bailouts to the "Too big too fail" . That is why when you look at statistics, you see a dramatic rise in income for the top 1% and stagnation and regression for the lower 99%. We live in a new Gilded Age on steroids.

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: Modern Money Theory and You

India's currency crashes to another record low

New Delhi (CNN Business)India's currency resumed its headlong plunge on Friday, stoking concerns that the world's fastest-growing major economy could be heading for a slowdown.

The rupee crossed 74 rupees to the US dollar for the first time ever, after the country's central bank surprised markets by holding off on raising interest rates. The currency recovered slightly later in the day.

The Reserve Bank of India (RBI) decided against hiking rates for the third time this year despite expectations that it would act to tame inflation caused by rising oil prices and the crashing currency, which makes imports more expensive.

The Indian rupee has fallen around 15% against the surging dollar this year, making it one of the world's worst performing currencies.

The Indian government has tried in vain to stop the slide. It recently made it easier for foreign investors to buy rupee bonds issued by Indian companies and raised tariffs on imported goods like washing machines and diamonds, measures designed to reduce the flow of money out of the country. ....

https://www.cnn.com/2018/10/05/economy/ ... index.html

Another economy that is likely getting tired of being held hostage to the almighty dollar.

In addition to the existing headwinds to its economy, India could soon face sanctions from the United States over a defense deal it signed with Russia on Friday.

Russian President Vladimir Putin signed the $5 billion missile deal in New Delhi, making India vulnerable to economic retaliation from Washington. The Trump administration imposed sanctions on China last month for a similar defense pact.

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Modern Money Theory and You

In the way the US economy is going and others, I do not see any of this happening. It is becoming a zero sum game.

Month after month the prior consecutive monthly record of US nonfarm payroll increases is broken.

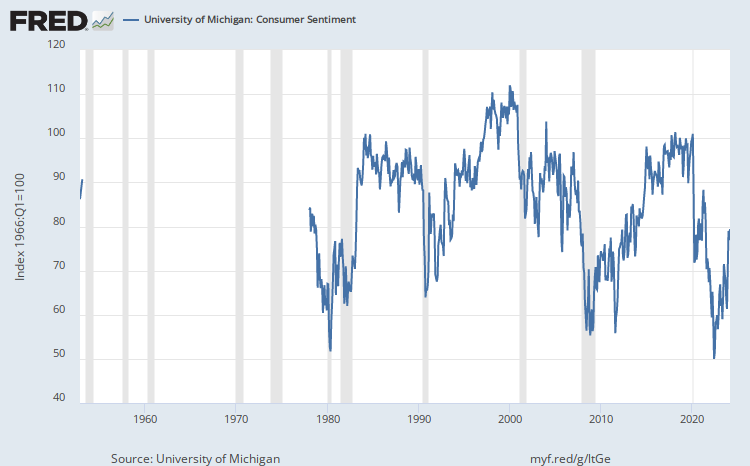

In the beyond the doomtard circles, US households are near record sentiment from the 1966 tie dyed tee shirt era.

- marmico

- Heavy Crude

- Posts: 1112

- Joined: Mon 28 Jul 2014, 14:46:35

Re: Modern Money Theory and You

onlooker wrote:Evil, do you propose the capital ie. money be given directly to the Indepedent Contractors or to the Businesses or Industries which transact with them?

In any case, it is a central contradiction that seems to now be most relevevant. In the chase for profit, companies wish to pare wages, but if you pare them too much, who will buy your products. Thomas Edison understood that when he referred to the need to pay his workers enough to buy his cars.

In the way the US economy is going and others, I do not see any of this happening. It is becoming a zero sum game. Meaning what benefits Big money does not benefit the little people. And as Big Govt is so inextricably tied to Big money, it is a foregone conclusion that the Government will side with Big Business. So, what is happening now is quite evident. The financial side of the Economy is cannibalizing the productive side. Via the Stock Market, via Tax breaks, via privatization and stock buybacks. Via bailouts to the "Too big too fail" . That is why when you look at statistics, you see a dramatic rise in income for the top 1% and stagnation and regression for the lower 99%. We live in a new Gilded Age on steroids.

To the independent contractors. Not given. Loaned. Loaned at the rate determined by whatever, probably politically charged, process is used to determine the need for such a thing. But while politically charged, the need would still be there - among businesses who require the work. Rates couldn't get too far out of line from need, or it would become obvious. So, it would be hard for those with an interest in a need not being filled to short circuit the process. Likewise, the other way round.

Of course, independent contractors will never do everything. The thing I am addressing are those tasks which are capable of being considered as truly independent from a company's operations, but which are necessary to them. An example would be delivering something prepared in a warehouse. The company is about preparing the thing. Delivering it is what the independent contractor does. Sales, especially in the world of the future, may also fall under this category. Not all aspects of what a company does can be parsed like that, not even when artificial intelligence replaces those aspects with machine workers as well. There's a different solution for that problem.

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Modern Money Theory and You

marmico wrote:In the way the US economy is going and others, I do not see any of this happening. It is becoming a zero sum game.

Month after month the prior consecutive monthly record of US nonfarm payroll increases is broken.

In the beyond the doomtard circles, US households are near record sentiment from the 1966 tie dyed tee shirt era.

As always, marmico refuses to acknowledge that this "prosperity" he loves to show us, while calling out "doomtards," was purchased by adding more $TRILLONS in debt to the national credit card.

He. Just. Can't. Go. There.

He would have to admit that he is cheering a delusion.

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Modern Money Theory and You

The US nonfinancial sector leverage ratio has been as flat as a pancake for almost 9 years. Nada credit impulse.

HeGhung. Just. Can't. Go. There.

HeGhung would have to admit that he is cheering a delusion.

HeGhung. Just. Can't. Go. There.

HeGhung would have to admit that he is cheering a delusion.

- marmico

- Heavy Crude

- Posts: 1112

- Joined: Mon 28 Jul 2014, 14:46:35

Re: Modern Money Theory and You

Yes Marmy post your fancy graphs but facts do not lie

https://business.financialpost.com/news ... it-bubbles

The 'mother of all credit bubbles' is brewing — and this time it isn’t household debt

Corporate America has transformed itself into one giant leveraged buyout

https://business.financialpost.com/news ... it-bubbles

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: Modern Money Theory and You

Nobel Prize in economics awarded to William Nordhaus and Paul Romer

London (CNN Business)American economists William Nordhaus and Paul Romer have been awarded the Nobel Prize for their work on understanding how economies can grow sustainably.

Nordhaus, a professor at Yale University, is best known for his work on climate economics. Romer, of NYU's Stern School of Business, is a proponent of a theory that examines how the world can achieve sustainable growth.

"This year's Laureates have designed methods for addressing some of our time's most basic and pressing questions about how we create long-term sustained and sustainable economic growth," the Royal Swedish Academy of Sciences said in a statement.

Nordhaus developed an influential model that examines the consequences of climate policy interventions, including carbon taxes, on the global economy. .....

.....Justin Wolfers, an economist at the University of Michigan, said on Twitter that the work of both winners showed "smart government policies" are "essential if the economy is to deliver good outcomes in the long run."

"It's all about market failure," he added. "Left alone, markets will generate too much pollution (Nordhaus) and too few ideas (Romer)."

https://www.cnn.com/2018/10/08/business ... index.html

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Modern Money Theory and You

https://www.newsweek.com/stock-market-1134867

" THERE COULD BE A FINANCIAL CRASH BEFORE END OF TRUMP'S FIRST TERM, EXPERTS SAY, CITING LOOMING DEBTS"

" THERE COULD BE A FINANCIAL CRASH BEFORE END OF TRUMP'S FIRST TERM, EXPERTS SAY, CITING LOOMING DEBTS"

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: Modern Money Theory and You

onlooker wrote:https://www.newsweek.com/stock-market-1134867

" THERE COULD BE A FINANCIAL CRASH BEFORE END OF TRUMP'S FIRST TERM, EXPERTS SAY, CITING LOOMING DEBTS"

From the link:

...... "We think the major economies are on the cusp of turning into the worst recessions we have seen in 10 years. Should the [U.S.] economy start to shrink, and our analysis suggests that it will, the high nominal levels of debt will instantly become a very big issue."

Experts cautioned that several economic markers had gotten much worse over the past decade, especially in regard to borrowed money. The U.S. household debt of $13.3 trillion is now far worse than it was during its 2008 peak, due primarily to mortgage lending.

Outstanding student loan debts have simultaneously increased from $611 billion of unpaid debt in 2008 to more than $1.5 trillion today. Automobile loans have far exceeded their 2008 peaks, sitting at about $1.25 trillion today, and unpaid credit card balances are just as high as the years leading up to the Great Recession.

Central bankers have also more than doubled global debt as they flooded national economies with cheap and easy money. In 2008, global debt sat at $177 trillion, in comparison to $247 trillion today.

“We won’t be able to call it a recession, it’s going to be worse than the Great Depression,” economic commentator Peter Schiff told the Post. “The U.S. economy is in so much worse shape than it was a decade ago.” .....

Que Marmico, who'll explain why these things aren't true or don't matter much.

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Modern Money Theory and You

The theorists behind Modern Money Theory say that the government can create money out of nothing. I agree they can. I think that as long as they create money and don't lose the faith of the people in the value of that money, they can create as much as they like. They also say that the problem with doing that is that it may create inflation. I also think that's true, to a point. What's always been known as the money multiplier has been a number attached to government spending, to understand how many times a dollar introduced into the economy had an impact beyond that initial introduction. Not every method of introduction is equal. Defense spending always had a higher multiplier, for instance, than transfer payments did. I can't remember the old numbers, but I think defense spending was always well above 2 and transfer payments were always closer to 1. You can easily see why, when you consider that a portion of money spent on defense likely found its way into the lives of people, engineers and administrators, who would then use their salaried position to borrow. Borrowing increases the money supply. People who simply got a welfare check might spend it at the grocery store, or on rent. Welfare is not about saving. It does not involve, to any substantial degree, the financial system. Simply throwing money at the poor, in numbers equal to the basic requirements of the poor, won't induce a robust economy. Money won't change hands very often before it gets lost in longer term investment, instruments which come with ownership but don't involve turning money over.

In order to form a truly robust economy people need to borrow. It should make sense that they need to borrow from positions from which they can repay their debts. Enough people at any given point need better than subsistence wages. I don't know what people's ideas are concerning a Universal Basic Income, UBI. I think most people are loathe, however, to entertain the idea that someone on the UBI should use it to grow their lives into something more prosperous than they see themselves, as taxpayers, as being. Yet, if the UBI takes into account the need to save, that's exactly what you would expect might happen. It would all depend upon what choices people in various positions made. The idea of the UBI must always incite jealousy, I think, or it won't work. I guess my question is, can this happen in America without it tearing the country apart? Artificial intelligence is coming. It will replace a great many workers. What are we going to do about it? I think it's high time that life coaching became more important within the educational system, for one thing. The average person ought to have a better understanding of what risk means to them, and within the economy.

In order to form a truly robust economy people need to borrow. It should make sense that they need to borrow from positions from which they can repay their debts. Enough people at any given point need better than subsistence wages. I don't know what people's ideas are concerning a Universal Basic Income, UBI. I think most people are loathe, however, to entertain the idea that someone on the UBI should use it to grow their lives into something more prosperous than they see themselves, as taxpayers, as being. Yet, if the UBI takes into account the need to save, that's exactly what you would expect might happen. It would all depend upon what choices people in various positions made. The idea of the UBI must always incite jealousy, I think, or it won't work. I guess my question is, can this happen in America without it tearing the country apart? Artificial intelligence is coming. It will replace a great many workers. What are we going to do about it? I think it's high time that life coaching became more important within the educational system, for one thing. The average person ought to have a better understanding of what risk means to them, and within the economy.

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

53 posts

• Page 2 of 3 • 1, 2, 3

Who is online

Users browsing this forum: No registered users and 76 guests