Credit Default Swaps: Part I Of III - A Brief History Of Mechanics, Product Types, And Standardization

Summary

This prefatory article is the opening of a tripartite series focusing on the most widely used type of credit derivative - credit default swaps.

Part I presents investors with an introduction to these derivatives - namely, the history, mechanics, and product types.

Part II expounds upon credit default swap valuations and provides examples.

Part III culminates in describing some of the indices market participants track these credit default swaps on.

Preface | The Spark of this Series

This series spawns from a recent interview I had with an investment bank for a role in the risk department as a hedge funds analyst. The management asked for an explanation surrounding the mechanics behind credit default swaps and how they are utilized to manage risk for hedge fund clients.

Besides being a great interview question at the time, given the state of our economy, I thought it was an informative topic to delve into in order to sharpen some of the knowledge learned about the credit derivatives space and share with investors who may be interested.

Furthermore, a large swath of our population remains unfamiliar with such instruments that play a vital role in our financial system. Perhaps, this series can provide some information to those who want to read a fair analysis of these products - outside of what they hear from politicians and the financial press.

The following information in this series will not glean insight into certain trading strategies, nor will it reveal any proprietary information belonging to other companies' dealings with credit default swaps. It will only serve the purpose to explain what these derivatives are and how they are used, priced, and where to find them.

A historical backdrop of real-world events and theater will be added to the end of each section to provide the subject matter a dash of flavor - how they have been utilized in a practical sense is just as important and will hopefully keep the material as interesting as possible.

Per the usual disclaimer, this is not investment advice, and I am not being paid for such a post by any institution, except for Seeking Alpha. It is born out of pure interests - writing, history, and financial markets - that I write this series. I hope investors find it to be a good read but, more importantly, find it to be beneficial for their respective endeavors.

Investment Thesis | Alternative Beta

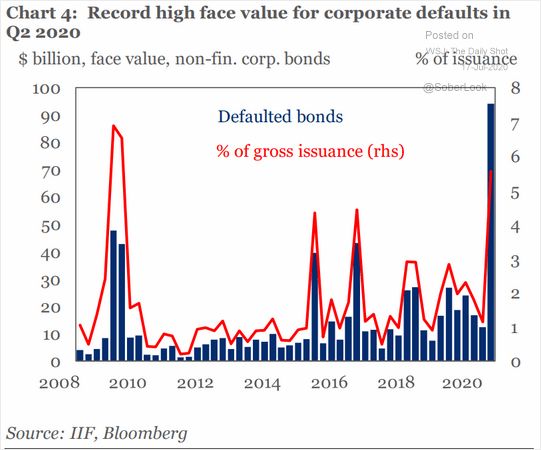

As corporate defaults climbed higher last quarter and credit downgrades hit new records, curious accredited investors may be interested in alternative investments to hedge, speculate, or find arbitrage opportunities during such states of uncertainty.

Prudent measures can be taken in times of duress outside of allocating investments in US treasuries, gold, and other traditional assets. Among the many ways to protect a portfolio is through alternative beta - more precisely, credit default swaps.

The goal - as mentioned in the preface - is for hedge funds, pension plans, and policymakers to benefit from this comprehensive review. Reading about the history, mechanics, and evolution of CDSs will allow institutional investors to consider whether it is a good fit.

A Brief History | Credit Derivatives & Credit Default Swaps

In order to understand credit default swaps, investors must first understand the term credit derivative. A credit derivative is a bilateral contract that isolates specific aspects of credit risk from an underlying instrument and transfers that risk between two parties. The payoff depends on the creditworthiness of the underlying instrument. Credit derivatives include:

credit default swaps (CDSs)

collateralized debt obligations (CDOs)

total return swaps

credit spread forwards

credit default swap options

In large part, these products were created because banks had little room to maneuver once assuming credit risk and due to the fact that credit had remained a business risk for which no tailored risk-management products existed. Over time, financial innovation and the demand for such products served as a catalyst to bring them to the marketplace.

The acceptance of these credit derivatives filled the gap. Products such as the above-mentioned have allowed these institutions to actively manage their portfolios of credit risk by entering into such credit derivative contracts to hedge their portfolios or speculate for gains. It is a financial innovation that allows for risk to be transferred but not destroyed - such is the nature of risk itself once created.

The largest benefit for institutions may be the fact that credit derivatives allow users to reduce credit exposure without physically removing assets from the balance sheet. Banks find this quite appealing and understandably so.

Therefore, banks have historically been the biggest buyers of credit protection, and insurance companies have been the most prominent sellers. If one would like to do more reading on the different product types and offerings of credit derivatives, this March 2001 Lehman Brothers report provides insight into the instruments that are still used today:

Regarding the recent trends in notional amounts, the growth of credit derivatives came alongside the dot-com bubble in the late 90s. In 2000, the notional principal for outstanding credit derivatives totaled approximately $800 billion. Only 7 years later, that amount spiked to $50 trillion. Later, in 2012, it fell to half of that at around $25 trillion.

Among these credit derivatives is the subject of this series - credit default swaps. Credit default swaps, or CDSs, are the most widely-used credit derivatives.

The first CDSs were created and traded by JPMorgan around 1997. This in-depth interview with Terri Duhon - an ex-JPMorgan swaps trader from 1994-2002 and a pioneer in the CDS space - gives a first-person perspective on the nature and function of these swaps.

Since then, these instruments have been both revered and scorned. The former due to the protection these derivatives provide as a hedge and the latter due primarily to the systemic risks they pose as evidenced in the fallout of AIG in the 2008 Global Financial Crisis, explained later in the epilogue.

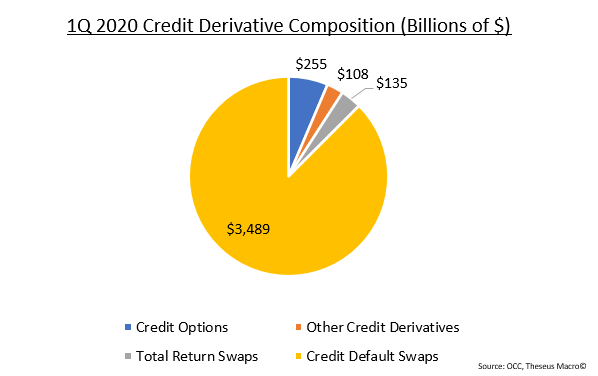

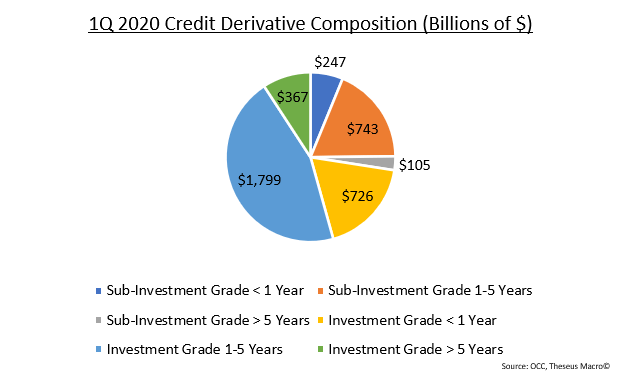

As of 2019, credit default swaps were the third-largest OTC derivatives market in the world behind interest rate and foreign exchange derivatives. The latest quarterly report issued on June 26, 2020, from the Office of the Comptroller of the Currency notes that CDSs are the dominant product among credit derivatives - representing approximately $3.5 trillion or 87.5% of all notional amounts. The composition of these derivatives for the 1Q 2020 can be found below:

It is apparent that the birth of credit derivatives was a watershed development for credit risk management departments within the financial and insurance industry. They continue to fundamentally change the way that banks price, manage, transact, distribute, and account for credit risk.

Hopefully, the following sections regarding these derivatives and, more specifically, CDSs, will give investors a clearer picture and mitigate the cognitive dissonance that surrounds these financial instruments espoused by politicians and the financial press.

Seeking Alpha