Is peak oil dead?

Re: Is peak oil dead?

" By selling Aramco shares they bring in cash that can be used to diversify their investments"....

From what I read, projected income from selling shares in Aramco is chump-change compared to their oil income. Maybe you see them as being proactive about the future, but large economies are essentially reactive. Methinks they are reacting to the declines in their sovereign wealth funds, and aren't confident they'll be able to replenish those funds with oil sales. You may be satisfied with simple answers, but I'm not so sure. Occam's Razor cuts both ways.

From what I read, projected income from selling shares in Aramco is chump-change compared to their oil income. Maybe you see them as being proactive about the future, but large economies are essentially reactive. Methinks they are reacting to the declines in their sovereign wealth funds, and aren't confident they'll be able to replenish those funds with oil sales. You may be satisfied with simple answers, but I'm not so sure. Occam's Razor cuts both ways.

Blessed are the Meek, for they shall inherit nothing but their Souls. - Anonymous Ghung Person

-

GHung - Intermediate Crude

- Posts: 3093

- Joined: Tue 08 Sep 2009, 16:06:11

- Location: Moksha, Nearvana

Re: Is peak oil dead?

I serious consider that 2015 may have been the annual peak. So no, IMO, peak oil is not dead. The days of showing a graph of US production and extrapolating and predicting world supply on that basis is over, though.

The problem is more with demand than with supply (although negative interest rates allow these zombie companies to keep producing more commodities). Go back and look at IEA demand predictions from a decade ago -- 2008 threw a big wrench in demand expectations.

For crude, the supply gain:

1996-2006: 9 MBD

2006-2016: 6 MBD

Supply increases have decreased since 1996. Why is this current imbalance a supply issue?

The problem is more with demand than with supply (although negative interest rates allow these zombie companies to keep producing more commodities). Go back and look at IEA demand predictions from a decade ago -- 2008 threw a big wrench in demand expectations.

For crude, the supply gain:

1996-2006: 9 MBD

2006-2016: 6 MBD

Supply increases have decreased since 1996. Why is this current imbalance a supply issue?

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Is peak oil dead?

supply increases have decreased since 1996. Why is this current imbalance a supply issue?

Supply outpaced demand starting in mid 2014 as a combined consequence of US LTO, Russia and Saudi increased production.

the chart shows that although demand continued to increase it was offset by the increased supply.

Supply outpaced demand starting in mid 2014 as a combined consequence of US LTO, Russia and Saudi increased production.

the chart shows that although demand continued to increase it was offset by the increased supply.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Is peak oil dead?

onlooker wrote:So Simmons was essentially correct about everything P, except his timing was a bit premature uh?

Simmons never pushed ETP theory. He, like everyone else, predicted prices going UP as depletion advances.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Is peak oil dead?

ennui2 wrote:onlooker wrote:So Simmons was essentially correct about everything P, except his timing was a bit premature uh?

Simmons never pushed ETP theory. He, like everyone else, predicted prices going UP as depletion advances.

And lost his bet, the same as Ehrlich. Against a reporter no less, talk about how that looks, an accountant being out smarted on resource economics by a damn reporter.

https://en.wikipedia.org/wiki/Simmons%E ... ierney_bet

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Is peak oil dead?

rockdoc123 wrote:Again recovery in Ghawar will be 70 - 73% according to Aramco which means there is still about 25 Gbbls left....I know of a lot of companies who would like to get their hands on an "oily film" of that size.

When was the last time you checked out the IHS Edin P2 estimate on Ghawar Rockdoc? It changed recently, and interestingly, not in the direction I would have expected.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Is peak oil dead?

ennui2 wrote:onlooker wrote:So Simmons was essentially correct about everything P, except his timing was a bit premature uh?

Simmons never pushed ETP theory. He, like everyone else, predicted prices going UP as depletion advances.

To infinity? Or is there some kind of limit?

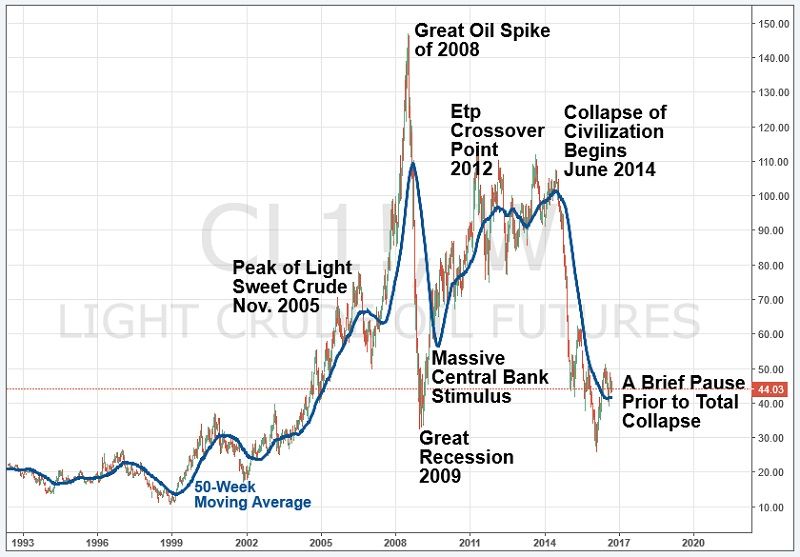

The price of oil already did go UP as depletion advanced. Did you miss it? In 2008, the price of oil shot up to $147/barrel. That was a giant shock to the economy and the Great recession was the direct result. With the central banks desperately bailing out and stimulating, the economy managed an anemic "recovery" and the oil price climbed back over $100/barrel. But the economy could not sustain a price over $100/barrel for very long. Now we are in collapse so the oil price will be going down from here on out.

Basic peak oil theory had always predicted that the economy would be very sensitive to high oil prices. That turned out to be true.

We already had the big "classic peak oil" moment and you didn't even notice! LOL.

-

SumYunGai - Permanently Banned

- Posts: 421

- Joined: Fri 29 Jul 2016, 21:02:21

Re: Is peak oil dead?

When was the last time you checked out the IHS Edin P2 estimate on Ghawar Rockdoc? It changed recently, and interestingly, not in the direction I would have expected.

having retired I no longer have access to proprietary datasets like IHS, WoodMac or Drillinginfo. Everything I have is from a few years back.

What does it say?

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Is peak oil dead?

SumYunGai wrote:Basic peak oil theory had always predicted that the economy would be very sensitive to high oil prices. That turned out to be true.

Please provide reference to seminal, basic peak oil theory as written by Hubbert in 1956 that says anything about the economy being sensitive to high oil prices.

SumYunGai wrote:We already had the big "classic peak oil" moment and you didn't even notice! LOL.

True. Global peak in 1979 was pretty ugly. I'll bet the Etp model can't backcast that one! Too bad the salesman for the Hill Group had to tuck tail and run because he couldn't defend that spurious relationship and was beginning to look terribly incompetent at his job. Probably didn't generate a single new sale of the report, as poorly as what's his name understood the model. Or modeling in general.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Is peak oil dead?

AdamB wrote:SumYunGai wrote:Basic peak oil theory had always predicted that the economy would be very sensitive to high oil prices. That turned out to be true.

Please provide reference to seminal, basic peak oil theory as written by Hubbert in 1956 that says anything about the economy being sensitive to high oil prices.

Basic peak oil theory includes a lot more than what Hubbert said in 1956. It's like saying that discussions about basic evolutionary theory can only include what Darwin wrote in 1859! I was obviously referring to basic peak oil theory as contained in the writings of Colin Campbell, Kenneth Deffeyes, Jay Hanson, and others.

Most people's common understanding of peak oil includes something about it causing high oil prices that would wreck the economy. That is what ennui is always harping about (i.e. "classic peak oil DOOM").

AdamB wrote:True. Global peak in 1979 was pretty ugly.

What global peak are you talking about? Do you mean energy/capita?

Last edited by SumYunGai on Sat 17 Sep 2016, 20:34:14, edited 3 times in total.

-

SumYunGai - Permanently Banned

- Posts: 421

- Joined: Fri 29 Jul 2016, 21:02:21

Re: Is peak oil dead?

AdamB wrote:

Please provide reference to seminal, basic peak oil theory .... that says anything about the economy being sensitive to high oil prices.

Check out Dr. Colin Campbell's writings. Campbell predicted that peak oil will produce oil shortages and high oil prices that collapse the global economy. Oil prices then collapse and the global economy slowly rebuilds. Eventually oil prices get high enough again to collapse the global economy again. Campbell believed the cycle might repeat several times, but with the overall trend being towards slower economic growth.

Campbell's prediction matches what we've seen since oil prices hit $148/bbl. i.e. we're in the slow rebuilding phase of Campbell's cycle model. Once the economy gains enough momentum to cause a significant rise in oil prices, then Campbell predicts the high oil prices will cause the global economy to crash again.

Cheers!

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Is peak oil dead?

The Netherlands is on the brink of TOTAL COLLAPSE

The European Union’s biggest natural gas producer is running out of reserves. The Netherlands, also the region’s largest trading hub for the fuel, has used up almost 80 percent of its natural gas reserves, Dutch statistics office CBS said on Friday. Production fell 38 percent over the previous two years and is set to fall further as the government limits extraction because of earthquakes in Groningen, the province that houses the EU’s largest gas deposit, it said. The nation of about 17 million people is struggling to contain tremors linked to gas production by a joint venture of Exxon Mobil Corp. and Royal Dutch Shell Plc that has damaged thousands of homes. The government budget has been hit by the caps on extraction and declining wholesale prices, with gas accounting for just 3 percent of state income in 2015, down from 9 percent two years earlier, the CBS said.

The European Union’s biggest natural gas producer is running out of reserves. The Netherlands, also the region’s largest trading hub for the fuel, has used up almost 80 percent of its natural gas reserves, Dutch statistics office CBS said on Friday. Production fell 38 percent over the previous two years and is set to fall further as the government limits extraction because of earthquakes in Groningen, the province that houses the EU’s largest gas deposit, it said. The nation of about 17 million people is struggling to contain tremors linked to gas production by a joint venture of Exxon Mobil Corp. and Royal Dutch Shell Plc that has damaged thousands of homes. The government budget has been hit by the caps on extraction and declining wholesale prices, with gas accounting for just 3 percent of state income in 2015, down from 9 percent two years earlier, the CBS said.

Last edited by StarvingLion on Sat 17 Sep 2016, 22:43:14, edited 1 time in total.

Outcast_Searcher is a fraud.

- StarvingLion

- Permanently Banned

- Posts: 2612

- Joined: Sat 03 Aug 2013, 18:59:17

Re: Is peak oil dead?

Russia is on the brink of TOTAL COLLAPSE.

Russia is seriously running out of cash - Sep. 16, 2016

CNNMoney - 1 day ago

Russia's rainy day fund has shrunk to just $32.2 billion this month and is likely to dry up ...

Russia 'could run out of cash reserves in 2017'

The Independent - 14 hours ago

Russia is seriously running out of cash | Money

WLWT.com - 1 day ago

Russia is seriously running out of cash - Sep. 16, 2016

CNNMoney - 1 day ago

Russia's rainy day fund has shrunk to just $32.2 billion this month and is likely to dry up ...

Russia 'could run out of cash reserves in 2017'

The Independent - 14 hours ago

Russia is seriously running out of cash | Money

WLWT.com - 1 day ago

Outcast_Searcher is a fraud.

- StarvingLion

- Permanently Banned

- Posts: 2612

- Joined: Sat 03 Aug 2013, 18:59:17

Re: Is peak oil dead?

The price of oil already did go UP as depletion advanced. Did you miss it? In 2008, the price of oil shot up to $147/barrel. That was a giant shock to the economy and the Great recession was the direct result. With the central banks desperately bailing out and stimulating, the economy managed an anemic "recovery" and the oil price climbed back over $100/barrel. But the economy could not sustain a price over $100/barrel for very long. Now we are in collapse so the oil price will be going down from here on out.

Oh for crying out loud. Do you think that you can wander from thread to thread and try to push this same idea? There is not an economist or financial banker in the world that would agree with you that oil prices started the 2008 - 2009 recession. They are all very adamant that it was the sub-prime mortgages and had bupkiss to do with oil price. You were instructed on the timing of all of this on another thread but it doesn't seem to stop you from bringing out the old "I can't prove it but know it to be true" BS. Also we have shown countless times here that $100 /bbl oil had absolutely no affect whatsoever on increasing global demand/consumption and the reason for the drop in price was over supply. Do you actually think if you spout the same BS a lot of times that it will suddenly be recognized as truth?

Honestly it is like dealing with a child who puts his hands over his ears and keeps chanting "I can't hear you".

Deal with the frigging data...you have none to support your arguments. Your model is not data by the way.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Is peak oil dead?

rockdoc123 wrote:There is not an economist ... in the world that would agree with you that oil prices started the 2008 - 2009 recession.

Considering how little you know about the subjects discussed at this site, you really should tone down your statements a bit. You have been proven wrong so often in the past, and once again today you've made a bone-headed and completely false statement. A word of advice----relax a bit and try conversing with the other posters instead of insisting you are right all the time.

Prof. James Hamilton is chair of the economics department at his University and he and his students are well known for advocating his view that oil price spikes cause recessions, including the "great recession" of 2008-2009. Check it out:

peak-oil-and-the-great-recession

The eminent economist Prof. James Hamilton believes that spikes in oil prices cause most recessions

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Is peak oil dead?

Plantagenet wrote:Considering how little you know about the subjects discussed at this site, you really should tone down your statements a bit. You have been proven wrong so often in the past, and once again today you've made a bone-headed and completely false statement. A word of advice----relax a bit and try conversing with the other posters instead of insisting you are right all the time.

That is good advice, Planty. Rockdoc has a bad habit of declaring himself right. It is hard to have a rational discussion when someone insists on doing that constantly.

I was writing this post about Jim Hamilton at the same time were posting your comment.

rockdoc123 wrote:The price of oil already did go UP as depletion advanced. Did you miss it? In 2008, the price of oil shot up to $147/barrel. That was a giant shock to the economy and the Great recession was the direct result. With the central banks desperately bailing out and stimulating, the economy managed an anemic "recovery" and the oil price climbed back over $100/barrel. But the economy could not sustain a price over $100/barrel for very long. Now we are in collapse so the oil price will be going down from here on out.

Oh for crying out loud. Do you think that you can wander from thread to thread and try to push this same idea? There is not an economist or financial banker in the world that would agree with you that oil prices started the 2008 - 2009 recession.

False. What about Jim Hamilton?

http://www.motherjones.com/kevin-drum/2 ... -recession

Peak Oil and the Great Recession

"Pretty similar" to 2005-09 means a big spike in oil prices that causes a big recession. The chart on the right shows what he means. The green line shows expected economic growth. The dashed line shows the Great Recession. And the red line? That's his estimate of the effect of the huge spike in oil prices in 2007-08. If Hamilton is right, then the oil spike is responsible for about two-thirds of the Great Recession all by itself. The housing and credit bubbles are only responsible for a fairly small piece of it.

rockdoc123 wrote:They are all very adamant that it was the sub-prime mortgages and had bupkiss to do with oil price.

I just showed that not all economists agree with you, so what you are saying is your opinion, not some absolute truth. You need to logically explain your opinion. So basically oil prices rise from $31.98 to $147.50 between 2004-2008 and this has no effect on the economy? Please explain how that makes any sense.

rockdoc123 wrote:Also we have shown countless times here that $100 /bbl oil had absolutely no affect whatsoever on increasing global demand/consumption and the reason for the drop in price was over supply.

That is what you keep saying. But you haven't actually proven anything. You just keep angrily declaring all of your opinions to be facts.

rockdoc123 wrote:Do you actually think if you spout the same BS a lot of times that it will suddenly be recognized as truth?

Do you?

-

SumYunGai - Permanently Banned

- Posts: 421

- Joined: Fri 29 Jul 2016, 21:02:21

Re: Is peak oil dead?

Plantagenet wrote:The eminent economist Prof. James Hamilton believes that spikes in oil prices cause most recessions

Why don't they sack him for this idiotic statement? Does he also believe that winter arrival is caused by spikes of temperature during the summer?

Another storyline from your link:

Most economists view the economic growth of the last century and a half as being fueled by ongoing technological progress.

"Most economists" are wrong. This is the other way round - technological progress has been fueled by economic growth.

Attributing spikes in oil prices to depletion dynamics is akin to explaining ocean waves by the ocean's drying up due to solar heat.

Why some "prof. Hamilton" who produсes nonsense papers, is in any more authoritative than poster rockdoc, who supports his view with solid facts? Because "prof. Hamilton" is "eminent", according to "prof. Hamilton"?

- radon1

- Intermediate Crude

- Posts: 2054

- Joined: Thu 27 Jun 2013, 06:09:44

Re: Is peak oil dead?

http://econweb.ucsd.edu/~jhamilton/oil_history.pdf

This is the well documented paper by Hamilton. Pretty straight forward. How do Deniers NOT see a correlation ?

This is the well documented paper by Hamilton. Pretty straight forward. How do Deniers NOT see a correlation ?

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: Is peak oil dead?

radon1 wrote:Plantagenet wrote:The eminent economist Prof. James Hamilton believes that spikes in oil prices cause most recessions

Why don't they sack him for this idiotic statement?

Brilliant.

radon1 wrote:radon1 wrote:Another storyline from your link:

Most economists view the economic growth of the last century and a half as being fueled by ongoing technological progress.

"Most economists" are wrong. This is the other way round - technological progress has been fueled by economic growth.

That is what Jim Hamilton is saying. That is the whole point. You are pulling his statement out of context to make it seem like he is saying the opposite of what actually believes so you can disagree with him. Nice straw man.

radon1 wrote:Why some "prof. Hamilton" who produсes nonsense papers, is in any more authoritative than poster rockdoc, who supports his view with solid facts?

LOL. Do you mean solid facts like this one?:

rockdoc123 wrote:There is not an economist or financial banker in the world that would agree with you that oil prices started the 2008 - 2009 recession.

Since Jim Hamilton is a real economist who believes the high oil prices lead directly to the Great Recession, Rockdoc123 is obviously wrong about this. So are you.

It is obvious that oil prices over $100 per barrel are not good for the economy. But rockdoc123 tries to claim that the biggest oil spike in history ($147.50) had absolutely no effect on the economy. He cannot support his wild claim logically, so instead he tries to pompously claim that every economist in the world agrees with him. This has been proven false.

The Great Oil Spike was followed immediately by the Great Recession. They sure seem to be related. Can you explain in some sort of logical way why the biggest oil spike in history didn't effect the economy?

Last edited by SumYunGai on Sun 18 Sep 2016, 10:19:24, edited 3 times in total.

-

SumYunGai - Permanently Banned

- Posts: 421

- Joined: Fri 29 Jul 2016, 21:02:21

Re: Is peak oil dead?

StarvingLion wrote:Russia is on the brink of TOTAL COLLAPSE.

Russia is seriously running out of cash - Sep. 16, 2016

CNNMoney - 1 day ago

Russia's rainy day fund has shrunk to just $32.2 billion this month and is likely to dry up ...

Russia 'could run out of cash reserves in 2017'

The Independent - 14 hours ago

Russia is seriously running out of cash | Money

WLWT.com - 1 day ago

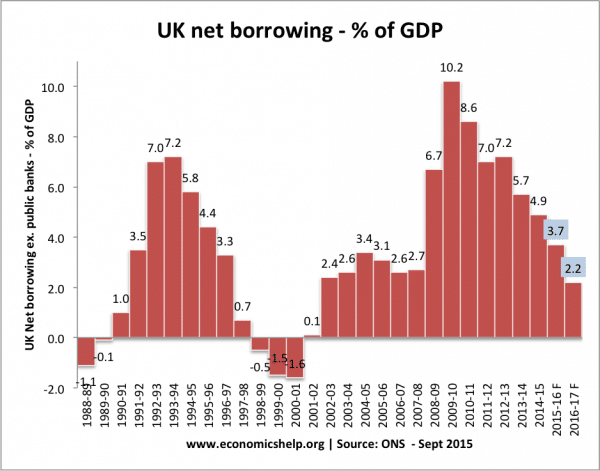

You need to buy a clue. Russia's money supply does not depend on any reserve fund just like in the USA and the EU. If you are talking about government financing then you are in full bore retard mode. How can some moderate deficit be an indication of collapse? By that standard the USA should have imploded when it hit deficits of $1.5 trillion. These "news" pieces are obvious agitprop designed for people who have no understanding of macroeconomics and monetary dynamics.

https://en.wikipedia.org/wiki/Money_creation

https://themoscowtimes.com/articles/rus ... lion-51559

A 2.6% GDP deficit. LOL. LOL. LOL.

The sky is falling, the sky is falling....

- dissident

- Expert

- Posts: 6458

- Joined: Sat 08 Apr 2006, 03:00:00

Who is online

Users browsing this forum: No registered users and 41 guests